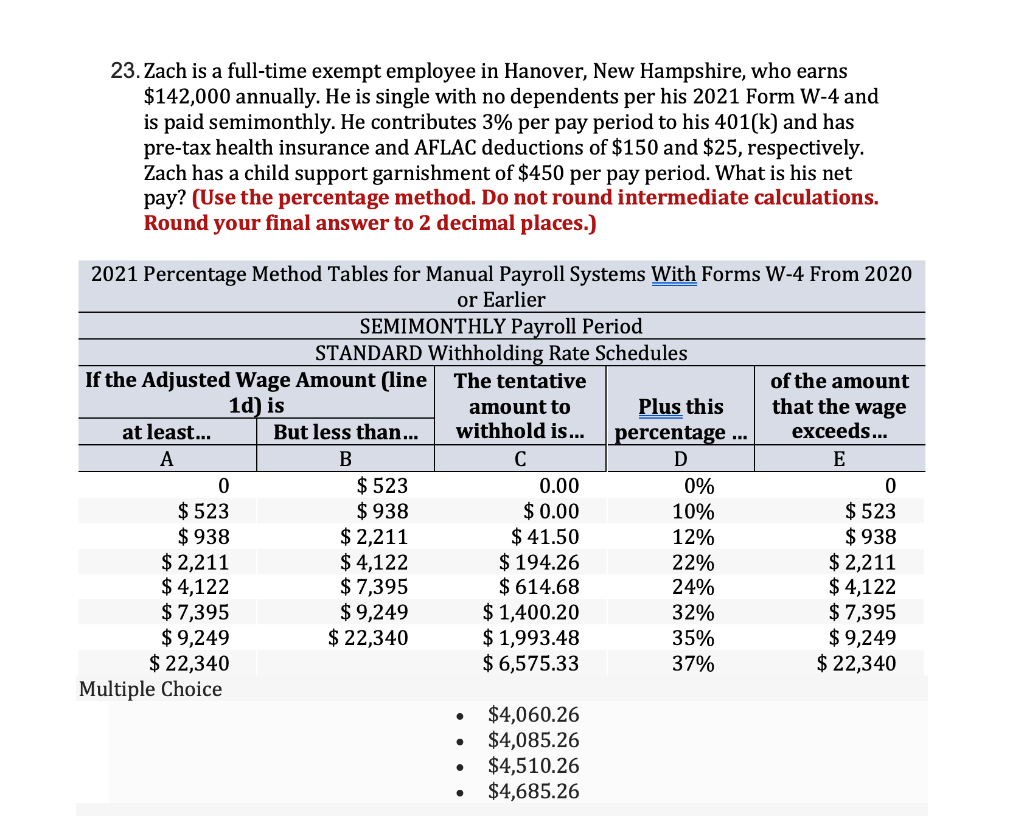

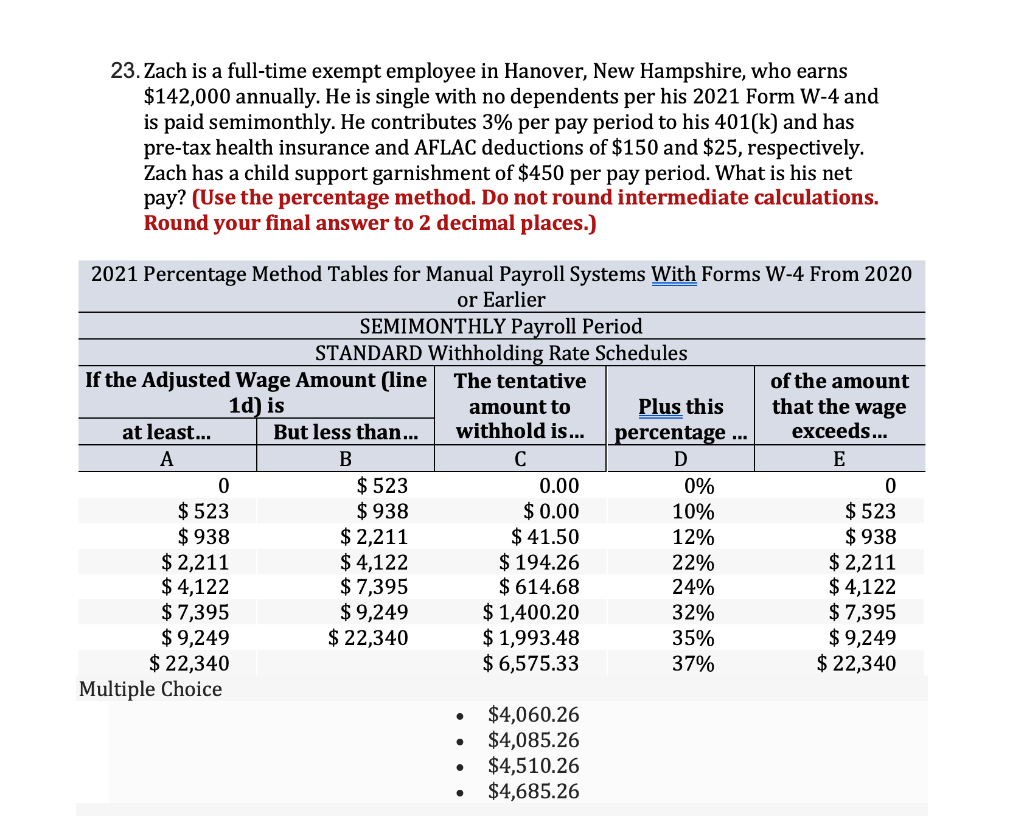

23. Zach is a full-time exempt employee in Hanover, New Hampshire, who earns $142,000 annually. He is single with no dependents per his 2021 Form W-4 and is paid semimonthly. He contributes 3% per pay period to his 401(k) and has pre-tax health insurance and AFLAC deductions of $150 and $25, respectively. Zach has a child support garnishment of $450 per pay period. What is his net pay? (Use the percentage method. Do not round intermediate calculations. Round your final answer to 2 decimal places.) 2021 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Earlier SEMIMONTHLY Payroll Period STANDARD Withholding Rate Schedules If the Adjusted Wage Amount (line The tentative of the amount 1d) is amount to Plus this that the wage at least... But less than... withhold is... percentage ... exceeds... A B D E 0 $ 523 0.00 0% 0 $ 523 $ 938 $ 0.00 10% $ 523 $ 938 $ 2,211 $ 41.50 12% $ 938 $ 2,211 $ 4,122 $ 194.26 22% $ 2,211 $ 4,122 $ 7,395 $ 614.68 24% $ 4,122 $ 7,395 $ 9,249 $ 1,400.20 32% $ 7,395 $ 9,249 $ 22,340 $ 1,993.48 35% $ 9,249 $ 22,340 $ 6,575.33 37% $ 22,340 Multiple Choice $4,060.26 $4,085.26 $4,510.26 $4,685.26 O . . 