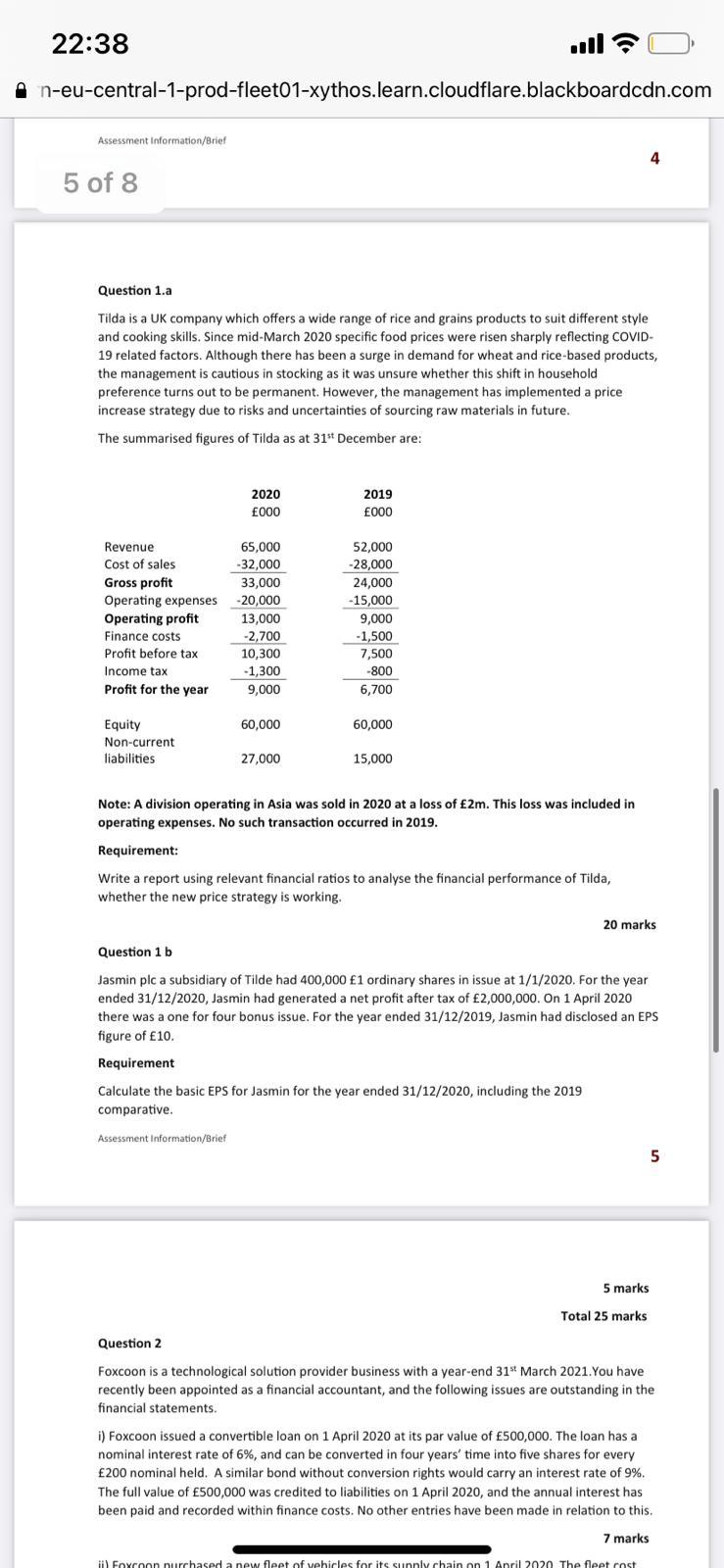

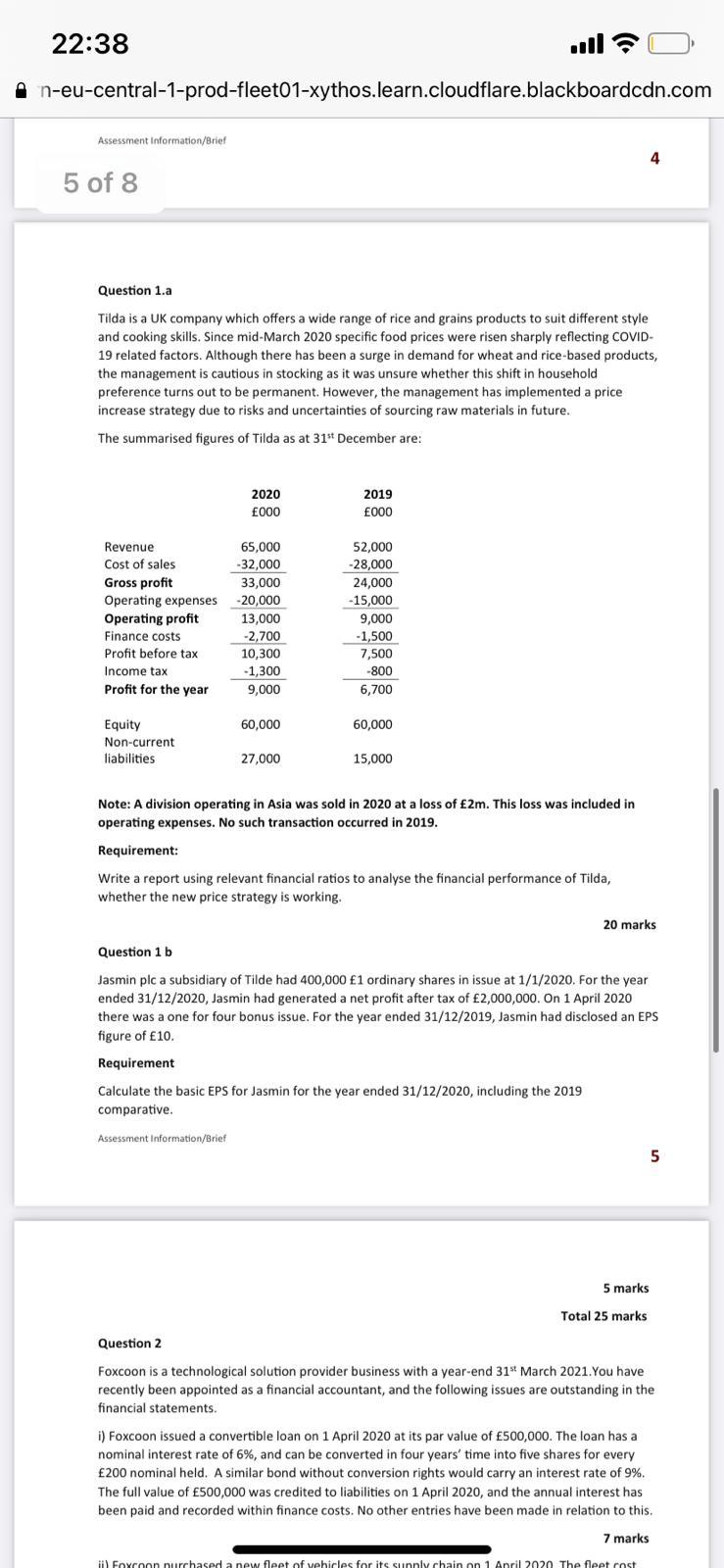

22:38 . n-eu-central-1-prod-fleet01-xythos.learn.cloudflare.blackboardcdn.com Assessment Information/Brief 5 of 8 Question 1.a Tilda is a UK company which offers a wide range of rice and grains products to suit different style and cooking skills. Since mid-March 2020 specific food prices were risen sharply reflecting COVID- 19 related factors. Although there has been a surge in demand for wheat and rice-based products, the management is cautious in stocking as it was unsure whether this shift in household preference turns out to be permanent. However, the management has implemented a price increase strategy due to risks and uncertainties of sourcing raw materials in future. The summarised figures of Tilda as at 31" December are: 2020 000 2019 000 Revenue Cost of sales Gross profit Operating expenses Operating profit Finance costs Profit before tax Income tax Profit for the year 65,000 -32,000 33,000 -20,000 13,000 -2.700 10,300 -1,300 9,000 52,000 -28,000 24,000 - 15,000 9,000 - 1,500 7,500 ... -800 6,700 60,000 60,000 Equity Non-current liabilities 27,000 15,000 Note: A division operating in Asia was sold in 2020 at a loss of 2m. This loss was included in operating expenses. No such transaction occurred in 2019. Requirement: Write a report using relevant financial ratios to analyse the financial performance of Tilda, whether the new price strategy is working. 20 marks Question 1 b Jasmin plc a subsidiary of Tilde had 400,000 1 ordinary shares in issue at 1/1/2020. For the year ended 31/12/2020, Jasmin had generated a net profit after tax of 2,000,000. On 1 April 2020 there was a one for four bonus issue. For the year ended 31/12/2019, Jasmin had disclosed an EPS figure of 10. Requirement Calculate the basic EPS for Jasmin for the year ended 31/12/2020, including the 2019 comparative. Assessment Information/Brief 5 5 marks Total 25 marks Question 2 Foxcoon is a technological solution provider business with a year-end 31 March 2021. You have recently been appointed as a financial accountant, and the following issues are outstanding in the financial statements. i) Foxcoon issued a convertible loan on 1 April 2020 at its par value of 500,000. The loan has a nominal interest rate of 6%, and can be converted in four years' time into five shares for every 200 nominal held. A similar bond without conversion rights would carry an interest rate of 9%. The full value of 500,000 was credited to liabilities on 1 April 2020, and the annual interest has been paid and recorded within finance costs. No other entries have been made in relation to this, 7 marks Hi Foxconn nurchased a new fleet of vehicles for its sunnly chain on 1 April 2020 The fleet cost