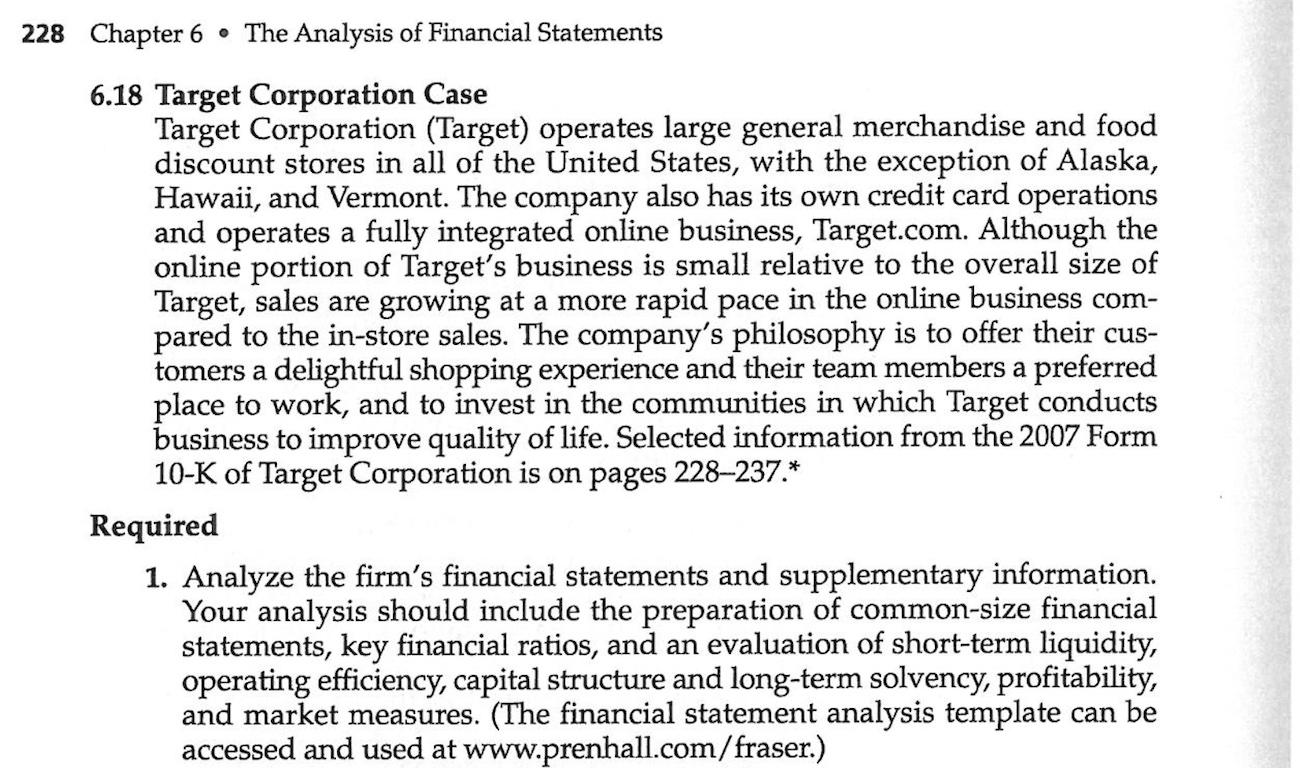

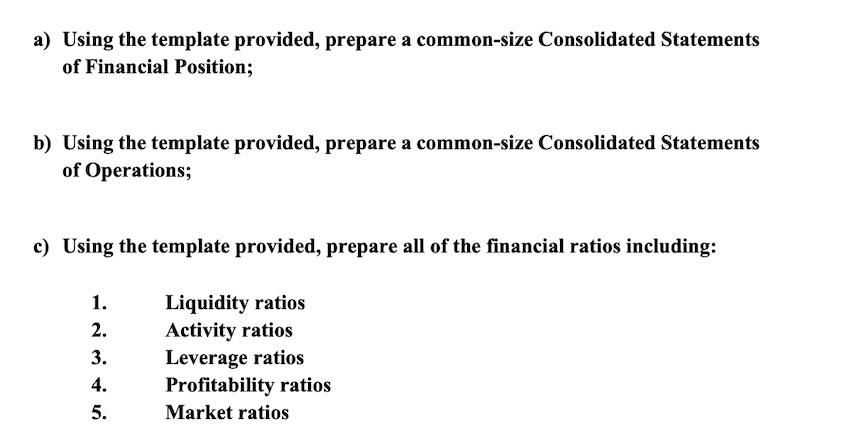

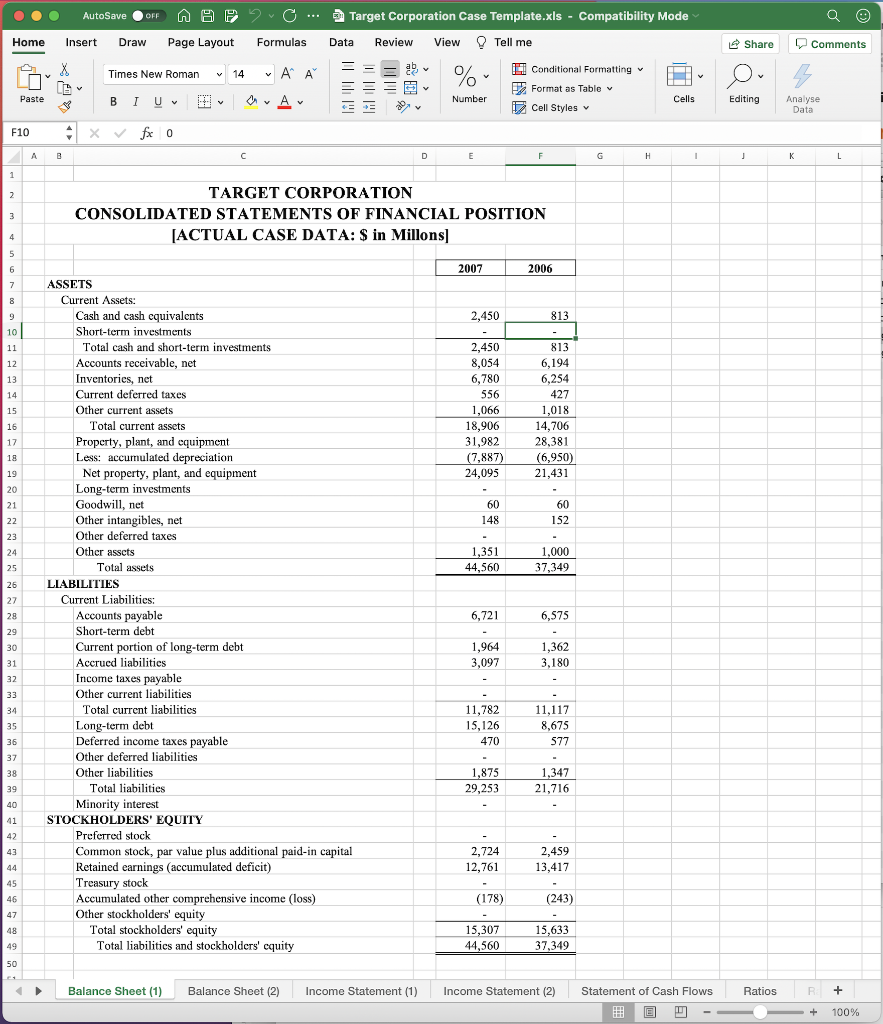

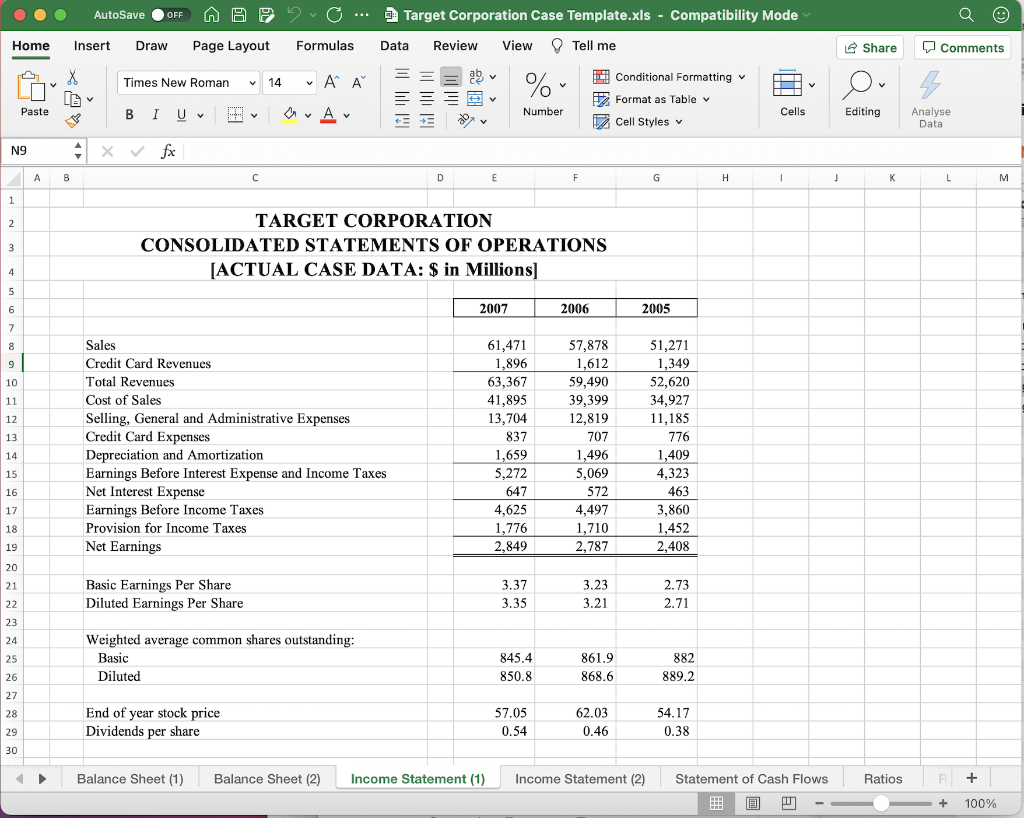

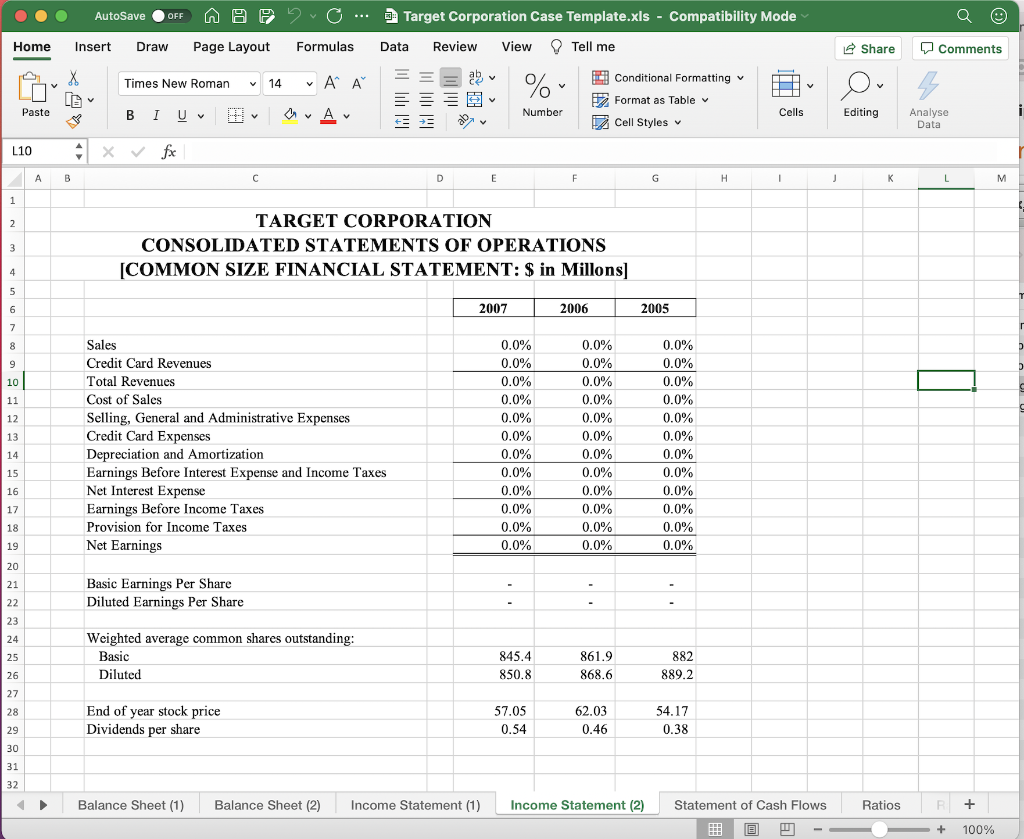

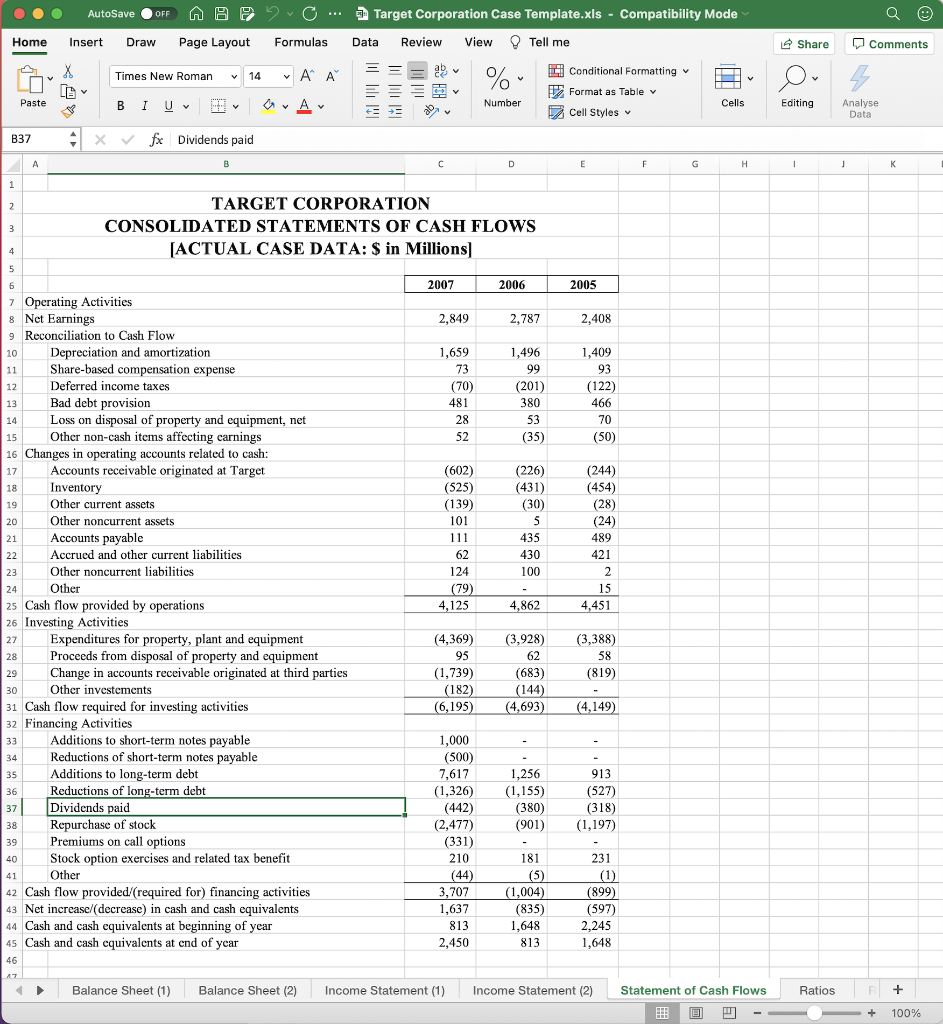

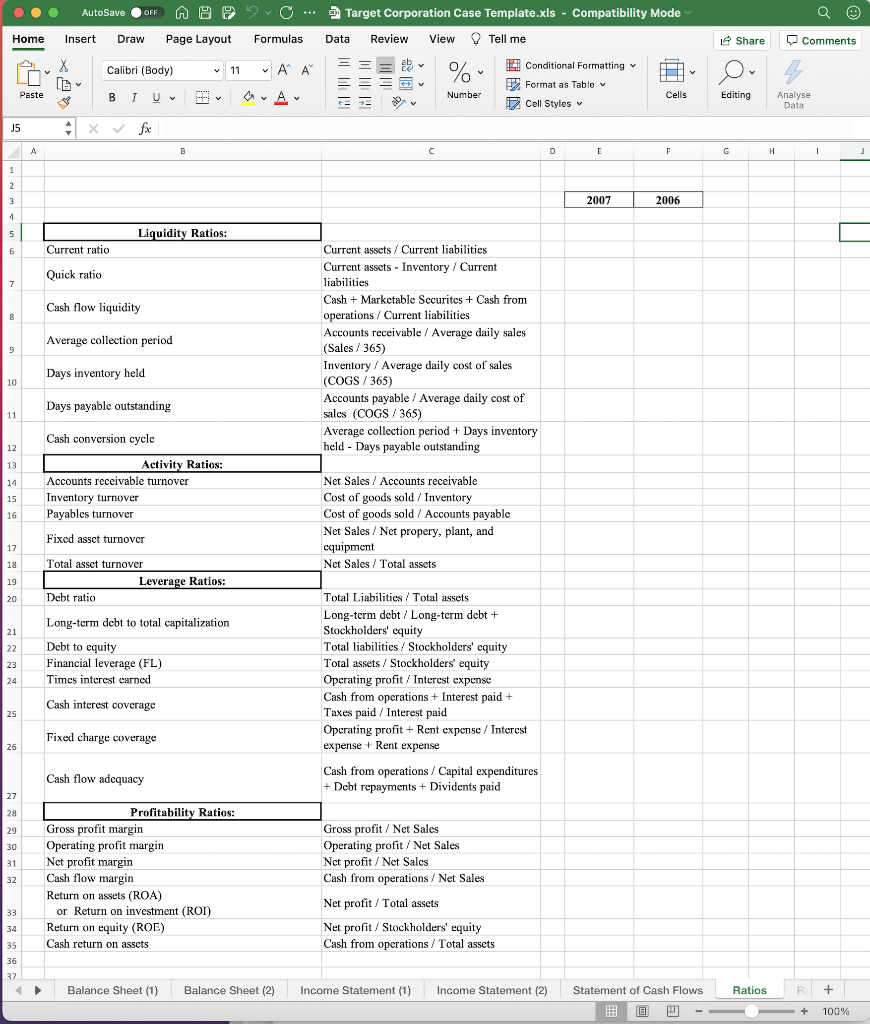

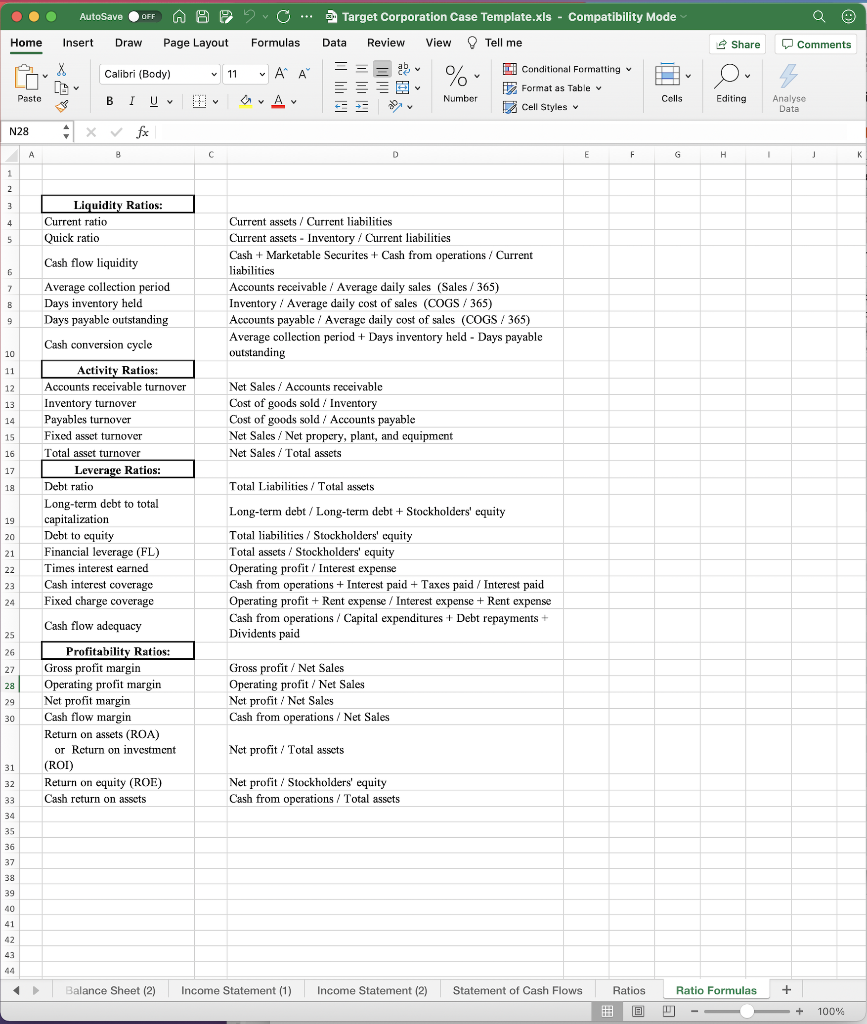

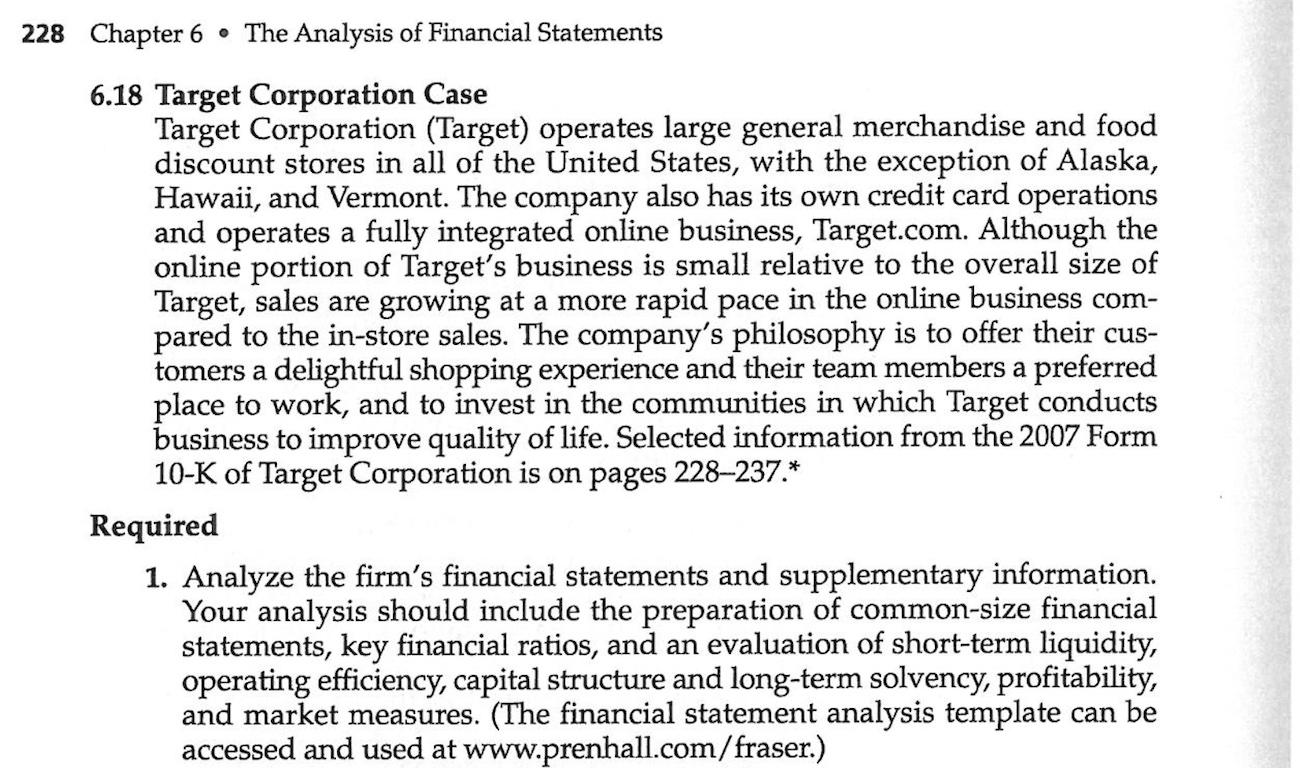

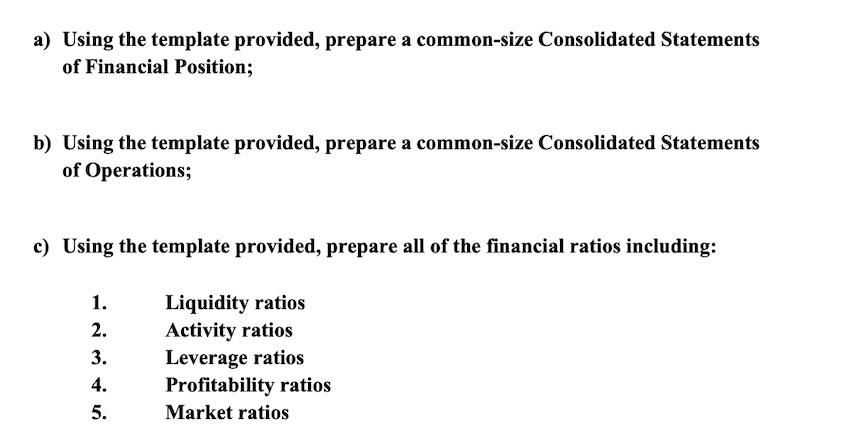

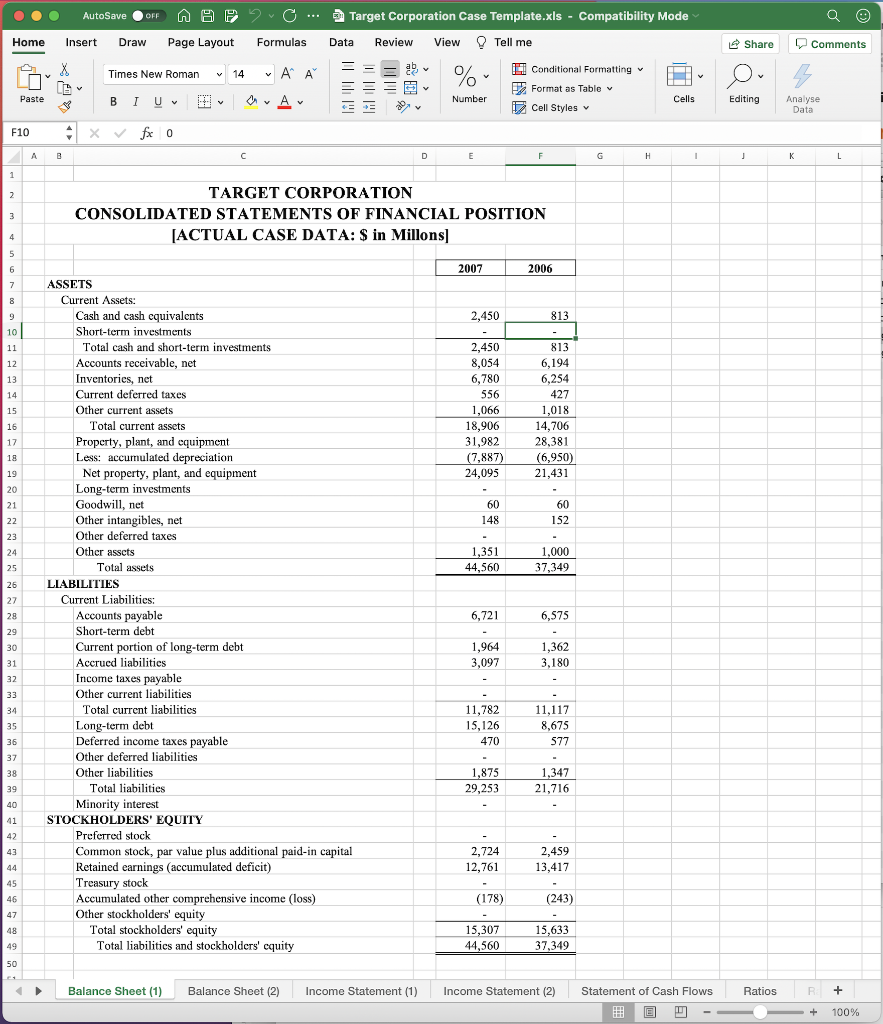

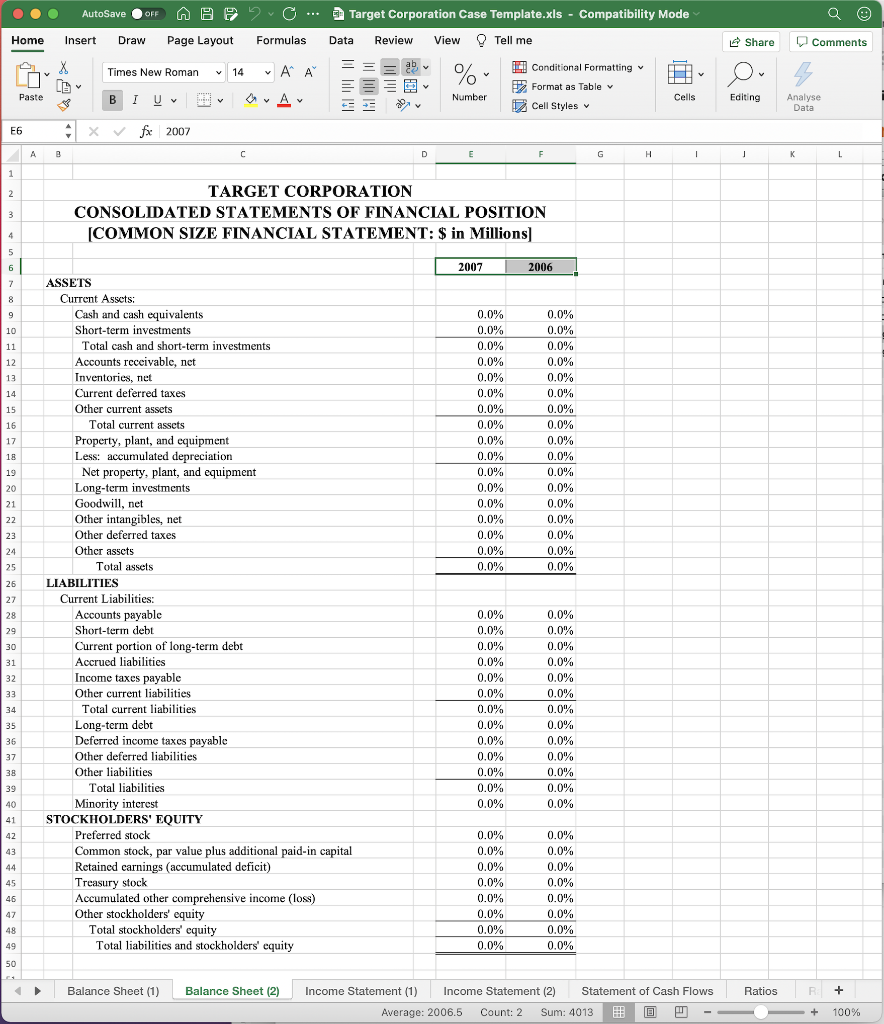

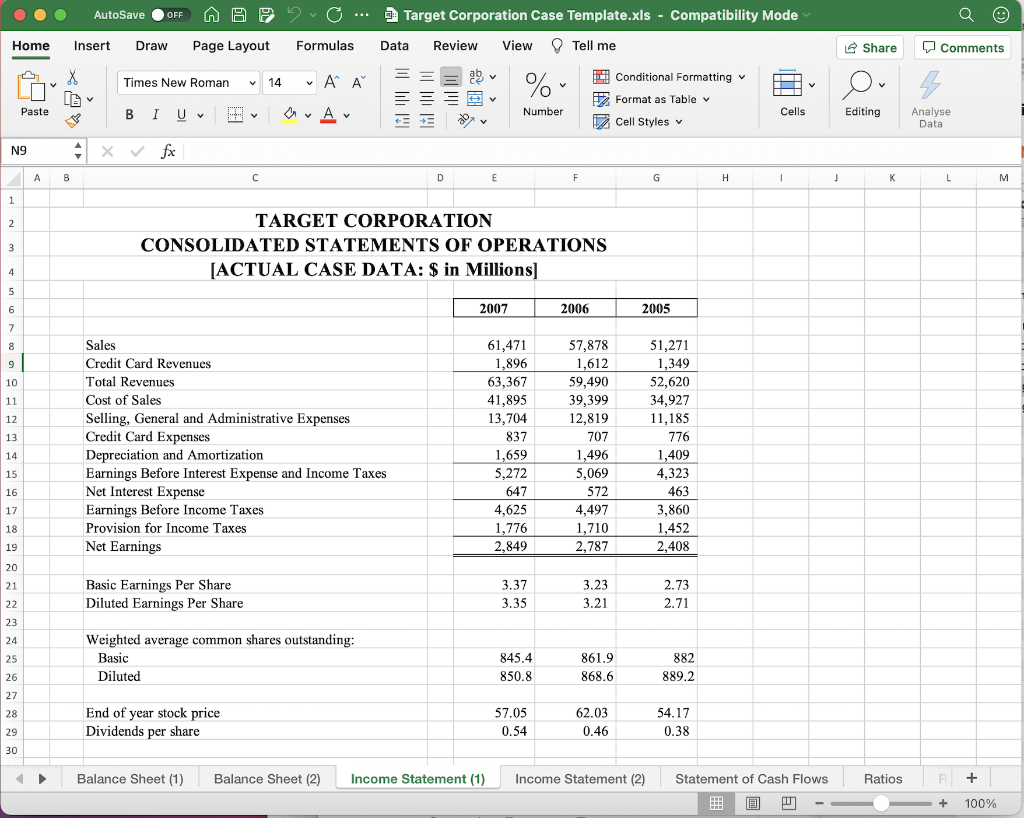

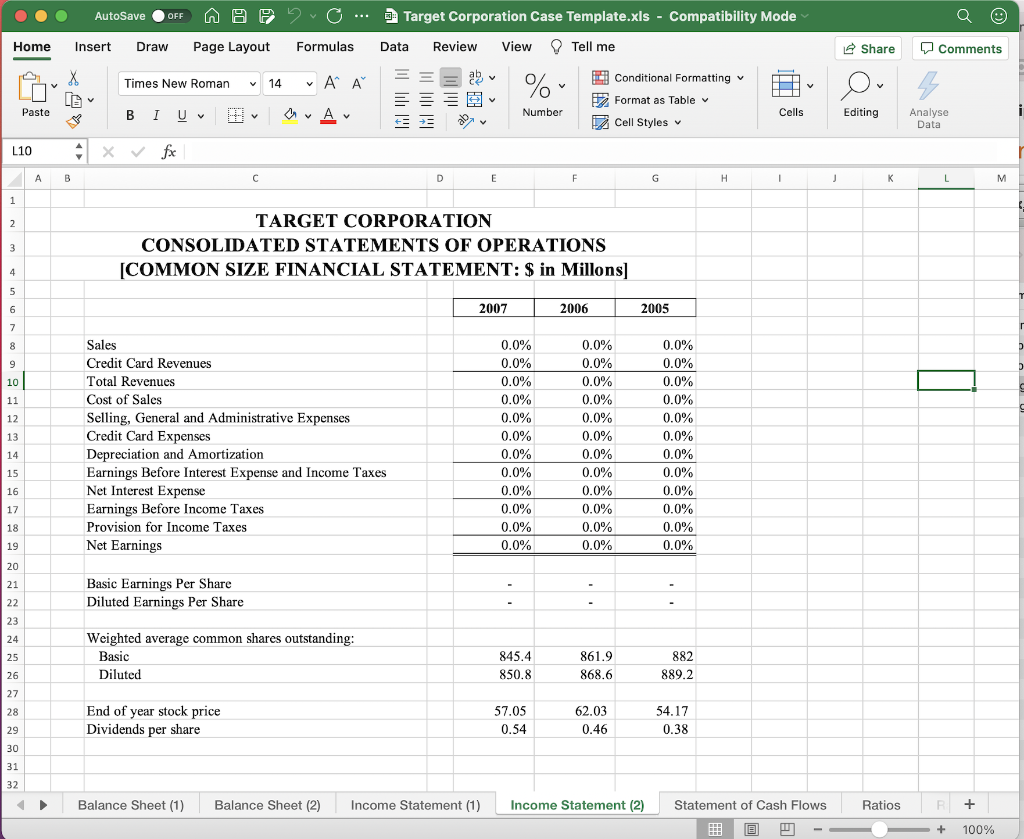

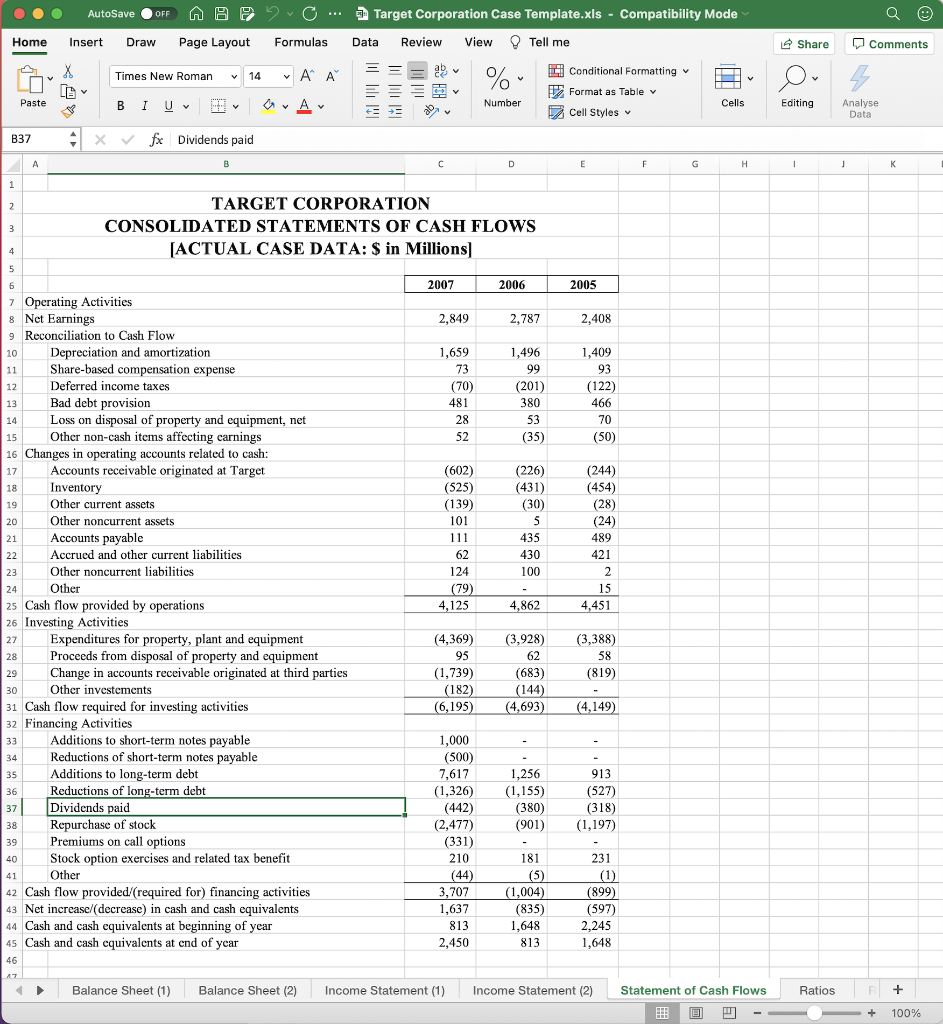

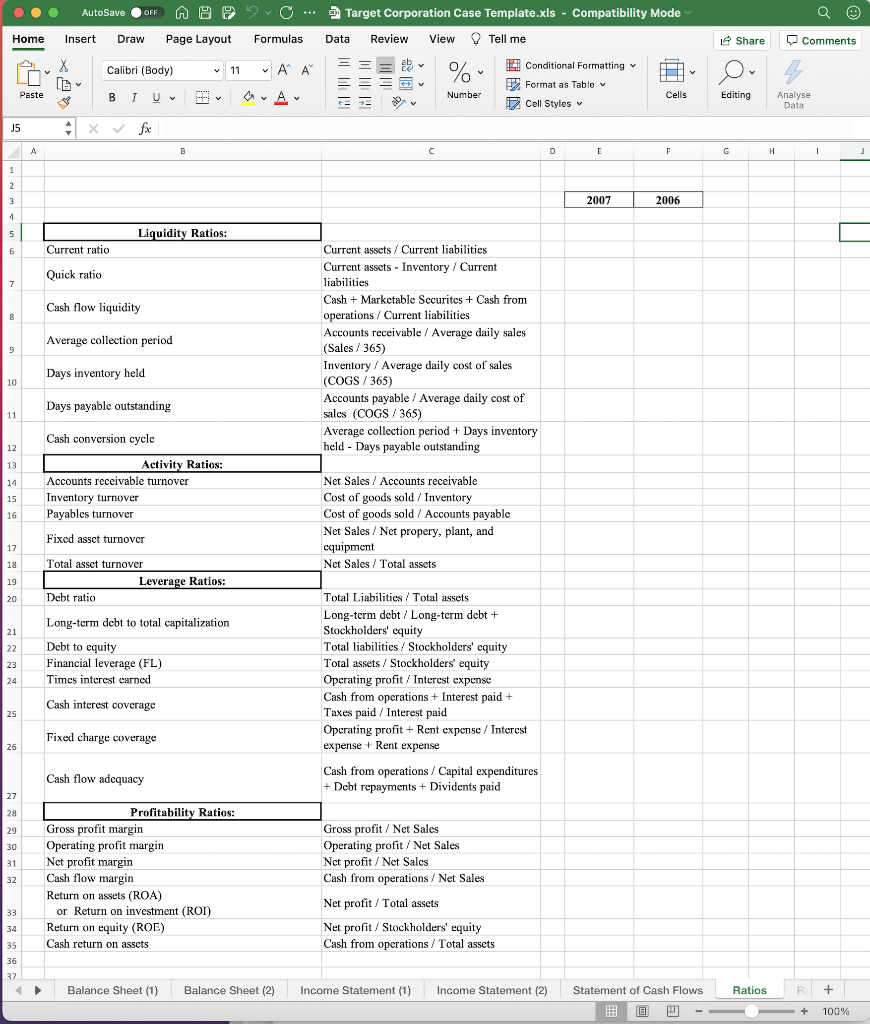

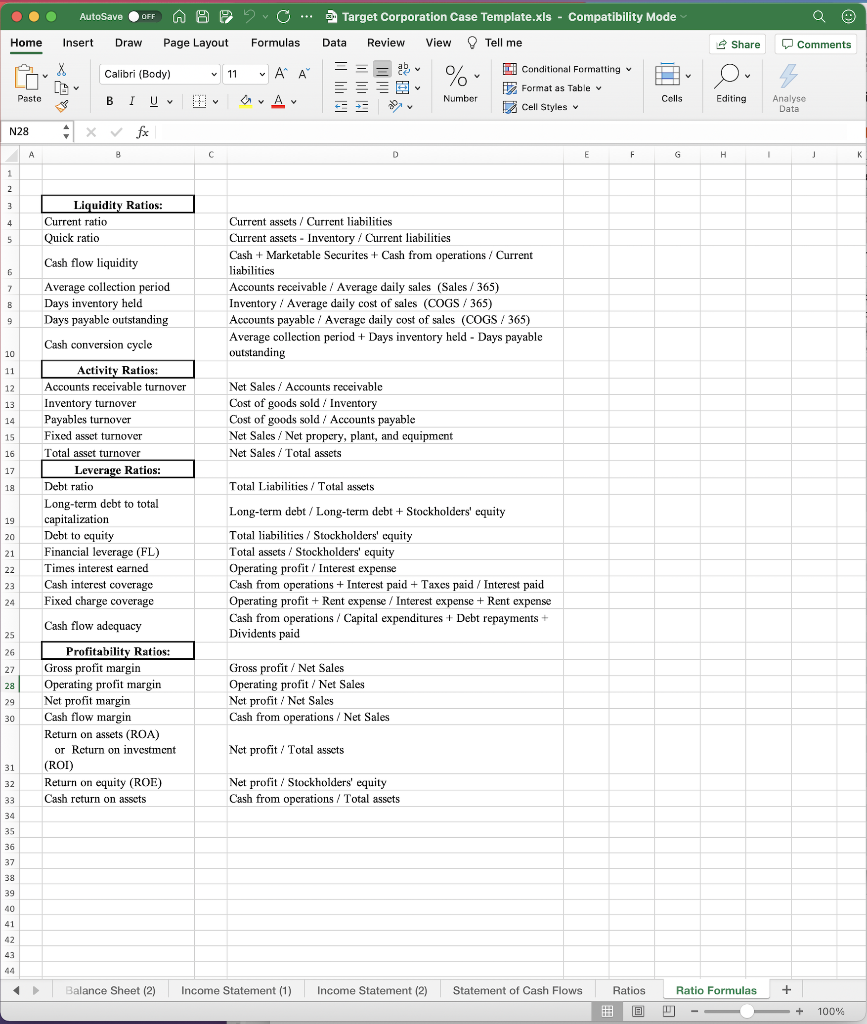

228 Chapter 6 The Analysis of Financial Statements 6.18 Target Corporation Case Target Corporation (Target) operates large general merchandise and food discount stores in all of the United States, with the exception of Alaska, Hawaii, and Vermont. The company also has its own credit card operations and operates a fully integrated online