Answered step by step

Verified Expert Solution

Question

1 Approved Answer

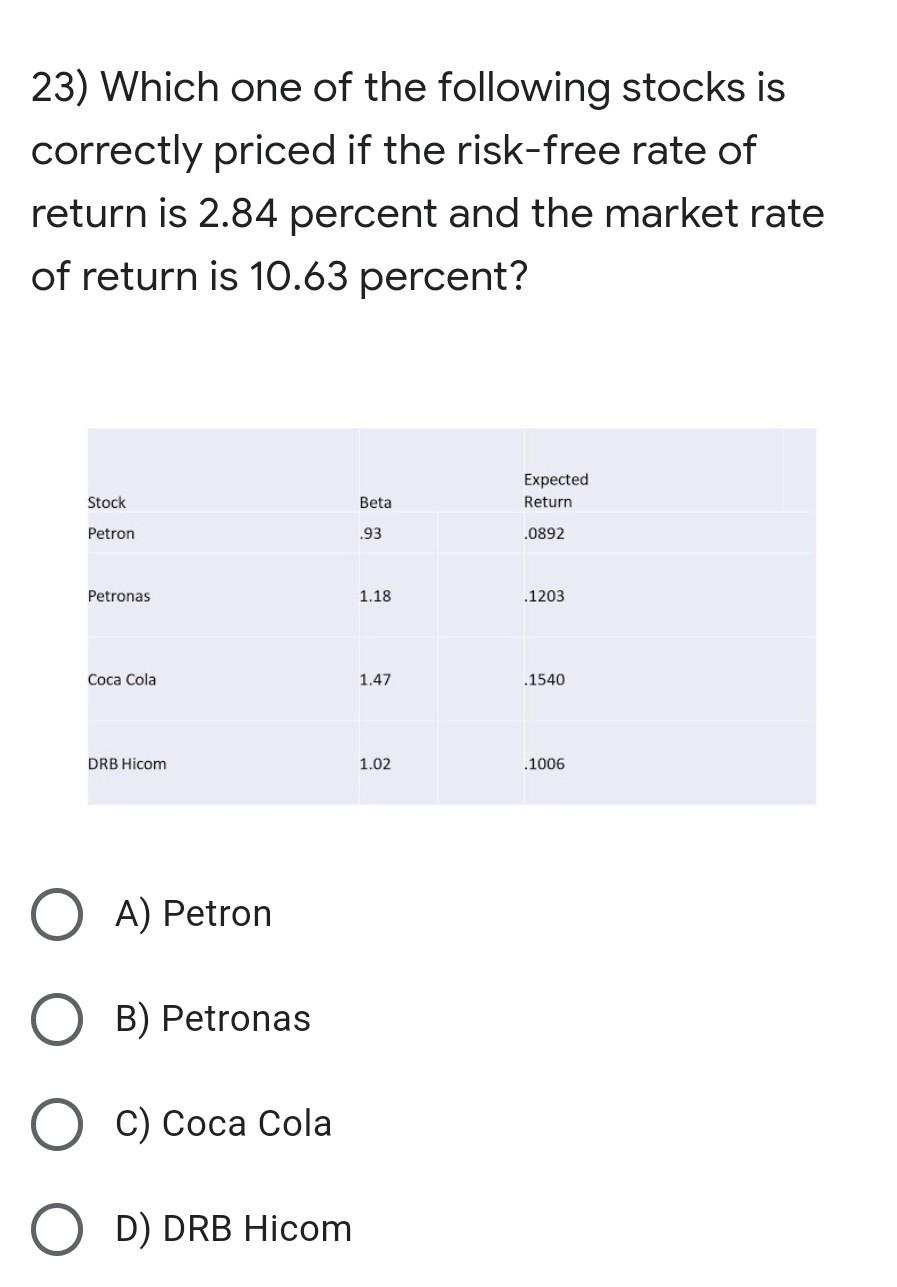

23) Which one of the following stocks is correctly priced if the risk-free rate of return is 2.84 percent and the market rate of return

