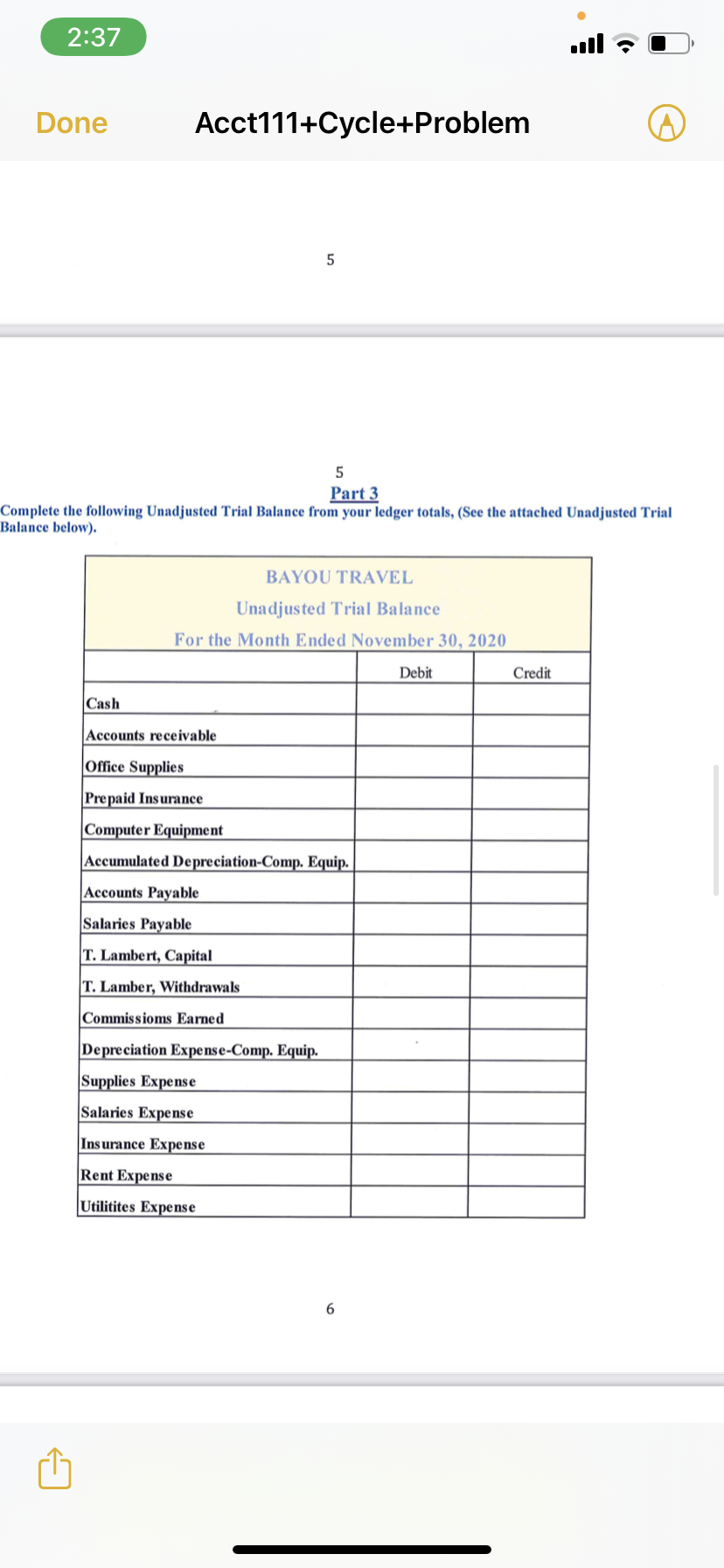

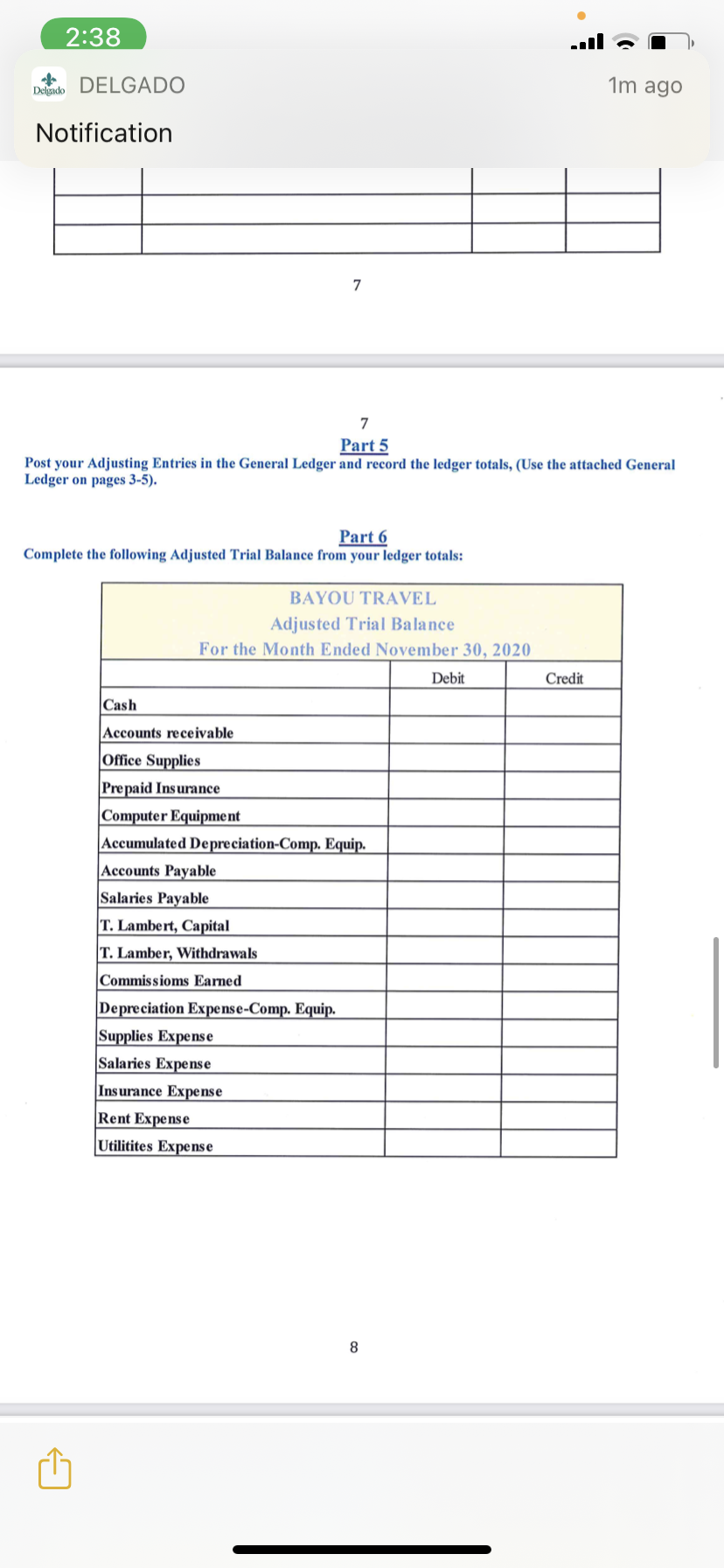

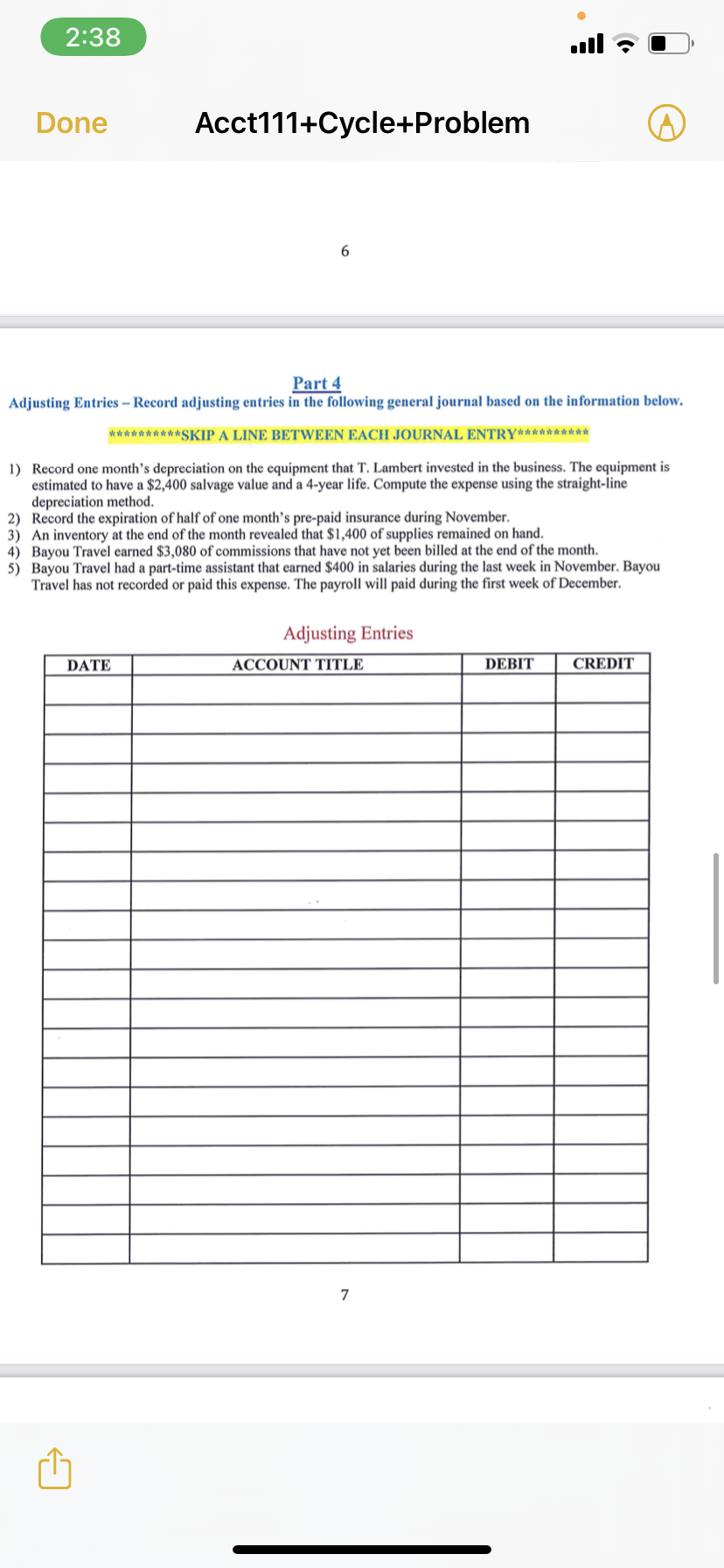

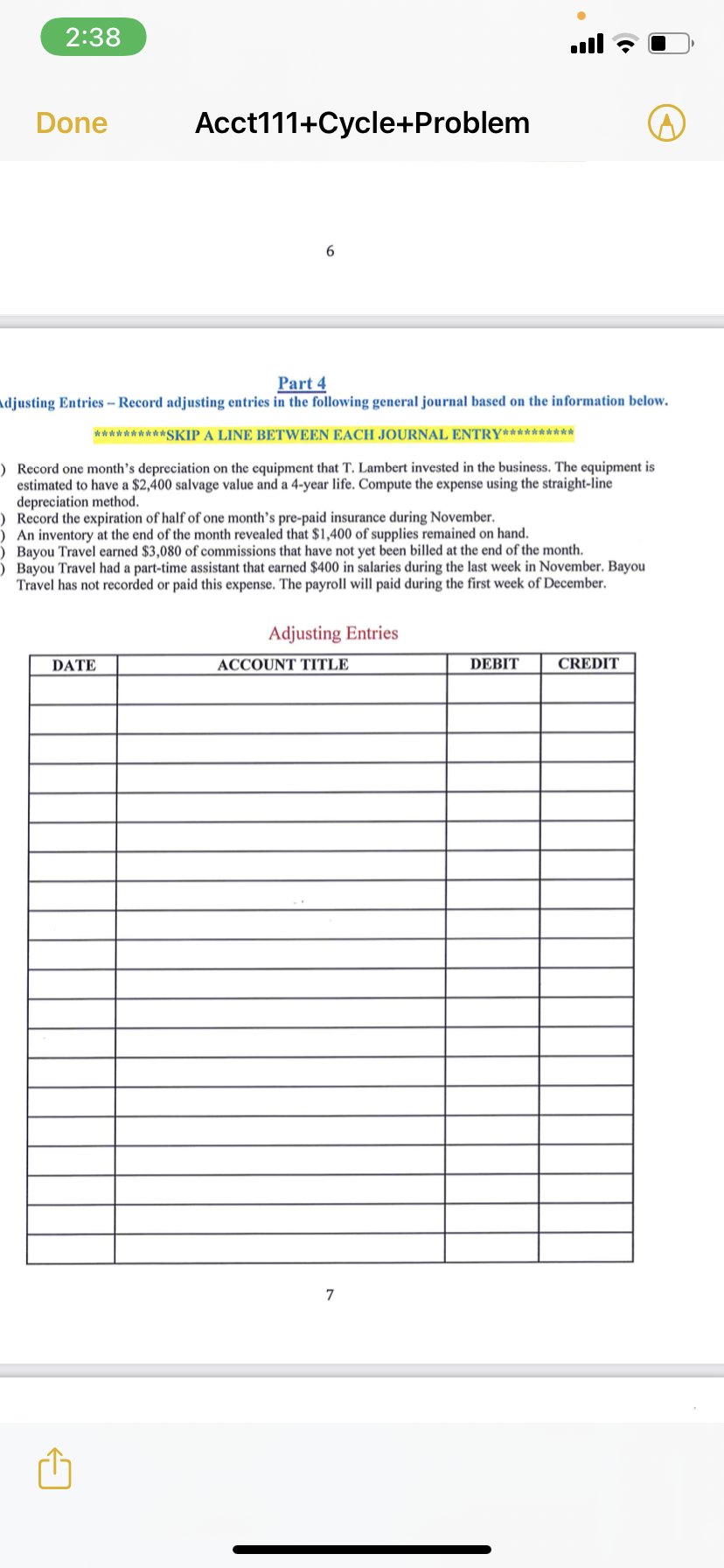

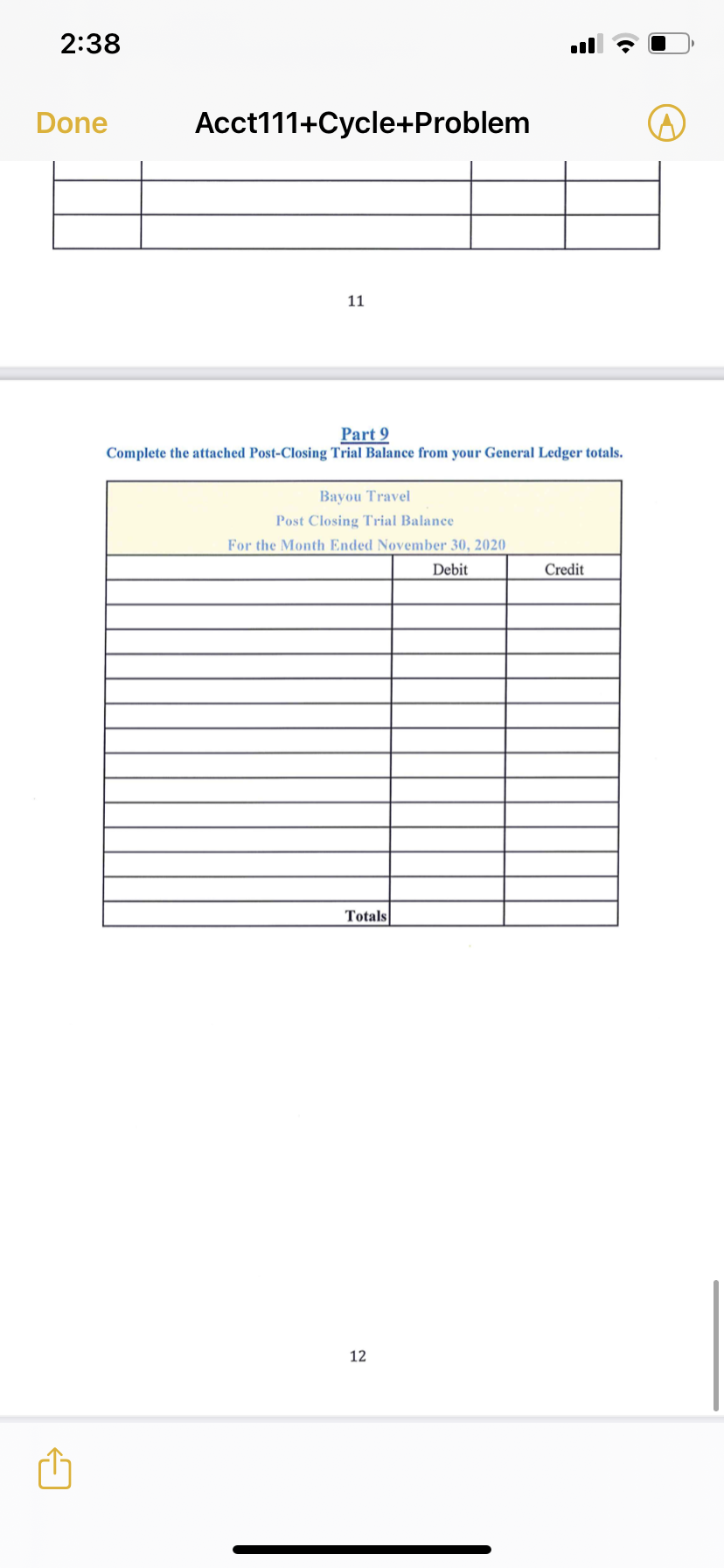

