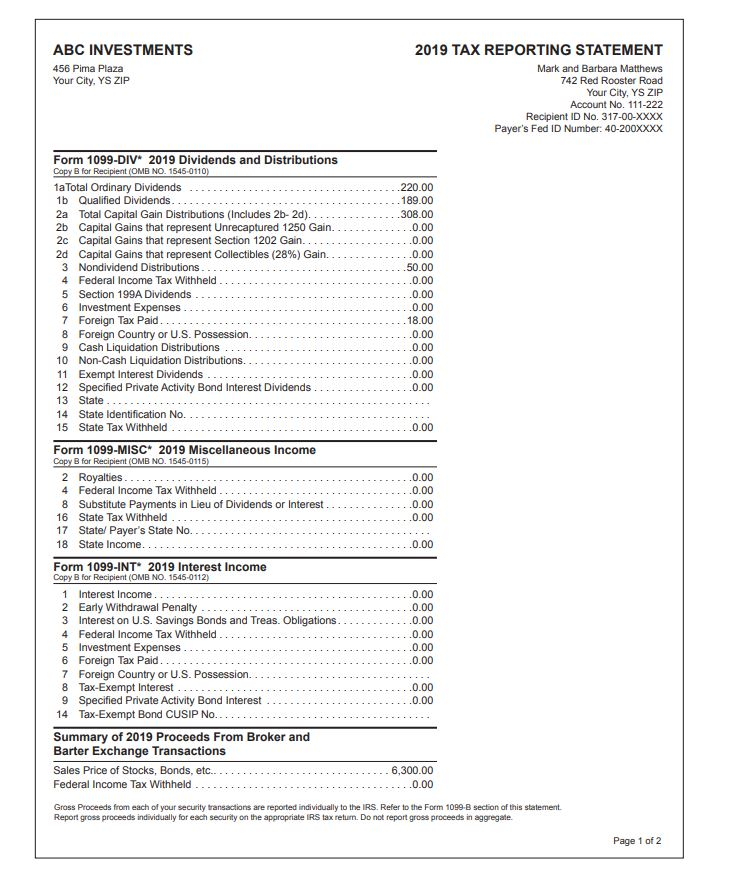

23. What is the total net amount of capital gain reported on Form 1040? OA. $308 OB. $2,411 C. $2,719 OD. $2,900

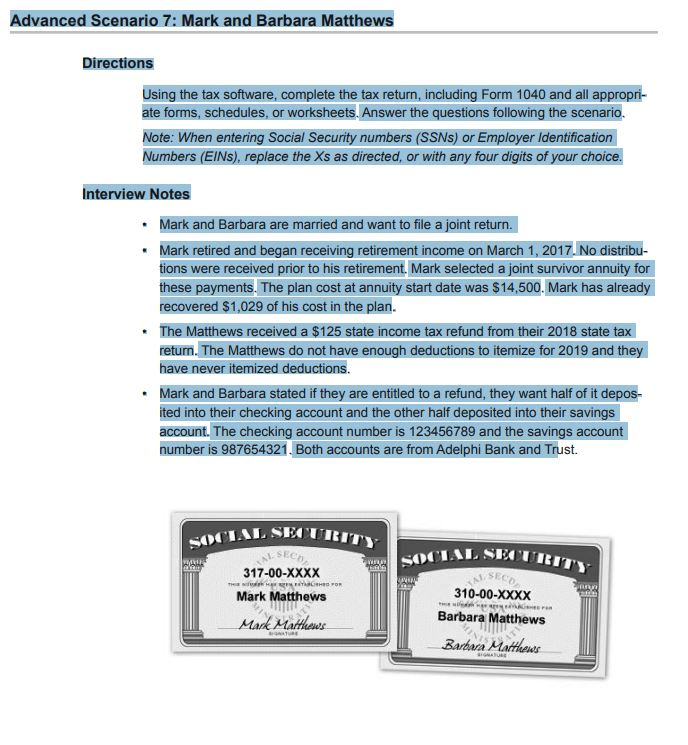

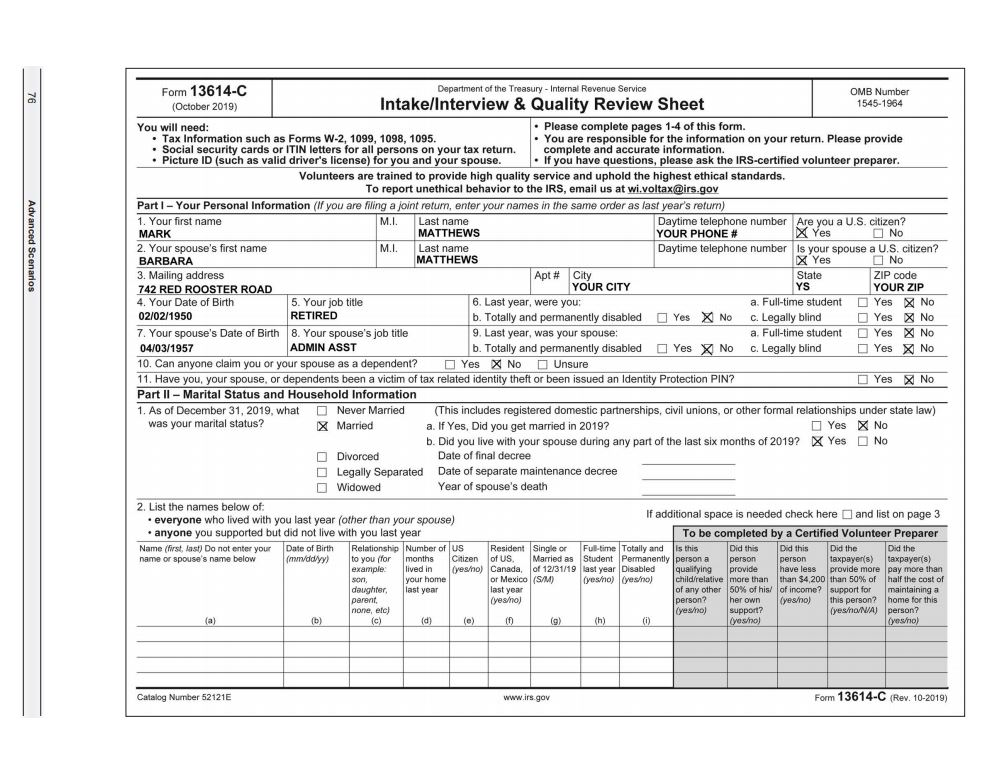

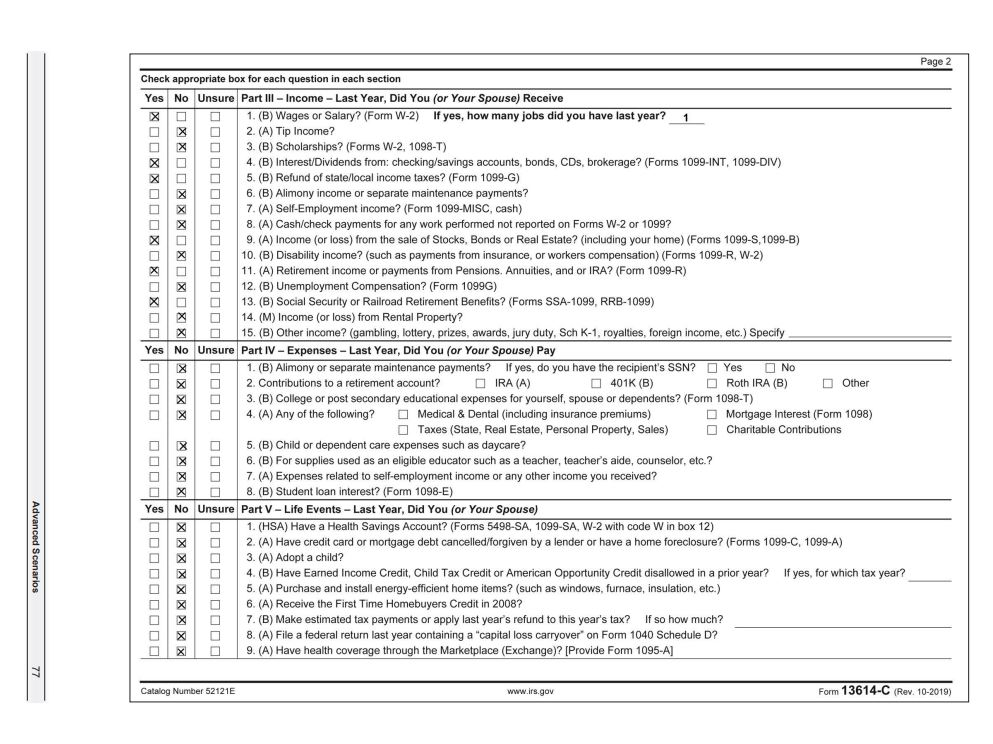

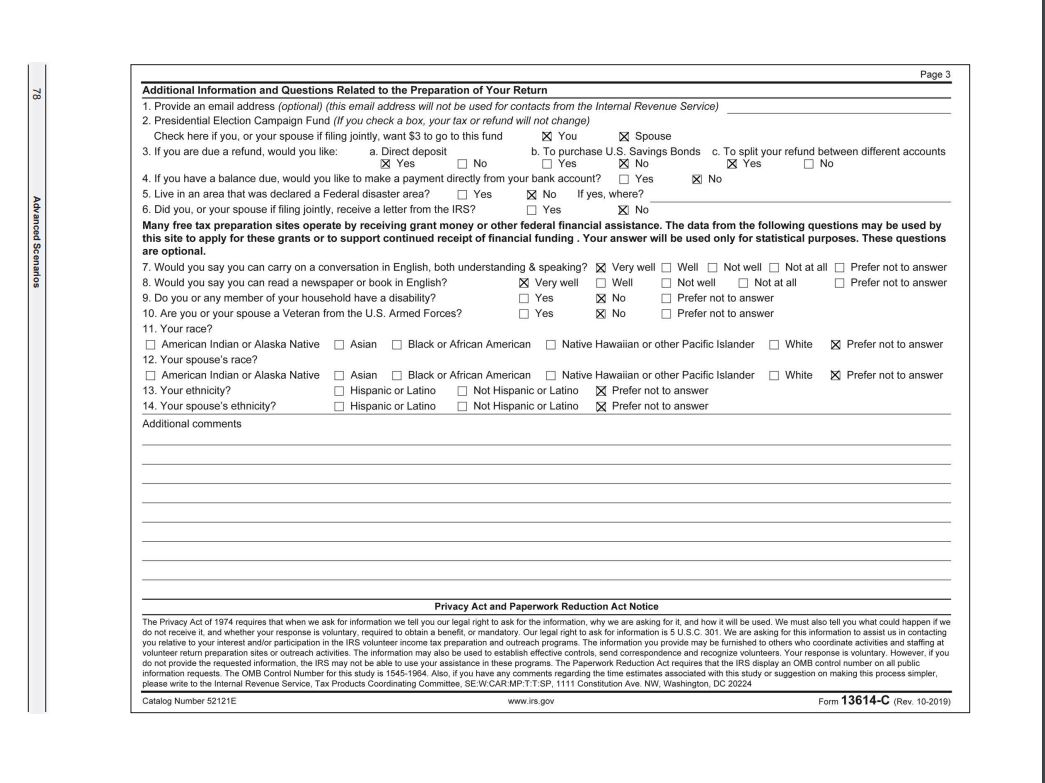

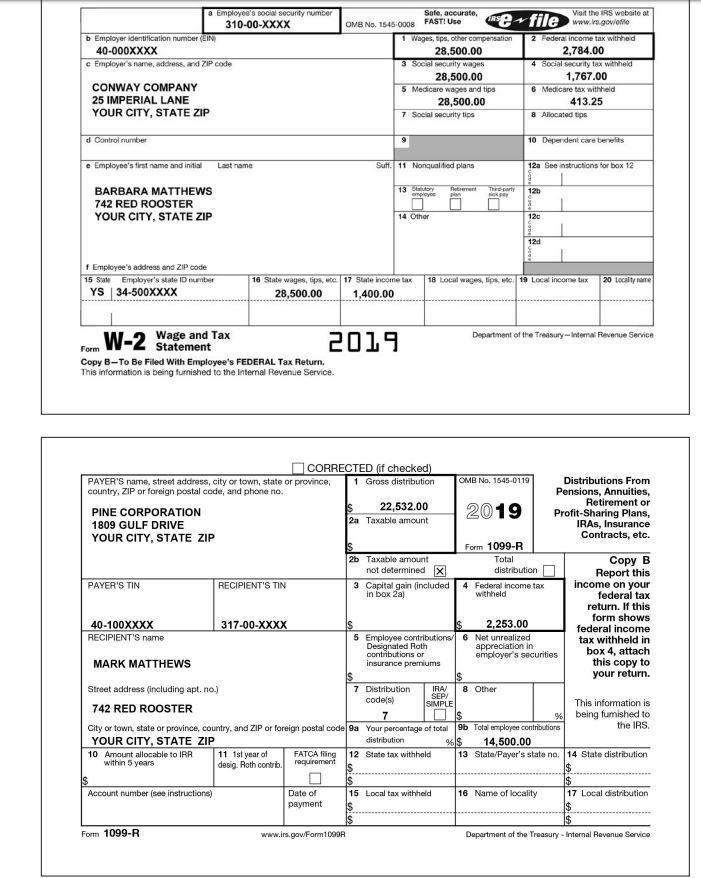

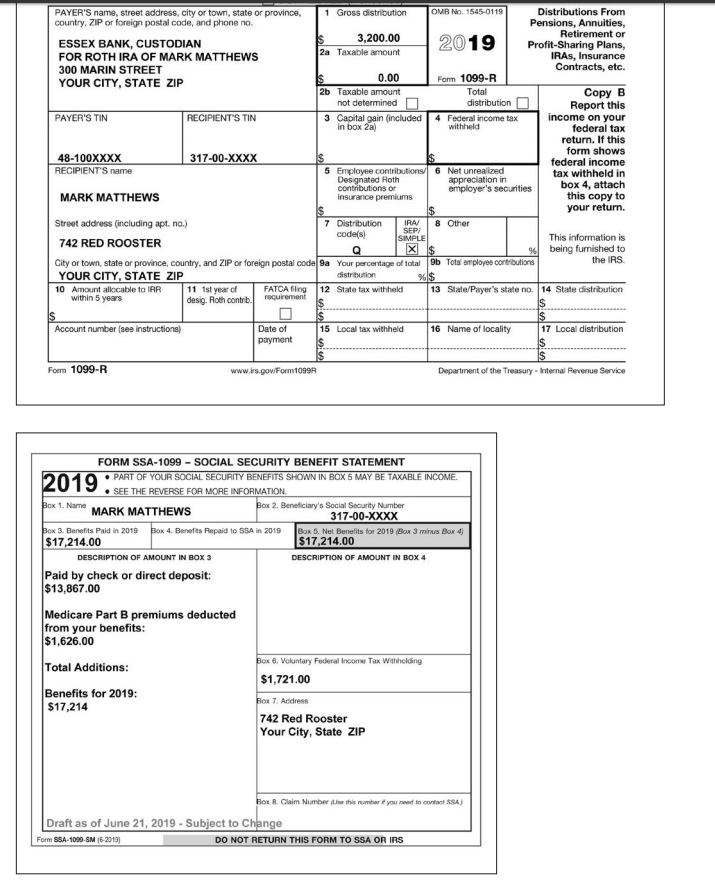

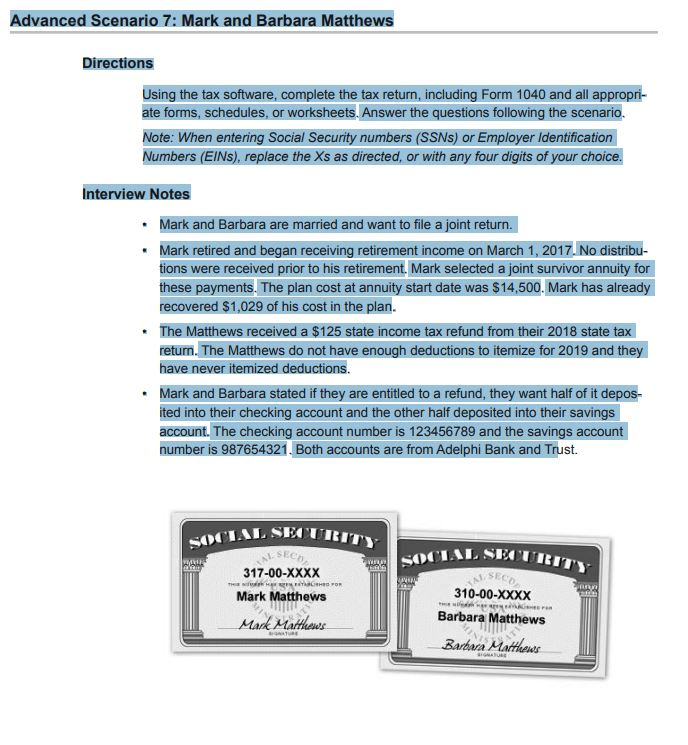

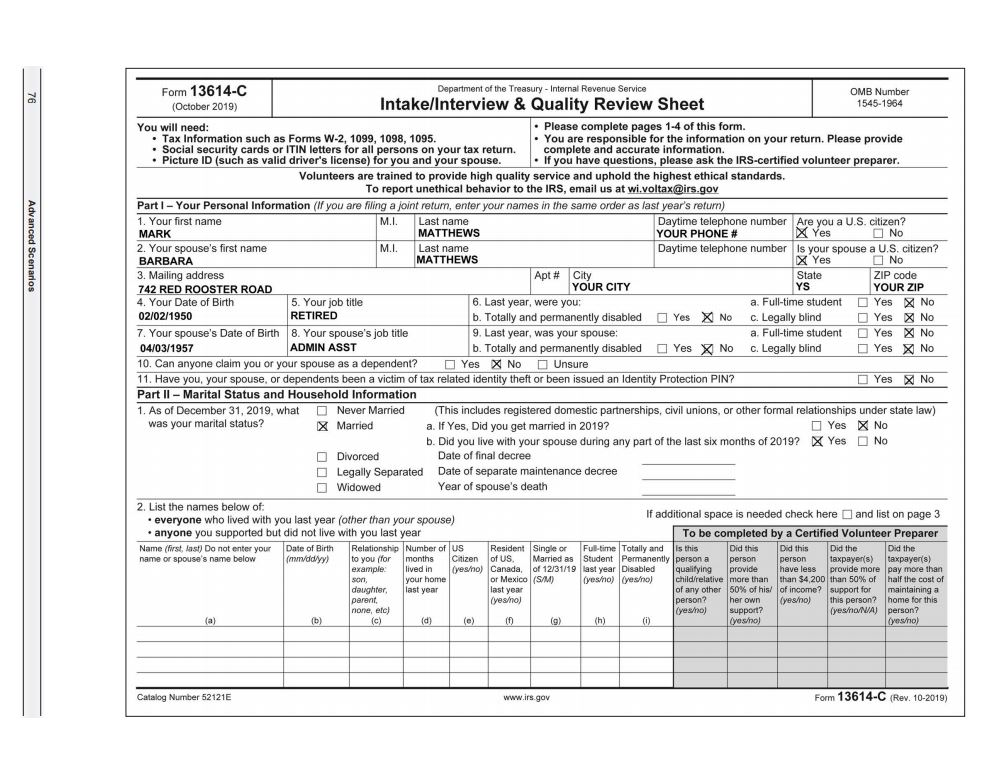

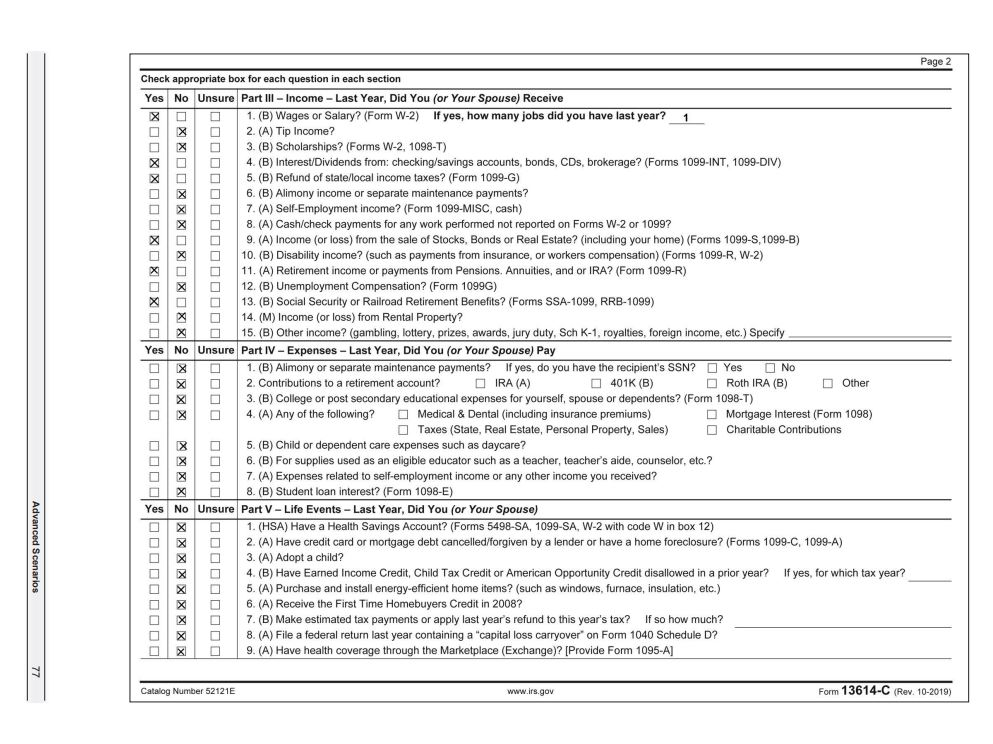

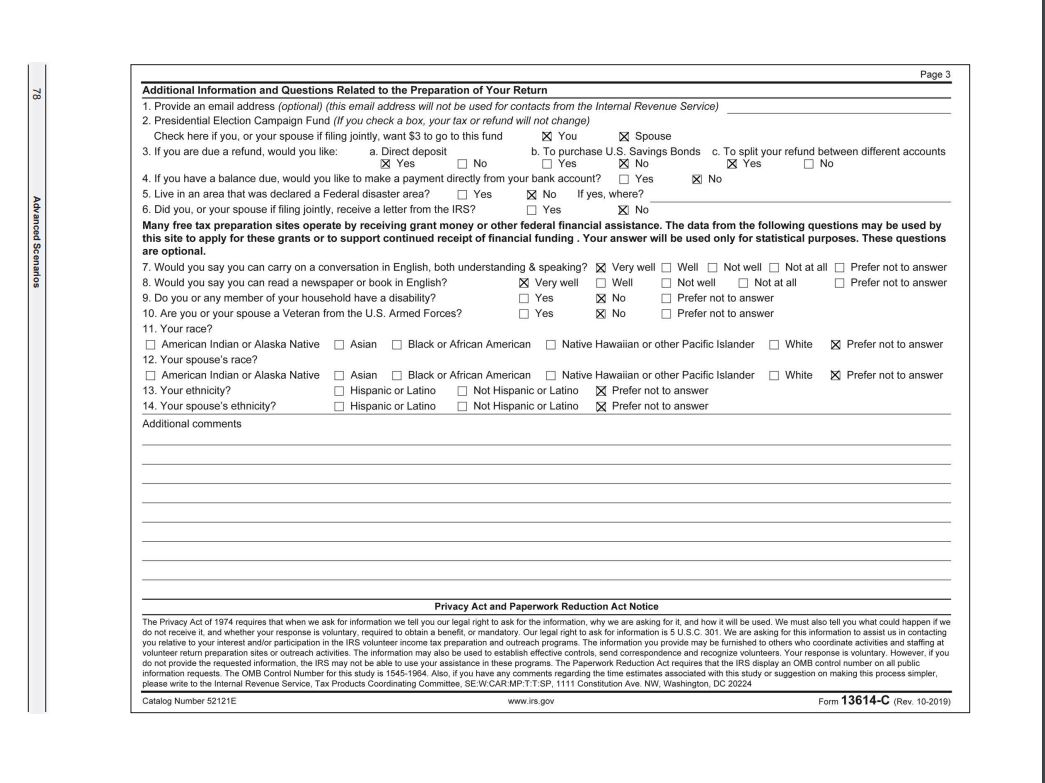

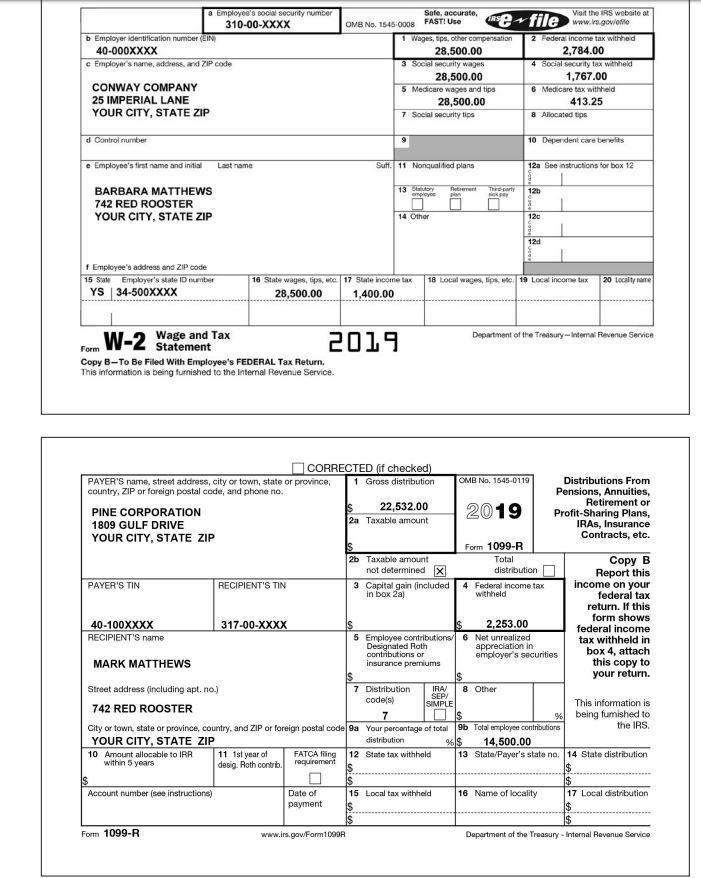

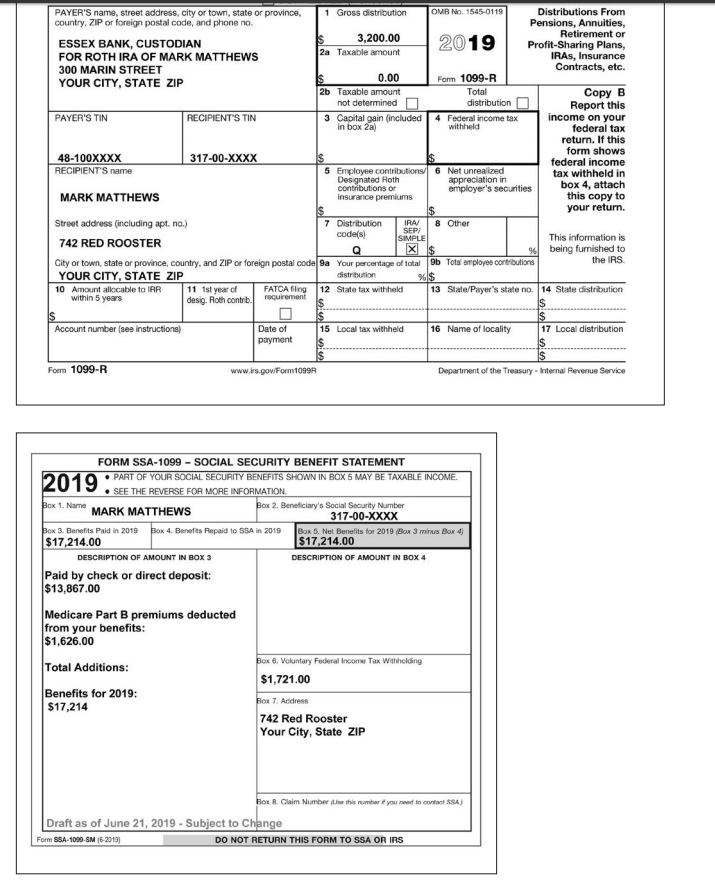

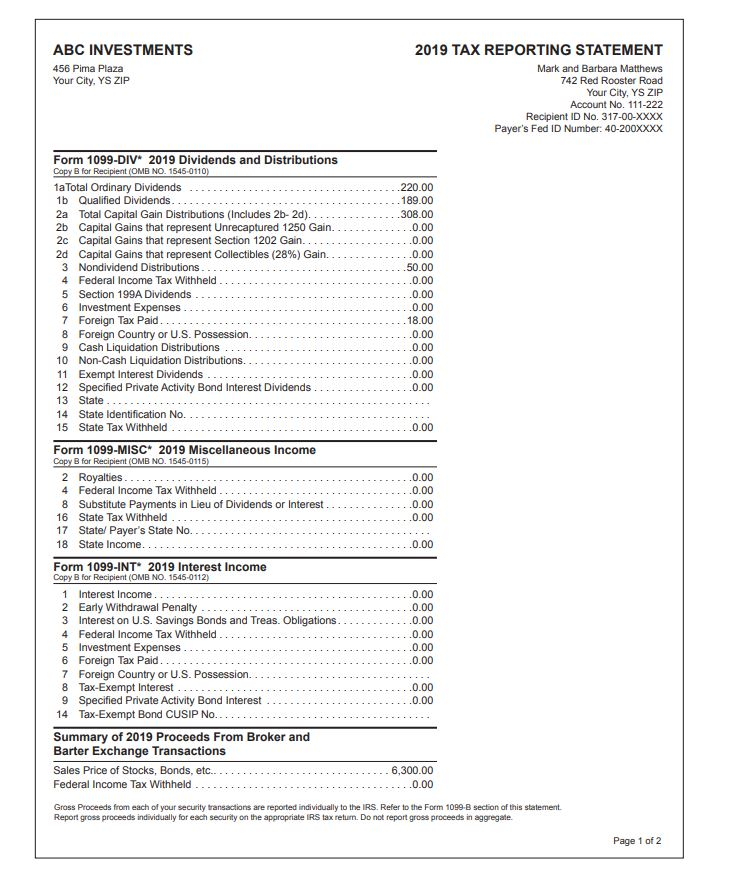

Advanced Scenario 7: Mark and Barbara Matthews Directions Using the tax software, complete the tax return, including Form 1040 and all appropri- ate forms, schedules, or worksheets. Answer the questions following the scenario. Note: When entering Social Security numbers (SSNs) or Employer Identification Numbers (EINS), replace the Xs as directed, or with any four digits of your choice. Interview Notes Mark and Barbara are married and want to file a joint return. Mark retired and began receiving retirement income on March 1, 2017. No distribu- tions were received prior to his retirement. Mark selected a joint survivor annuity for these payments. The plan cost at annuity start date was $14,500. Mark has already recovered $1,029 of his cost in the plan. The Matthews received a $125 state income tax refund from their 2018 state tax return. The Matthews do not have enough deductions to itemize for 2019 and they have never itemized deductions. Mark and Barbara stated if they are entitled to a refund, they want half of it depos- ited into their checking account and the other half deposited into their savings account. The checking account number is 123456789 and the savings account number is 987654321. Both accounts are from Adelphi Bank and Trust. SECURITY SOCIAL SEU nel SEC 317-00-XXXX SPOR Mark Matthews SOCIAL SECUR SEED 310-00-XXXX Barbara Matthews Barbara Matthews Mark Matthews 76 Advanced Scenarios Form 13614-C Department of the Treasury - Internal