Question

22. The Engler Oil Company is deciding whether to drill for oil on a tract of land that the company owns. The company estimates that

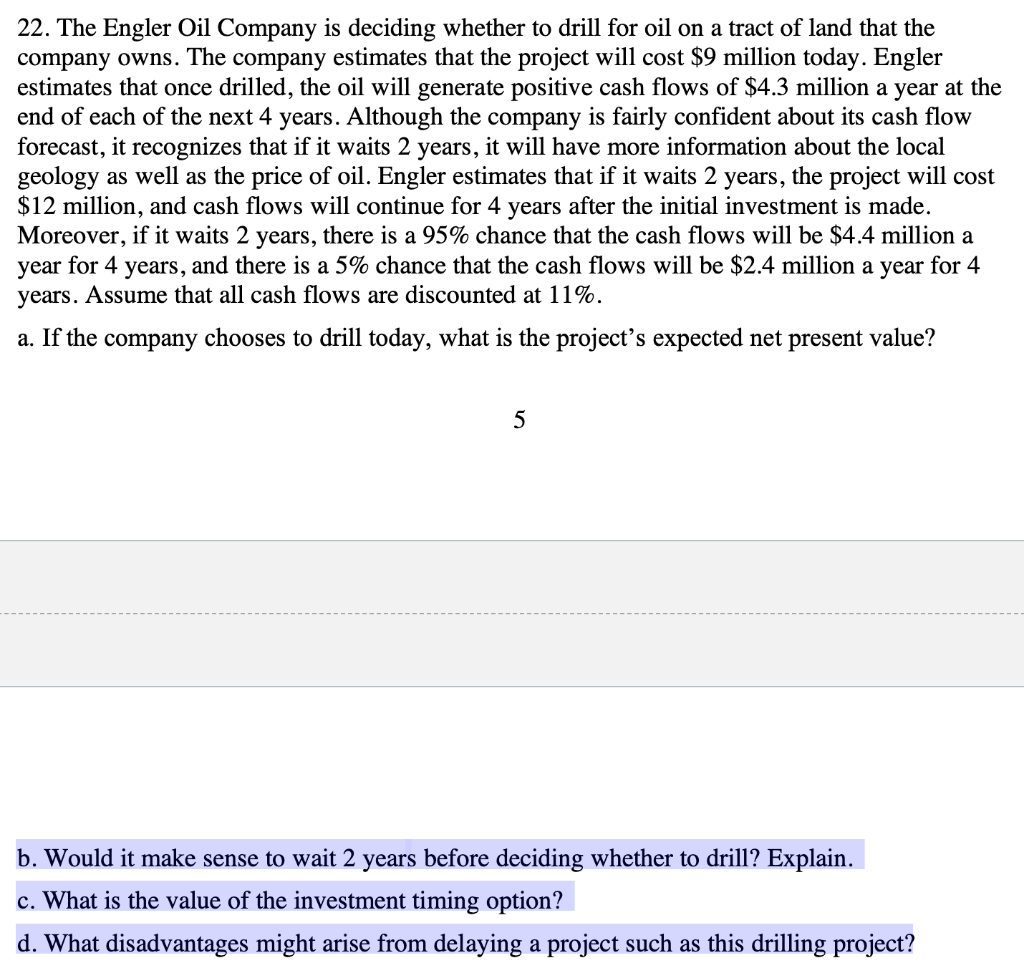

22. The Engler Oil Company is deciding whether to drill for oil on a tract of land that the company owns. The company estimates that the project will cost $9 million today. Engler estimates that once drilled, the oil will generate positive cash flows of $4.3 million a year atthe end of each of the next 4 years. Although the company is fairly confident about its cash flow forecast, it recognizes that if it waits 2 years, it will have more information about the local geology as well as the price of oil. Engler estimates that ifit waits 2 years, the project will cost $12 million, and cash flows will continue for 4 years after the initial investment is made. Moreover, if it waits 2 years, there is a 95% chance that the cash flows will be $4.4 million a year for 4 years, and thereis a 5% chance that the cash flows will be $2.4 million a year for 4 years. Assume that all cash flows are discounted at 11%. a. If the company chooses to drill today, what is the projects expected net present value? b. Would it make sense to wait 2 years before deciding whether to drill? Explain. c. What is the value of the investment timing option? d. What disadvantages might arise from delaying a project such as this drilling project? *********PLEASE DO NOT USE EXCEL********

22. The Engler Oil Company is deciding whether to drill for oil on a tract of land that the company owns. The company estimates that the project will cost $9 million today. Engler estimates that once drilled, the oil will generate positive cash flows of $4.3 million a year atthe end of each of the next 4 years. Although the company is fairly confident about its cash flow forecast, it recognizes that if it waits 2 years, it will have more information about the local geology as well as the price of oil. Engler estimates that ifit waits 2 years, the project will cost $12 million, and cash flows will continue for 4 years after the initial investment is made. Moreover, if it waits 2 years, there is a 95% chance that the cash flows will be $4.4 million a year for 4 years, and thereis a 5% chance that the cash flows will be $2.4 million a year for 4 years. Assume that all cash flows are discounted at 11%. a. If the company chooses to drill today, what is the projects expected net present value? b. Would it make sense to wait 2 years before deciding whether to drill? Explain. c. What is the value of the investment timing option? d. What disadvantages might arise from delaying a project such as this drilling project? *********PLEASE DO NOT USE EXCEL********

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started