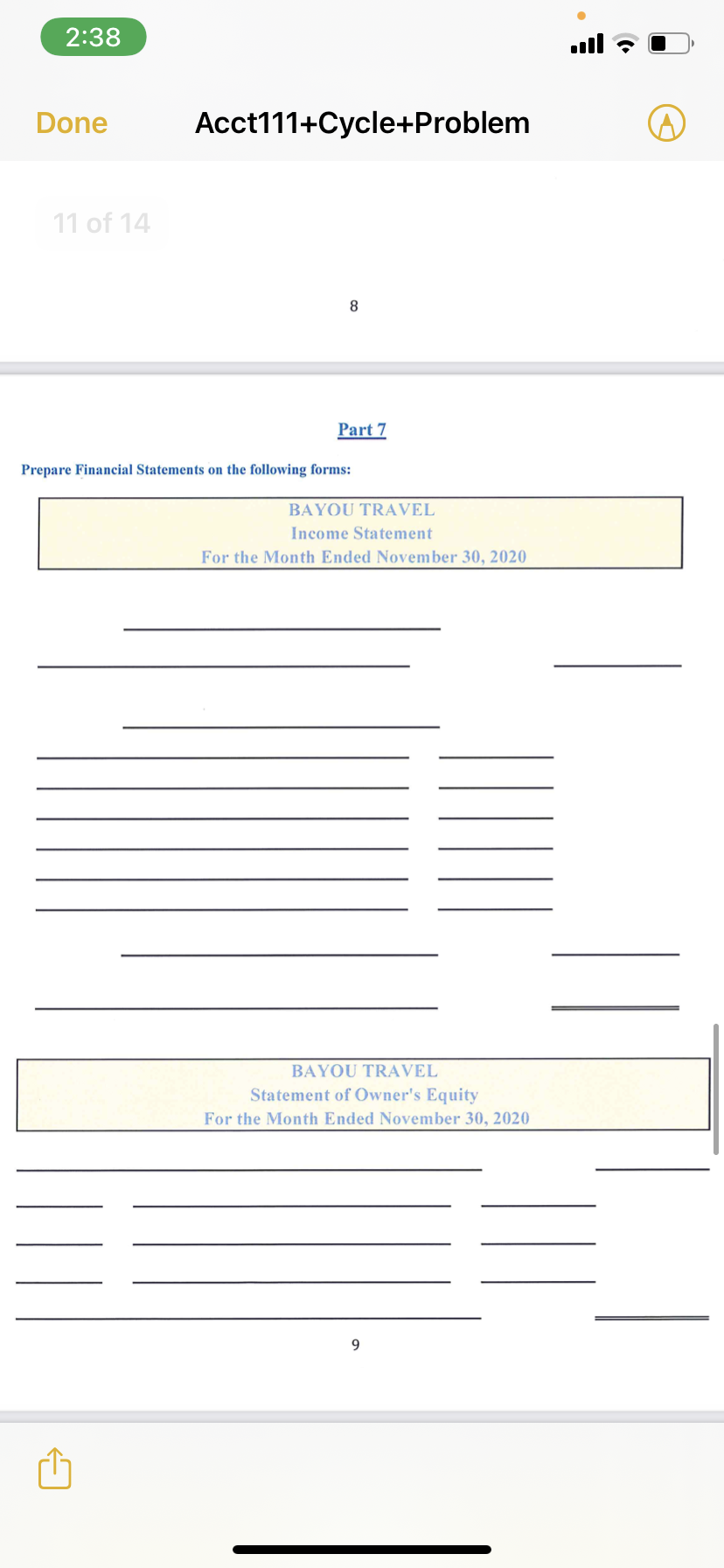

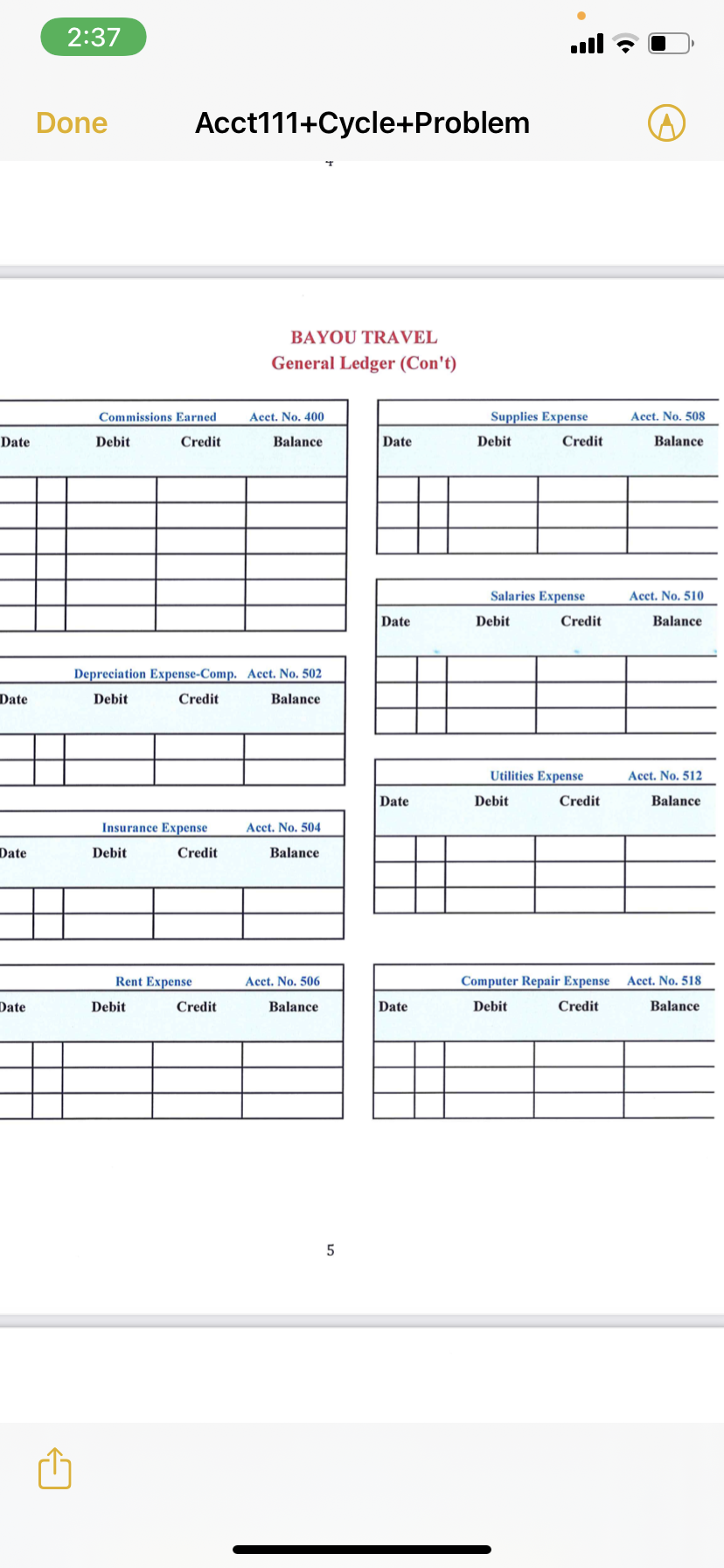

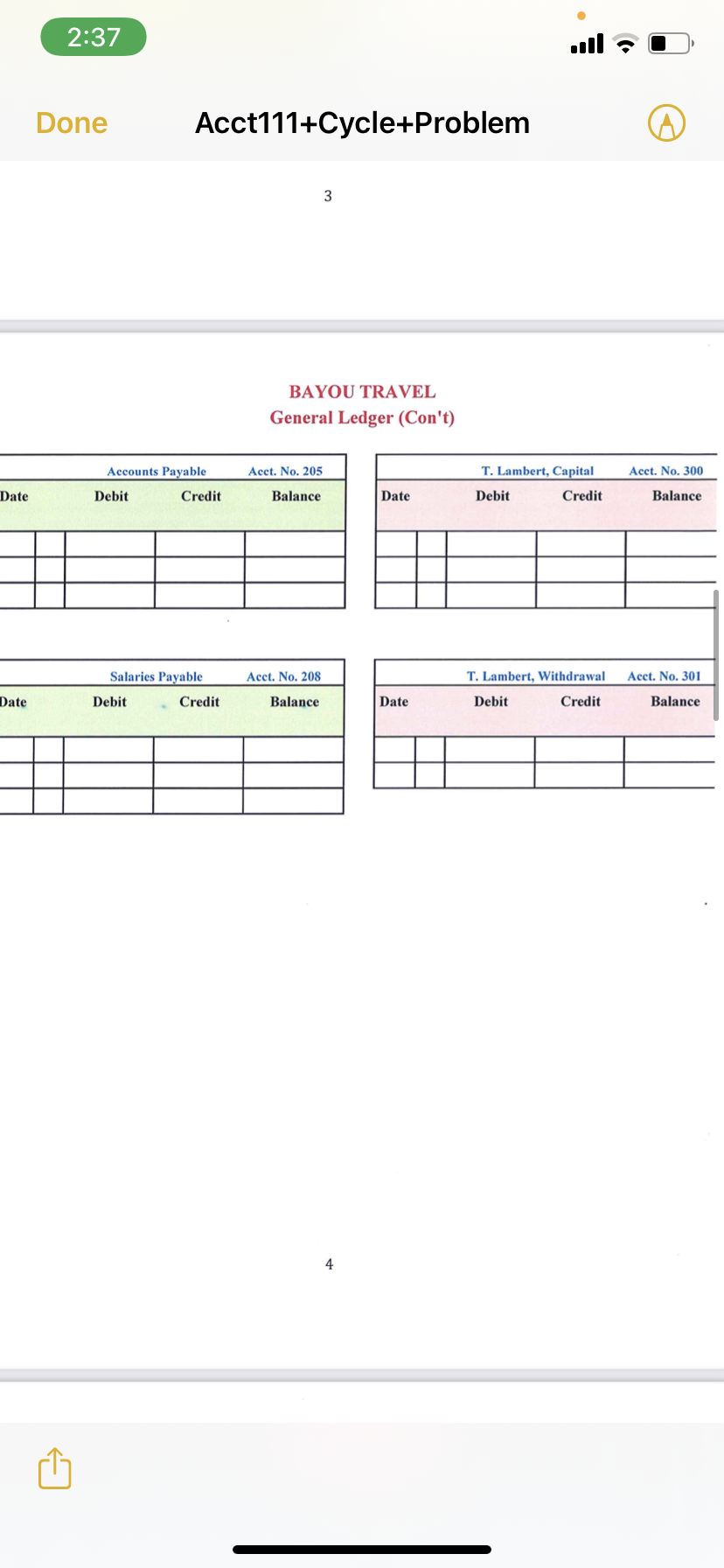

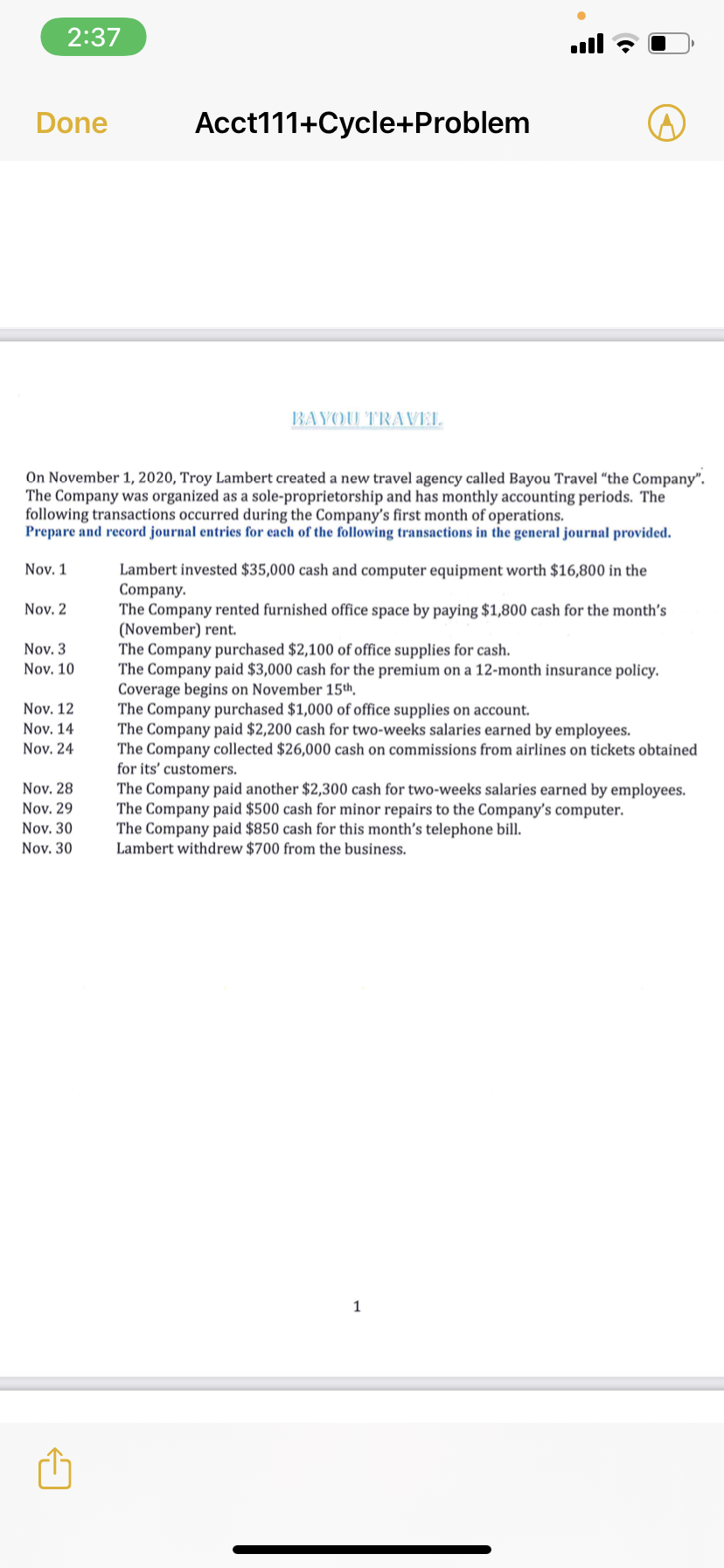

