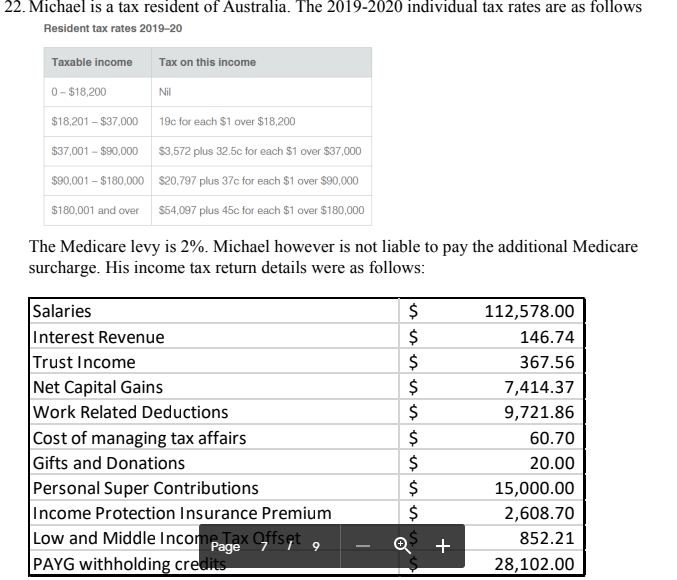

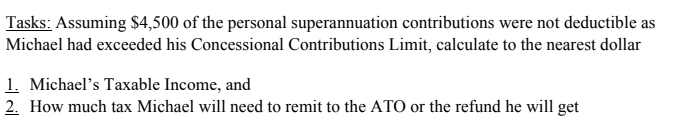

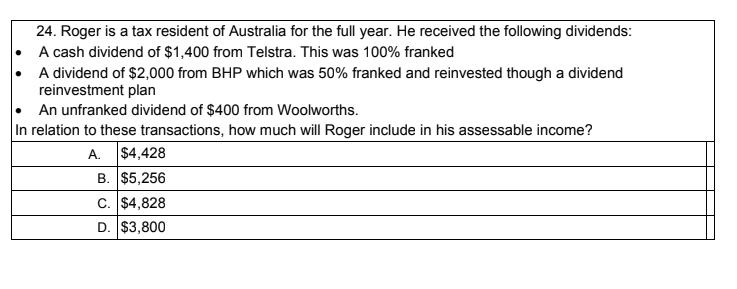

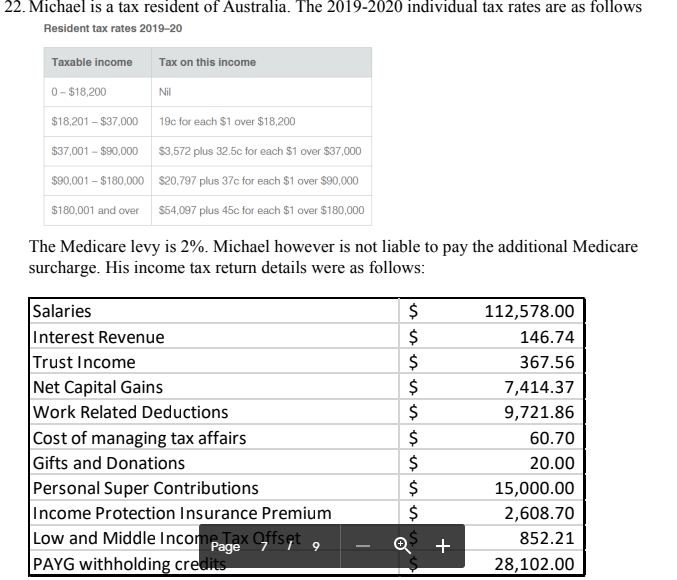

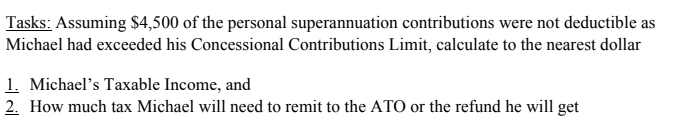

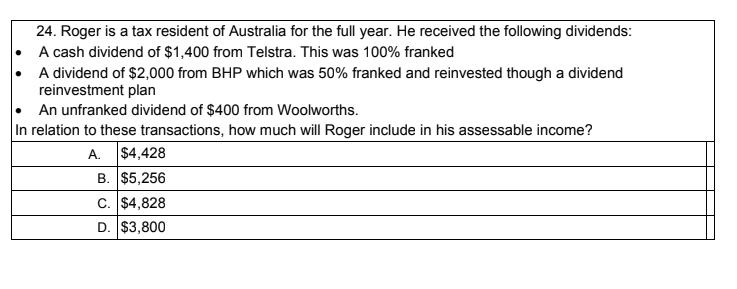

22. Michael is a tax resident of Australia. The 2019-2020 individual tax rates are as follows Resident tax rates 2019-20 Taxable income Tax on this income 0-$18,200 Nil $18,201 - $37,000 19c for each $1 over $18,200 $37,001 - $90,000 $3,572 plus 32,5c for each $1 over $37,000 $90,001 - $180,000 $20,797 plus 37c for each $1 over $90,000 $180,001 and over $54,097 plus 45c for each $1 over $180,000 The Medicare levy is 2%. Michael however is not liable to pay the additional Medicare surcharge. His income tax return details were as follows: Salaries Interest Revenue Trust Income Net Capital Gains Work Related Deductions Cost of managing tax affairs Gifts and Donations Personal Super Contributions Income Protection Insurance Premium Low and Middle Income Tax Offset Page 7 PAYG withholding credits $ $ $ $ $ $ $ $ $ 112,578.00 146.74 367.56 7,414.37 9,721.86 60.70 20.00 15,000.00 2,608.70 852.21 28,102.00 9 + Tasks: Assuming $4,500 of the personal superannuation contributions were not deductible as Michael had exceeded his Concessional Contributions Limit, calculate to the nearest dollar 1. Michael's Taxable income, and 2. How much tax Michael will need to remit to the ATO or the refund he will get 24. Roger is a tax resident of Australia for the full year. He received the following dividends: A cash dividend of $1,400 from Telstra. This was 100% franked A dividend of $2,000 from BHP which was 50% franked and reinvested though a dividend reinvestment plan An unfranked dividend of $400 from Woolworths. In relation to these transactions, how much will Roger include in his assessable income? A. $4,428 B. $5,256 C. $4,828 D. $3,800 25. Robert owns an investment property which is currently rented to tenants. He purchases a washing machine for the rental property which costs $1,100 plus $100 delivery and installation. He makes all payments on day one of the tax year. Robert is not registered for GST. Which of the following statements is correct? A. Robert can claim a tax deduction of $1,100 in the year of the purchase Assume the Prime Cost method of depreciation is elected, Robert will depreciate the B. washing machine over its effective life with the initial depreciable amount set at $1,100 C. Robert can claim a tax deduction of $1,200 in the year of the purchase D. Assume the Prime Cost method of depreciation is