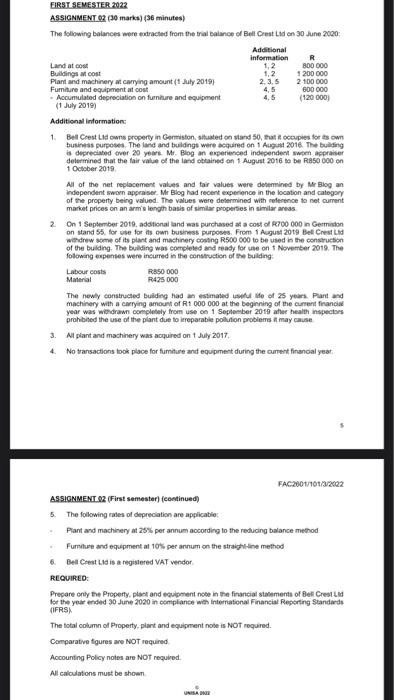

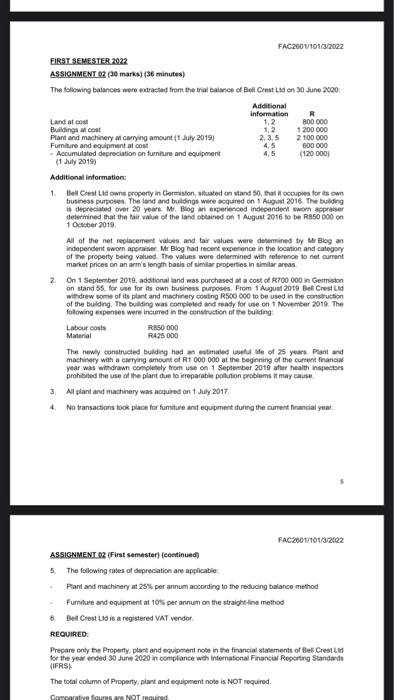

2.3.5 4.5 FIRST SEMESTER 2022 ASSIGNMENT 02 (30 marks) (36 minutes) The following balances were extracted from the trial balance of Bell Crest Lad on 30 June 2020 Additional information Land at com 1,2 800 000 Buildings at cost 1.2 1 200 000 Plant and machinery at carrying amount (1 July 2019 2 100 000 Furniture and equipment at cost 4,5 600 000 Accumulated depreciation on furniture and equipment (120 000) (1 July 2019 Additional information: 1. Bell CrestLid own property in Germiston, situated on stand 50, that occupied for its own business purposes. The land and buildings were acquired on 1 August 2016 The building depreciated over 20 years M. Blog an experienced independent wo appraiser determined that the fair value of the land obtained on 1 August 2016 to be 850 000 on 1 October 2015 All of the net replacement values and fair values were determined by Mr Blog an independent sworn appraiser, Mr Blog had recent experience in the location and category of the property being valued. The values were determined with reference to net current market prices on an arm's length basis of similar properties in similar areas 2 On 1 September 2010. additional land was purchased at a cost of R700 000 in Germiston on stand 55. for use for its own business purposes. From 1 August 2019 Bell Crest Lid withdrew some of its plant and machinery costing R500 000 to be used in the construction of the buiding. The building was completed and ready for use on 1 November 2019. The following expenses were incurred in the construction of the building Labour costs R350 000 Material R425 000 The newly constructed building had an estimated site of 25 years. Pantand machinery with a carrying amount of R1 000 000 at the beginning of the current financial year was we drawn completely from use on 1 September 2019 ate health inspectors prohibited the use of the plant due to irreparable pollution problems may cause 3. All plant and machinery was acquired on July 2017 4. No transactions took place for fumiture and equipment during the current financial yeat, FAC2001/101/3/2002 ASSIGNMENT 2 (First semester) continued 5. The following rates of depreciation are applicable Piant and machinery at 25% per annum according to the reducing balance method Furniture and equipment at 10% per annum on the straight line method 6. Bel CrestLid is a registered VAT vendor REQUIRED Prepare only the Property, pleet and equipment note in the financial statements of Bell CrestLid for the year ended 30 June 2020 in compliance with international Financial Reporting Standards (IFRS) The total column of Property, plant and equipment note is NOT required. Comparative figures are NOT required Accounting Policy notes are NOT required All calculations must be shown UNISA FAC 2001/101/3/2002 FIRST SEMESTER 2022 ASSIGNMENT 03 (30 marks) (36 minutes) The following balances were extracted from the tral balance of Bell Crest Lad on 30 June 2020 Additional Information Land at com 1.2 800 000 Buildings acost 12 1 200 000 Plant and machinery carrying amount (1 July 2019) 2.3.5 2 100 000 Furniture and equipment at com 45 600 000 Accumulated depreciation on furniture and equipment 4,5 (120 000) (1 July 2019) Additional information: 1. Bel CrestLid own property in Germiston, situated on stand 50, that occupies for its own business purposes. The land and buildings were acquired on 1 August 2016. The building depreciated over 20 years. Mr. Blog an experienced independent wor appraiser determined that the fair value of the land obtained on 1 August 2016 to be R850 000 on 1 October 2019 All of the net replacement values and fair values were determined by Mr Blog an independent sworn appraiser Mr Blog had recent experience in the location and category of the property being valued. The values were determined with reference to net current market prices on an arm's length basis of similar properties in similar areas 2 On 1 September 2019, additional land was purchased at a cost of R700 000 in Germiston on stand 5. for use for its own business purposes. From 1 August 2019 Bel Crest Ltd withdrew some of its plant and machinery costing R500 000 to be used in the construction of the building. The building was completed and ready for use on 1 November 2019. The following expenses were incurred in the construction of the building Labour costs RASO 000 Material R425 000 The newly constructed building had an estimated with me of 25 years, Plant and machinery with a carrying amount of R1 000 000 at the beginning of the current financia year was withdrawn completely from use on 1 September 2013 ater health inspectors prohibited the use of the plant due to irreparable pollution problems it may cause 3. All plant and machinery was acquired on July 2017 4. No transactions took place for future and equipment during the current financial yeat, FAC2001/101/3/2022 ASSIGNMENT 92 (First semester) continued 5. The following rates of depreciation are applicable Piant and machinery at 25% per annum according to the reducing balance method Furniture and equipment at 10% per annum on the straight line method 6 Bell CrestLid is a registered VAT vendor REQUIRED Prepare only the Property, plant and equipment note in the financial Statements of Bel CrestLid for the year ended 30 June 2020 in compliance with international Financial Reporting Standards (IFRS) The total column of Property, plant and equipment note is NOT required. Comparative fours are NOT roured