Revenue Service OMB Number (October 2019) Intake/Interview & Quality Review Sheet 1545-1964 You will need: Please complete pages 1-4 of this form. Tax Information such as Forms W-2, 1099, 1098, 1095. . You are responsible for the information on your return. Please provide Social security cards or ITIN letters for all persons on your tax return. complete and accurate information. Picture ID (such as valid driver's license) for you and your spouse. If you have questions, please ask the IRS-certified volunteer preparer. Volunteers are trained to provide high quality service and uphold the highest ethical standards. To report unethical behavior to the IRS, email us at wi.voltax@irs.gov Part 1 - Your Personal Information (If you are filing a joint return, enter your names in the same order as last year's return) 1. Your first name M.I. Last name Daytime telephone number Are you a U.S. citizen? MARK MATTHEWS YOUR PHONE # X Yes No 2. Your spouse's first name M.I. Last name Daytime telephone number is your spouse a U.S. citizen? BARBARA MATTHEWS X Yes No 3. Mailing address Apt # City State ZIP code 742 RED ROOSTER ROAD YOUR CITY YOUR ZIP 4. Your Date of Birth 5. Your job title 6. Last year, were you: a. Full-time student Yes No 02/02/1950 RETIRED b. Totally and permanently disabled Yes No c. Legally blind Yes No 7. Your spouse's Date of Birth 8. Your spouse's job title 9. Last year, was your spouse: a. Full-time student Yes X No 04/03/1957 ADMIN ASST b. Totally and permanently disabled Yes No c. Legally blind Y es No 10. Can anyone claim you or your spouse as a dependent? Yes X No Unsure 11. Have you, your spouse, or dependents been a victim of tax related identity theft or been issued an Identity Protection PIN? D Yes No Part II - Marital Status and Household Information 1. As of December 31, 2019, what Never Married (This includes registered domestic partnerships, civil unions, or other formal relationships under state law) was your marital status? X Married a. If Yes, Did you get married in 2019? Yes No b. Did you live with your spouse during any part of the last six months of 2019? X Yes No Divorced Date of final decree Legally Separated Date