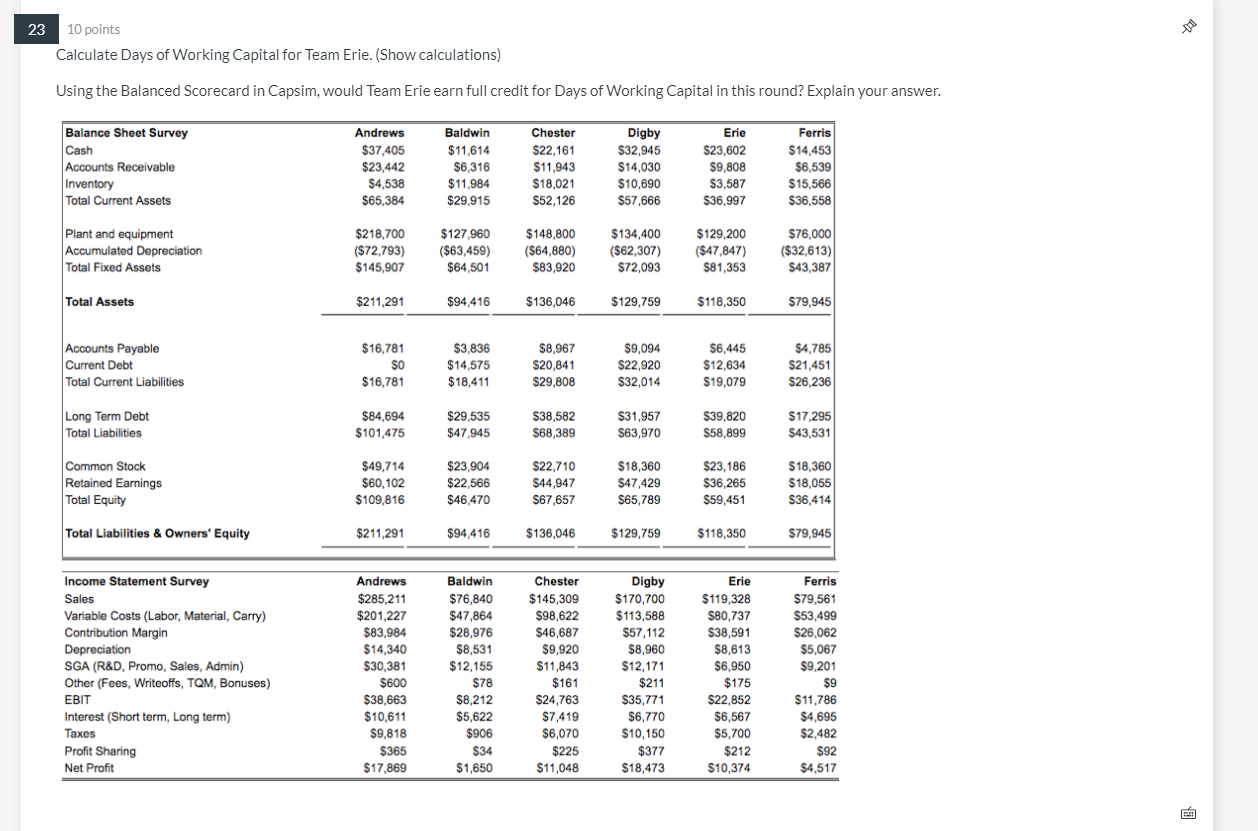

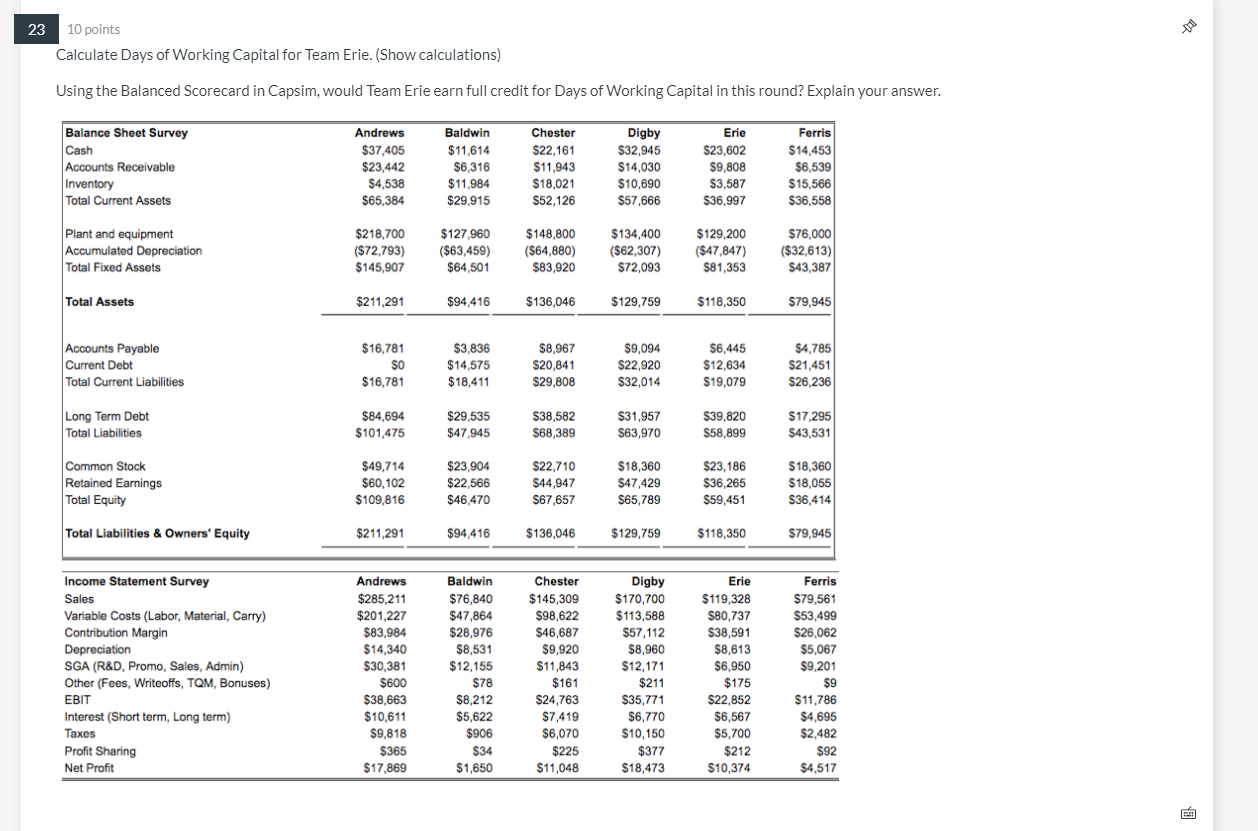

23 10 points Calculate Days of Working Capital for Team Erie. (Show calculations) Using the Balanced Scorecard in Capsim, would Team Erie earn full credit for Days of Working Capital in this round? Explain your answer. Andrews Baldwin Chester Erie Ferris $23,602 Balance Sheet Survey Cash Accounts Receivable Inventory Total Current Assets $37,405 $23,442 $4,538 $65,384 $9,808 $11,614 $6,316 $11,984 $29,915 Digby $32.945 $14,030 $10,690 $57,666 $22,161 $11,943 $18,021 $52,126 $14,453 $6,539 $15,566 $36,558 $3,587 $36.997 Plant and equipment Accumulated Depreciation Total Fixed Assets $218,700 ($72,793) $145,907 $127,960 ($63,459) $64,501 $148,800 ($64,880) $83,920 $134,400 ($62,307) $72,093 $129,200 ($47,847) $81,353 $ $76,000 ($32,613) $43,387 Total Assets $211,291 $94,416 $136,046 $129,759 $118,350 $79,945 $ Accounts Payable Current Debt $16,781 $0 $16,781 $3,836 $14,575 $18,411 $8,967 $20,841 $29,808 $9,094 S22,920 $32,014 $6,445 $12,634 $19,079 $4,785 $21,451 $26,236 Total Current Liabilities Long Term Debt Total Liabilities $84,694 $101,475 $29,535 $47,945 $38,582 $68,389 $31,957 $63,970 $39,820 $58,899 $17,295 $43,531 $23,904 Common Stock Retained Earnings Total Equity $49,714 $60,102 $109,816 $22,566 $22,710 $44,947 $67,657 $ $18,360 $47,429 $65,789 $23,186 $36,265 $59,451 $18,360 $18,055 $36,414 $46,470 Total Liabilities & Owners' Equity $211,291 $94,416 $136,046 $129,759 $118,350 $79,945 Income Statement Survey Andrews Baldwin Chester Ferris Sales Variable Costs (Labor, Material, Carry) Contribution Margin Depreciation SGA (R&D, Promo, Sales, Admin) Other (Fees, Writeoffs, TQM, Bonuses) EBIT Interest (Short term, Long term) Taxes Profit Sharing Net Profit $285,211 $201.227 $83,984 $14,340 $30,381 $600 $38,663 $10,611 $9,818 $365 $17,869 $76,840 $47,864 $28,976 $8,531 $12,155 $78 $8,212 $145,309 $98,622 $46,687 $9.920 $11,843 $161 $24,763 $7,419 $6,070 $225 $11,048 Digby $170,700 $113,588 $57,112 $8,960 $12,171 $211 $ $35,771 $6,770 $10,150 $377 $18,473 Erie $119,328 $80,737 $38,591 $8,613 $6,950 $175 S22,852 $6,567 $5,700 $212 $10,374 $79,561 $53,499 $26,062 $5,067 $9,201 $9 $11,786 $4,695 $2,482 $92 $4,517 $5,622 $906 $34 $1,650 23 10 points Calculate Days of Working Capital for Team Erie. (Show calculations) Using the Balanced Scorecard in Capsim, would Team Erie earn full credit for Days of Working Capital in this round? Explain your answer. Andrews Baldwin Chester Erie Ferris $23,602 Balance Sheet Survey Cash Accounts Receivable Inventory Total Current Assets $37,405 $23,442 $4,538 $65,384 $9,808 $11,614 $6,316 $11,984 $29,915 Digby $32.945 $14,030 $10,690 $57,666 $22,161 $11,943 $18,021 $52,126 $14,453 $6,539 $15,566 $36,558 $3,587 $36.997 Plant and equipment Accumulated Depreciation Total Fixed Assets $218,700 ($72,793) $145,907 $127,960 ($63,459) $64,501 $148,800 ($64,880) $83,920 $134,400 ($62,307) $72,093 $129,200 ($47,847) $81,353 $ $76,000 ($32,613) $43,387 Total Assets $211,291 $94,416 $136,046 $129,759 $118,350 $79,945 $ Accounts Payable Current Debt $16,781 $0 $16,781 $3,836 $14,575 $18,411 $8,967 $20,841 $29,808 $9,094 S22,920 $32,014 $6,445 $12,634 $19,079 $4,785 $21,451 $26,236 Total Current Liabilities Long Term Debt Total Liabilities $84,694 $101,475 $29,535 $47,945 $38,582 $68,389 $31,957 $63,970 $39,820 $58,899 $17,295 $43,531 $23,904 Common Stock Retained Earnings Total Equity $49,714 $60,102 $109,816 $22,566 $22,710 $44,947 $67,657 $ $18,360 $47,429 $65,789 $23,186 $36,265 $59,451 $18,360 $18,055 $36,414 $46,470 Total Liabilities & Owners' Equity $211,291 $94,416 $136,046 $129,759 $118,350 $79,945 Income Statement Survey Andrews Baldwin Chester Ferris Sales Variable Costs (Labor, Material, Carry) Contribution Margin Depreciation SGA (R&D, Promo, Sales, Admin) Other (Fees, Writeoffs, TQM, Bonuses) EBIT Interest (Short term, Long term) Taxes Profit Sharing Net Profit $285,211 $201.227 $83,984 $14,340 $30,381 $600 $38,663 $10,611 $9,818 $365 $17,869 $76,840 $47,864 $28,976 $8,531 $12,155 $78 $8,212 $145,309 $98,622 $46,687 $9.920 $11,843 $161 $24,763 $7,419 $6,070 $225 $11,048 Digby $170,700 $113,588 $57,112 $8,960 $12,171 $211 $ $35,771 $6,770 $10,150 $377 $18,473 Erie $119,328 $80,737 $38,591 $8,613 $6,950 $175 S22,852 $6,567 $5,700 $212 $10,374 $79,561 $53,499 $26,062 $5,067 $9,201 $9 $11,786 $4,695 $2,482 $92 $4,517 $5,622 $906 $34 $1,650