Answered step by step

Verified Expert Solution

Question

1 Approved Answer

22-25 Help me to answer this in 1 and a half - 2 hours please give me a correct answer 1 pol 22. Lessor granted

22-25 Help me to answer this in 1 and a half - 2 hours please give me a correct answer

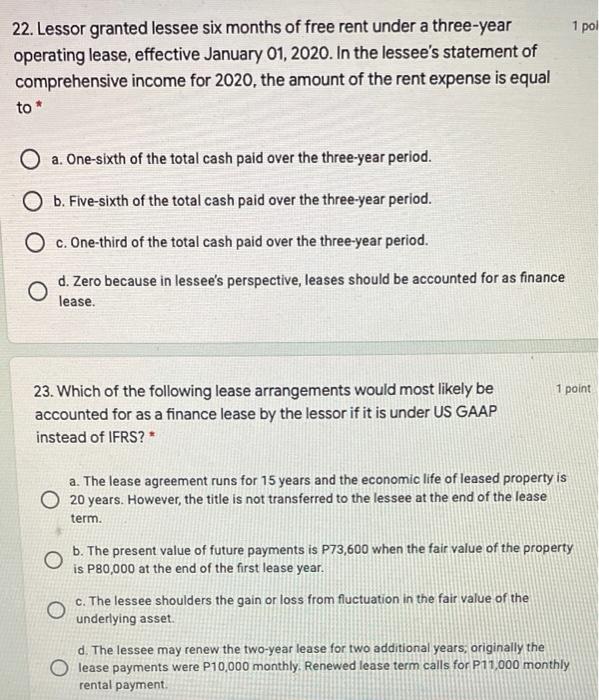

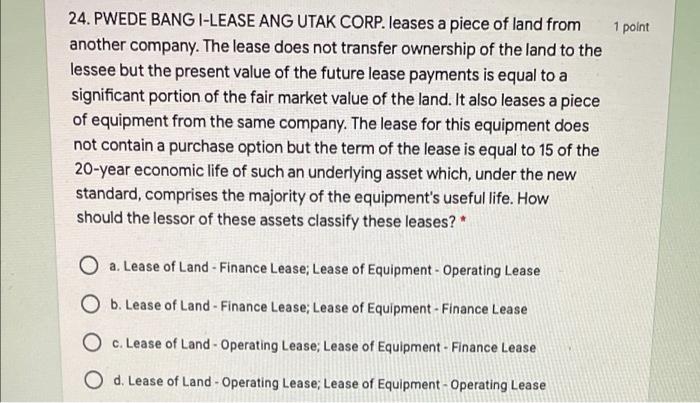

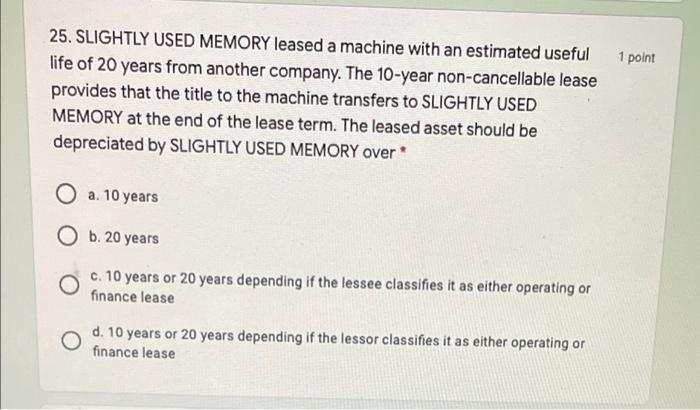

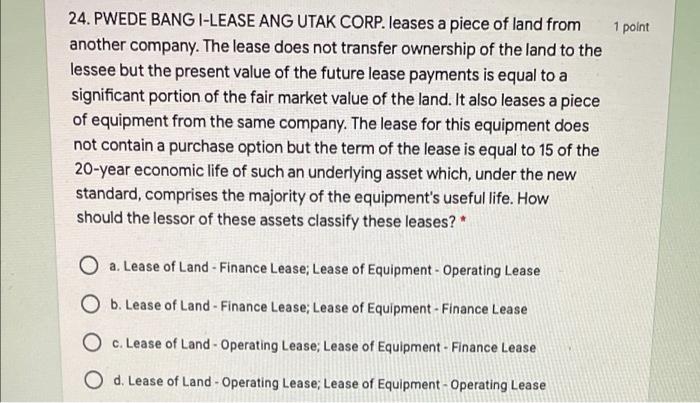

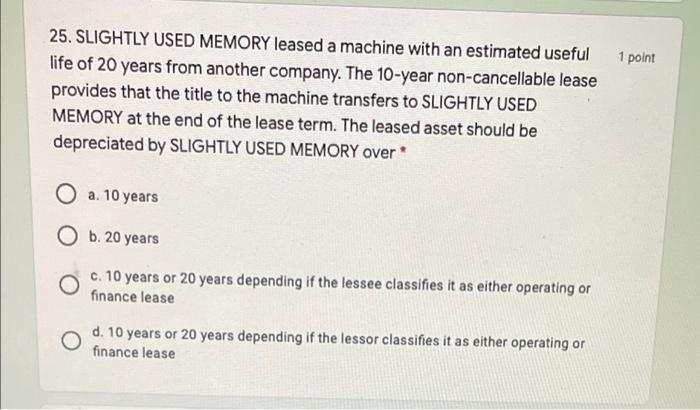

1 pol 22. Lessor granted lessee six months of free rent under a three-year operating lease, effective January 01, 2020. In the lessee's statement of comprehensive income for 2020, the amount of the rent expense is equal to * O a. One-sixth of the total cash paid over the three-year period. O b. Five-sixth of the total cash paid over the three-year period. O c. One-third of the total cash paid over the three-year period. O d. Zero because in lessee's perspective, leases should be accounted for as finance lease. 1 point 23. Which of the following lease arrangements would most likely be accounted for as a finance lease by the lessor if it is under US GAAP instead of IFRS? a. The lease agreement runs for 15 years and the economic life of leased property is 20 years. However, the title is not transferred to the lessee at the end of the lease term. b. The present value of future payments is P73,600 when the fair value of the property is P80,000 at the end of the first lease year. c. The lessee shoulders the gain or loss from fluctuation in the fair value of the underlying asset O d. The lessee may renew the two-year lease for two additional