Answered step by step

Verified Expert Solution

Question

1 Approved Answer

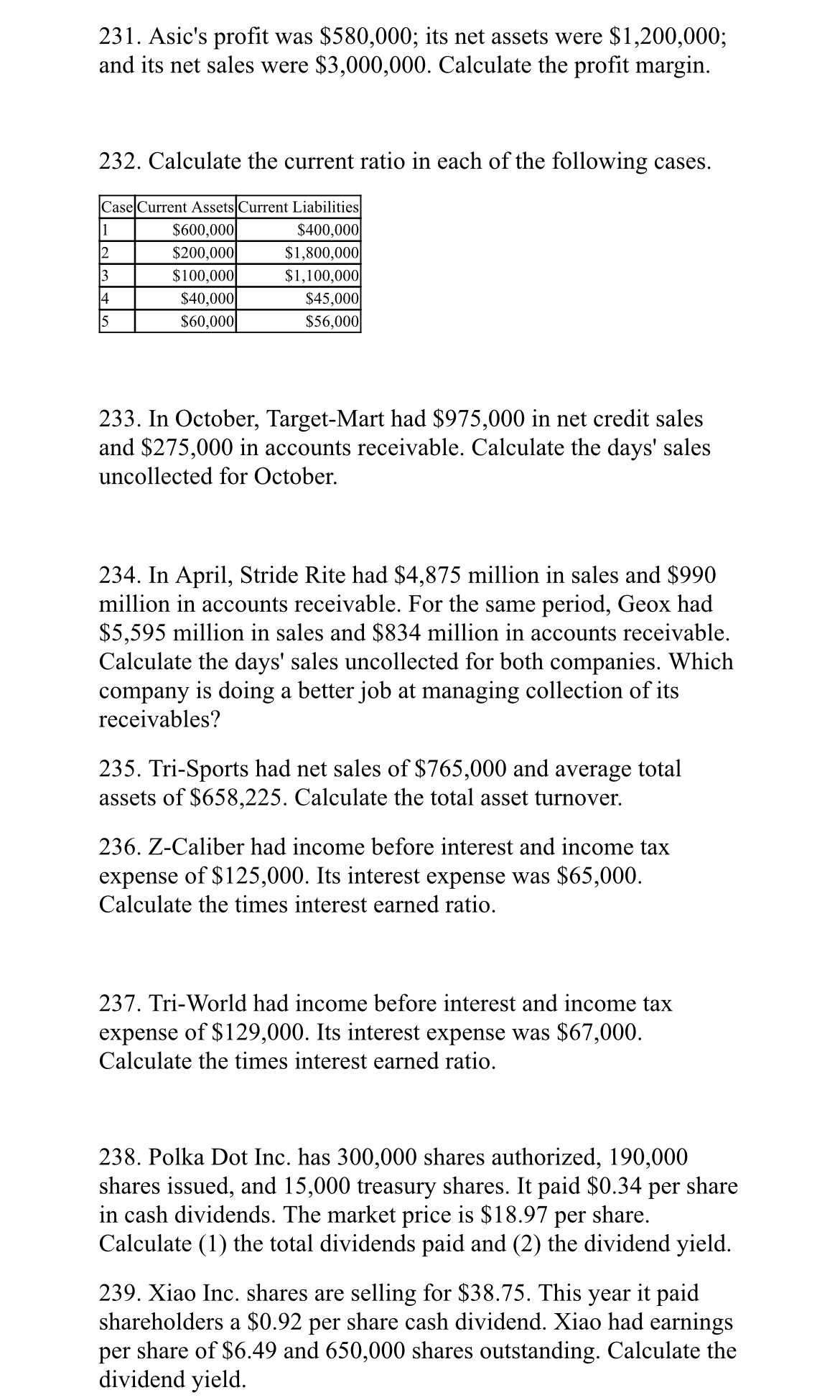

231. Asic's profit was $580,000; its net assets were $1,200,000; and its net sales were $3,000,000. Calculate the profit margin. 232. Calculate the current