business, Target.com. Although the online portion of Target's business is small relative to the overall size of Target, sales are growing at a more rapid pace in the online business com- pared to the in-store sales. The company's philosophy is to offer their cus- tomers a delightful shopping experience and their team members a preferred place to work, and to invest in the communities in which Target conducts business to improve quality of life. Selected information from the 2007 Form 10-K of Target Corporation is on pages 228-237.* Required 1. Analyze the firm's financial statements and supplementary information. Your analysis should include the preparation of common-size financial statements, key financial ratios, and an evaluation of short-term liquidity, operating efficiency, capital structure and long-term solvency, profitability, and market measures. (The financial statement analysis template can be accessed and used at www.prenhall.com/fraser.) a) Using the template provided, prepare a common-size Consolidated Statements of Financial Position; ; b) Using the template provided, prepare a common-size Consolidated Statements of Operations; c) Using the template provided, prepare all of the financial ratios including: 1. 2. 3. 4. 5. Liquidity ratios Activity ratios Leverage ratios Profitability ratios Market ratios AutoSave OFF A G... Home Insert Draw Page Layout Formulas Share Comments Target Corporation Case Template.xls - Compatibility Mode Data Review View Tell me 07 Conditional Formatting P2 Format as Table Number Cells 17 Cell Styles X Times New Roman v 14 ~ A Paste BI V A Editing Analyse Data F10 x fx 0 A B c D E F G H J K L L 1 2 2 3 3 TARGET CORPORATION CONSOLIDATED STATEMENTS OF FINANCIAL POSITION [ACTUAL CASE DATA: $ in Millons) 5 6 2007 2006 7 8 9 2,450 813 10 11 12 13 14 15 2,450 8,054 6,780 SEC 556 ca 1,066 18 On 18,906 31,982 (7,887) 24,095 813 6,194 6,254 102 427 1,018 1018 14,706 2006 28,381 (6,950) 21,431 16 17 18 19 20 ASSETS Current Assets: Cash and cash equivalents Short-term investments Total cash and short-term investments Accounts receivable, net Inventories, net