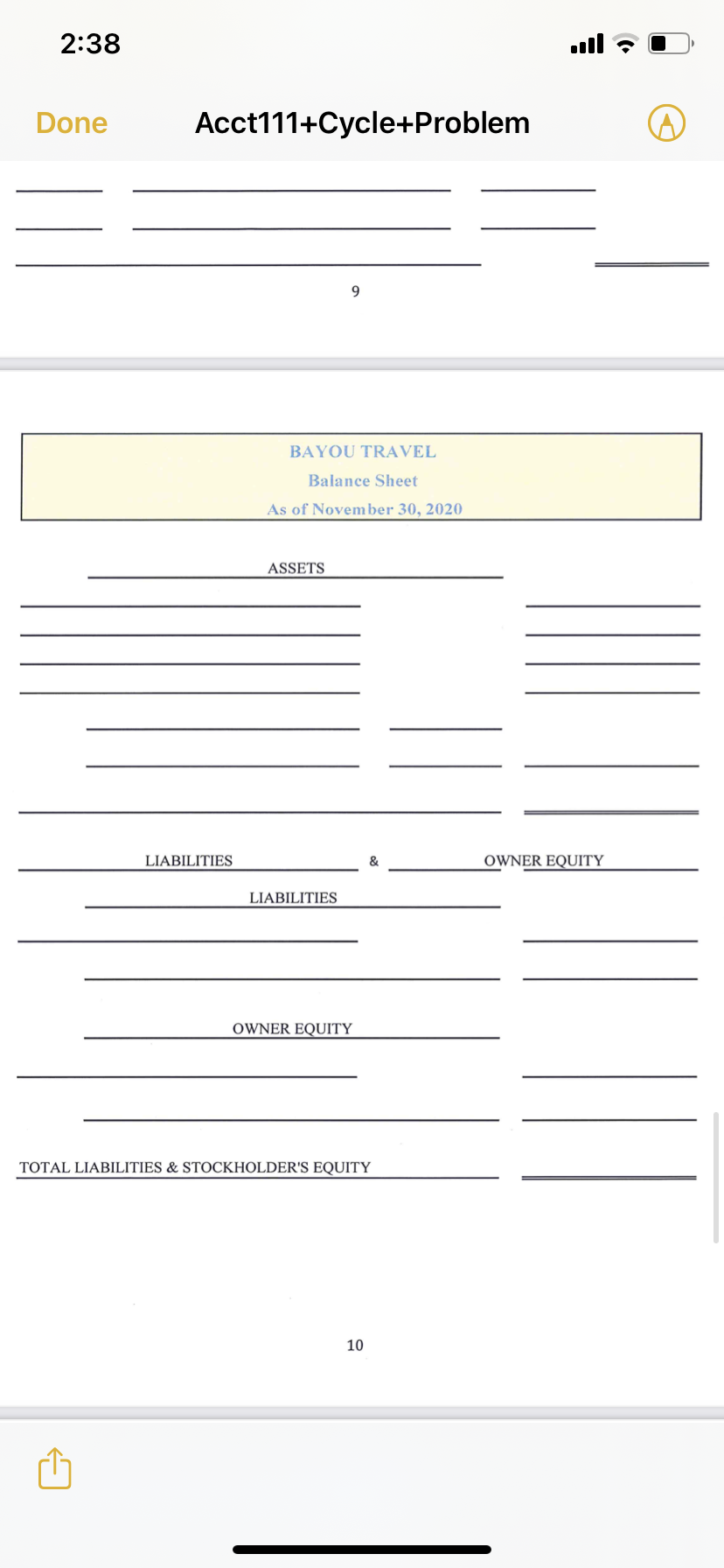

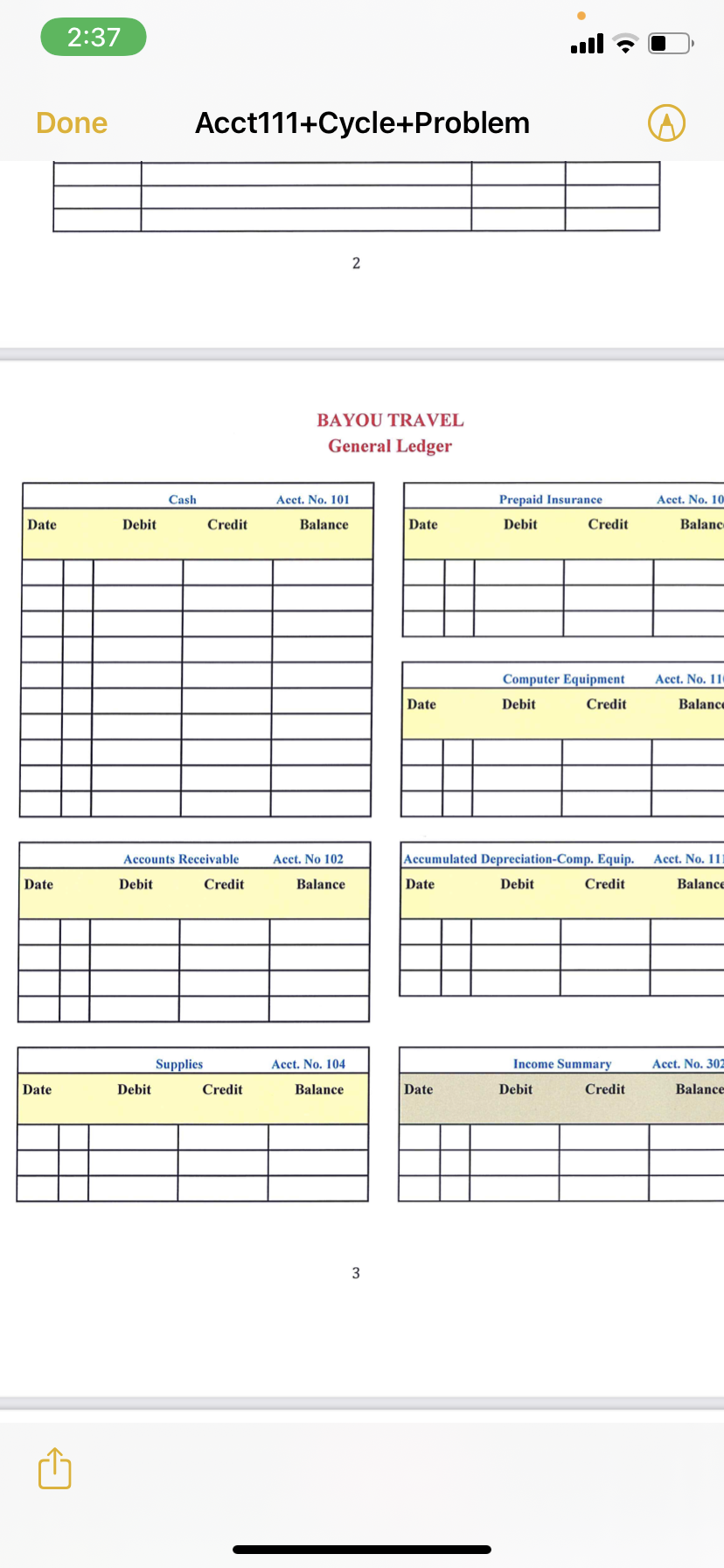

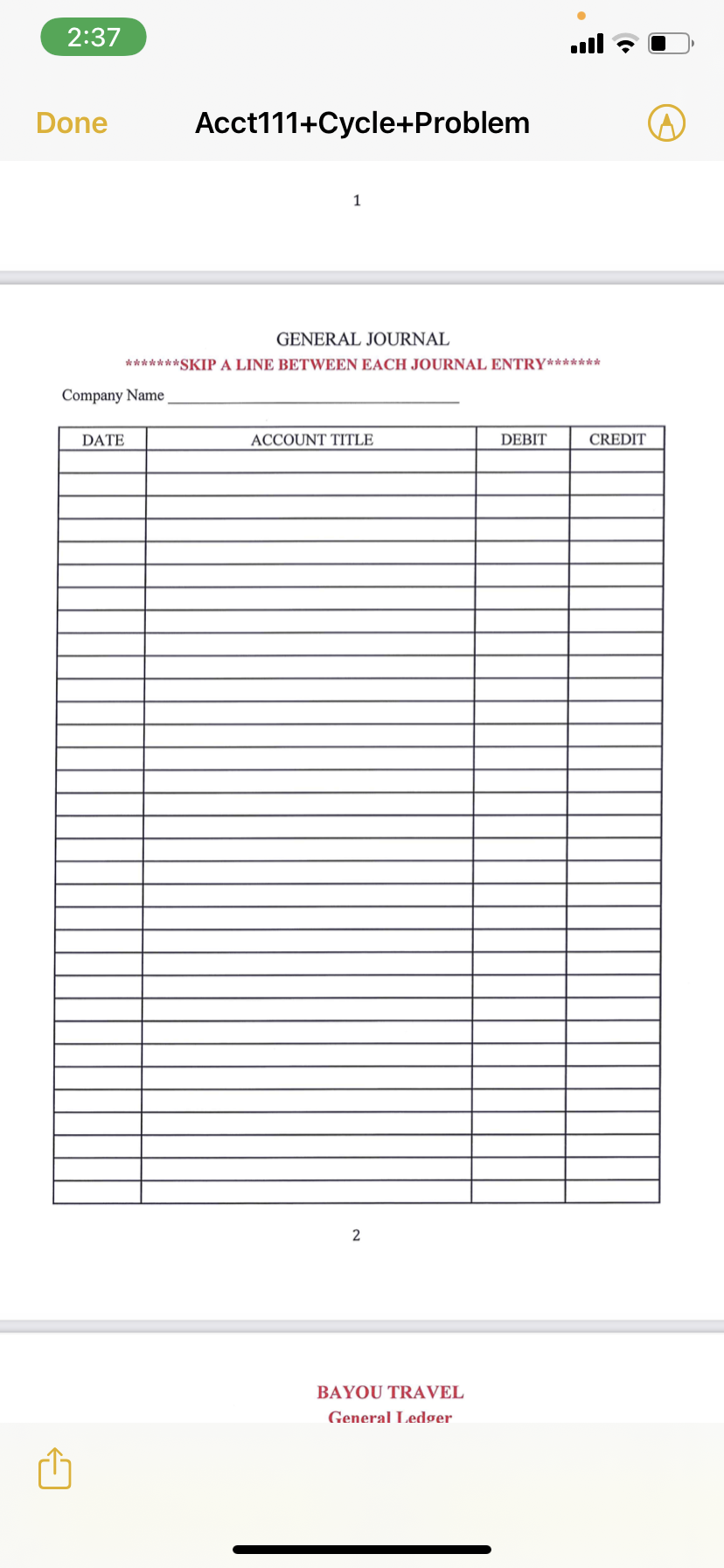

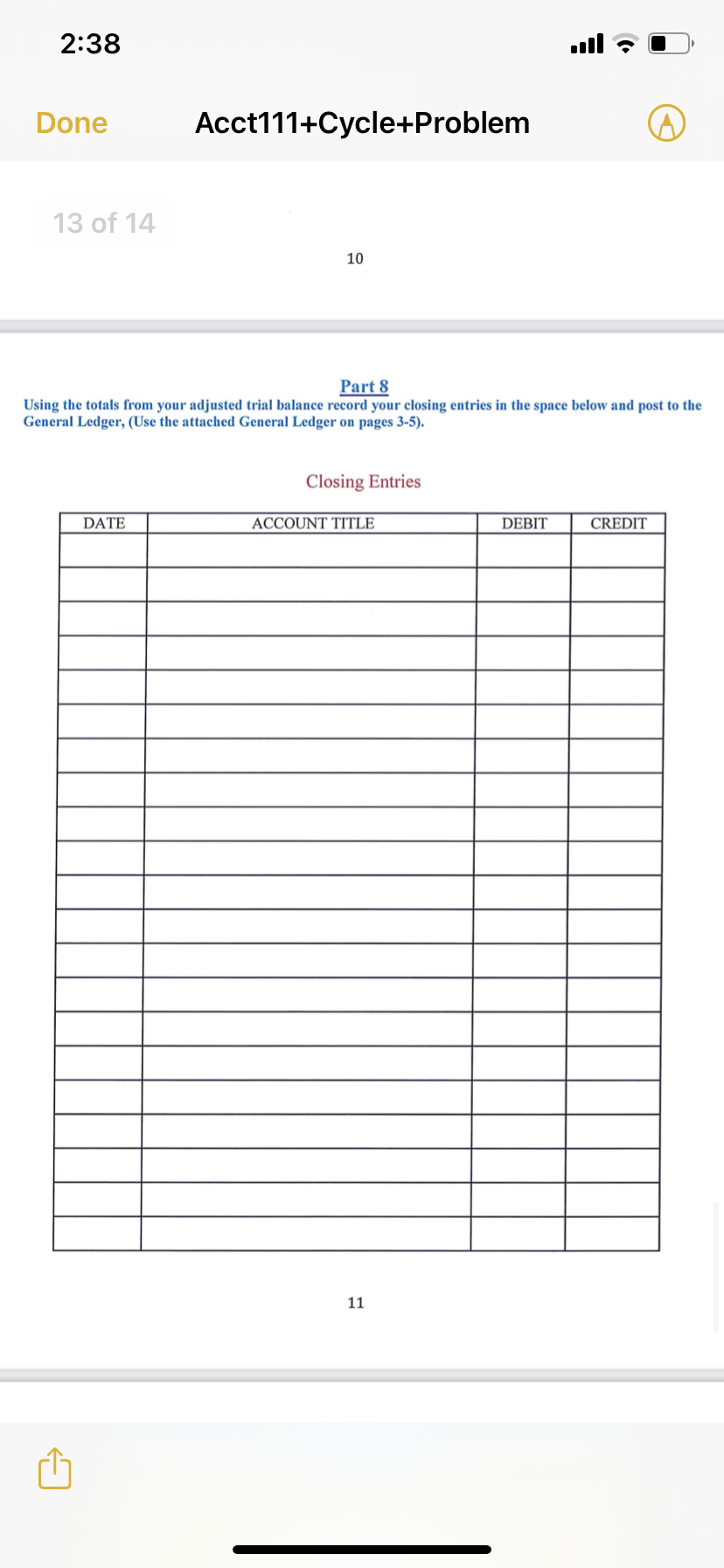

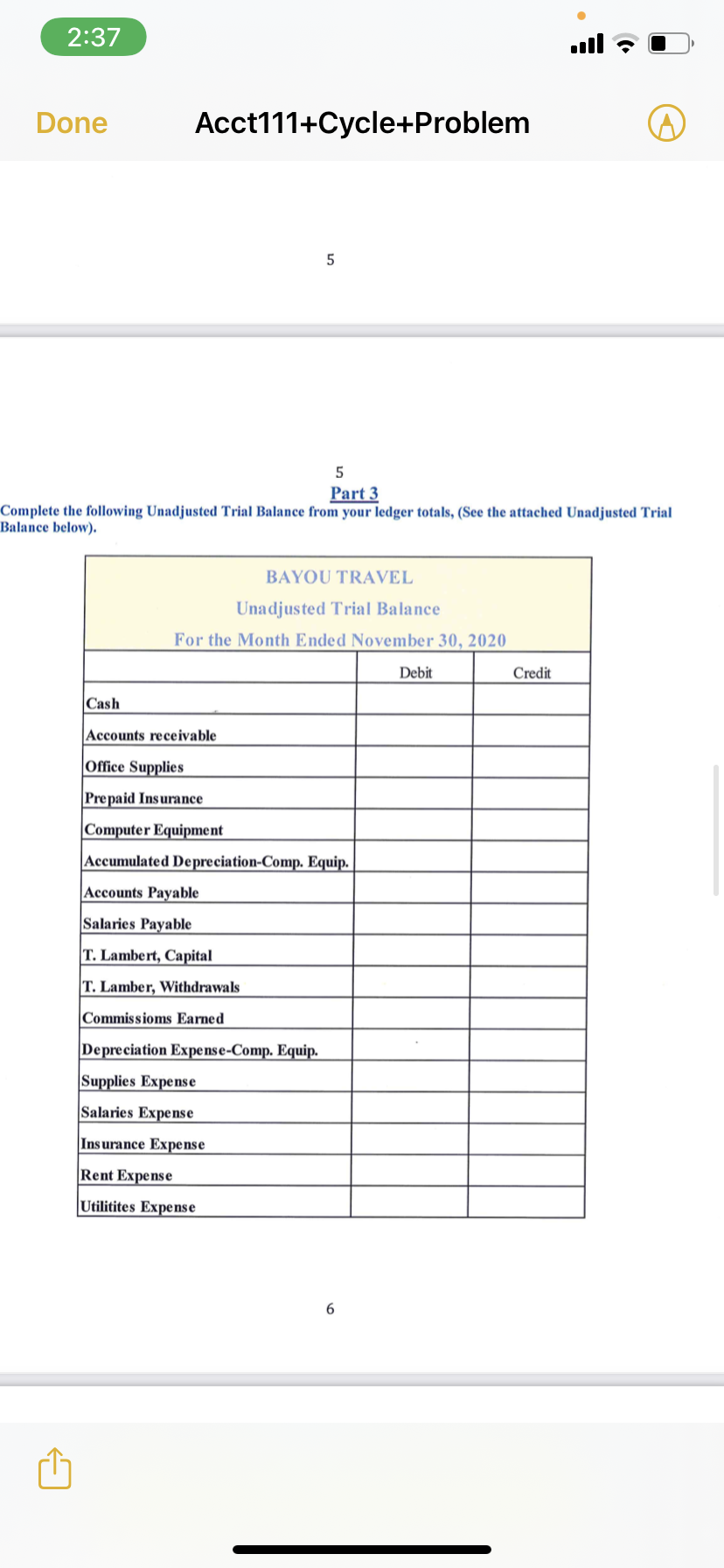