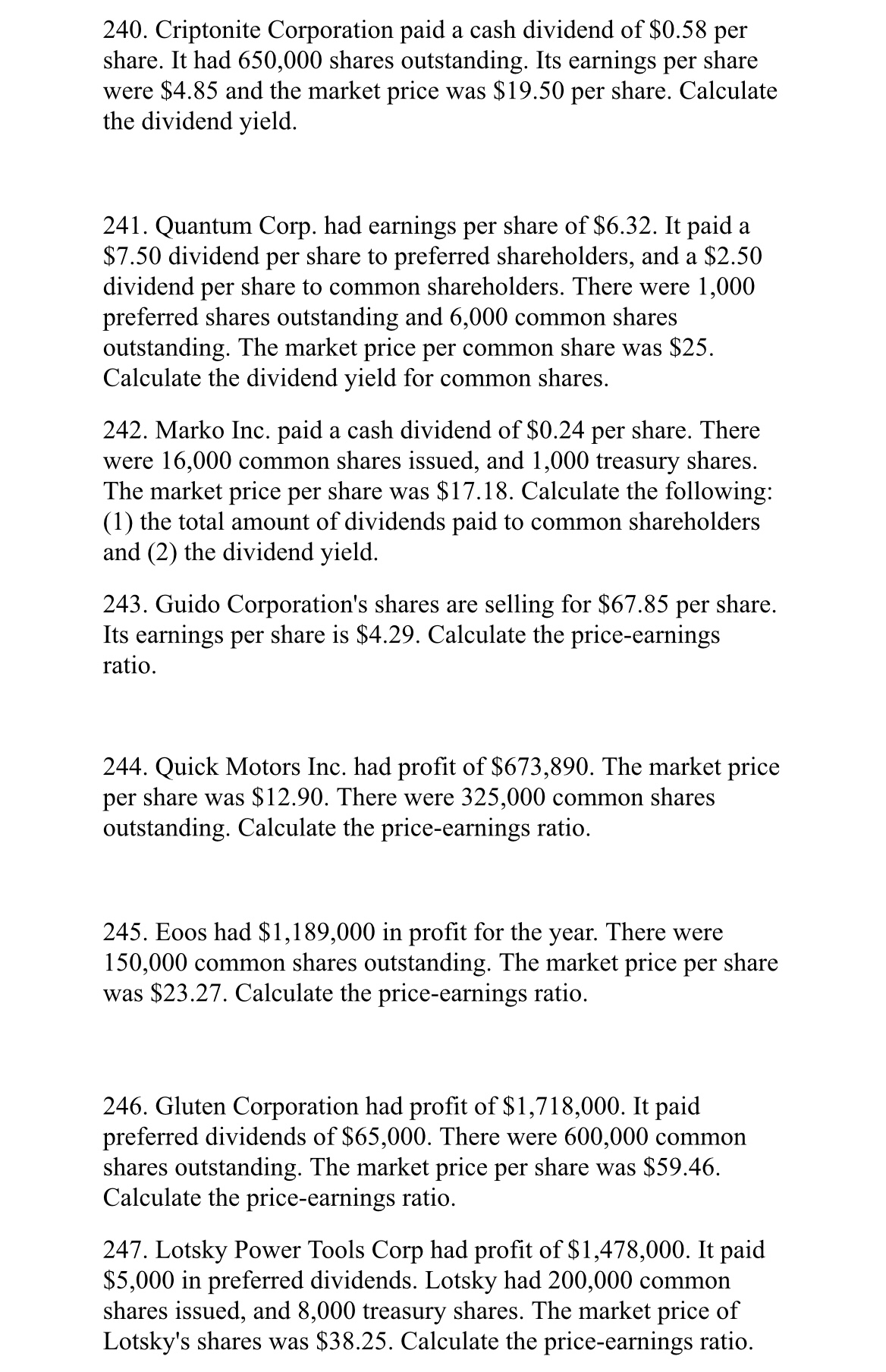

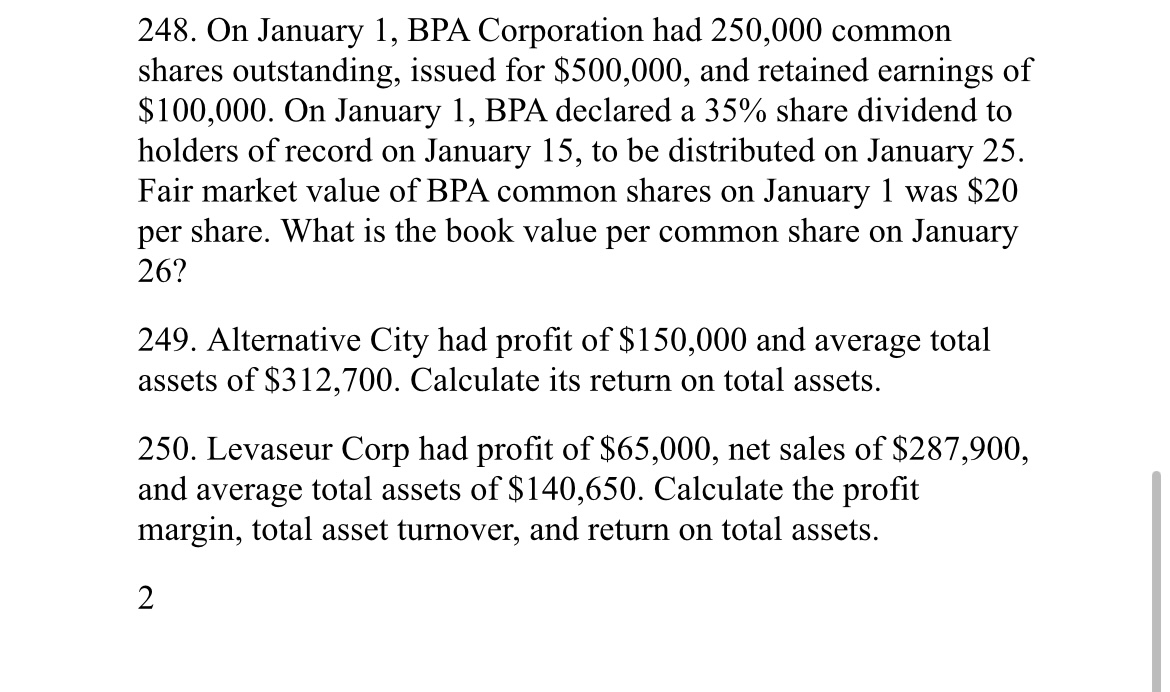

231. Asic's profit was $580,000; its net assets were $1,200,000; and its net sales were $3,000,000. Calculate the profit margin. 232. Calculate the current ratio in each of the following cases. Case Current Assets Current Liabilities $400,000 $1,800,000 $1,100,000 1 2 3 14 5 $600,000 $200,000 $100,000 $40,000 $60,000 $45,000 $56,000 233. In October, Target-Mart had $975,000 in net credit sales and $275,000 in accounts receivable. Calculate the days' sales uncollected for October. 234. In April, Stride Rite had $4,875 million in sales and $990 million in accounts receivable. For the same period, Geox had $5,595 million in sales and $834 million in accounts receivable. Calculate the days' sales uncollected for both companies. Which company is doing a better job at managing collection of its receivables? 235. Tri-Sports had net sales of $765,000 and average total assets of $658,225. Calculate the total asset turnover. 236. Z-Caliber had income before interest and income tax expense of $125,000. Its interest expense was $65,000. Calculate the times interest earned ratio. 237. Tri-World had income before interest and income tax expense of $129,000. Its interest expense was $67,000. Calculate the times interest earned ratio. 238. Polka Dot Inc. has 300,000 shares authorized, 190,000 shares issued, and 15,000 treasury shares. It paid $0.34 per share in cash dividends. The market price is $18.97 per share. Calculate (1) the total dividends paid and (2) the dividend yield. 239. Xiao Inc. shares are selling for $38.75. This year it paid shareholders a $0.92 per share cash dividend. Xiao had earnings per share of $6.49 and 650,000 shares outstanding. Calculate the dividend yield. 240. Criptonite Corporation paid a cash dividend of $0.58 per share. It had 650,000 shares outstanding. Its earnings per share were $4.85 and the market price was $19.50 per share. Calculate the dividend yield. 241. Quantum Corp. had earnings per share of $6.32. It paid a $7.50 dividend per share to preferred shareholders, and a $2.50 dividend per share to common shareholders. There were 1,000 preferred shares outstanding and 6,000 common shares outstanding. The market price per common share was $25. Calculate the dividend yield for common shares. 