Answered step by step

Verified Expert Solution

Question

1 Approved Answer

22 The policies wrap around the benefits in comprehensive policies, essential health benefits policies, hospital and surgical policies, and catastrophic policies, filling in their

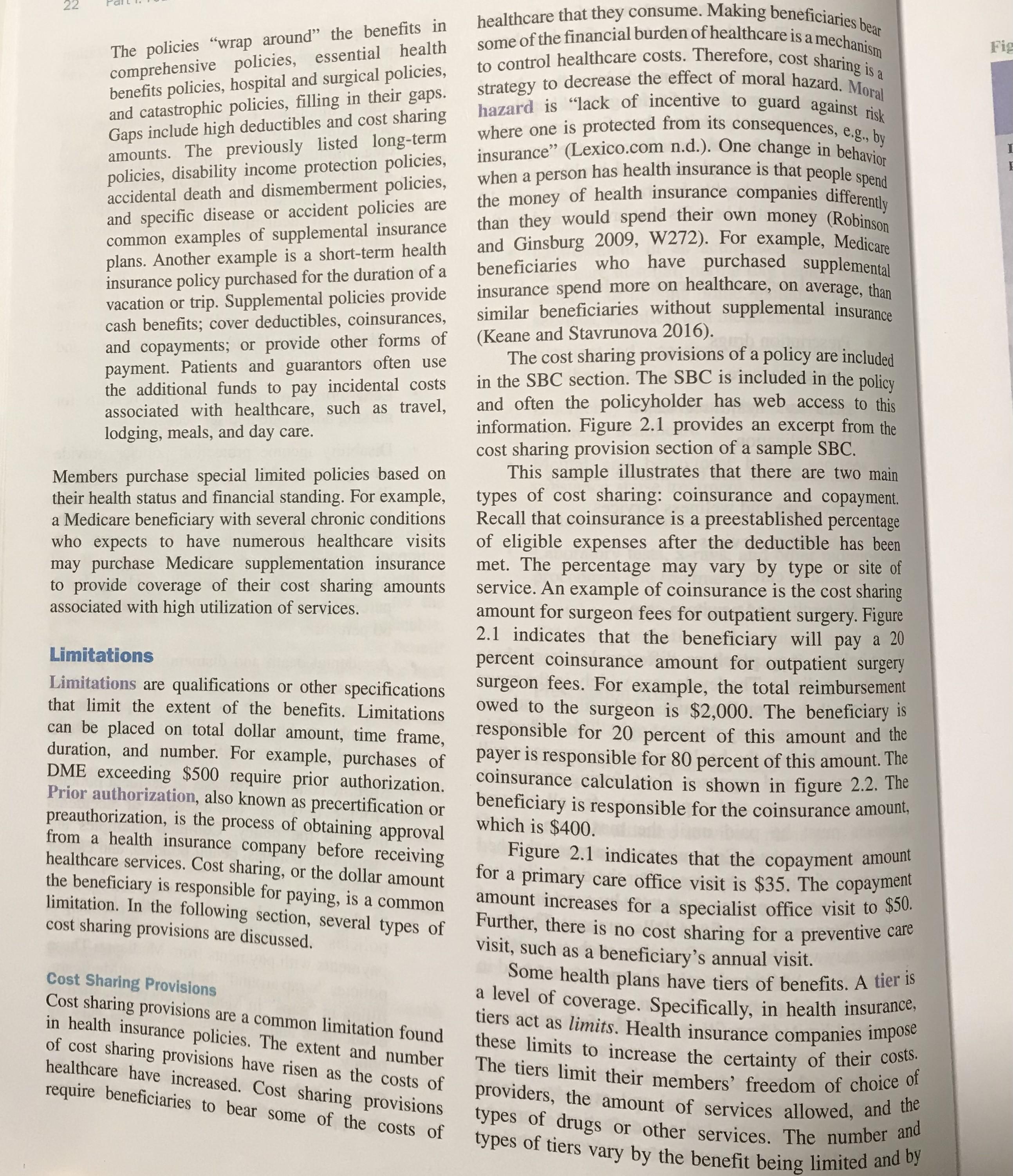

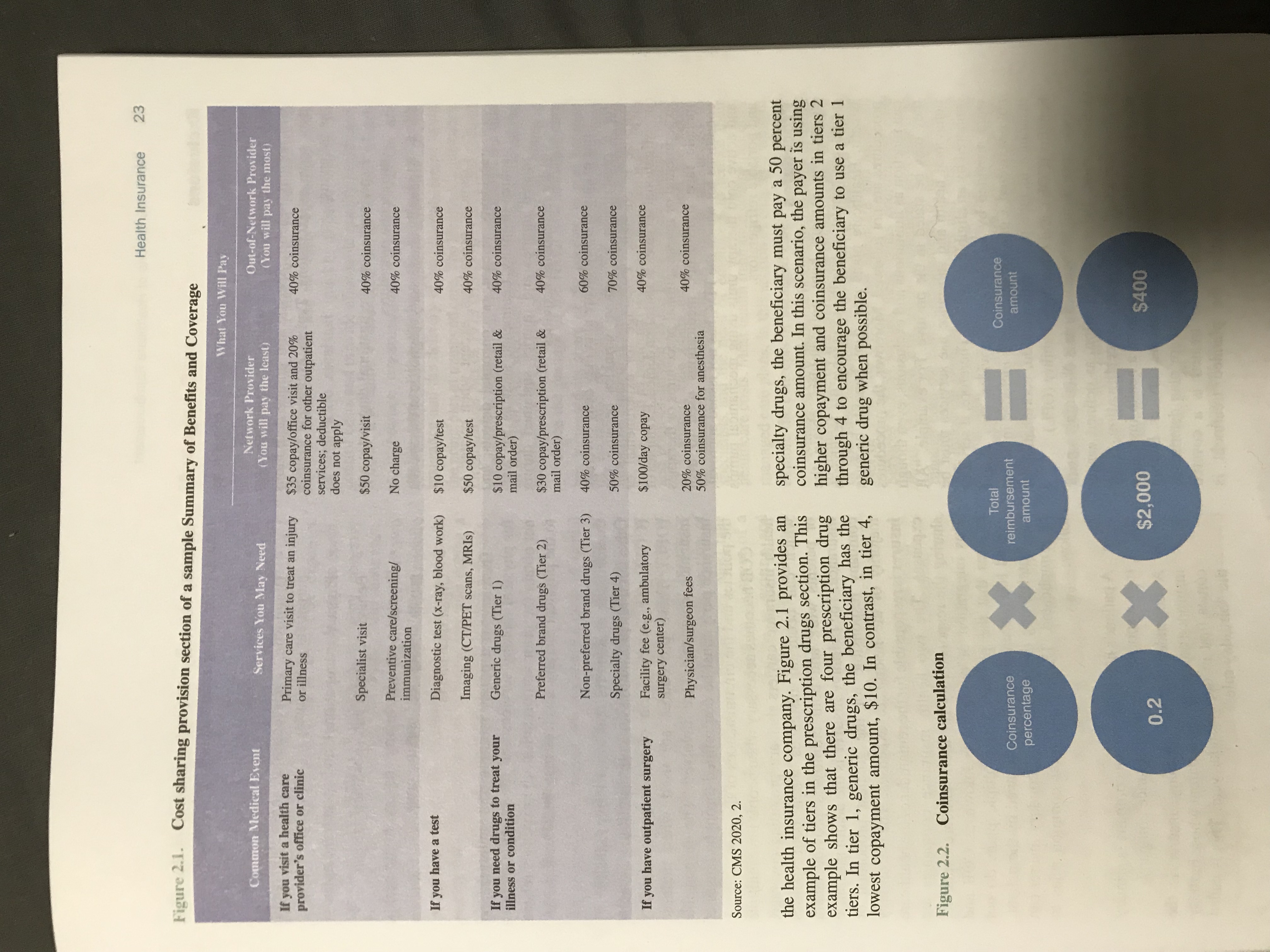

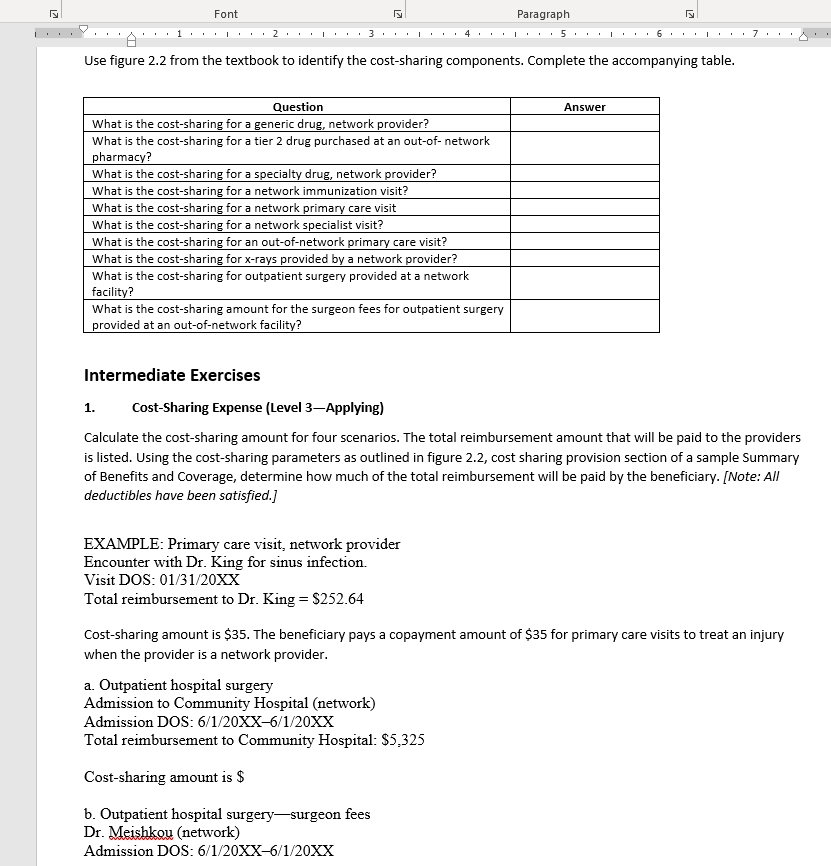

22 The policies "wrap around" the benefits in comprehensive policies, essential health benefits policies, hospital and surgical policies, and catastrophic policies, filling in their gaps. Gaps include high deductibles and cost sharing amounts. The previously listed long-term policies, disability income protection policies, accidental death and dismemberment policies, and specific disease or accident policies are common examples of supplemental insurance plans. Another example is a short-term health insurance policy purchased for the duration of a vacation or trip. Supplemental policies provide cash benefits; cover deductibles, coinsurances, and copayments; or provide other forms of payment. Patients and guarantors often use the additional funds to pay incidental costs associated with healthcare, such as travel, lodging, meals, and day care. Members purchase special limited policies based on their health status and financial standing. For example, a Medicare beneficiary with several chronic conditions who expects to have numerous healthcare visits may purchase Medicare supplementation insurance to provide coverage of their cost sharing amounts associated with high utilization of services. Limitations Limitations are qualifications or other specifications that limit the extent of the benefits. Limitations can be placed on total dollar amount, time frame, duration, and number. For example, purchases of DME exceeding $500 require prior authorization. Prior authorization, also known as precertification or preauthorization, is the process of obtaining approval from a health insurance company before receiving healthcare services. Cost sharing, or the dollar amount the beneficiary is responsible for paying, is a common limitation. In the following section, several types of cost sharing provisions are discussed. Cost Sharing Provisions