Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2.3- *PLEASE ANSWER ALL 5 QUESTIONS* 5 multiple choice questions. 1. 2. 3. TRUE OR FALSE 4. 5. The Merry Maids provided cleaning services to

2.3-*PLEASE ANSWER ALL 5 QUESTIONS*

5 multiple choice questions.

1.

2.

3. TRUE OR FALSE

4.

5.

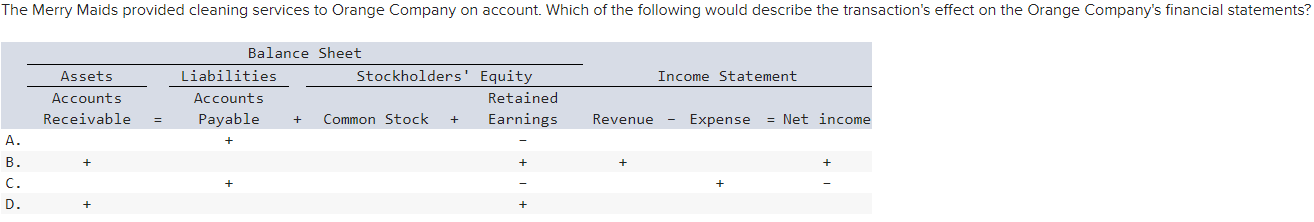

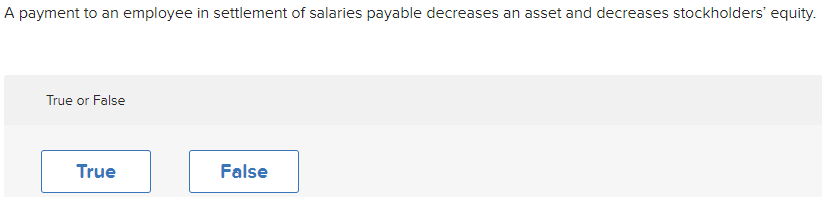

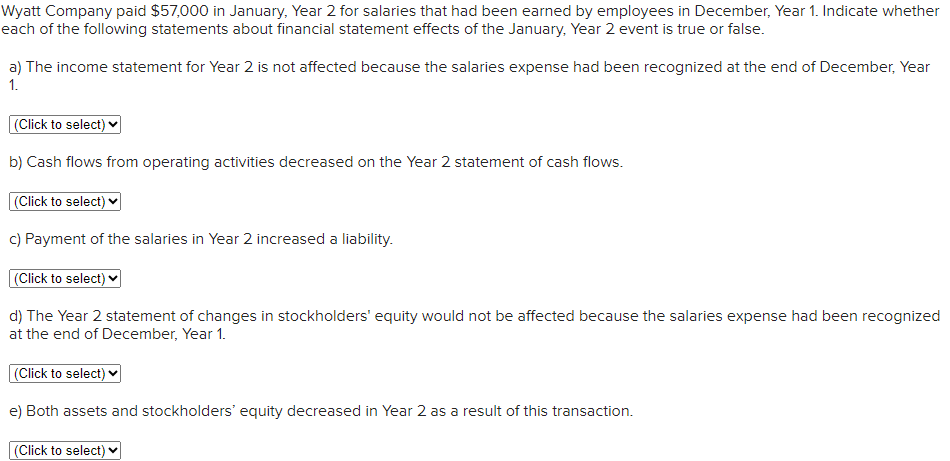

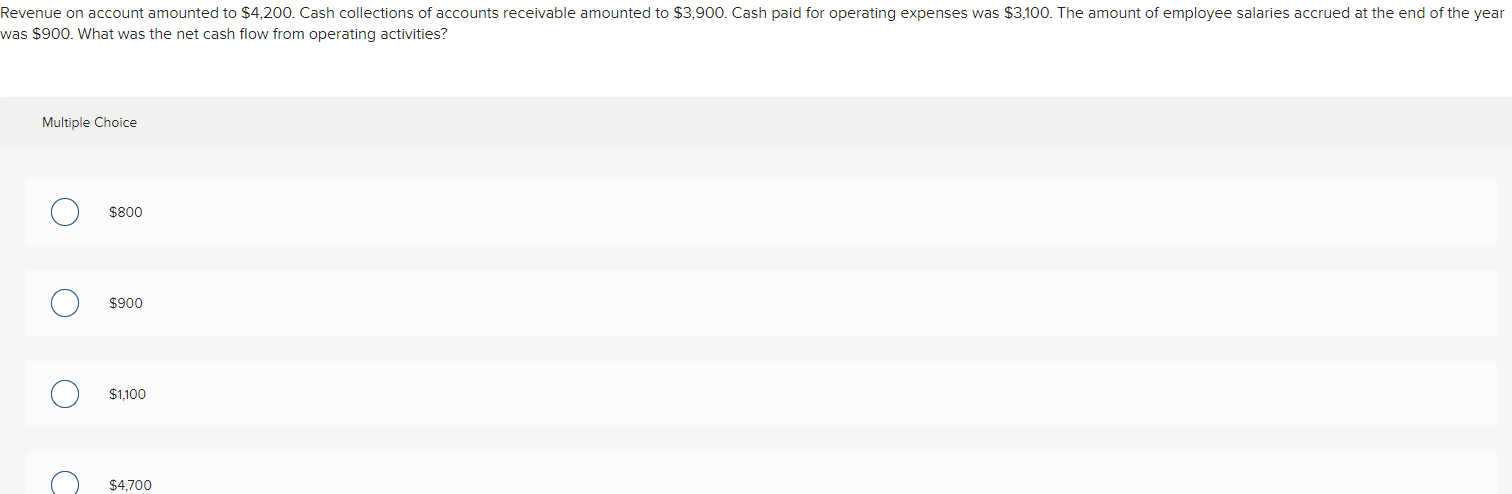

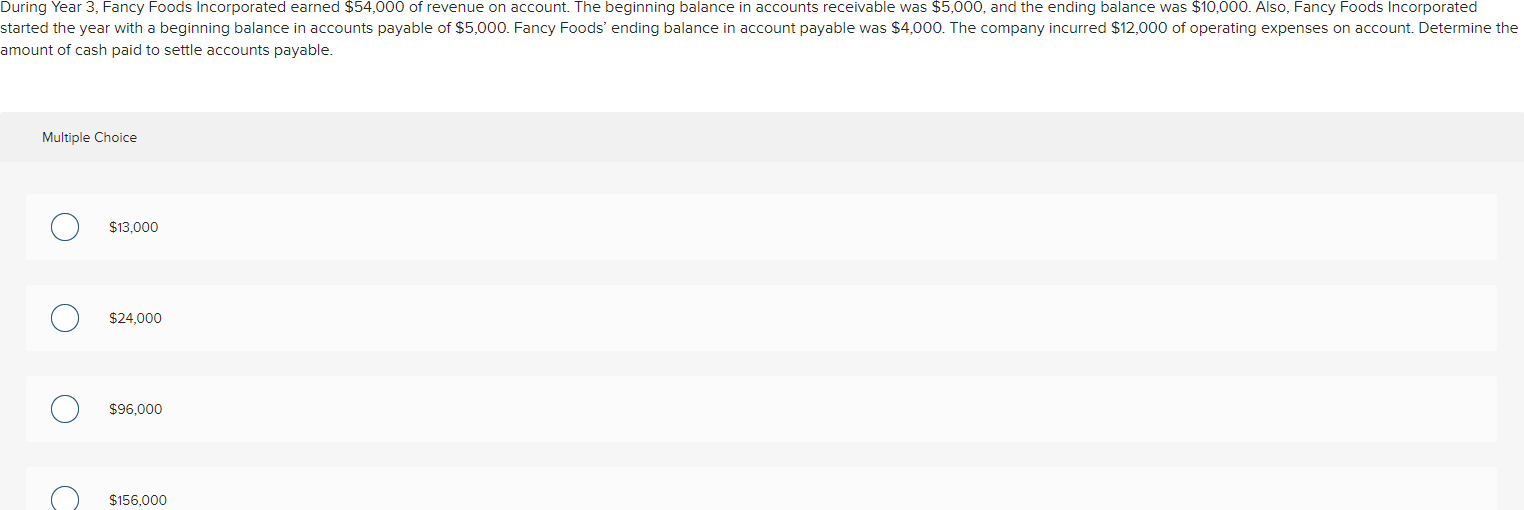

The Merry Maids provided cleaning services to Orange Company on account. Which of the following would describe the transaction's effect on the Orange Company's financial statements? imount of cash paid to settle accounts payable. Multiple Choice $13,000 $24,000 $96,000 $156,000 vas $900. What was the net cash flow from operating activities? Multiple Choice $800 $900 $1,100 $4,700 Wyatt Company paid $57,000 in January, Year 2 for salaries that had been earned by employees in December, Year 1 . Indicate whether each of the following statements about financial statement effects of the January, Year 2 event is true or false. a) The income statement for Year 2 is not affected because the salaries expense had been recognized at the end of December, Year 1. b) Cash flows from operating activities decreased on the Year 2 statement of cash flows. c) Payment of the salaries in Year 2 increased a liability. d) The Year 2 statement of changes in stockholders' equity would not be affected because the salaries expense had been recognized at the end of December, Year 1. e) Both assets and stockholders' equity decreased in Year 2 as a result of this transaction. A payment to an employee in settlement of salaries payable decreases an asset and decreases stockholders' equity. True or False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started