of separate maintenance decree Widowed Year of spouse's death 2. List the names below of: everyone who lived with you last year (other than your spouse) If additional space is needed check here and list on page 3 anyone you supported but did not live with you last year To be completed by a Certified Volunteer Preparer Name (first, last) Do not enter your Date of Birth Relationship Number of US Resident Single or Full-time Totally and is this Did this Did this Did the Did the name or spouse's name below (mm/dd/yy) to you (for months Citizen of US. Married as Student Permanently person a person person taxpayer(s) taxpayer(s) example: lived in lyeso) Canada, of 12/31/19 last year Disabled qualifying provide have less provide more pay more than Ison, l your home or Mexico (S/M) (yeso) yeso) child/relative more than than $4,200 than 50% of half the cost of daughter last year last year of any other 50% of his/ of income? support for maintaining a parent, (yeso) person? her own (yeso) this person? home for this none, etc) (yeso) support? vesho/NVAJ person? (b) (c) Casino Orono) Catalog Number 52121E www.irs.gov Form 13614-C (Rev. 10-2019) Check appropriate box for each question in each section Yes No Unsure Part III - Income - Last Year, Did You (or Your Spouse) Receive X 1. (B) Wages or Salary? (Form W-2) If yes, how many jobs did you have last year? 1 2. (A) Tip Income? 3. (B) Scholarships? (Forms W-2, 1098-T) 4. (B) Interest/Dividends from: checking/savings accounts, bonds, CDs, brokerage? (Forms 1099-INT, 1099-DIV) 5. (B) Refund of state/local income taxes? (Form 1099-G) 6. (B) Alimony income or separate maintenance payments? 7. (A) Self-Employment income? (Form 1099-MISC, cash) 8. (A) Cash/check payments for any work performed not reported on Forms W-2 or 1099? 9. (A) Income (or loss) from the sale of Stocks, Bonds or Real Estate (including your home) (Forms 1099-S. 1099-B) 10. (B) Disability income? (such as payments from insurance, or workers compensation) (Forms 1099-R, W-2) 11. (A) Retirement income or payments from Pensions. Annuities, and or IRA? (Form 1099-R) 12. (B) Unemployment Compensation? (Form 1099G) 13. (B) Social Security or Railroad Retirement Benefits? (Forms SSA-1099, RRB-1099) 14. (M) Income (or loss) from Rental Property? 