Answered step by step

Verified Expert Solution

Question

1 Approved Answer

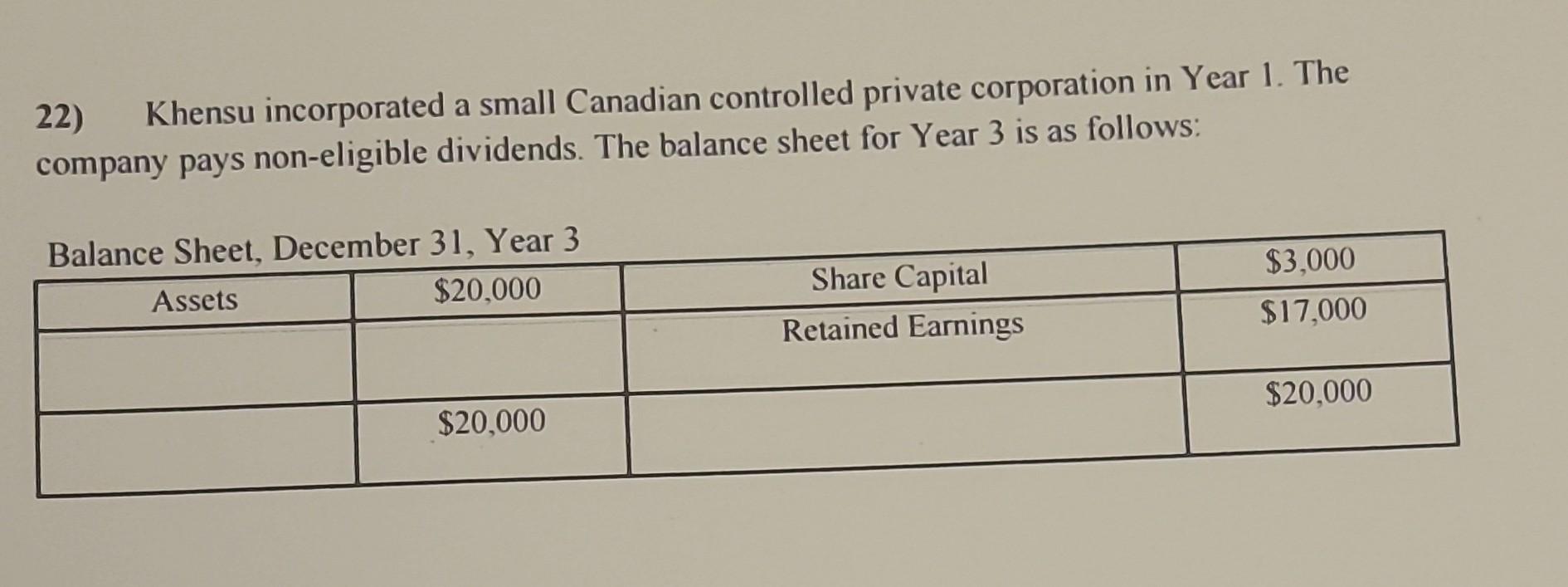

22) Khensu incorporated a small Canadian controlled private corporation in Year 1. The company pays non-eligible dividends. The balance sheet for Year 3 is as

