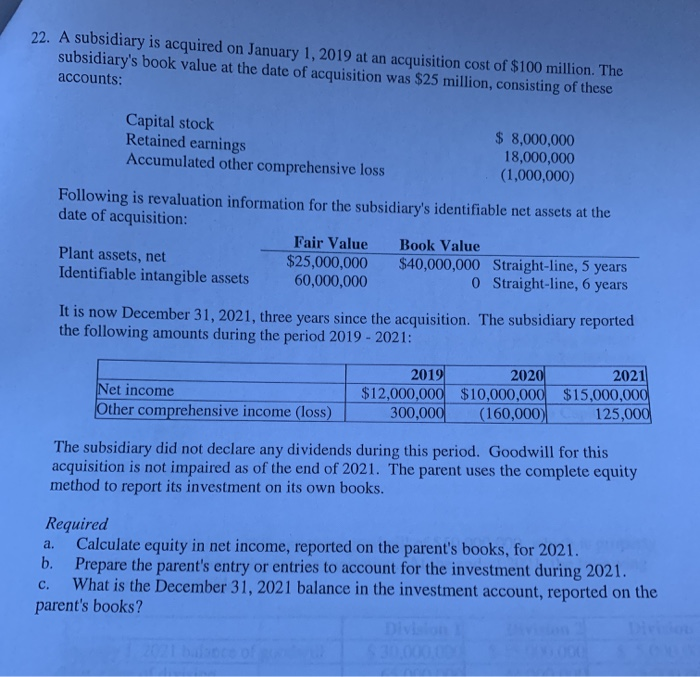

22. A subsidiary is acquired on January 1, 2019 at an acquisition cost of $100 million. The subsidiary's book value at the date of acquisition was $25 million, consisting of these accounts: Capital stock Retained earnings Accumulated other comprehensive loss $ 8,000,000 18,000,000 (1,000,000) Following is revaluation information for the subsidiary's identifiable net assets at the date of acquisition: Fair Value Book Value Plant assets, net $25,000,000 $40,000,000 Straight-line, 5 years Identifiable intangible assets 60,000,000 0 Straight-line, 6 years It is now December 31, 2021, three years since the acquisition. The subsidiary reported the following amounts during the period 2019-2021: 2019 2020 2021 Net income $12,000,000 $10,000,000 $15,000,000 Other comprehensive income (loss) 300,000 (160,000 125,000 The subsidiary did not declare any dividends during this period. Goodwill for this acquisition is not impaired as of the end of 2021. The parent uses the complete equity method to report its investment on its own books. Required a. Calculate equity in net income, reported on the parent's books, for 2021. b. Prepare the parent's entry or entries to account for the investment during 2021. c. What is the December 31, 2021 balance in the investment account, reported on the parent's books? 22. A subsidiary is acquired on January 1, 2019 at an acquisition cost of $100 million. The subsidiary's book value at the date of acquisition was $25 million, consisting of these accounts: Capital stock Retained earnings Accumulated other comprehensive loss $ 8,000,000 18,000,000 (1,000,000) Following is revaluation information for the subsidiary's identifiable net assets at the date of acquisition: Fair Value Book Value Plant assets, net $25,000,000 $40,000,000 Straight-line, 5 years Identifiable intangible assets 60,000,000 0 Straight-line, 6 years It is now December 31, 2021, three years since the acquisition. The subsidiary reported the following amounts during the period 2019-2021: 2019 2020 2021 Net income $12,000,000 $10,000,000 $15,000,000 Other comprehensive income (loss) 300,000 (160,000 125,000 The subsidiary did not declare any dividends during this period. Goodwill for this acquisition is not impaired as of the end of 2021. The parent uses the complete equity method to report its investment on its own books. Required a. Calculate equity in net income, reported on the parent's books, for 2021. b. Prepare the parent's entry or entries to account for the investment during 2021. c. What is the December 31, 2021 balance in the investment account, reported on the parent's books