years, originally the O lease payments were P10,000 monthly Renewed lease term calls for P11,000 monthly rental payment 1 point 24. PWEDE BANG I-LEASE ANG UTAK CORP.leases a piece of land from another company. The lease does not transfer ownership of the land to the lessee but the present value of the future lease payments is equal to a significant portion of the fair market value of the land. It also leases a piece of equipment from the same company. The lease for this equipment does not contain a purchase option but the term of the lease is equal to 15 of the 20-year economic life of such an underlying asset which, under the new standard, comprises the majority of the equipment's useful life. How should the lessor of these assets classify these leases?" a. Lease of Land - Finance Lease; Lease of Equipment - Operating Lease O b. Lease of Land - Finance Lease: Lease of Equipment - Finance Lease c. Lease of Land - Operating Lease; Lease of Equipment - Finance Lease O d. Lease of Land - Operating Lease; Lease of Equipment - Operating Lease 1 point 25. SLIGHTLY USED MEMORY leased a machine with an estimated useful life of 20 years from another company. The 10-year non-cancellable lease provides that the title to the machine transfers to SLIGHTLY USED MEMORY at the end of the lease term. The leased asset should be depreciated by SLIGHTLY USED MEMORY over O a. 10 years O b. 20 years c. 10 years or 20 years depending if the lessee classifies it as either operating or finance lease d. 10 years or 20 years depending if the lessor classifies it as either operating or finance lease

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started