Cost sharing provisions are a common limitation found in health insurance policies. The extent and number of cost sharing provisions have risen as the costs of healthcare have increased. Cost sharing provisions require beneficiaries to bear some of the costs of healthcare that they consume. Making beneficiaries bear some of the financial burden of healthcare is a mechanism to control healthcare costs. Therefore, cost sharing is a strategy to decrease the effect of moral hazard. Moral hazard is "lack of incentive to guard against risk where one is protected from its consequences, e.g., by insurance" (Lexico.com n.d.). One change in behavior when a person has health insurance is that people spend the money of health insurance companies differently than they would spend their own money (Robinson and Ginsburg 2009, W272). For example, Medicare beneficiaries who have purchased supplemental insurance spend more on healthcare, on average, than similar beneficiaries without supplemental insurance (Keane and Stavrunova 2016). The cost sharing provisions of a policy are included in the SBC section. The SBC is included in the policy and often the policyholder has web access to this information. Figure 2.1 provides an excerpt from the cost sharing provision section of a sample SBC. This sample illustrates that there are two main types of cost sharing: coinsurance and copayment. Recall that coinsurance is a preestablished percentage of eligible expenses after the deductible has been met. The percentage may vary by type or site of service. An example of coinsurance is the cost sharing amount for surgeon fees for outpatient surgery. Figure 2.1 indicates that the beneficiary will pay a 20 percent coinsurance amount for outpatient surgery surgeon fees. For example, the total reimbursement owed to the surgeon is $2,000. The beneficiary is responsible for 20 percent of this amount and the payer is responsible for 80 percent of this amount. The coinsurance calculation is shown in figure 2.2. The beneficiary is responsible for the coinsurance amount, which is $400. Figure 2.1 indicates that the copayment amount for a primary care office visit is $35. The copayment amount increases for a specialist office visit to $50. Further, there is no cost sharing for a preventive care visit, such as a beneficiary's annual visit. Some health plans have tiers of benefits. A tier is a level of coverage. Specifically, in health insurance, tiers act as limits. Health insurance companies impose these limits to increase the certainty of their costs. The tiers limit their members' freedom of choice of providers, the amount of services allowed, and the types of drugs or other services. The number and types of tiers vary by the benefit being limited and by Fig I Figure 2.1. Cost sharing provision section of a sample Summary of Benefits and Coverage Health Insurance 23 Common Medical Event If you visit a health care provider's office or clinic Services You May Need Primary care visit to treat an injury or illness What You Will Pay Network Provider (You will pay the least) Out-of-Network Provider (You will pay the most) 40% coinsurance $35 copay/office visit and 20% coinsurance for other outpatient services; deductible does not apply $50 copay/visit Specialist visit If you have a test If you need drugs to treat your illness or condition Preventive care/screening/ immunization Diagnostic test (x-ray, blood work) Imaging (CT/PET scans, MRIs) Generic drugs (Tier 1) No charge $10 copay/test 40% coinsurance 40% coinsurance 40% coinsurance $50 copay/test 40% coinsurance $10 copay/prescription (retail & mail order) 40% coinsurance Preferred brand drugs (Tier 2) $30 copay/prescription (retail & mail order) 40% coinsurance 40% coinsurance If you have outpatient surgery Non-preferred brand drugs (Tier 3) Specialty drugs (Tier 4) Facility fee (e.g., ambulatory surgery center) Physician/surgeon fees 50% coinsurance $100/day copay 20% coinsurance 50% coinsurance for anesthesia Source: CMS 2020, 2. 60% coinsurance 70% coinsurance 40% coinsurance 40% coinsurance the health insurance company. Figure 2.1 provides an example of tiers in the prescription drugs section. This example shows that there are four prescription drug tiers. In tier 1, generic drugs, the beneficiary has the lowest copayment amount, $10. In contrast, in tier 4, specialty drugs, the beneficiary must pay a 50 percent coinsurance amount. In this scenario, the payer is using higher