Answered step by step

Verified Expert Solution

Question

1 Approved Answer

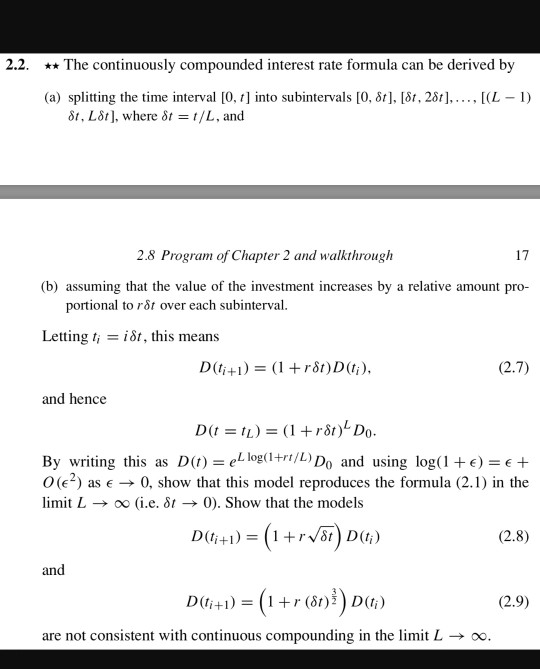

2.2. The continuously compounded interest rate formula can be derived by splitting the time interval [0, t] nto subintervals [0, ], [3r, 2&J, 8t, L8t],

2.2. The continuously compounded interest rate formula can be derived by splitting the time interval [0, t] nto subintervals [0, ], [3r, 2&J, 8t, L8t], where -t/L, and (a) , [(L-1) 2.8 Program of Chapter 2 and walkthrough 17 umig fae he ran portional to rr over each subintervail. Lettingt i St, this means (2.7) and hence D(t = tl) = (1 + r8ty. Do By writing this as Do)-eg Do and using log( e) O(e-) as 0, show that this model reproduces the formula (2.1) in the limit L-> oo (i.e. 0). Show that the models DG +1 ) = (1 + r var) D(G) (2.8) and D(ti+1) (1 +r(81)3) D(ti ) (2.9) are not consistent with continuous compounding in the limit L oo. 2.2. The continuously compounded interest rate formula can be derived by splitting the time interval [0, t] nto subintervals [0, ], [3r, 2&J, 8t, L8t], where -t/L, and (a) , [(L-1) 2.8 Program of Chapter 2 and walkthrough 17 umig fae he ran portional to rr over each subintervail. Lettingt i St, this means (2.7) and hence D(t = tl) = (1 + r8ty. Do By writing this as Do)-eg Do and using log( e) O(e-) as 0, show that this model reproduces the formula (2.1) in the limit L-> oo (i.e. 0). Show that the models DG +1 ) = (1 + r var) D(G) (2.8) and D(ti+1) (1 +r(81)3) D(ti ) (2.9) are not consistent with continuous compounding in the limit L oo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started