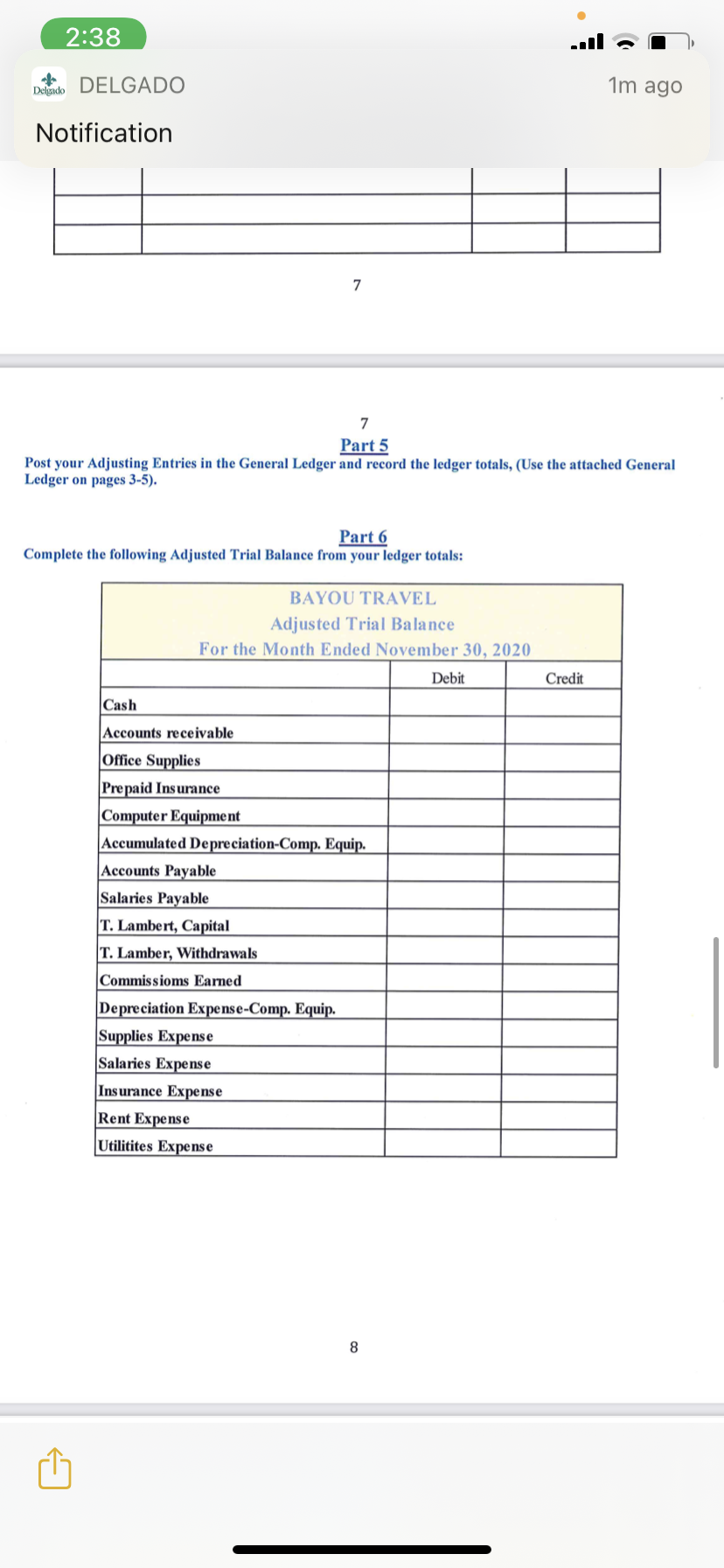

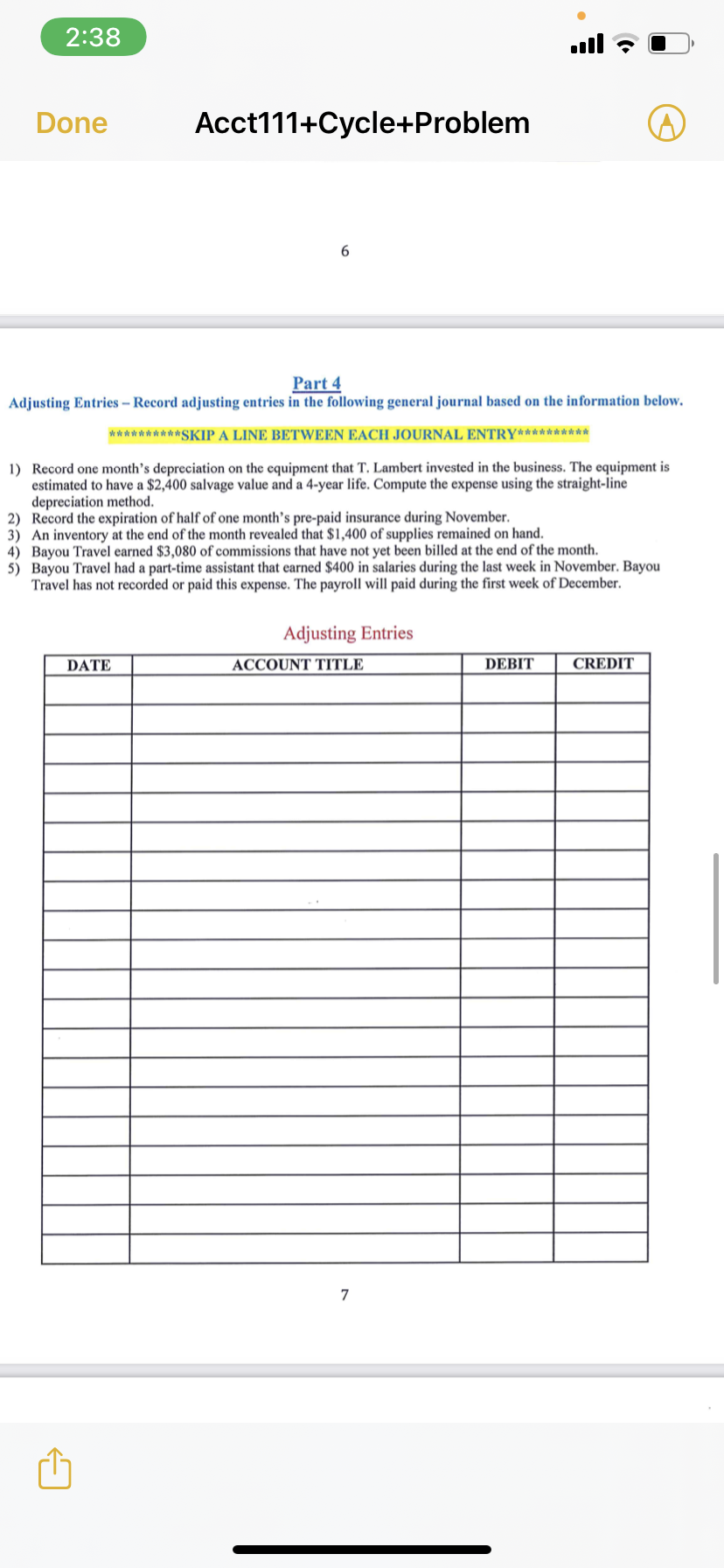

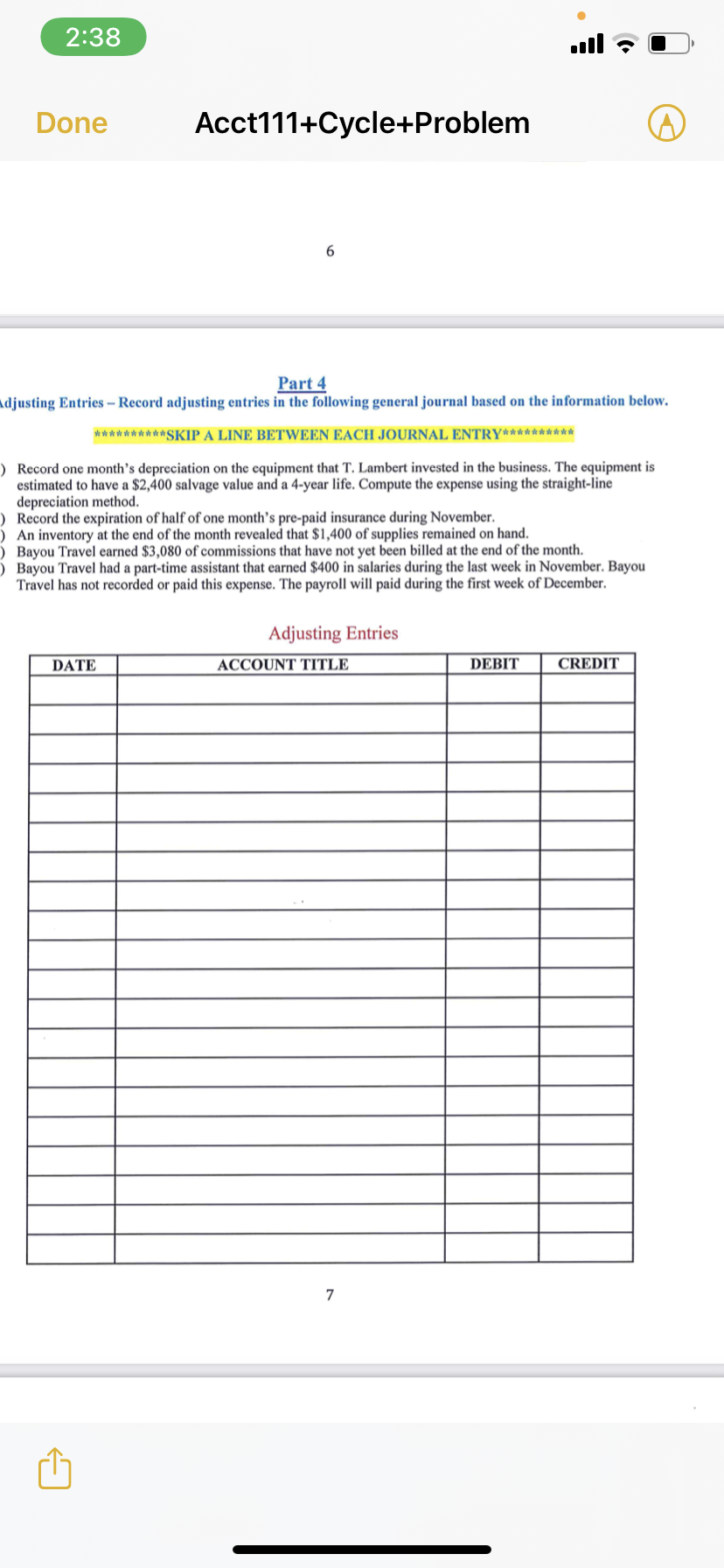

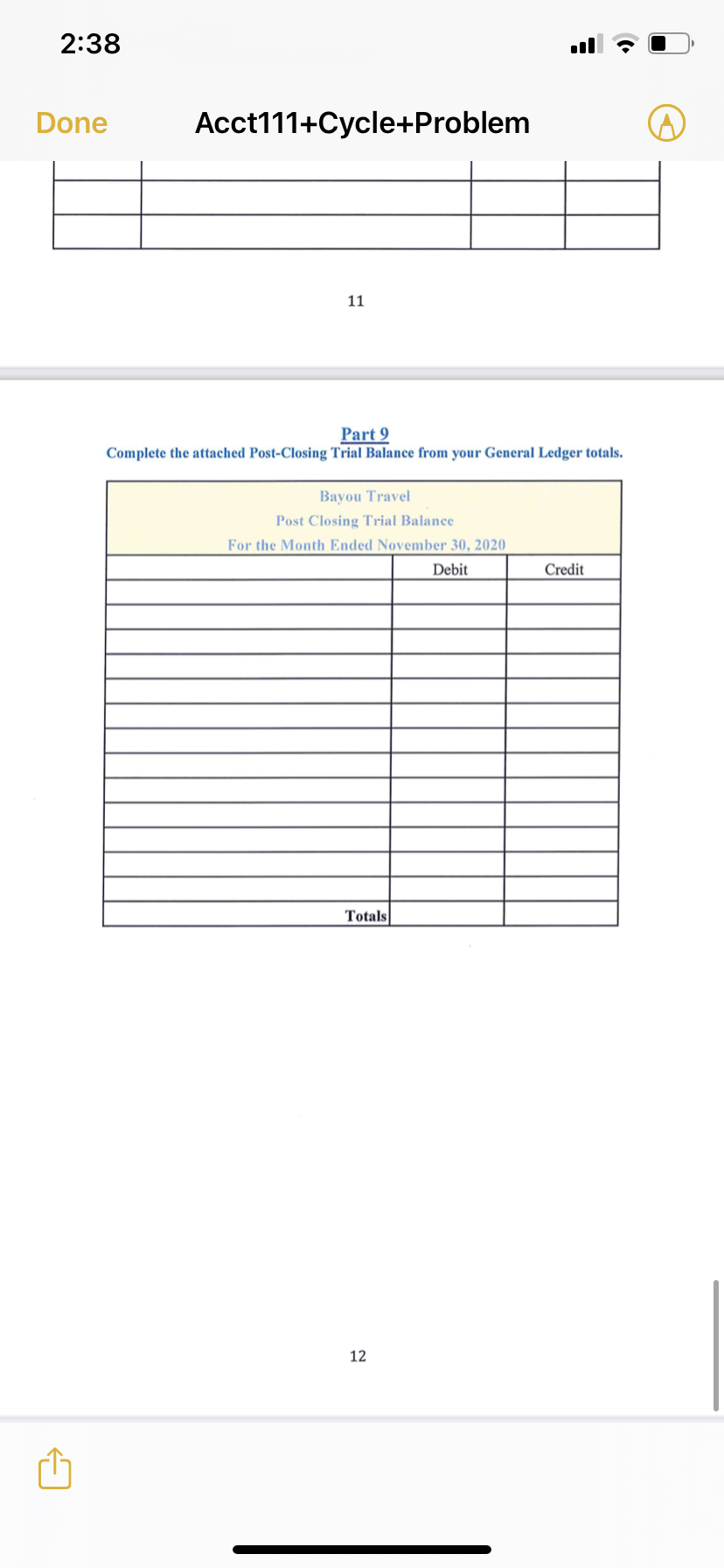

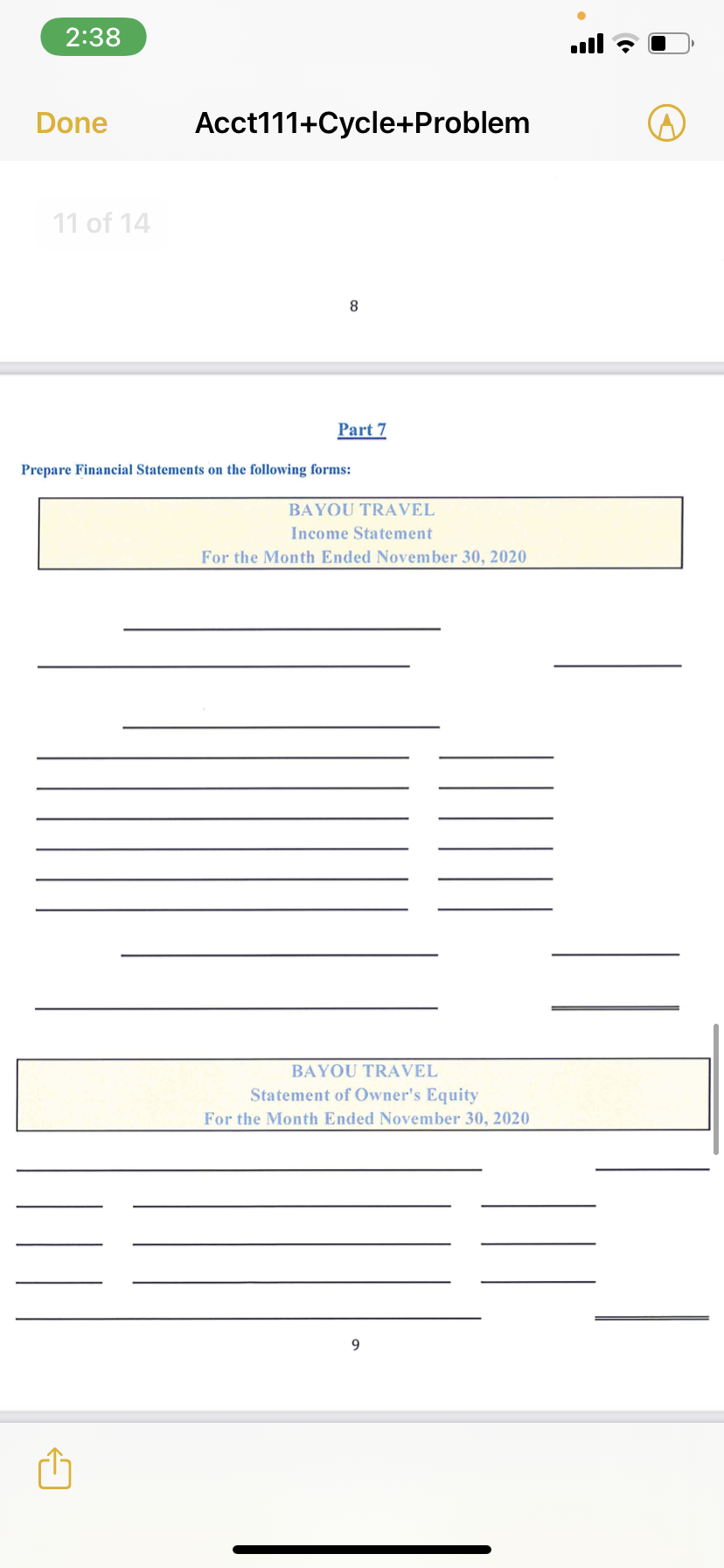

