Question

2-3 Calculating Project FCF In the spring of 2015, Jemison Electric was considering an investment in a new distribution center. Jemisons CFO anticipates additional earnings

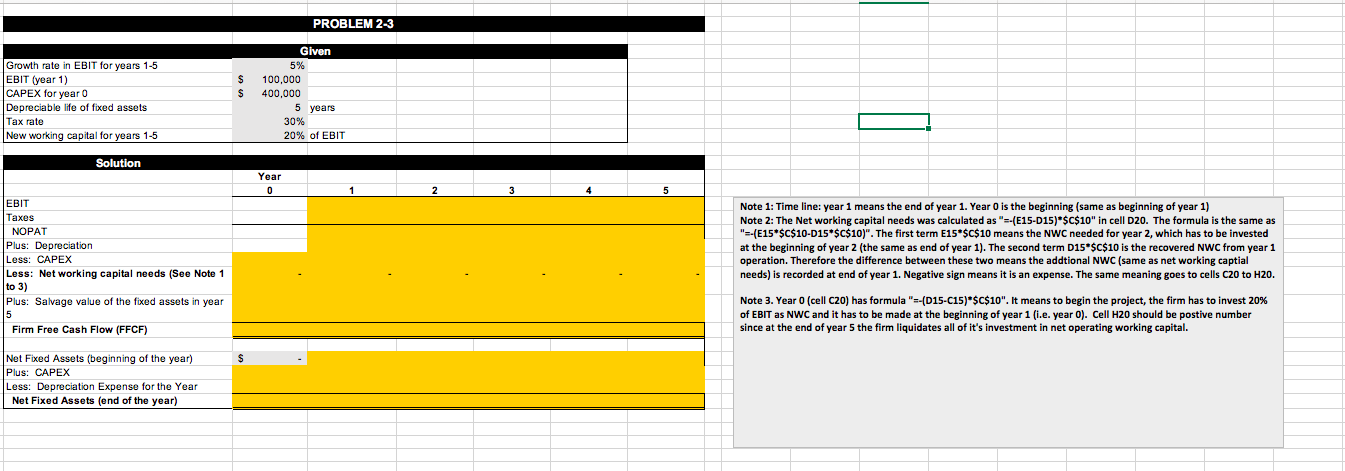

2-3 Calculating Project FCF In the spring of 2015, Jemison Electric was considering an investment in a new distribution center. Jemisons CFO anticipates additional earnings before interest and taxes (EBIT) of $100,000 for the first year of operation of the center, and, over the next five years, the firm estimates that this amount will grow at a rate of 5% per year. The distribution center will require an initial investment of $400,000 that will be depreciated over a five-year period toward a zero salvage value using straight-line depreciation of $80,000 per year. Jemisons CFO estimates that the distribution center will need operating net working capital equal to 20% of EBIT to support operation. Assuming the firm faces a 30% tax rate, calculate the projects annual project free cash flows (FCFs) for each of the next five years where the salvage value of operating networking capital and fixed assets is assumed to equal their book values, respectively.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started