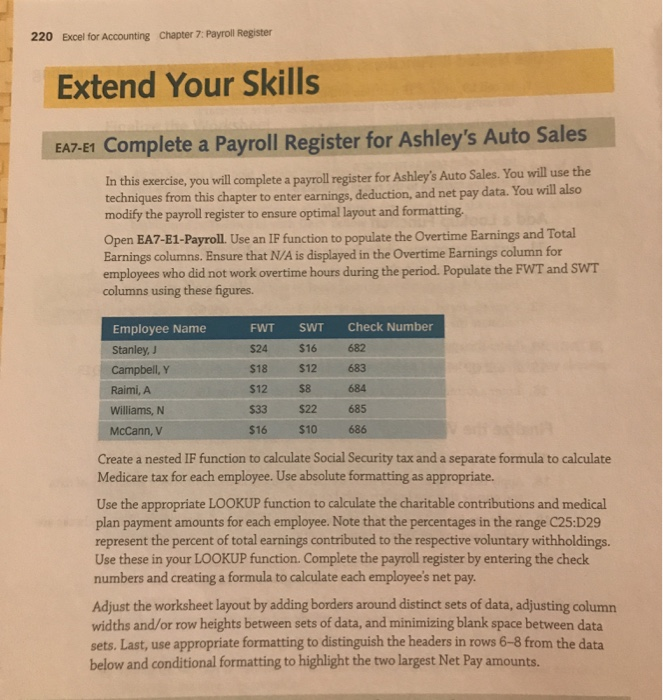

220 Excel for Accounting Chapter 7: Payroll Register Extend Your Skills EA7-E1 Complete a Payroll Register for Ashley's Auto Sales In this exercise, you will complete a payroll register for Ashley's Auto Sales. You will use the techniques from this chapter to enter earnings, deduction, and net pay data. You will also modify the payroll register to ensure optimal layout and formatting Open EA7-E1-Payroll. Use an IF function to populate the Overtime Earnings and Total Earnings columns. Ensure that N/A is displayed in the Overtime Earnings column for employees who did not work overtime hours during the period. Populate the FWT and SWT columns using these figures. Employee Name Stanley, Campbell, Y Raimi, A Williams, N McCann, v FWT $24 $18 512 533 $16 SWT $16 512 $8 522 10 Check Number 682 683 684 685 686 Create a nested IF function to calculate Social Security tax and a separate formula to calculate Medicare tax for each employee. Use absolute formatting as appropriate. Use the appropriate LOOKUP function to calculate the charitable contributions and medical plan payment amounts for each employee. Note that the percentages in the range C25:D29 represent the percent of total earnings contributed to the respective voluntary withholdings. Use these in your LOOKUP function. Complete the payroll register by entering the check numbers and creating a formula to calculate each employee's net pay. Adjust the worksheet layout by adding borders around distinct sets of data, adjusting column widths and/or row heights between sets of data, and minimizing blank space between data sets. Last, use appropriate formatting to distinguish the headers in rows 6-8 from the data below and conditional formatting to highlight the two largest Net Pay amounts. 220 Excel for Accounting Chapter 7: Payroll Register Extend Your Skills EA7-E1 Complete a Payroll Register for Ashley's Auto Sales In this exercise, you will complete a payroll register for Ashley's Auto Sales. You will use the techniques from this chapter to enter earnings, deduction, and net pay data. You will also modify the payroll register to ensure optimal layout and formatting Open EA7-E1-Payroll. Use an IF function to populate the Overtime Earnings and Total Earnings columns. Ensure that N/A is displayed in the Overtime Earnings column for employees who did not work overtime hours during the period. Populate the FWT and SWT columns using these figures. Employee Name Stanley, Campbell, Y Raimi, A Williams, N McCann, v FWT $24 $18 512 533 $16 SWT $16 512 $8 522 10 Check Number 682 683 684 685 686 Create a nested IF function to calculate Social Security tax and a separate formula to calculate Medicare tax for each employee. Use absolute formatting as appropriate. Use the appropriate LOOKUP function to calculate the charitable contributions and medical plan payment amounts for each employee. Note that the percentages in the range C25:D29 represent the percent of total earnings contributed to the respective voluntary withholdings. Use these in your LOOKUP function. Complete the payroll register by entering the check numbers and creating a formula to calculate each employee's net pay. Adjust the worksheet layout by adding borders around distinct sets of data, adjusting column widths and/or row heights between sets of data, and minimizing blank space between data sets. Last, use appropriate formatting to distinguish the headers in rows 6-8 from the data below and conditional formatting to highlight the two largest Net Pay amounts