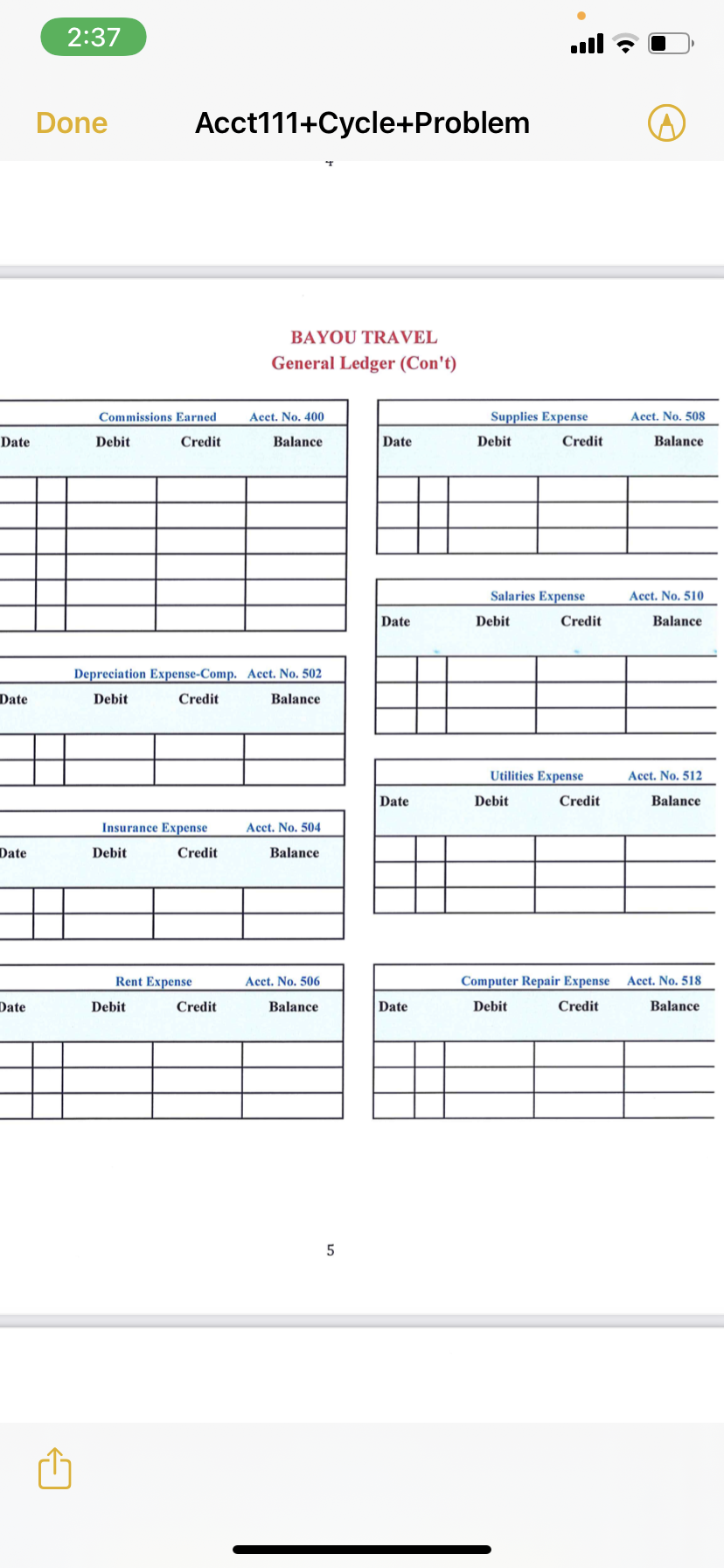

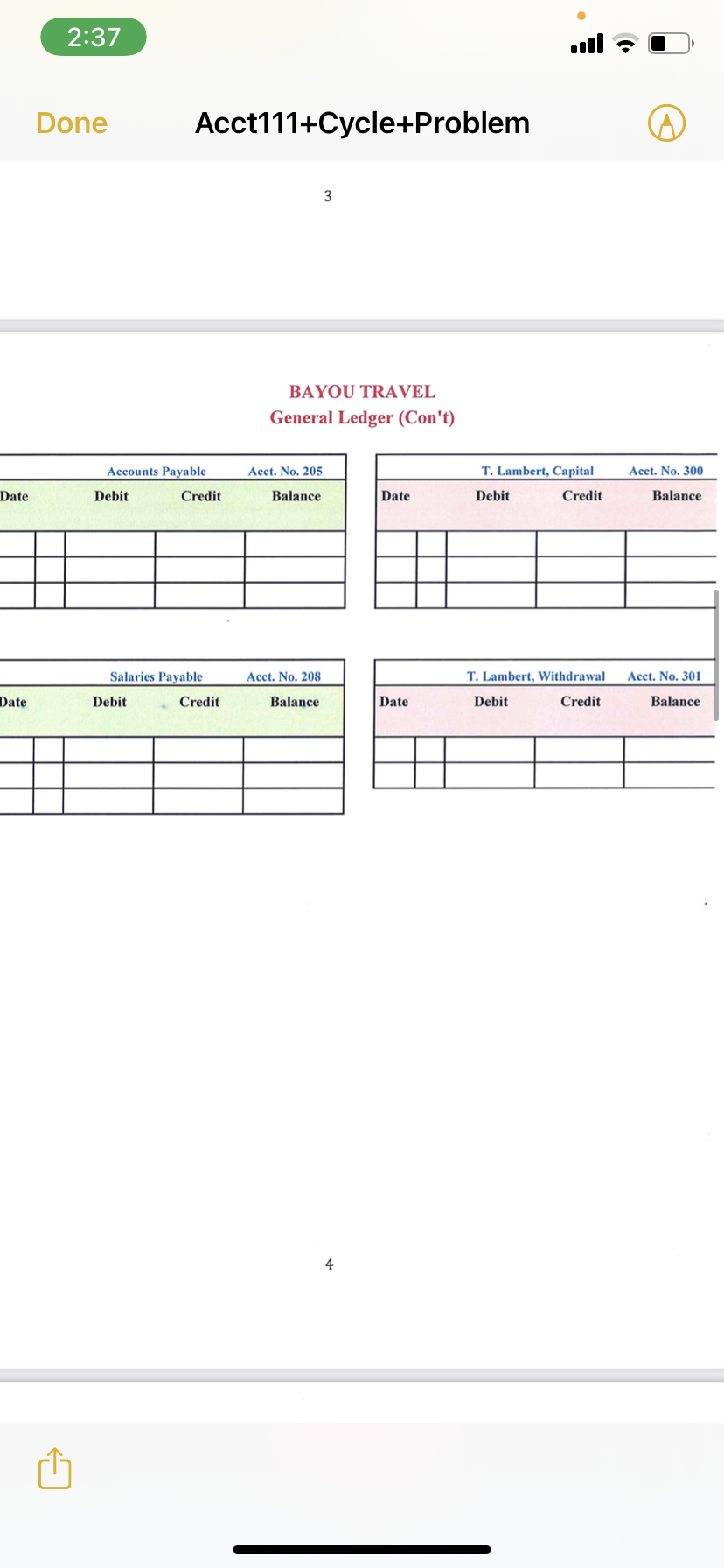

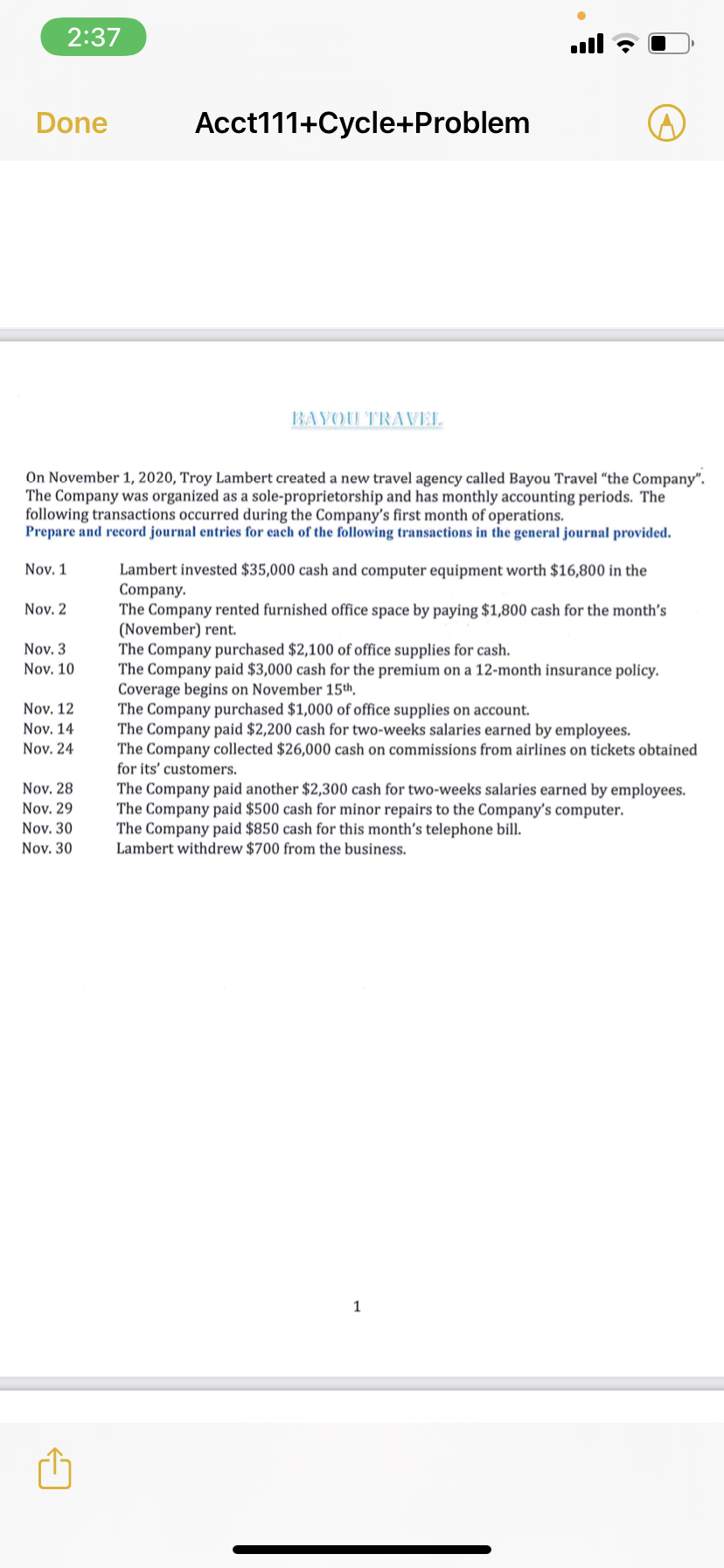

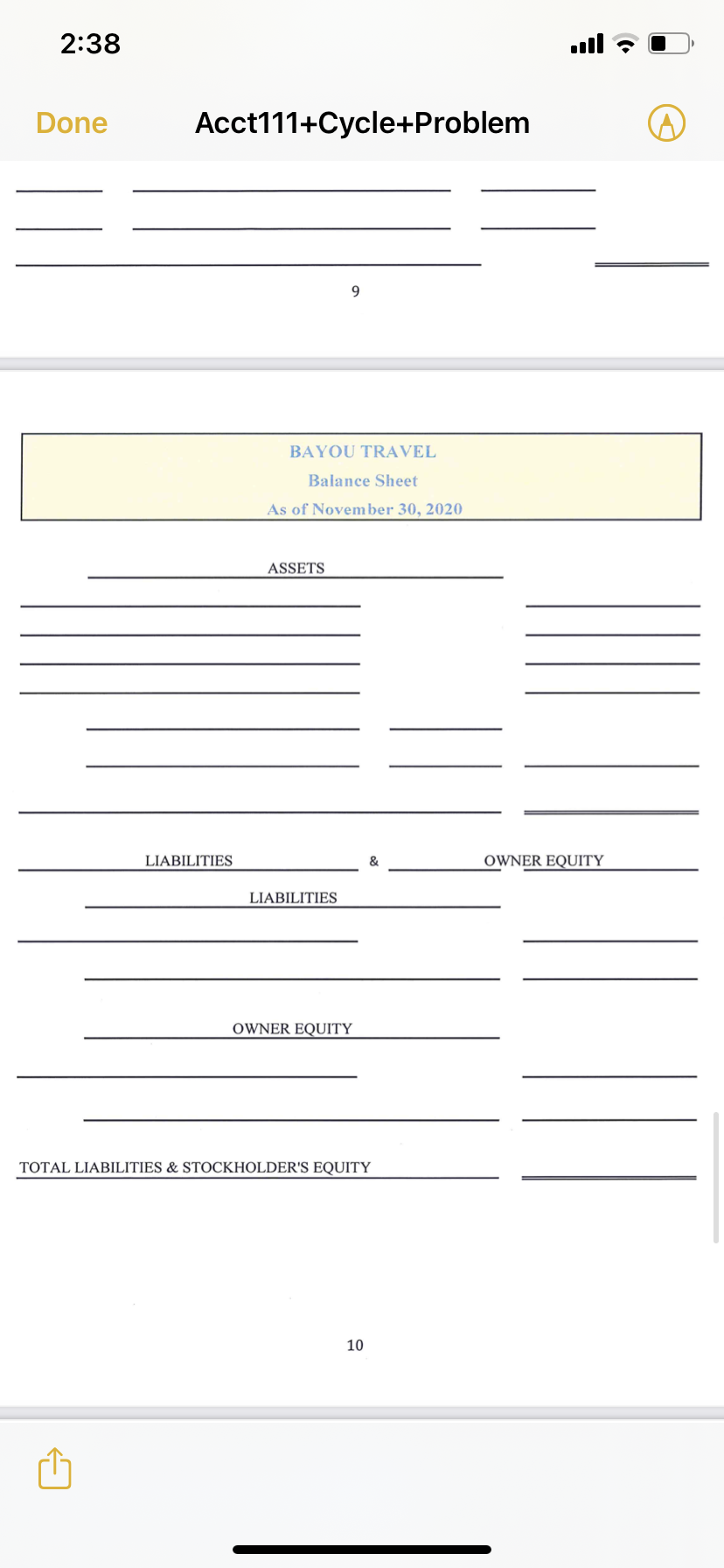

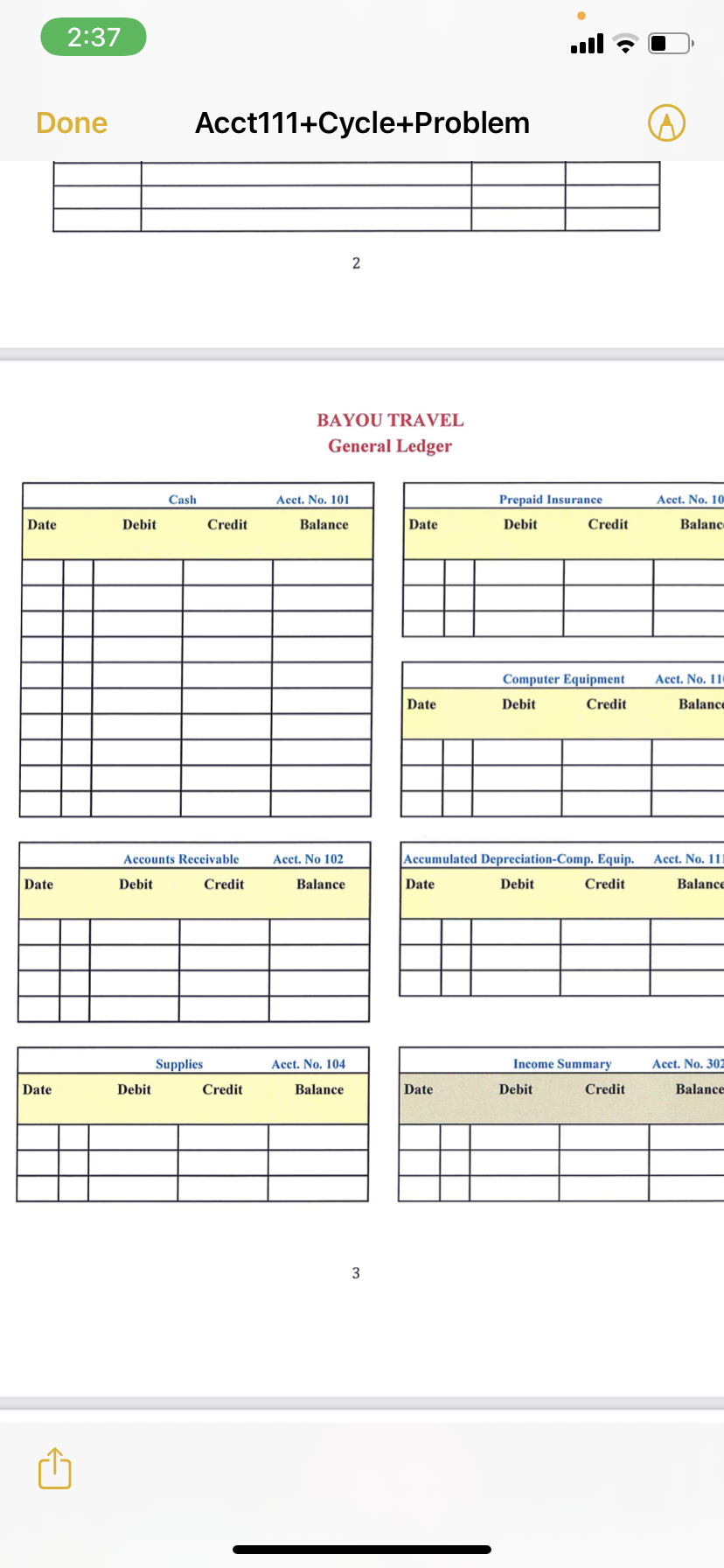