Current deferred taxes Other current assets Total current assets Property, plant, and equipment Less: accumulated depreciation Net property, plant, and equipment Long-term investments Goodwill, net Other intangibles, net Other deferred taxes Other assets Total assets DE LIABILITIES Current Liabilities: Accounts payable Short-term debt Current portion of long-term debt Accrued liabilities Income taxes payable Other current liabilities Total current liabilities 21 60 148 60 152 22 1,351 44,560 1,000 37,349 23 24 25 26 27 28 29 30 31 6,721 6,575 1,964 3,097 1,362 3,180 32 33 34 35 Long-term debt 11,782 15,126 470 11,117 8,675 577 36 37 38 39 40 1,875 29,253 1,347 21,716 41 42 43 Deferred income taxes payable Other deferred liabilities Other liabilities Total liabilities Minority interest STOCKHOLDERS' EQUITY Preferred stock Free Stock Common stock, par value plus additional paid-in capital Retained carnings accumulated deficit) Treasury stock Accumulated other comprehensive income (loss) Other stockholders' equity Total stockholders' equity Total liabilities and stockholders' cquity 2,724 12,761 2,459 13,417 44 45 (178) (243) 46 47 48 49 15,307 44,560 15,633 37,349 50 Balance Sheet (1) Balance Sheet (2) Income Statement (1) Income Statement (2) Statement of Cash Flows Ratios F + + 100% AutoSave OFF AB 2 @evo G... Home Insert Draw Page Layout Formulas Share Comments Target Corporation Case Template.xls - Compatibility Mode Data Review View Tell me L. Conditional Formatting % Format as Table Number Cells Cell Styles Times New Roman y 14 ~ A A O 2 v V Paste Av Editing Analyse Data E6 fx 2007 A B D E E F G H ! K L L 1 2 3 TARGET CORPORATION CONSOLIDATED STATEMENTS OF FINANCIAL POSITION [COMMON SIZE FINANCIAL STATEMENT: $ in Millions) 4 5 6 2007 2006 7 8 9 ASSETS Current Assets: Cash and cash equivalents Short-term investments Total cash and short-term investments Accounts receivable, net 10 11 % 12 13 Inventories, net 14 15 16 17 10 18 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% / % 0.0% % 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% % 0.0% 0.0% 0.0% 0.0% 0.0% % 