15. (B) Other income? (gambling, lottery, prizes, awards, jury duty, Sch K-1, royalties, foreign income, etc.) Specify Unsure Part IV-Expenses - Last Year, Did You (or Your Spouse) Pay 1. (B) Alimony or separate maintenance payments? If yes, do you have the recipient's SSN? Yes No 2. Contributions to a retirement account? O IRA (A) O 401K (B) Roth IRA (B) Other 3. (B) College or post secondary educational expenses for yourself, spouse or dependents? (Form 1098-T) 4. (A) Any of the following? Medical & Dental (including insurance premiums) Mortgage Interest (Form 1098) Taxes (State, Real Estate, Personal Property, Sales) Charitable Contributions 5. (B) Child or dependent care expenses such as daycare? 6. (B) For supplies used as an eligible educator such as a teacher, teacher's aide, counselor, etc.? 7. (A) Expenses related to self-employment income or any other income you received? 8. (B) Student loan interest? (Form 1098-E) Unsure Part V-Life Events - Last Year, Did You (or Your Spouse) 1. (HSA) Have a Health Savings Account? (Forms 5498-SA, 1099-SA, W-2 with code w in box 12) 2. (A) Have credit card or mortgage debt cancelled/forgiven by a lender or have a home foreclosure? (Forms 1099-C, 1099-A) 3. (A) Adopt a child? 4. (B) Have Earned Income Credit, Child Tax Credit or American Opportunity Credit disallowed in a prior year? If yes, for which tax year? 5. (A) Purchase and install energy-efficient home items? (such as windows, furnace, insulation, etc.) 6. (A) Receive the First Time Homebuyers Credit in 2008? 7. (B) Make estimated tax payments or apply last year's refund to this year's tax? If so how much? 8. (A) File a federal return last year containing a "capital loss carryover' on Form 1040 Schedule D? 9. (A) Have health coverage through the Marketplace (Exchange)? [Provide Form 1095-A] ? 