242. Marko Inc. paid a cash dividend of $0.24 per share. There were 16,000 common shares issued, and 1,000 treasury shares. The market price per share was $17.18. Calculate the following: (1) the total amount of dividends paid to common shareholders and (2) the dividend yield. 243. Guido Corporation's shares are selling for $67.85 per share. Its earnings per share is $4.29. Calculate the price-earnings ratio. 244. Quick Motors Inc. had profit of $673,890. The market price per share was $12.90. There were 325,000 common shares outstanding. Calculate the price-earnings ratio. 245. Eoos had $1,189,000 in profit for the year. There were 150,000 common shares outstanding. The market price per share was $23.27. Calculate the price-earnings ratio. 246. Gluten Corporation had profit of $1,718,000. It paid preferred dividends of $65,000. There were 600,000 common shares outstanding. The market price per share was $59.46. Calculate the price-earnings ratio. 247. Lotsky Power Tools Corp had profit of $1,478,000. It paid $5,000 in preferred dividends. Lotsky had 200,000 common shares issued, and 8,000 treasury shares. The market price of Lotsky's shares was $38.25. Calculate the price-earnings ratio. 248. On January 1, BPA Corporation had 250,000 common shares outstanding, issued for $500,000, and retained earnings of $100,000. On January 1, BPA declared a 35% share dividend to holders of record on January 15, to be distributed on January 25. Fair market value of BPA common shares on January 1 was $20 per share. What is the book value per common share on January 26? 249. Alternative City had profit of $150,000 and average total assets of $312,700. Calculate its return on total assets. 250. Levaseur Corp had profit of $65,000, net sales of $287,900, and average total assets of $140,650. Calculate the profit margin, total asset turnover, and return on total assets. 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

231 The profit margin can be calculated by dividing the profit by the net sales and multiplying by 100 to express it as a percentage Profit Margin Profit Net Sales 100 Profit Margin 580000 3000000 100 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started