0.0% no 0.0% 0.0% 0.0% % 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 00 0.0% 0.0% % 0.0% 19 20 21 Current deferred taxes Other current assets Total current assets Property, plant, and equipment Less: accumulated depreciation Net property, plant, and equipment Long-term investments Goodwill, net Other intangibles, net Other deferred taxes Other asscts Total assets LIABILITIES Current Liabilities: Accounts payable Short-term debt Current portion of long-term debt Accrued liabilities Income taxes payable Other current liabilities 22 23 24 25 26 27 28 29 30 31 32 33 Total current liabilities 34 0.0% 0.0% 0.0% 0.0% 0.0% 0.00% 0.0% 0.0% 0.0% / % 0.0% 0.0% % 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 02 0.0% 0.0% 0 0.0% 000 0.0% 0.0 0.0% % 0.0% 0.0% 0.0% 0.0% Long-term debt 35 36 -- 37 38 39 . 40 41 42 Deferred income taxes payable Other deferred liabilities Other liabilities Total liabilities Minority interest STOCKHOLDERS' EQUITY Preferred stock Frecu se Common stock, par value plus additional paid-in capital Retained carnings (accumulated deficit) Treasury stock Accumulated other comprehensive income (loss) Other stockholders' equity Total stockholders' equity Total liabilities and stockholders' equity 43 44 45 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% % 0.0% 0.0% 0.0% 46 47 48 49 50 Balance Sheet (1) Balance Sheet (2) Ratios F + Income Statement (1) Income Statement (2) Statement of Cash Flows Average: 2006.5 Count: 2 Sum: 4013 + 100% Home Share Comments AutoSave OFF a H @yo.. Target Corporation Case Template.xls - Compatibility Mode Insert Draw Page Layout Formulas Data Review View Tell me Times New Roman ab Conditional Formatting v 14 ~ AA % Format as Table Number Cells BIU Cell Styles V Tv Paste Editing Analyse v Data N9 4 x fx A B D E F G H 1 K L M 1 2 2 3 TARGET CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS [ACTUAL CASE DATA: $ in Millions) 4 5 6 2007 2006 2005 7 7 8 57,878 9 10 11 12 13 Sales Credit Card Revenues Total Revenues Cost of Sales Selling, General and Administrative Expenses Credit Card Expenses Depreciation and Amortization