Answered step by step

Verified Expert Solution

Question

1 Approved Answer

224 Chapter 4 Assignment Problems Clarice Moishe $ 4,420 2,620 11-year-old child 1,875 13-year-old child 14,250 Total medical fees paid $23,165 Reimbursement from company medical

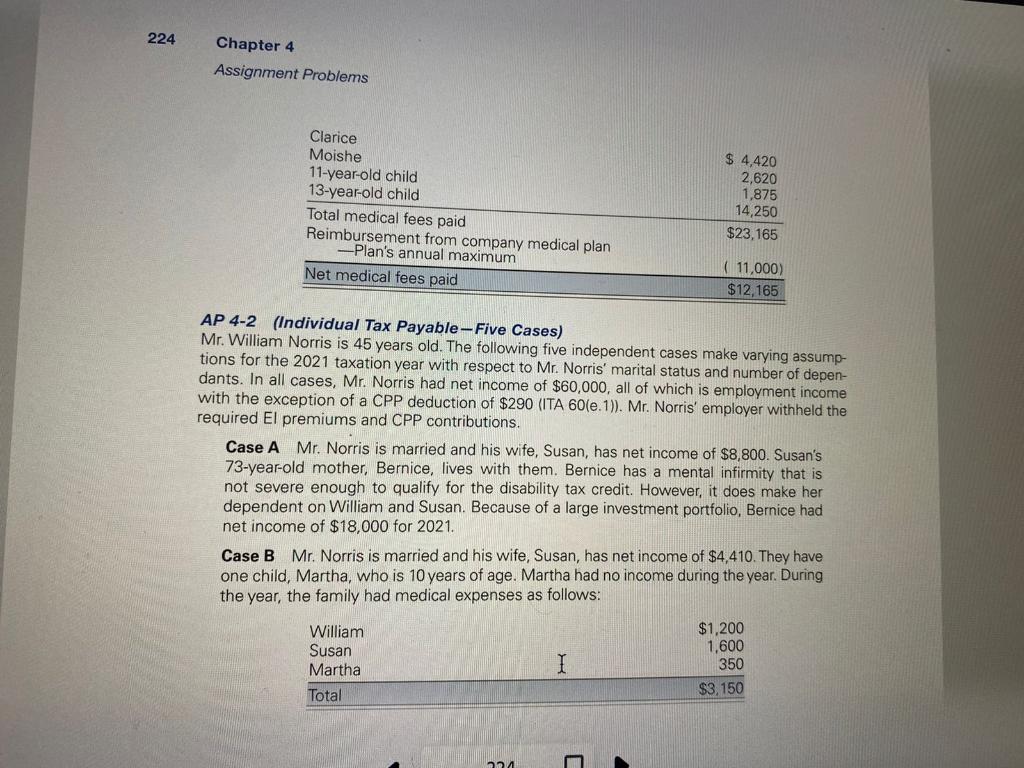

224 Chapter 4 Assignment Problems Clarice Moishe $ 4,420 2,620 11-year-old child 1,875 13-year-old child 14,250 Total medical fees paid $23,165 Reimbursement from company medical plan -Plan's annual maximum (11,000) Net medical fees paid $12,165 AP 4-2 (Individual Tax Payable-Five Cases) Mr. William Norris is 45 years old. The following five independent cases make varying assump- tions for the 2021 taxation year with respect to Mr. Norris' marital status and number of depen- dants. In all cases, Mr. Norris had net income of $60,000, all of which is employment income with the exception of a CPP deduction of $290 (ITA 60(e. 1)). Mr. Norris' employer withheld the required El premiums and CPP contributions. Case A Mr. Norris is married and his wife, Susan, has net income of $8,800. Susan's 73-year-old mother, Bernice, lives with them. Bernice has a mental infirmity that is not severe enough to qualify for the disability tax credit. However, it does make her dependent on William and Susan. Because of a large investment portfolio, Bernice had net income of $18,000 for 2021. Case B Mr. Norris is married and his wife, Susan, has net income of $4,410. They have one child, Martha, who is 10 years of age. Martha had no income during the year. During the year, the family had medical expenses as follows: William Susan Martha Total $1,200 1,600 I 350 $3,150

224 Chapter 4 Assignment Problems Clarice Moishe $ 4,420 2,620 11-year-old child 1,875 13-year-old child 14,250 Total medical fees paid $23,165 Reimbursement from company medical plan -Plan's annual maximum (11,000) Net medical fees paid $12,165 AP 4-2 (Individual Tax Payable-Five Cases) Mr. William Norris is 45 years old. The following five independent cases make varying assump- tions for the 2021 taxation year with respect to Mr. Norris' marital status and number of depen- dants. In all cases, Mr. Norris had net income of $60,000, all of which is employment income with the exception of a CPP deduction of $290 (ITA 60(e. 1)). Mr. Norris' employer withheld the required El premiums and CPP contributions. Case A Mr. Norris is married and his wife, Susan, has net income of $8,800. Susan's 73-year-old mother, Bernice, lives with them. Bernice has a mental infirmity that is not severe enough to qualify for the disability tax credit. However, it does make her dependent on William and Susan. Because of a large investment portfolio, Bernice had net income of $18,000 for 2021. Case B Mr. Norris is married and his wife, Susan, has net income of $4,410. They have one child, Martha, who is 10 years of age. Martha had no income during the year. During the year, the family had medical expenses as follows: William Susan Martha Total $1,200 1,600 I 350 $3,150 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started