Answered step by step

Verified Expert Solution

Question

1 Approved Answer

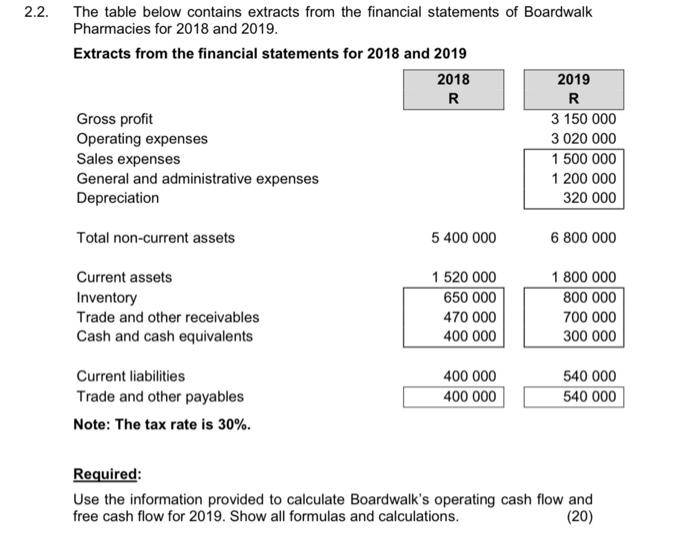

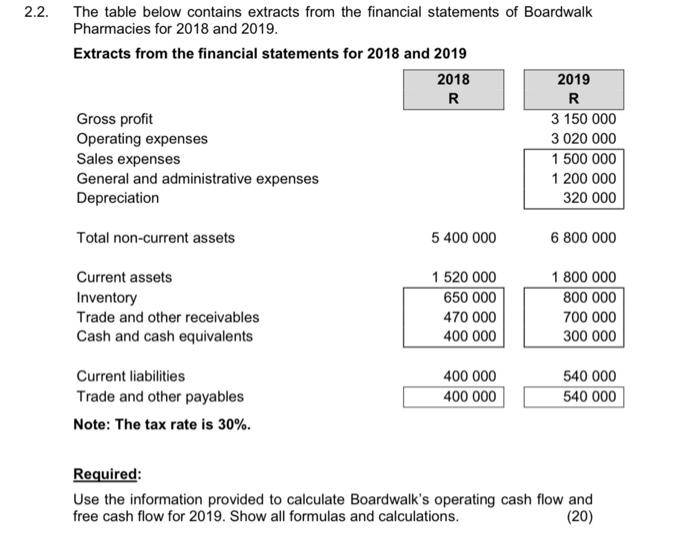

2.2. The table below contains extracts from the financial statements of Boardwalk Pharmacies for 2018 and 2019. Extracts from the financial statements for 2018 and

2.2. The table below contains extracts from the financial statements of Boardwalk Pharmacies for 2018 and 2019. Extracts from the financial statements for 2018 and 2019 Required: Use the information provided to calculate Boardwalks operating free cash flow for 2019. Show all formulas and calculations.  2.2. The table below contains extracts from the financial statements of Boardwalk Pharmacies for 2018 and 2019. Extracts from the financial statements for 2018 and 2019 2018 2019 R R Gross profit 3 150 000 Operating expenses 3 020 000 Sales expenses 1 500 000 General and administrative expenses 1 200 000 Depreciation 320 000 Total non-current assets 5 400 000 6 800 000 Current assets Inventory Trade and other receivables Cash and cash equivalents 1 520 000 650 000 470 000 400 000 1 800 000 800 000 700 000 300 000 Current liabilities Trade and other payables Note: The tax rate is 30%. 400 000 400 000 540 000 540 000 Required: Use the information provided to calculate Boardwalk's operating cash flow and free cash flow for 2019. Show all formulas and calculations. (20)

2.2. The table below contains extracts from the financial statements of Boardwalk Pharmacies for 2018 and 2019. Extracts from the financial statements for 2018 and 2019 2018 2019 R R Gross profit 3 150 000 Operating expenses 3 020 000 Sales expenses 1 500 000 General and administrative expenses 1 200 000 Depreciation 320 000 Total non-current assets 5 400 000 6 800 000 Current assets Inventory Trade and other receivables Cash and cash equivalents 1 520 000 650 000 470 000 400 000 1 800 000 800 000 700 000 300 000 Current liabilities Trade and other payables Note: The tax rate is 30%. 400 000 400 000 540 000 540 000 Required: Use the information provided to calculate Boardwalk's operating cash flow and free cash flow for 2019. Show all formulas and calculations. (20)

2.2. The table below contains extracts from the financial statements of Boardwalk Pharmacies for 2018 and 2019.

Extracts from the financial statements for 2018 and 2019

Required: Use the information provided to calculate Boardwalks operating free cash flow for 2019. Show all formulas and calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started