Earnings Before Interest Expense and Income Taxes Net Interest Expense Earnings Before Income Taxes Provision for Income Taxes Net Earnings 61,471 1,896 63,367 41,895 13,704 837 1,659 5,272 647 4,625 1,776 2,849 51,271 1,349 52,620 34,927 11,185 776 1,409 4,323 463 3,860 1,452 2,408 1,612 59,490 39,399 12,819 707 1,496 5,069 572 4,497 1,710 2,787 14 15 16 17 18 19 20 21 Basic Earnings Per Share Diluted Earnings Per Share 3.37 3.35 3.23 3.21 2.73 2.71 22 23 24 25 Weighted average common shares outstanding: Basic Diluted 845.4 850.8 861.9 868.6 882 889.2 26 27 28 29 End of year stock price Dividends per share 57.05 0.54 62.03 0.46 54.17 0.38 30 Balance Sheet (1) Balance Sheet (2) Income Statement (1) Income Statement (2) Statement of Cash Flows Ratios F + + 100% OFF Share Comments y AutoSave @@@ WO... Target Corporation Case Template.xls - Compatibility Mode Home Insert Draw Page Layout Formulas Data Review View Tell me ab Li Conditional Formatting Times New Roman A A 14 % Format as Table Paste Uv Cells a. Av Number Cell Styles L10 X fe H