elected, Robert will depreciate the washing machine over its effective life, with the initial depreciable amount set at $1,200 22. Michael is a tax resident of Australia. The 2019-2020 individual tax rates are as follows Resident tax rates 2019-20 Taxable income Tax on this income 0-$18,200 Nil $18,201 - $37,000 19c for each $1 over $18,200 $37,001 - $90,000 $3,572 plus 32,5c for each $1 over $37,000 $90,001 - $180,000 $20,797 plus 37c for each $1 over $90,000 $180,001 and over $54,097 plus 45c for each $1 over $180,000 The Medicare levy is 2%. Michael however is not liable to pay the additional Medicare surcharge. His income tax return details were as follows: Salaries Interest Revenue Trust Income Net Capital Gains Work Related Deductions Cost of managing tax affairs Gifts and Donations Personal Super Contributions Income Protection Insurance Premium Low and Middle Income Tax Offset Page 7 PAYG withholding credits $ $ $ $ $ $ $ $ $ 112,578.00 146.74 367.56 7,414.37 9,721.86 60.70 20.00 15,000.00 2,608.70 852.21 28,102.00 9 + Tasks: Assuming $4,500 of the personal superannuation contributions were not deductible as Michael had exceeded his Concessional Contributions Limit, calculate to the nearest dollar 1. Michael's Taxable income, and 2. How much tax Michael will need to remit to the ATO or the refund he will get 24. Roger is a tax resident of Australia for the full year. He received the following dividends: A cash dividend of $1,400 from Telstra. This was 100% franked A dividend of $2,000 from BHP which was 50% franked and reinvested though a dividend reinvestment plan An unfranked dividend of $400 from Woolworths. In relation to these transactions, how much will Roger include in his assessable income? A. $4,428 B. $5,256 C. $4,828 D. $3,800 25. Robert owns an investment property which is currently rented to tenants. He purchases a washing machine for the rental property which costs $1,100 plus $100 delivery and installation. He makes all payments on day one of the tax year. Robert is not registered for GST. Which of the following statements is correct? A. Robert can claim a tax deduction of $1,100 in the year of the purchase Assume the Prime Cost method of depreciation is elected, Robert will depreciate the B. washing machine over its effective life with the initial depreciable amount set at $1,100 C. Robert can claim a tax deduction of $1,200 in the year of the purchase D. Assume the Prime Cost method of depreciation is elected, Robert will depreciate the washing machine over its effective life, with the initial depreciable amount set at $1,200