00000000 00X100XX0X0000000000000000000 Advanced Scenarios 77 Catalog Number 52121E www.irs.gov Form 13614-C (Rev. 10-2019) Advanced Scenarios Page 3 Additional Information and Questions Related to the Preparation of Your Return 1. Provide an email address (optional) (this email address will not be used for contacts from the Internal Revenue Service) 2. Presidential Election Campaign Fund (If you check a box, your fax or refund will not change) Check here if you, or your spouse if filing jointly, want $3 to go to this fund You X Spouse 3. If you are due a refund, would you like: a. Direct deposit b. To purchase U.S. Savings Bonds c. To split your refund between different accounts X Yes No Yes No X Yes No 4. If you have a balance due, would you like to make a payment directly from your bank account? Yes XI No 5. Live in an area that was declared a Federal disaster area? Yes No If yes, where? 6. Did you, or your spouse if filing jointly, receive a letter from the IRS? Yes No Many free tax preparation sites operate by receiving grant money or other federal financial assistance. The data from the following questions may be used by this site to apply for these grants or to support continued receipt of financial funding. Your answer will be used only for statistical purposes. These questions are optional 7. Would you say you can carry on a conversation in English, both understanding & Speaking? X Very well Well Not well Not at all Prefer not to answer 8. Would you say you can read a newspaper or book in English? X Very well Well Not well Not at all Prefer not to answer 9. Do you or any member of your household have a disability? D Yes X No Prefer not to answer 10. Are you or your spouse a Veteran from the U.S. Armed Forces? Yes XNo Prefer not to answer 11. Your race? American Indian or Alaska Native Asian Black or African American Native Hawaiian or other Pacific Islander White X Prefer not to answer 12. Your spouse's race? American Indian or Alaska Native Asian Black or African American Native Hawaiian or other Pacific Islander White X Prefer not to answer 13. Your ethnicity? Hispanic or Latino Not Hispanic or Latino X Prefer not to answer 14. Your spouse's ethnicity? Hispanic or Latino Not Hispanic or Latino X Prefer not to answer Additional comments Privacy Act and Paperwork Reduction Act Notice The Privacy Act of 1974 requires that when we ask for information we tell you our legal