23. Zach is a full-time exempt employee in Hanover, New Hampshire, who earns $142,000 annually. He is single with no dependents per his 2021 Form W-4 and is paid semimonthly. He contributes 3% per pay period to his 401(k) and has pre-tax health insurance and AFLAC deductions of $150 and $25, respectively. Zach has a child support garnishment of $450 per pay period. What is his net pay? (Use the percentage method. Do not round intermediate calculations. Round your final answer to 2 decimal places.) 2021 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Earlier SEMIMONTHLY Payroll Period STANDARD Withholding Rate Schedules If the Adjusted Wage Amount (line The tentative of the amount 1d) is amount to Plus this that the wage at least... But less than... withhold is... percentage ... exceeds... A B D E 0 $ 523 0.00 0% 0 $ 523 $ 938 $ 0.00 10% $ 523 $ 938 $ 2,211 $ 41.50 12% $ 938 $ 2,211 $ 4,122 $ 194.26 22% $ 2,211 $ 4,122 $ 7,395 $ 614.68 24% $ 4,122 $ 7,395 $ 9,249 $ 1,400.20 32% $ 7,395 $ 9,249 $ 22,340 $ 1,993.48 35% $ 9,249 $ 22,340 $ 6,575.33 37% $ 22,340 Multiple Choice $4,060.26 $4,085.26 $4,510.26 $4,685.26 O