copayment and coinsurance amounts in tiers 2 through 4 to encourage the beneficiary to use a tier 1 generic drug when possible. Figure 2.2. Coinsurance calculation Coinsurance percentage * Total reimbursement amount Coinsurance amount 0.2 $2,000 = $400 ly Font 1 2 Paragraph 3 4 5. N 7 Use figure 2.2 from the textbook to identify the cost-sharing components. Complete the accompanying table. Question What is the cost-sharing for a generic drug, network provider? What is the cost-sharing for a tier 2 drug purchased at an out-of-network pharmacy? What is the cost-sharing for a specialty drug, network provider? What is the cost-sharing for a network immunization visit? What is the cost-sharing for a network primary care visit What is the cost-sharing for a network specialist visit? What is the cost-sharing for an out-of-network primary care visit? What is the cost-sharing for x-rays provided by a network provider? What is the cost-sharing for outpatient surgery provided at a network facility? What is the cost-sharing amount for the surgeon fees for outpatient surgery provided at an out-of-network facility? Answer Intermediate Exercises 1. Cost-Sharing Expense (Level 3-Applying) Calculate the cost-sharing amount for four scenarios. The total reimbursement amount that will be paid to the providers is listed. Using the cost-sharing parameters as outlined in figure 2.2, cost sharing provision section of a sample Summary of Benefits and Coverage, determine how much of the total reimbursement will be paid by the beneficiary. [Note: All deductibles have been satisfied.] EXAMPLE: Primary care visit, network provider Encounter with Dr. King for sinus infection. Visit DOS: 01/31/20XX Total reimbursement to Dr. King = $252.64 Cost-sharing amount is $35. The beneficiary pays a copayment amount of $35 for primary care visits to treat an injury when the provider is a network provider. a. Outpatient hospital surgery Admission to Community Hospital (network) Admission DOS: 6/1/20XX-6/1/20XX Total reimbursement to Community Hospital: $5,325 Cost-sharing amount is $ b. Outpatient hospital surgery-surgeon fees Dr. Meishko (network) Admission DOS: 6/1/20XX-6/1/20XX

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started