right to ask for the information, why we are asking for it, and how it will be used. We must also tell you what could happen if we do not receive it, and whether your response is voluntary, required to obtain a benefit, or mandatory. Our legal right to ask for information is 5 U.S.C. 301. We are asking for this information to assist us in contacting you relative to your interest and/or participation in the IRS volunteer income tax preparation and outreach programs. The information you provide may be furnished to others who coordinate activities and staffing at volunteer return preparation sites or outreach activities. The information may also be used to establish effective controls, send correspondence and recognize volunteers. Your response is voluntary. However, if you do not provide the requested information, the IRS may not be able to use your assistance in these programs. The Paperwork Reduction Act requires that the IRS display an OMB control number on all public information requests The OMB Control Number for this study is 1545-1984 Also, if you have any comments regarding the time estimates associated with this study or suggestion on making this process simpler please write to the Internal Revenue Service, Tax Products Coordinating Committee, SEW CAR MPT T SP, 1111 Constitution Ave NW Washington DC 20224 Catalog Number 52121E www.lrs.gov Form 13614-C (Rev. 10-2019) Sate accurate Visit the IRS website at OMB No 1545-0008 FAST! Use ase se file file www.ra.govifle & Employee's social security number 310-00-XXXX b Employer identification number (EIN 40-000XXXX c Employer's name, address, and ZIP code Wages, tips, other compensation 28.500.00 3 Social Security wages 28,500.00 5 Medicare wages and tips 28,500.00 7 Social security tips 2 Federal income tax withheld 2,784.00 4 Social Security tax withheld 1,767.00 6 Medicare tax withheld 413.25 8 Allocated tips CONWAY COMPANY 25 IMPERIAL LANE YOUR CITY, STATE ZIP d Control number 10 Dependent care bereits e Employee's first name and initial Last name Sutt. 11 Nonqualified plans 12a See instructions for box 12 120 BARBARA MATTHEWS 742 RED ROOSTER YOUR CITY, STATE ZIP f Employee's address