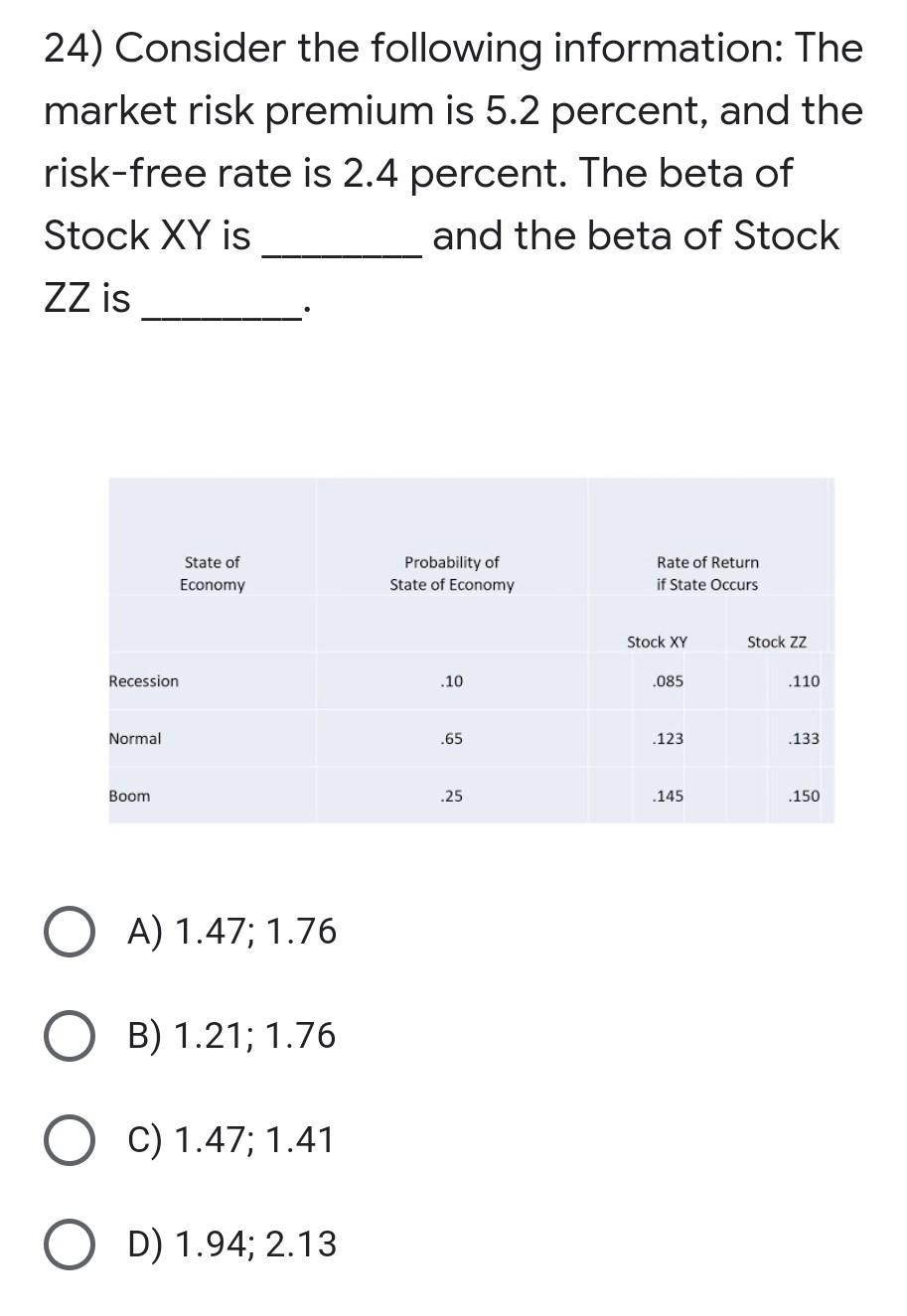

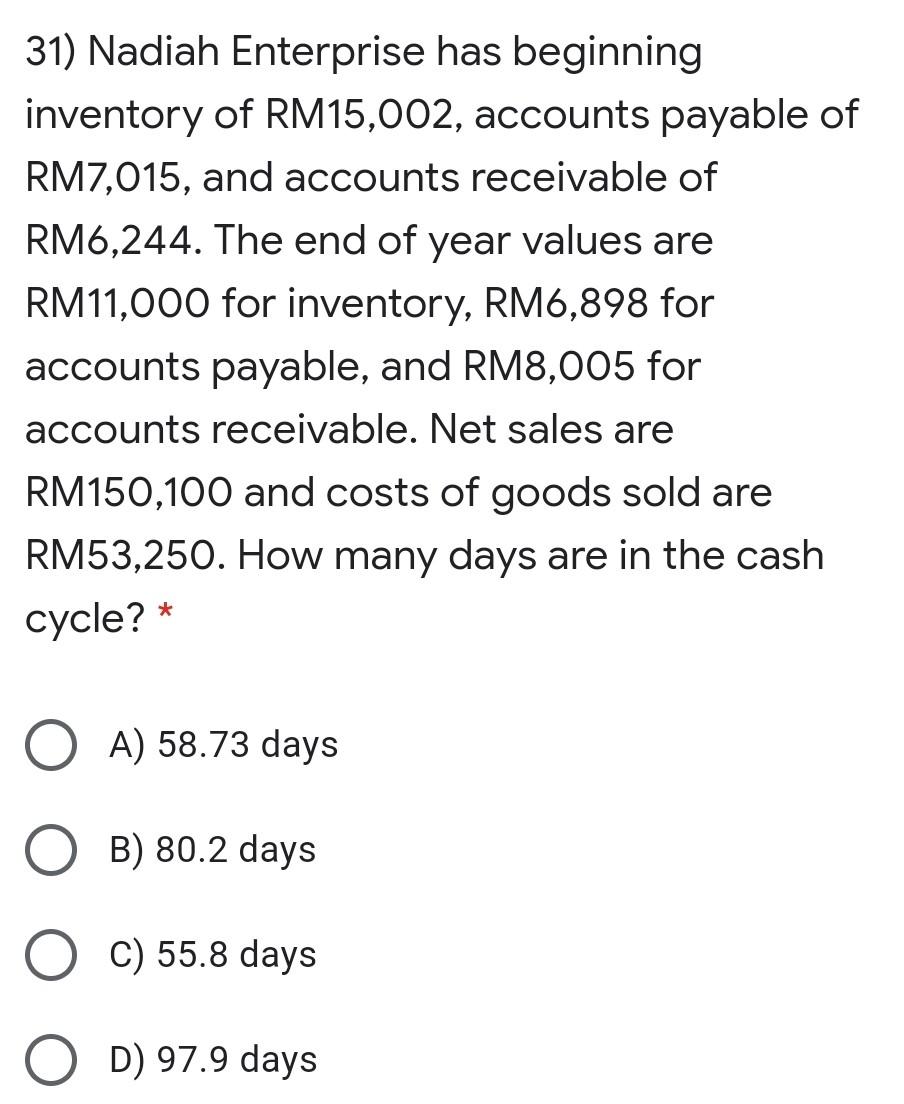

23) Which one of the following stocks is correctly priced if the risk-free rate of return is 2.84 percent and the market rate of return is 10.63 percent? Expected Return Stock Beta Petron .93 .0892 Petronas 1.18 .1203 Coca Cola 1.47 .1540 DRB Hicom 1.02 .1006 O A) Petron B) Petronas C) Coca Cola D) DRB Hicom 24) Consider the following information: The market risk premium is 5.2 percent, and the risk-free rate is 2.4 percent. The beta of Stock XY is and the beta of Stock ZZ is State of Economy Probability of State of Economy Rate of Return if State Occurs Stock XY Stock ZZ Recession .10 .085 .110 Normal .65 .123 .133 Boom .25 .145 .150 A) 1.47; 1.76 B) 1.21; 1.76 C) 1.47; 1.41 O D) 1.94; 2.13 31) Nadiah Enterprise has beginning inventory of RM15,002, accounts payable of RM7,015, and accounts receivable of RM6,244. The end of year values are RM11,000 for inventory, RM6,898 for accounts payable, and RM8,005 for accounts receivable. Net sales are RM150,100 and costs of goods sold are RM53,250. How many days are in the cash cycle? * O A) 58.73 days B) 80.2 days C) 55.8 days O D) 97.9 days

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started