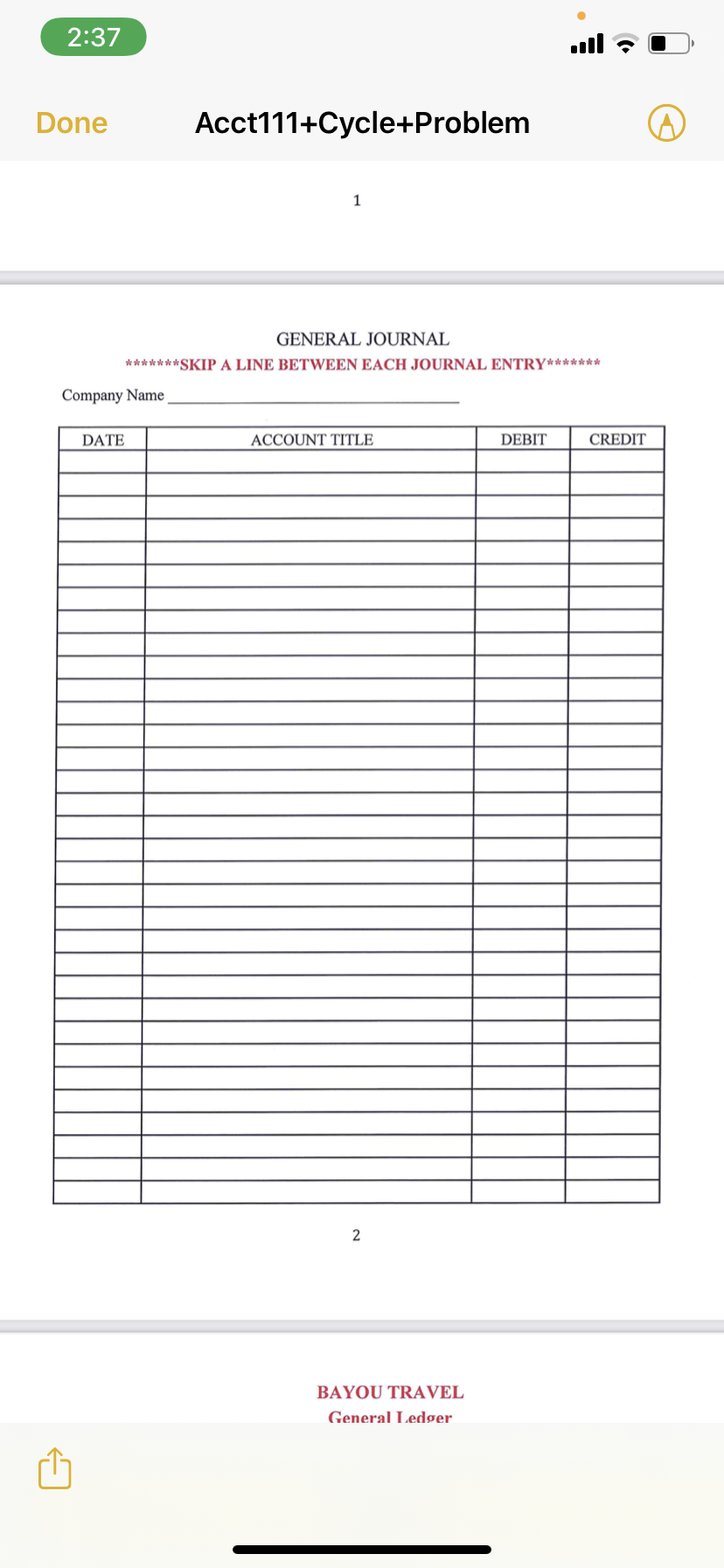

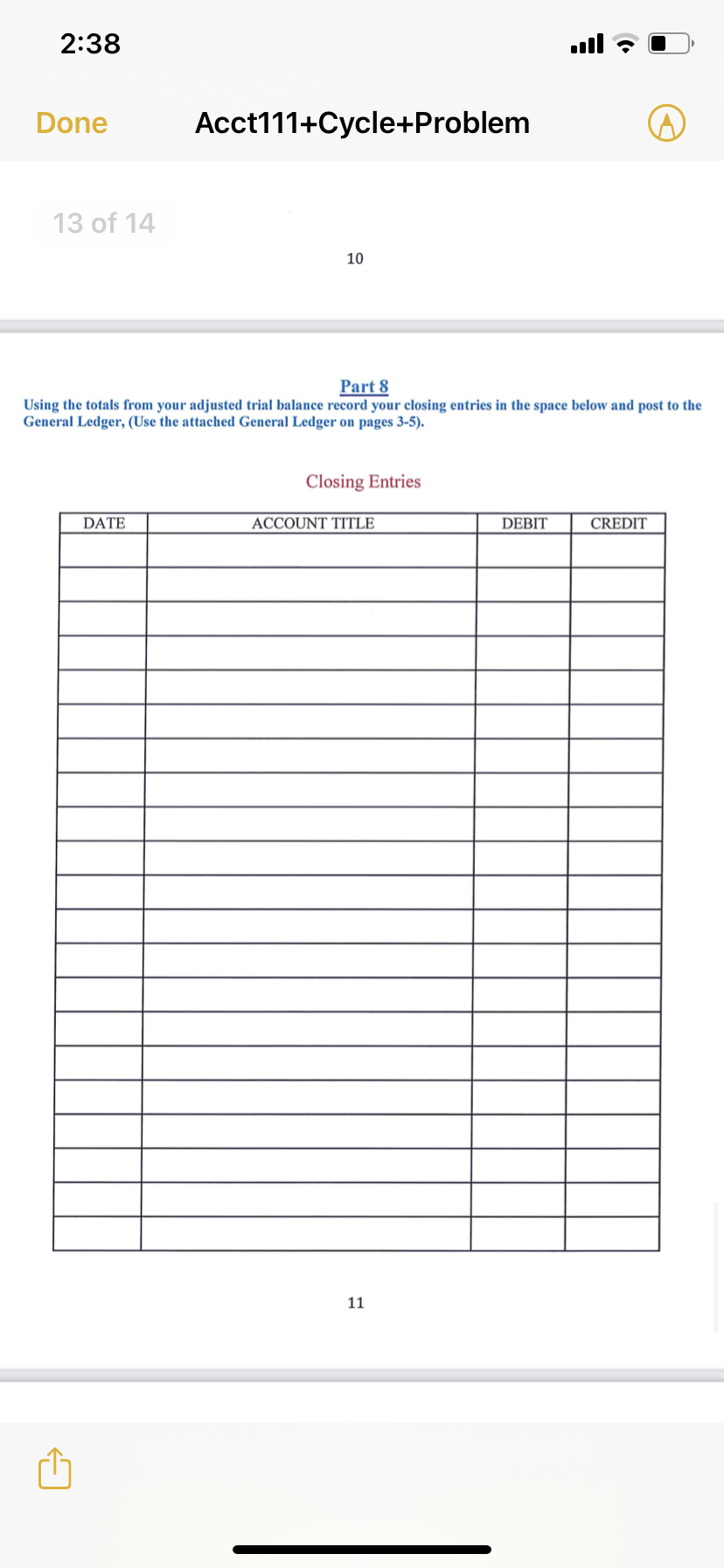

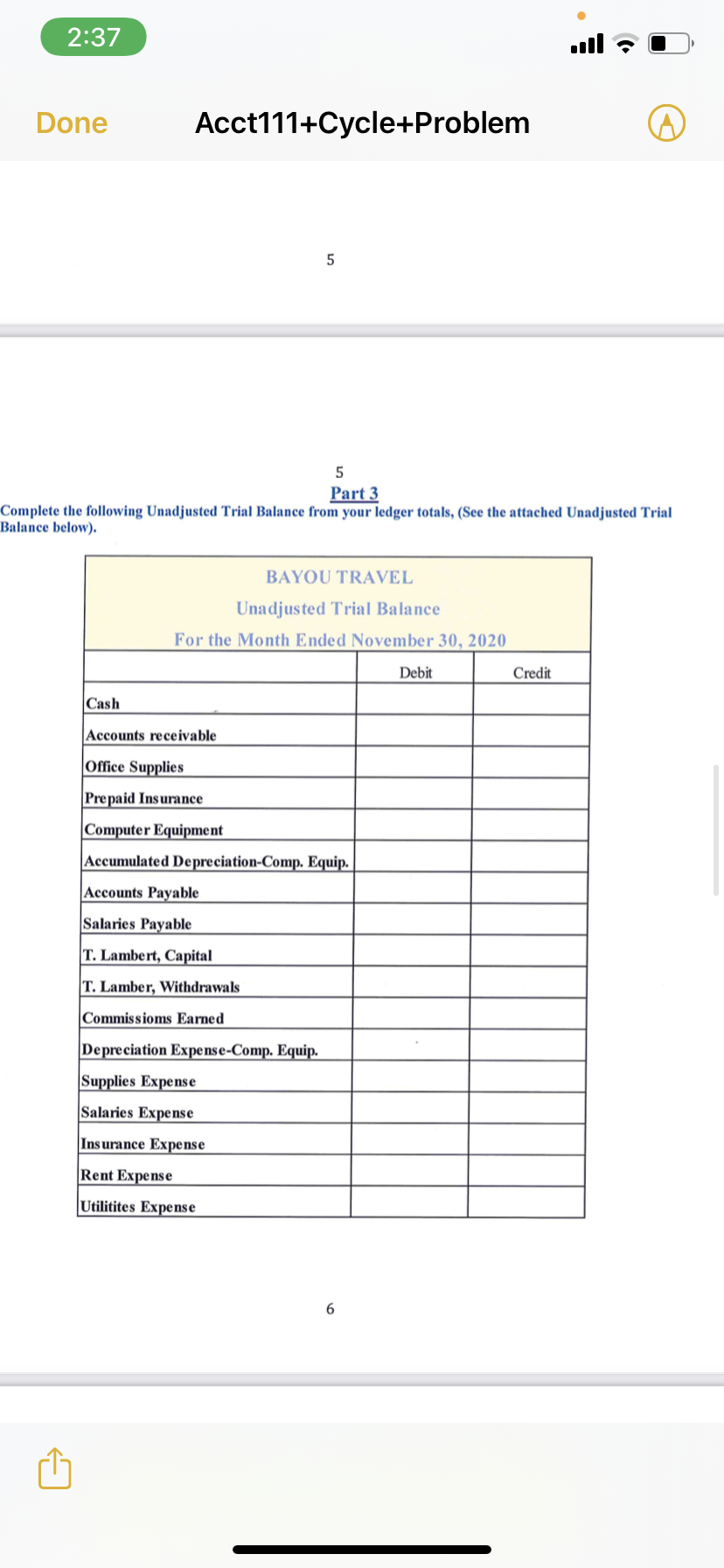

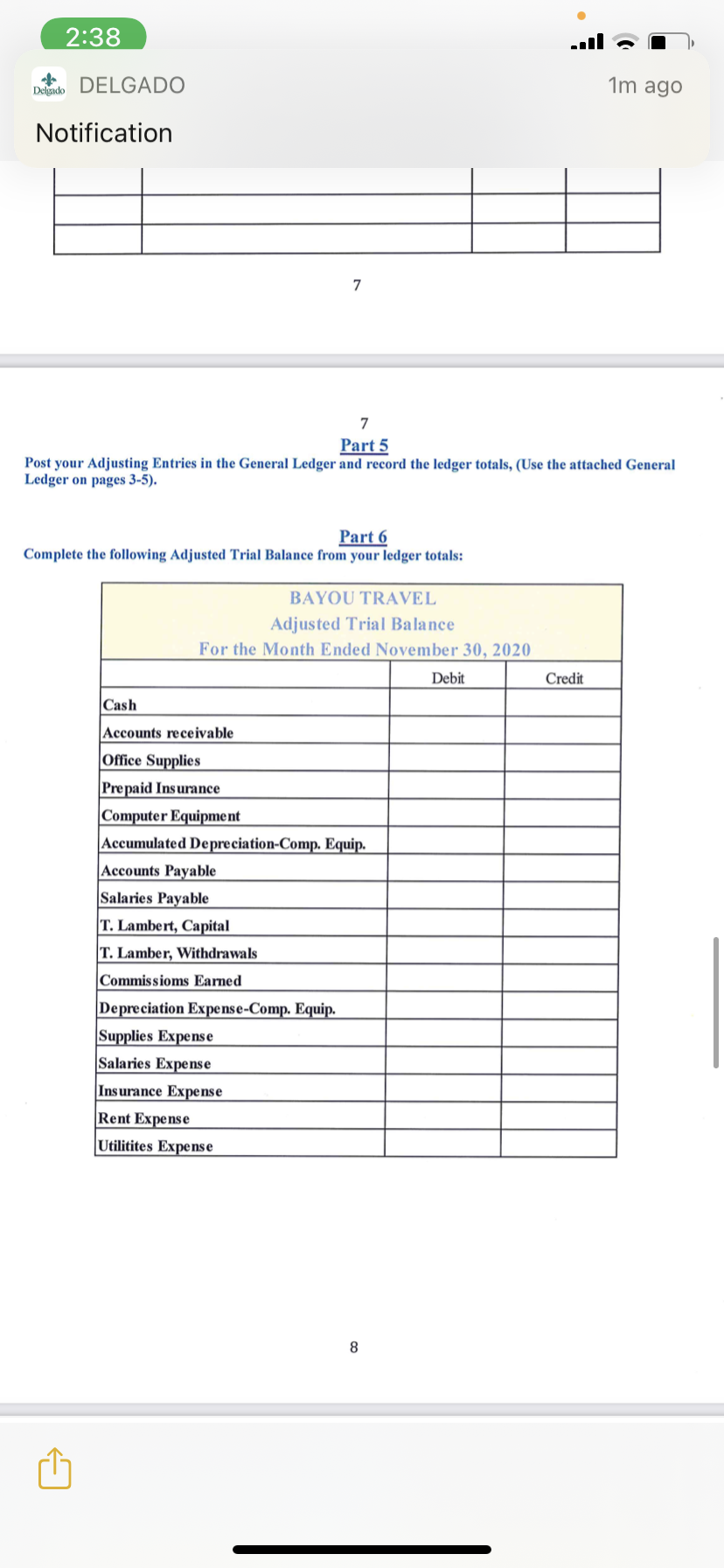

