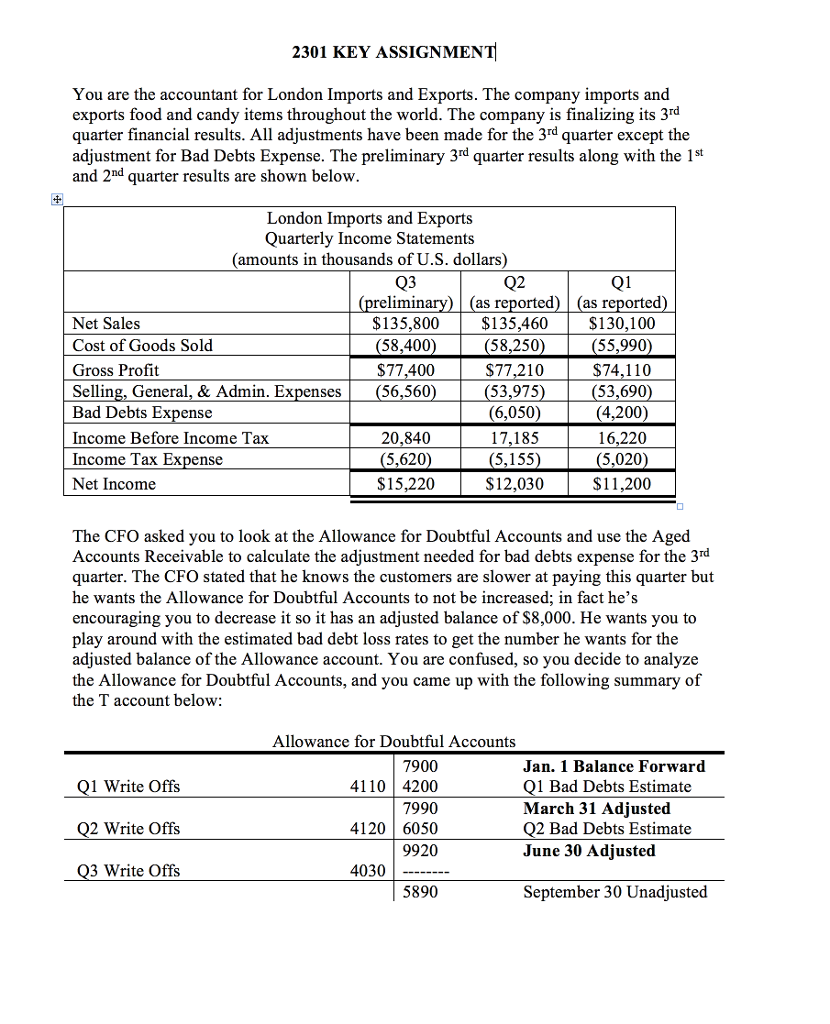

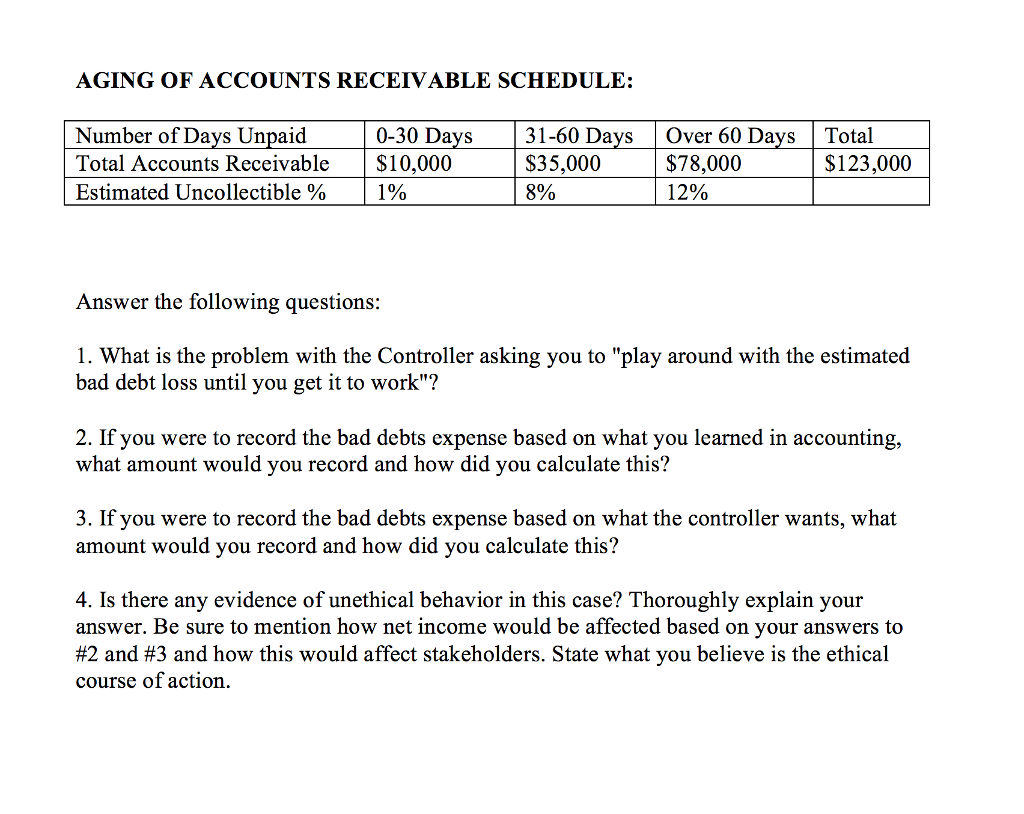

2301 KEY ASSIGNMENT You are the accountant for London Imports and Exports. The company imports and exports food and candy items throughout the world. The company is finalizing its 3rd quarter financial results. All adjustments have been made for the 3rd quarter except the adjustment for Bad Debts Expense. The preliminary 3rd quarter results along with the 1st and 2nd quarter results are shown below London Imports and Exports Quarterly Income Statements (amounts in thousands of U.S. dollars) 2 relimin $135,800 58,400 $77,400 56,560 as reported) (as reported Net Sales Cost of Goods Sold Gross Profit Selling, General, & Admin. Expenses Bad Debts Expense Income Before Income Tax Income Tax Expense Net Income $135,460S130,100 55,990) $74,110 53,690 (4,200) 16,220 5.020) $11,200 58,250) S77,210 (53,975) (6,050) 17,185 (5,155) S12,030 20,840 (5,620) $15,220 The CFO asked you to look at the Allowance for Doubtful Accounts and use the Aged Accounts Receivable to calculate the adjustment needed for bad debts expense for the 3d quarter. The CFO stated that he knows the customers are slower at paying this quarter but he wants the Allowance for Doubtful Accounts to not be increased; in fact he's encouraging you to decrease it so it has an adjusted balance of $8,000. He wants you to play around with the estimated bad debt loss rates to get the number he wants for the adjusted balance of the Allowance account. You are confused, so you decide to analyze the Allowance for Doubtful Accounts, and you came up with the following summary of the T account below: Allowance for Doubtful Accounts 7900 4110 4200 7990 41206050 9920 Jan. 1 Balance Forward 1 Write Offs 1 Bad Debts Estimate March 31 Adjusted Q2 Bad Debts Estimate June 30 Adjusted 2 Write Offs 3 