and ZIP code 15 Sale Employer's state ID number YS 34-500XXXX 18 Local wages, tipsec19 Local income tax 16 State wages, tips, te 17 State income tax 28,500.00 1,400.00 Department of the Treasury-womal Revenue Service 2019 W32 Wage and Tax Form 2 Statement Copy B-To Be Filed With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service 2019 CORRECTED (if checked) PAYER'S namne, street address, city or town, state or province, 1 Gross distribution OMB No. 1545-0119 Distributions From country, ZIP or foreign postal code, and phone no. Pensions, Annuities, $ 22,532.00 Retirement or PINE CORPORATION Profit-Sharing Plans, 1809 GULF DRIVE 2a Taxable amount IRAs, Insurance YOUR CITY, STATE ZIP Contracts, etc. Form 1099-R 2b Taxable amount Total Copy B not determined X distribution Report this PAYER'S TIN RECIPIENT'S TIN 3 Capital gain included 4 Federal income tax income on your in box 2a withheld federal tax return. If this form shows 40-100XXXX 317-00-XXXX 2,253.00 federal income RECIPIENT'S name 5 Employee contributions 6 Net unrealized tax withheld in Designated Roth appreciation in contributions or employer's securities box 4, attach MARK MATTHEWS insurance premiums this copy to your return. Street address (including apt. no.) 7 Distribution IRA 8 Other code(s) This information is 742 RED ROOSTER $ being fumished to City or town, state or province, country, and ZIP or foreign postal code 9a Your percentage of total 9b Total employee contributions the IRS YOUR CITY, STATE ZIP distribution 91s 14.500.00 10 Armount allocable to IRA 11 1st year of FATCA fiing 12 State tax withheld 13 State/Payer's state no. 14 State distribution within 5 years desig, Roth contrib. requirement SIMPLE Account number (see instructions) 15 Local tax withheld 16 Name of locality 17 Local distribution Date of payment Form 1099-R www.irs.gowForm1099R Department of the Treasury - Internal Revenue Service ABC INVESTMENTS 456 Pima Plaza Your City, YS ZIP 2019 TAX REPORTING STATEMENT Mark and Barbara Matthews 742 Red Rooster Road Your City, YS ZIP Account No. 111-222 Recipient ID No. 317-00-XXXX Payer's Fed ID Number: 40-200XXXX ..220.00 . 