Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2.1 Critically discuss how profitability is suitable as a measure of cost effectiveness in the short-term 2.2 If your company chose to invest in

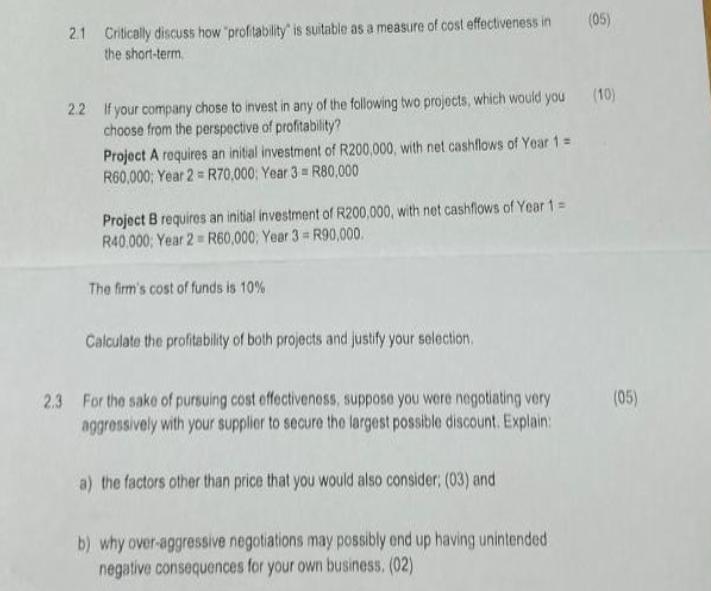

2.1 Critically discuss how "profitability is suitable as a measure of cost effectiveness in the short-term 2.2 If your company chose to invest in any of the following two projects, which would you (10) choose from the perspective of profitability? Project A requires an initial investment of R200,000, with net cashflows of Year 1 = R60,000; Year 2= R70,000; Year 3 R80,000 Project B requires an initial investment of R200,000, with net cashflows of Year 1 = R40.000; Year 2- R60,000, Year 3 = R90,000. The firm's cost of funds is 10% Calculate the profitability of both projects and justify your selection. 2.3 For the sake of pursuing cost effectiveness, suppose you were negotiating very aggressively with your supplier to secure the largest possible discount. Explain: a) the factors other than price that you would also consider: (03) and (05) b) why over-aggressive negotiations may possibly end up having unintended negative consequences for your own business. (02) (05) The firm's cost of funds is 10% Calculate the profitability of both projects and justify your selection. 2.3 For the sake of pursuing cost effectiveness, suppose you were negotiating very aggressively with your supplier to secure the largest possible discount. Explain: a) the factors other than price that you would also consider; (03) and b) why over-aggressive negotiations may possibly end up having unintended negative consequences for your own business. (02) (C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

2 Profitability and Project Selection 21 Suitability of Profitability in ShortTerm CostEffectiveness Profitabilitywhile a popular measurehas limitatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started