Answered step by step

Verified Expert Solution

Question

1 Approved Answer

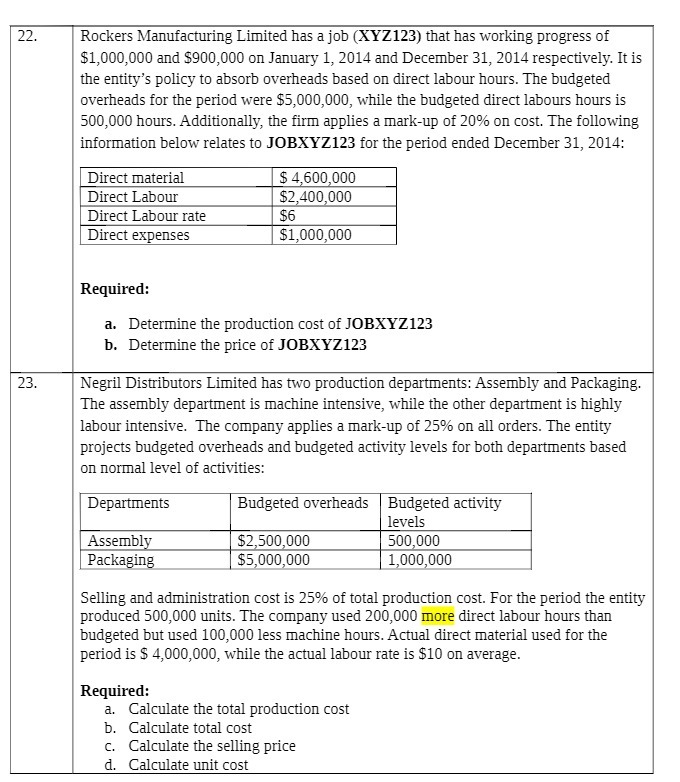

22. 23. Rockers Manufacturing Limited has a job (XYZ123) that has working progress of $1,000,000 and $900,000 on January 1, 2014 and December 31,

22. 23. Rockers Manufacturing Limited has a job (XYZ123) that has working progress of $1,000,000 and $900,000 on January 1, 2014 and December 31, 2014 respectively. It is the entity's policy to absorb overheads based on direct labour hours. The budgeted overheads for the period were $5,000,000, while the budgeted direct labours hours is 500,000 hours. Additionally, the firm applies a mark-up of 20% on cost. The following information below relates to JOBXYZ123 for the period ended December 31, 2014: Direct material Direct Labour Direct Labour rate Direct expenses Required: $ 4,600,000 $2,400,000 $6 $1,000,000 a. Determine the production cost of JOBXYZ123 b. Determine the price of JOBXYZ123 Negril Distributors Limited has two production departments: Assembly and Packaging. The assembly department is machine intensive, while the other department is highly labour intensive. The company applies a mark-up of 25% on all orders. The entity projects budgeted overheads and budgeted activity levels for both departments based on normal level of activities: Departments Assembly Packaging Budgeted overheads Budgeted activity $2,500,000 $5,000,000 levels 500,000 1,000,000 Selling and administration cost is 25% of total production cost. For the period the entity produced 500,000 units. The company used 200,000 more direct labour hours than budgeted but used 100,000 less machine hours. Actual direct material used for the period is $4,000,000, while the actual labour rate is $10 on average. Required: a. Calculate the total production cost b. Calculate total cost c. Calculate the selling price d. Calculate unit cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started