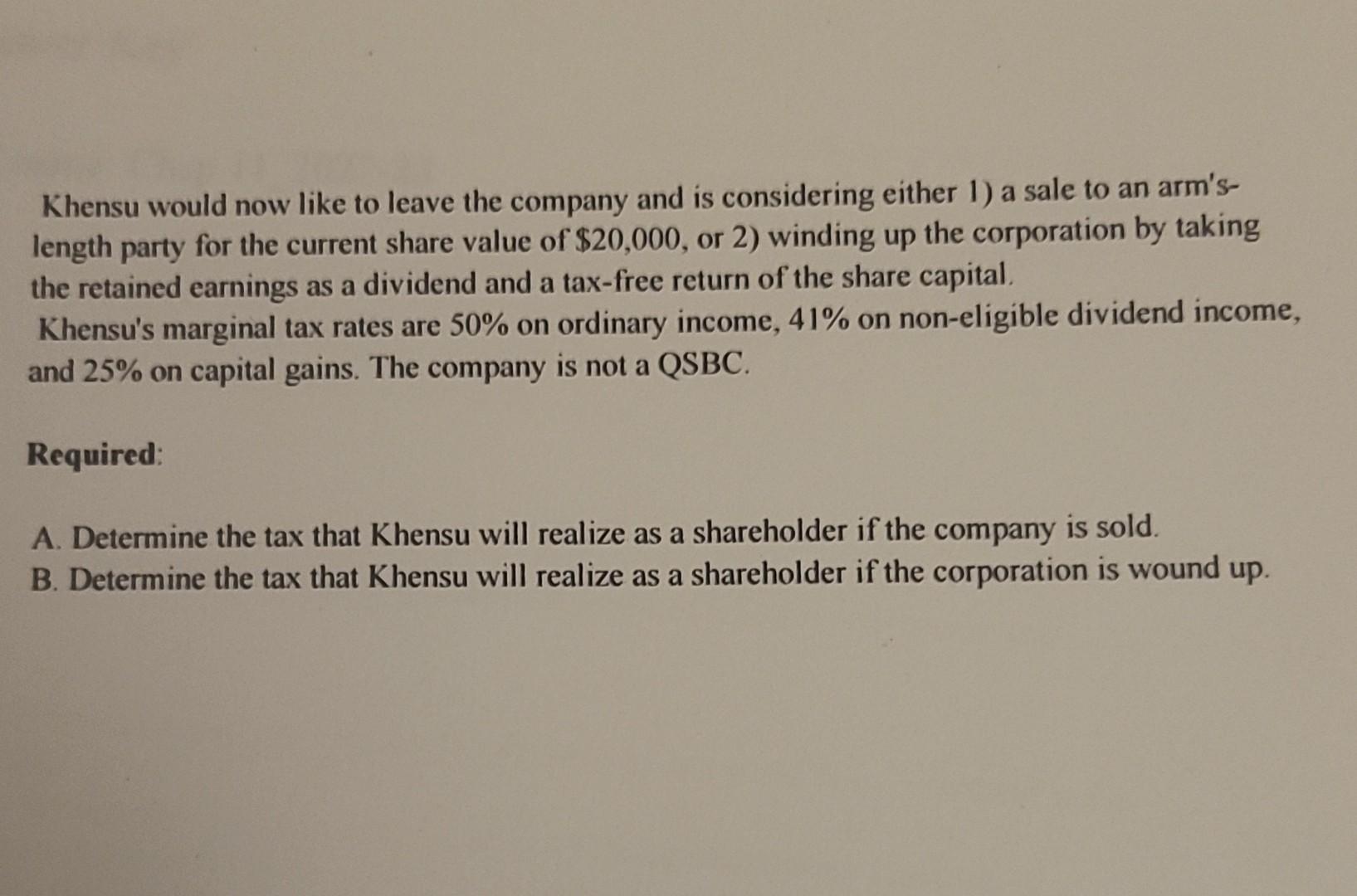

22) Khensu incorporated a small Canadian controlled private corporation in Year 1. The company pays non-eligible dividends. The balance sheet for Year 3 is as follows: Khensu would now like to leave the company and is considering either 1) a sale to an arm'slength party for the current share value of $20,000, or 2 ) winding up the corporation by taking the retained earnings as a dividend and a tax-free return of the share capital. Khensu's marginal tax rates are 50% on ordinary income, 41% on non-eligible dividend income, and 25% on capital gains. The company is not a QSBC. Required: A. Determine the tax that Khensu will realize as a shareholder if the company is sold. B. Determine the tax that Khensu will realize as a shareholder if the corporation is wound up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started