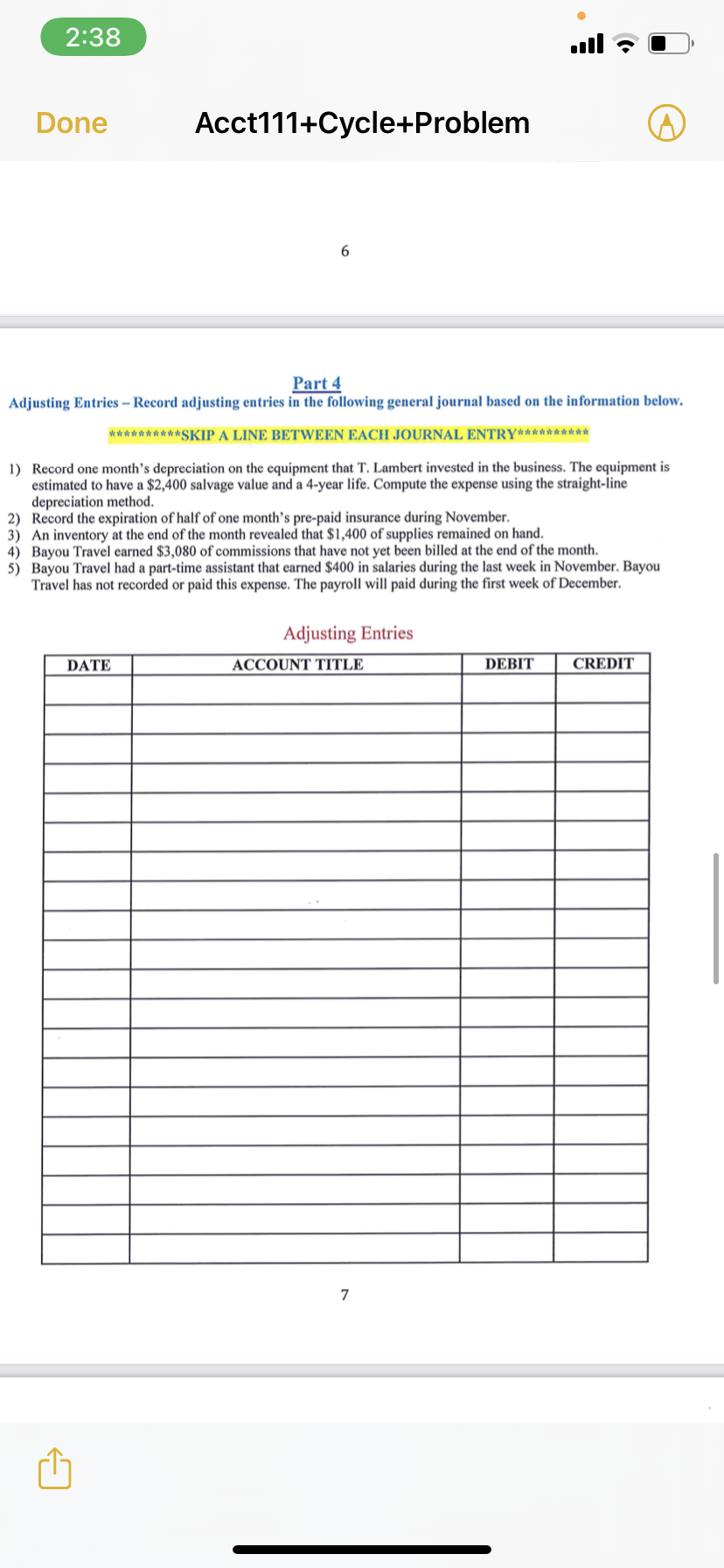

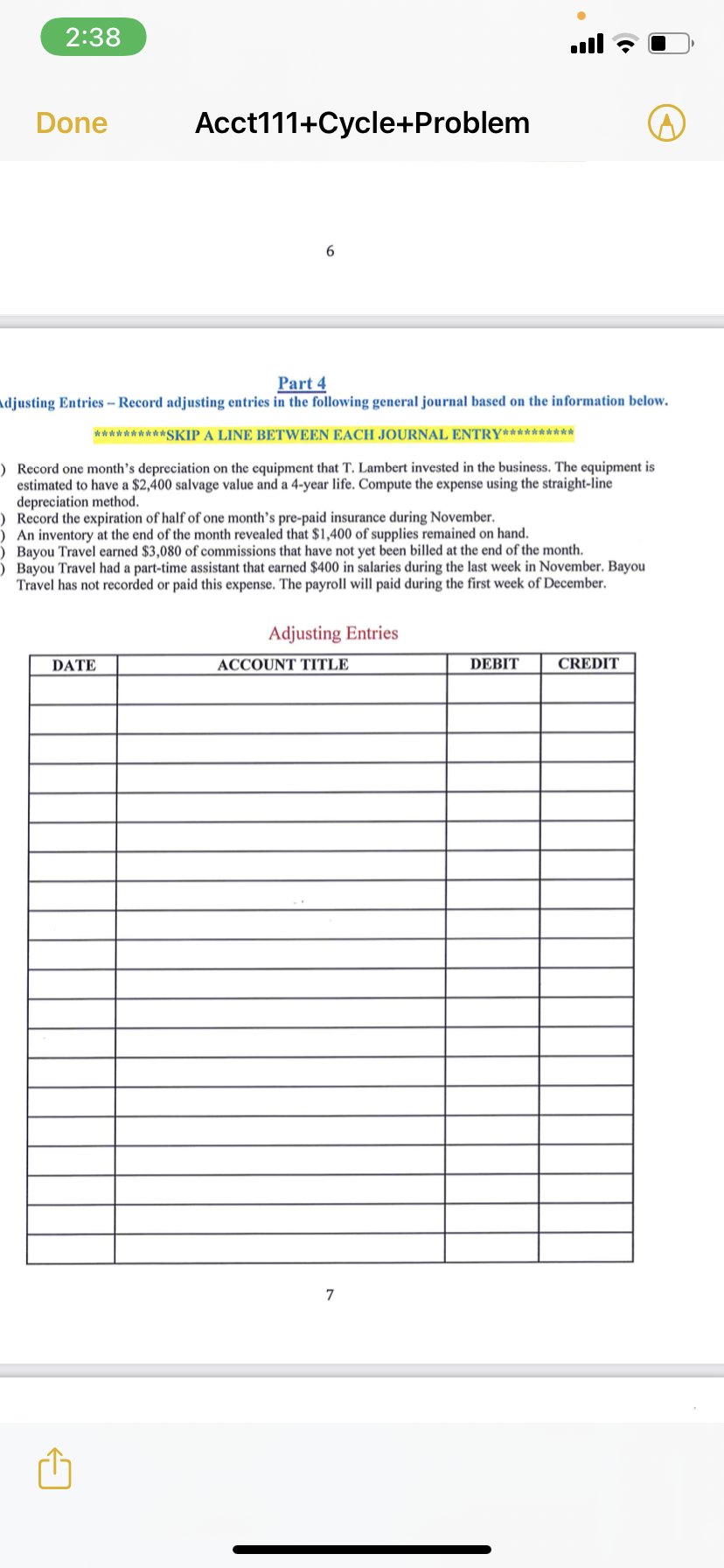

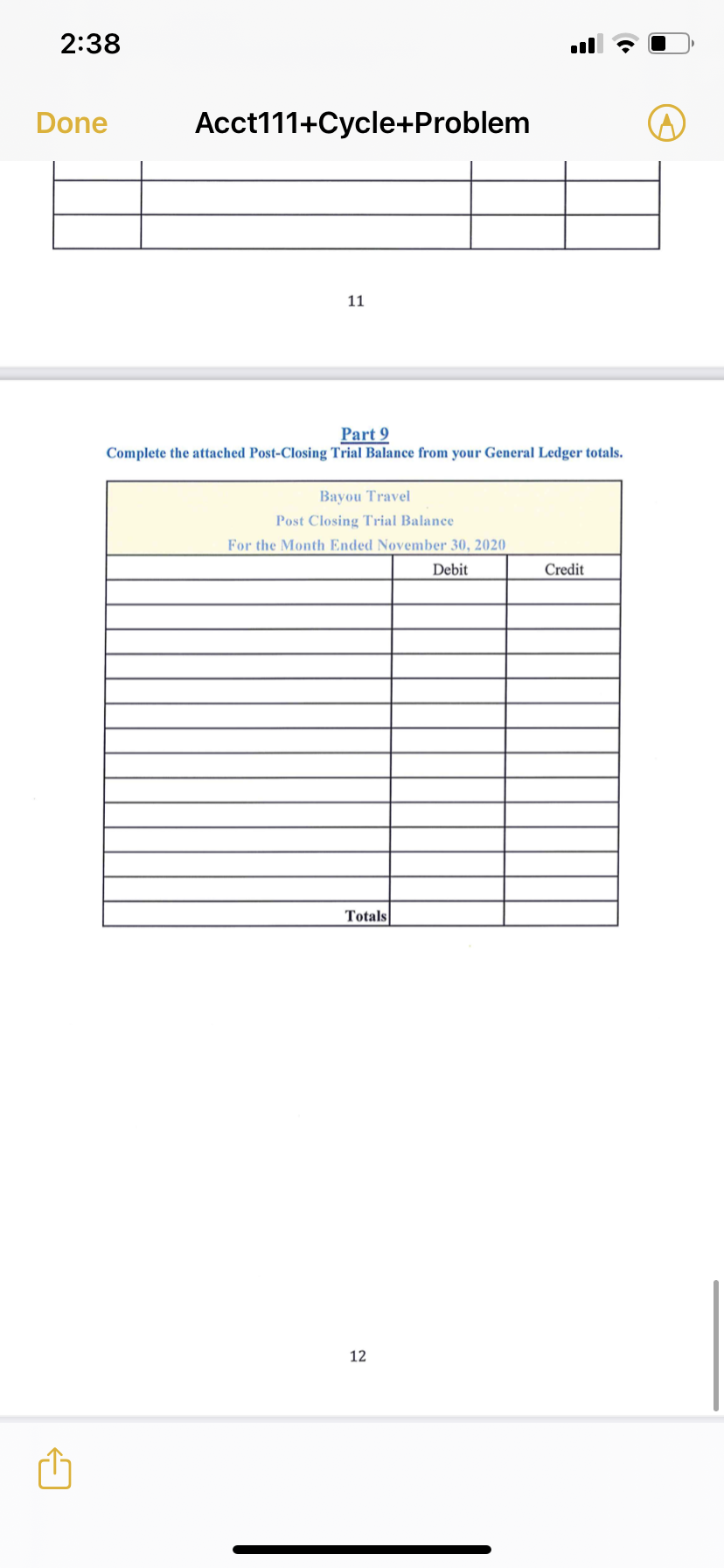

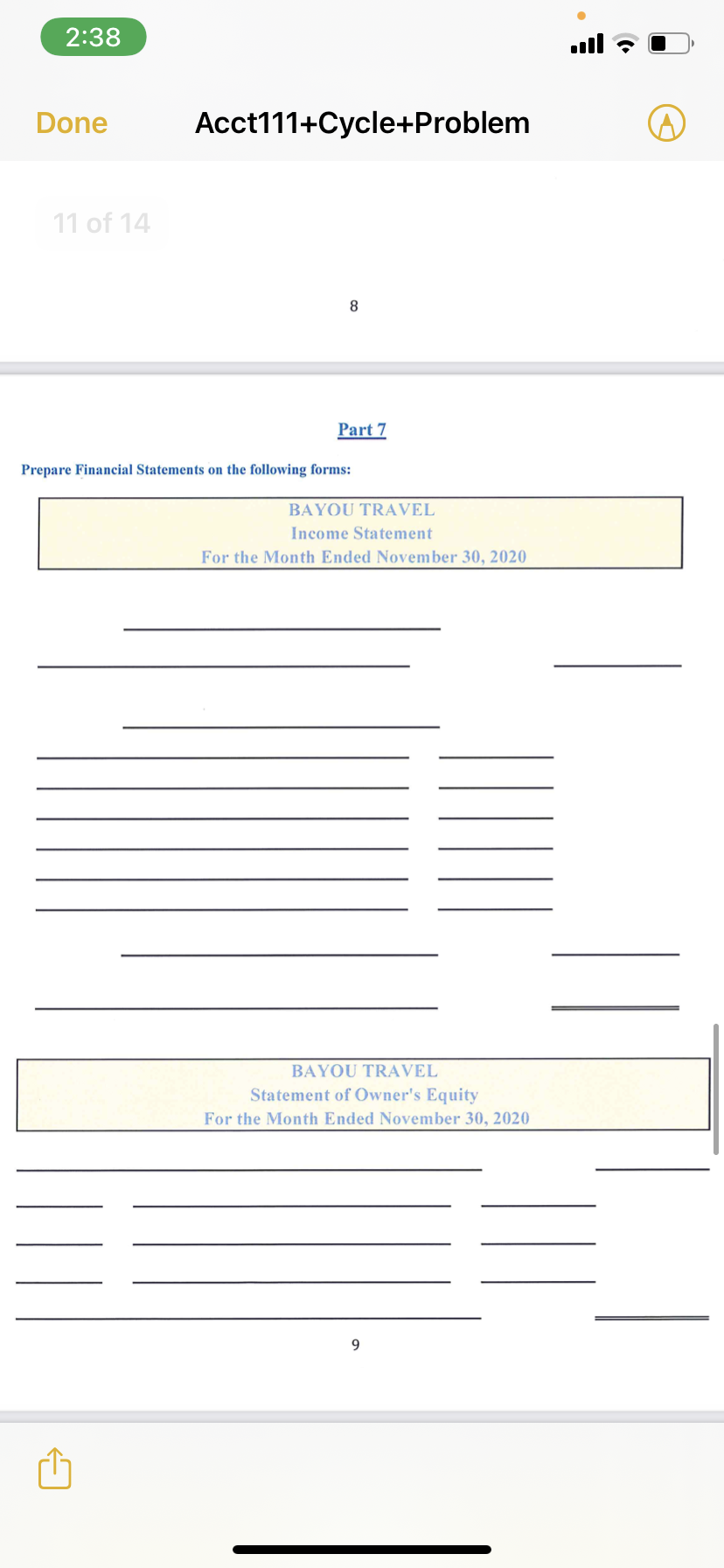

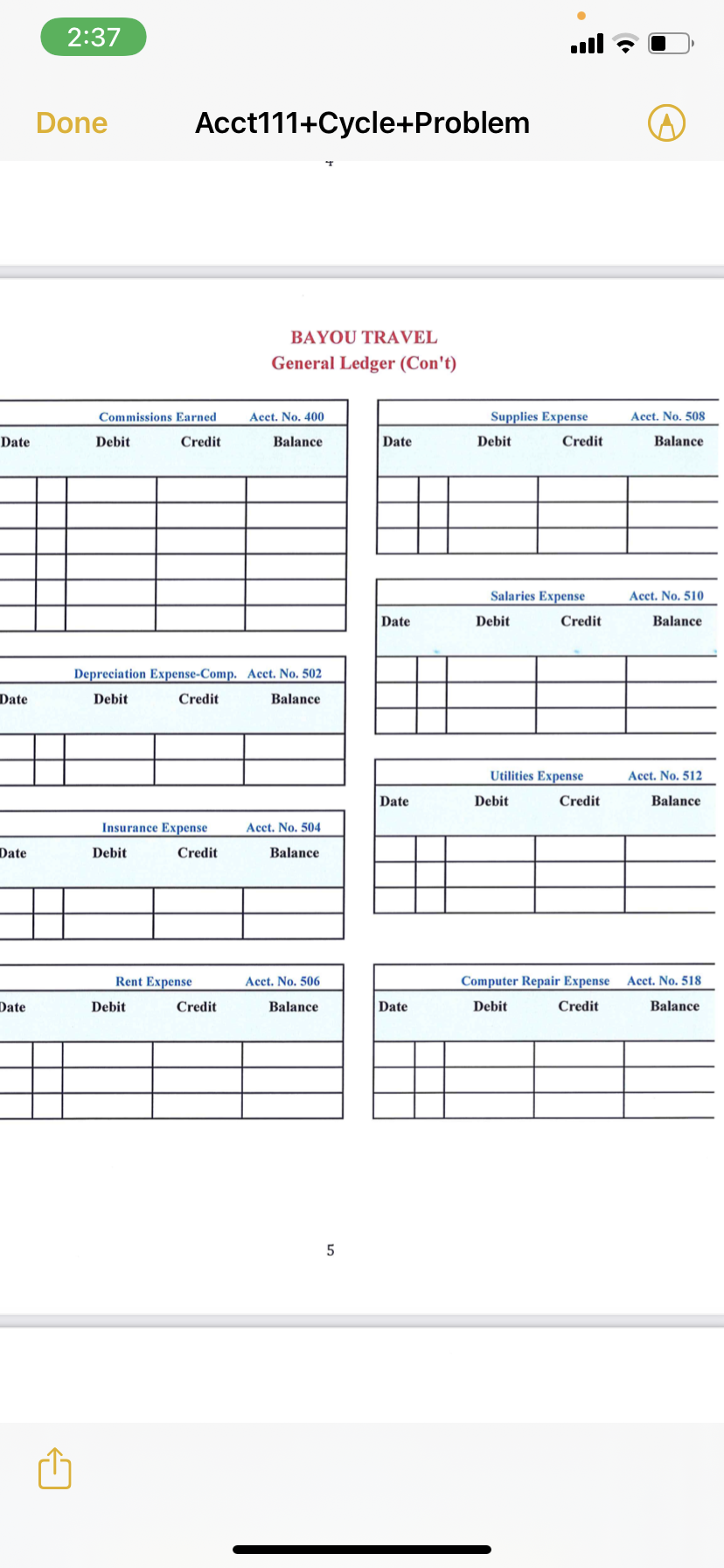