Write Offs 4030 5890 September 30 Unadjusted 2301 KEY ASSIGNMENT You are the accountant for London Imports and Exports. The company imports and exports food and candy items throughout the world. The company is finalizing its 3rd quarter financial results. All adjustments have been made for the 3rd quarter except the adjustment for Bad Debts Expense. The preliminary 3rd quarter results along with the 1st and 2nd quarter results are shown below London Imports and Exports Quarterly Income Statements (amounts in thousands of U.S. dollars) 2 relimin $135,800 58,400 $77,400 56,560 as reported) (as reported Net Sales Cost of Goods Sold Gross Profit Selling, General, & Admin. Expenses Bad Debts Expense Income Before Income Tax Income Tax Expense Net Income $135,460S130,100 55,990) $74,110 53,690 (4,200) 16,220 5.020) $11,200 58,250) S77,210 (53,975) (6,050) 17,185 (5,155) S12,030 20,840 (5,620) $15,220 The CFO asked you to look at the Allowance for Doubtful Accounts and use the Aged Accounts Receivable to calculate the adjustment needed for bad debts expense for the 3d quarter. The CFO stated that he knows the customers are slower at paying this quarter but he wants the Allowance for Doubtful Accounts to not be increased; in fact he's encouraging you to decrease it so it has an adjusted balance of $8,000. He wants you to play around with the estimated bad debt loss rates to get the number he wants for the adjusted balance of the Allowance account. You are confused, so you decide to analyze the Allowance for Doubtful Accounts, and you came up with the following summary of the T account below: Allowance for Doubtful Accounts 7900 4110 4200 7990 41206050 9920 Jan. 1 Balance Forward 1 Write Offs 1 Bad Debts Estimate March 31 Adjusted Q2 Bad Debts Estimate June 30 Adjusted 2 Write Offs 3 Write Offs 4030 5890 September 30 Unadjusted