189.00 .308.00 .0.00 ..0.00 ..0.00 .50.00 ..0.00 Form 1099-DIV 2019 Dividends and Distributions Copy B for Recipient (OMB NO. 1545-0110) 1a Total Ordinary Dividends .......... 1b Qualified Dividends. 2a Total Capital Gain Distributions (Includes 2b-2d). 2b Capital Gains that represent Unrecaptured 1250 Gain.... 2c Capital Gains that represent Section 1202 Gain. 2d Capital Gains that represent Collectibles (28%) Gain.. 3 Nondividend Distributions .... 4 Federal Income Tax Withheld ... 5 Section 199A Dividends 6 Investment Expenses... 7 Foreign Tax Paid...... 8 Foreign Country or U.S. Possession... 9 Cash Liquidation Distributions. 10 Non-Cash Liquidation Distributions....... 11 Exempt Interest Dividends 12 Specified Private Activity Bond Interest Dividends.. 13 State............... 14 State Identification No... 15 State Tax Withheld ..... ..0.00 .0.00 . 18.00 ...0.00 .0.00 ..0.00 -0.00 .0.00 .0.00 Form 1099-MISC 2019 Miscellaneous Income Capy B for Recipient (OMB NO. 1545-0115) ..0.00 ..0.00 ..0.00 ..0.00 .....0.00 2 Royalties 4 Federal Income Tax Withheld. 8 Substitute Payments in Lieu of Dividends or Interest .. 16 State Tax Withheld 17 State/ Payer's State No.. 18 State Income....................... . Form 1099-INT 2019 Interest Income Copy B for Recipient (OMB NO. 1545-0112) 1 Interest Income.... 2 Early Withdrawal Penalty ........... 3 Interest on U.S. Savings Bonds and Treas. Obligations... 4 Federal Income Tax Withheld.... 5 Investment Expenses........... 6 Foreign Tax Paid.......... 7 Foreign country or U.S. Possession...... 8 Tax-Exempt Interest ........ 9 Specified Private Activity Bond Interest ... 14 Tax-Exempt Bond CUSIP No..... .......0.00 ...0.00 .....0.00 ..0.00 ..0.00 ..0.00 ....0.00 ...0.00 Summary of 2019 Proceeds From Broker and Barter Exchange Transactions Sales Price of Stocks, Bonds, etc................ Federal Income Tax Withheld ..... ....... 6,300.00 ...0.00 Grass Proceeds from each of your security transactions are reported individually to the IRS. Refer to the Form 1099-B section of this statement. Report gross proceeds individually for each security on the appropriate IRS tax return. Do not report gross proceeds in aggregate. Page 1 of 2