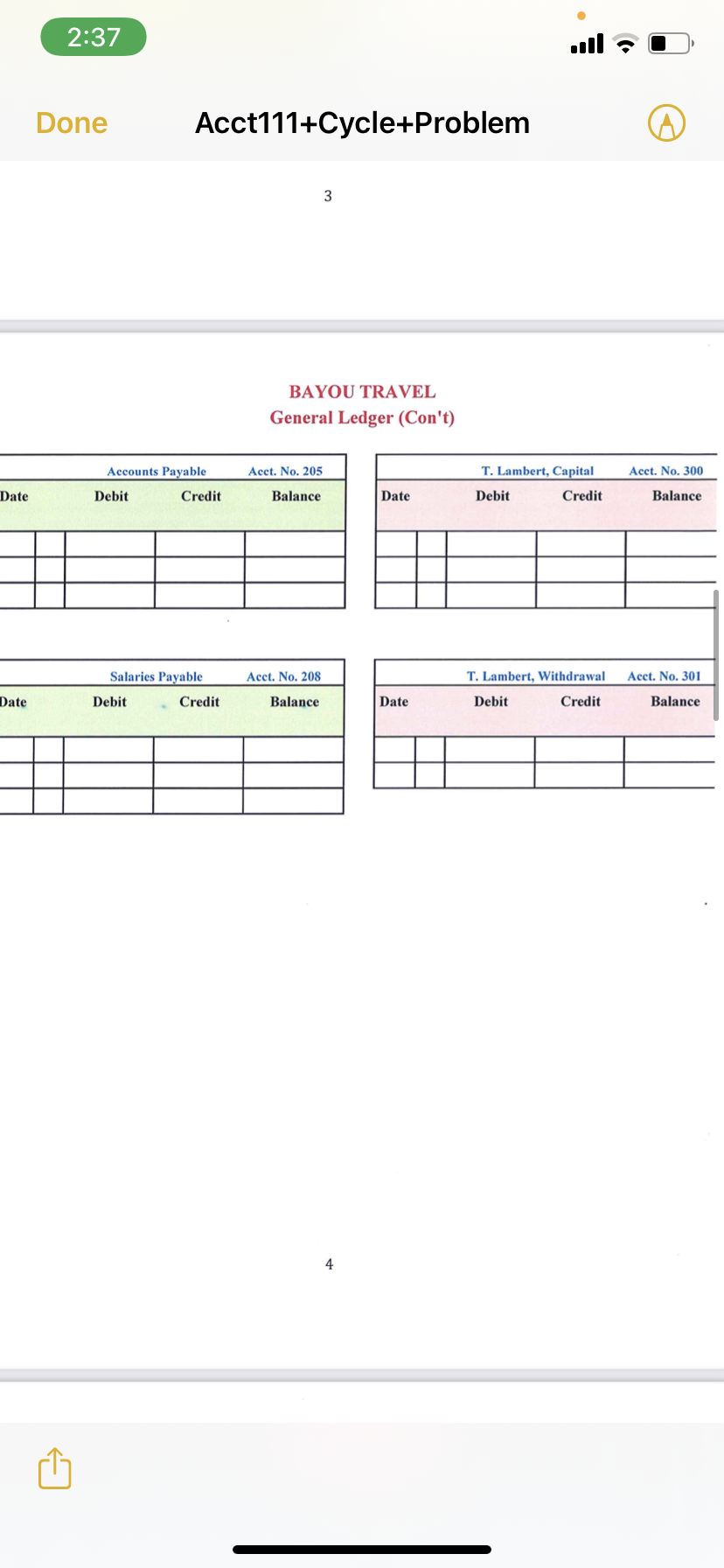

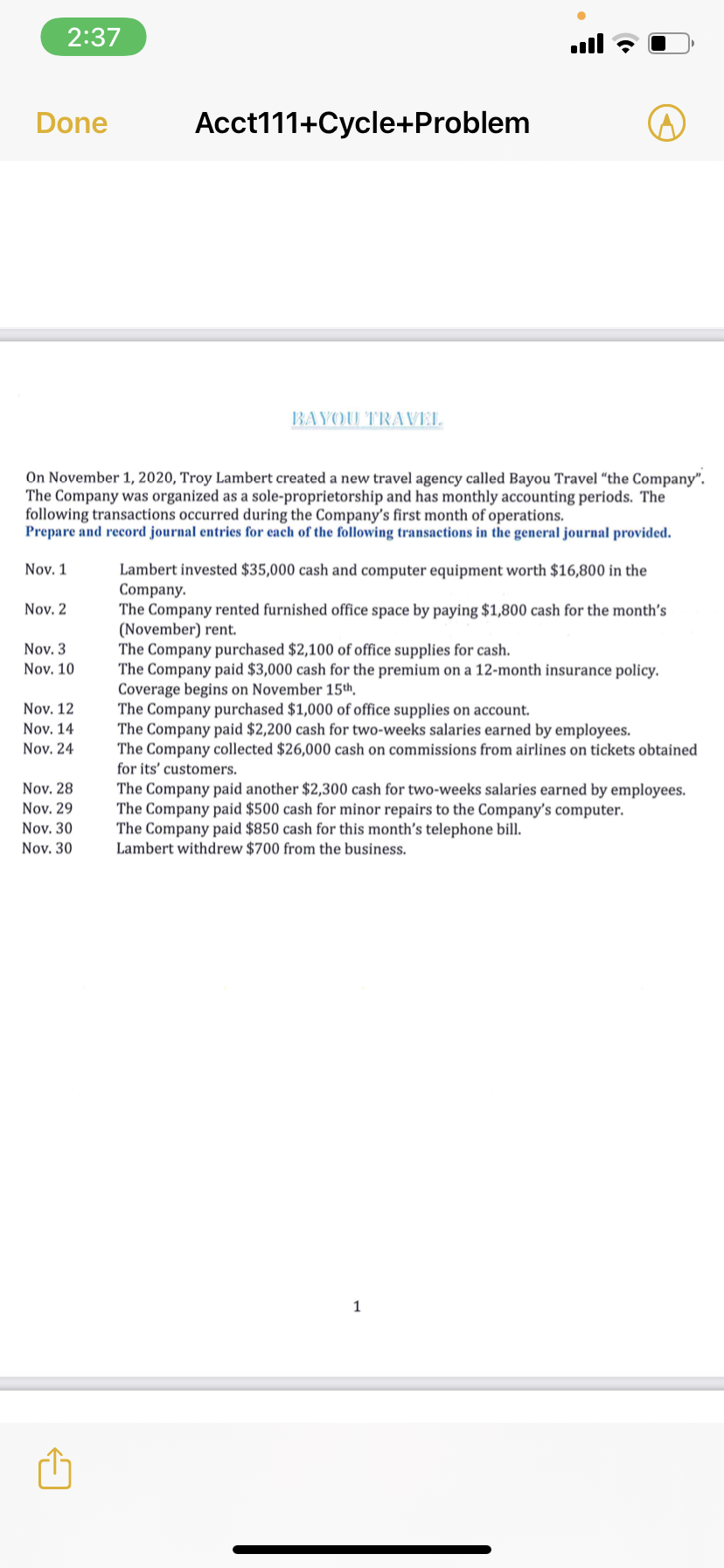

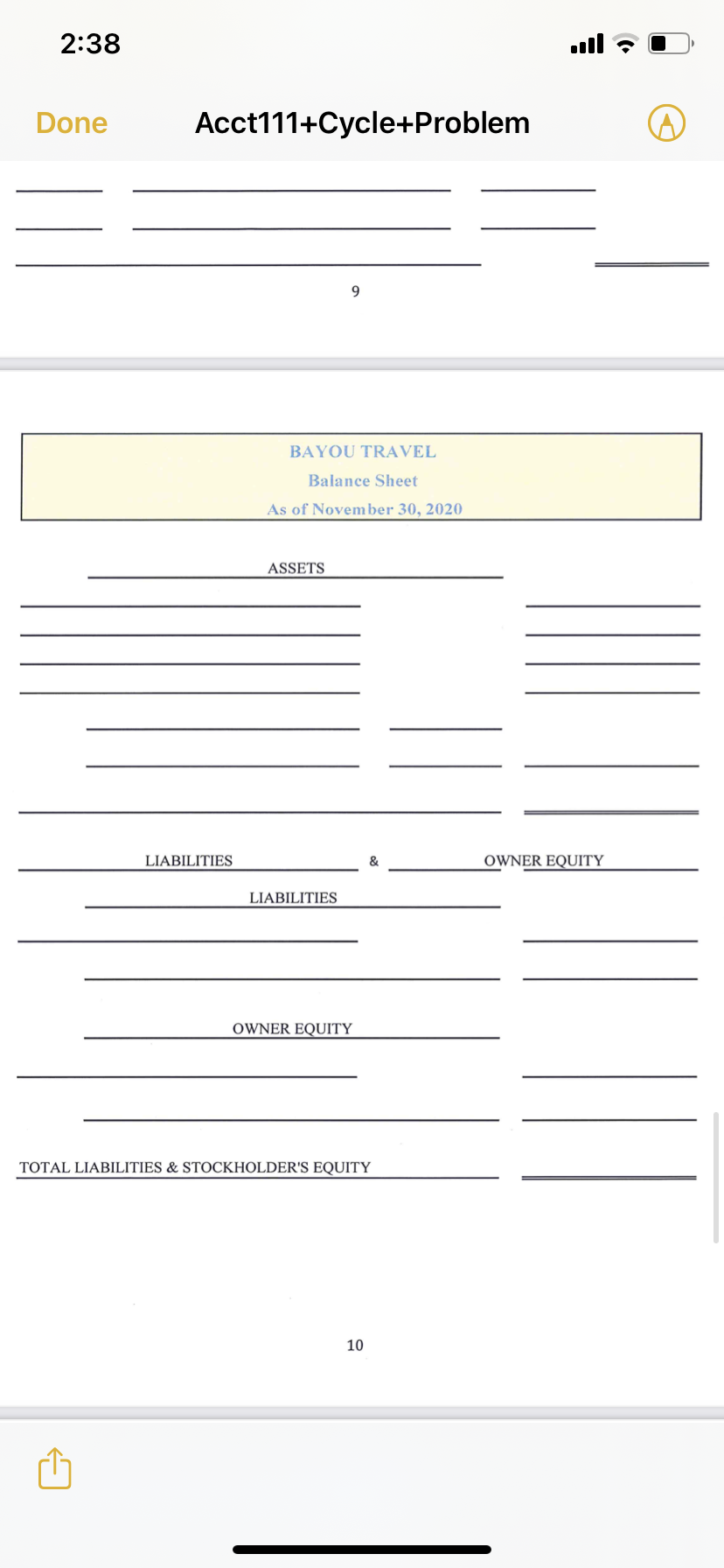

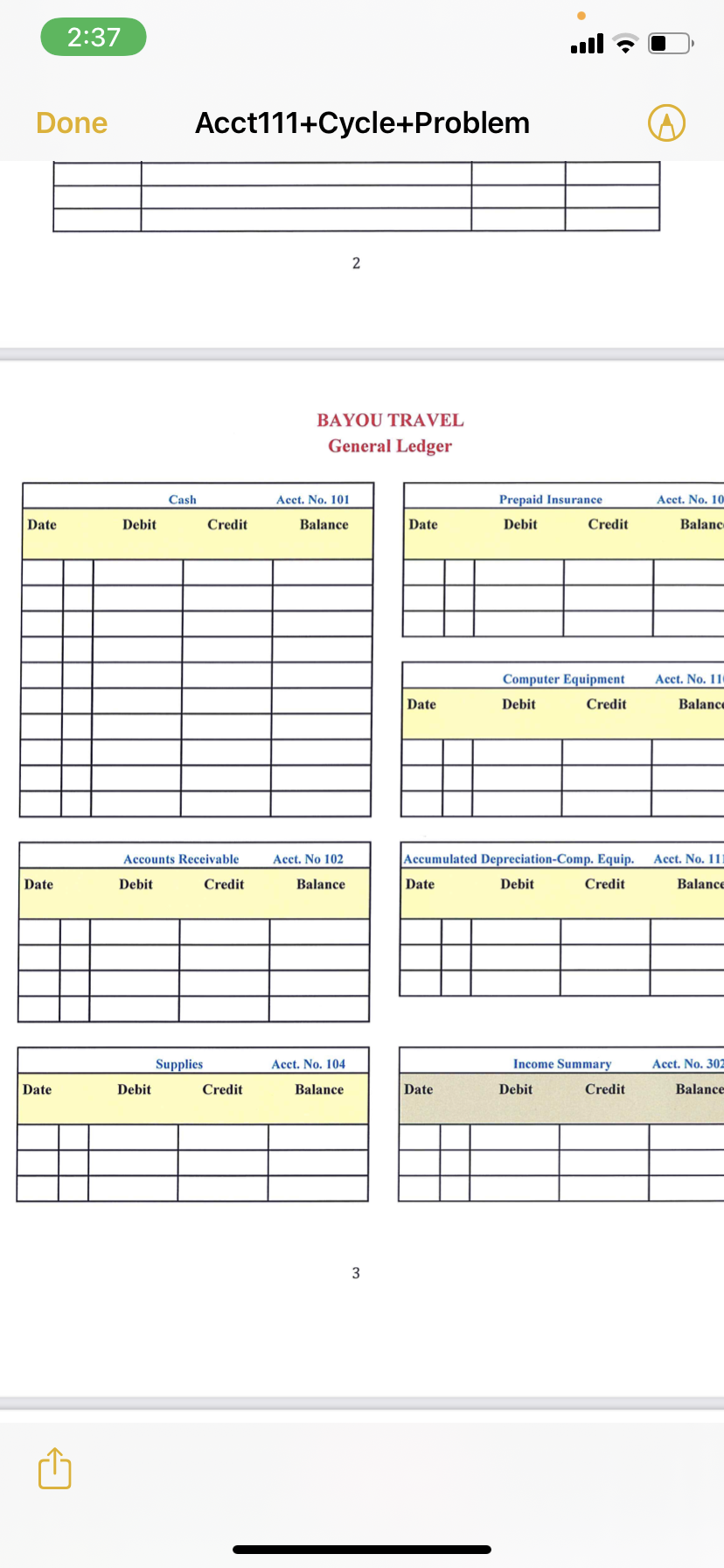

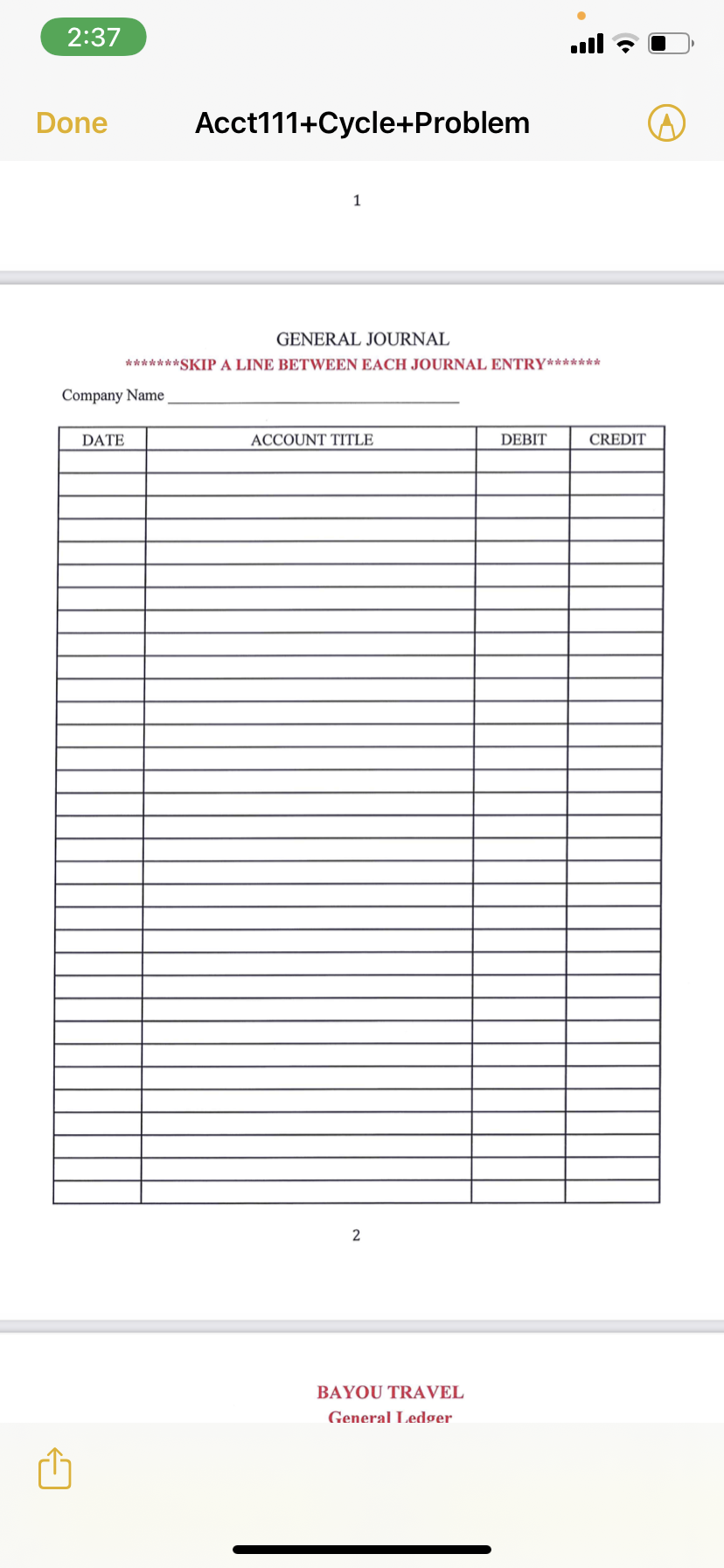

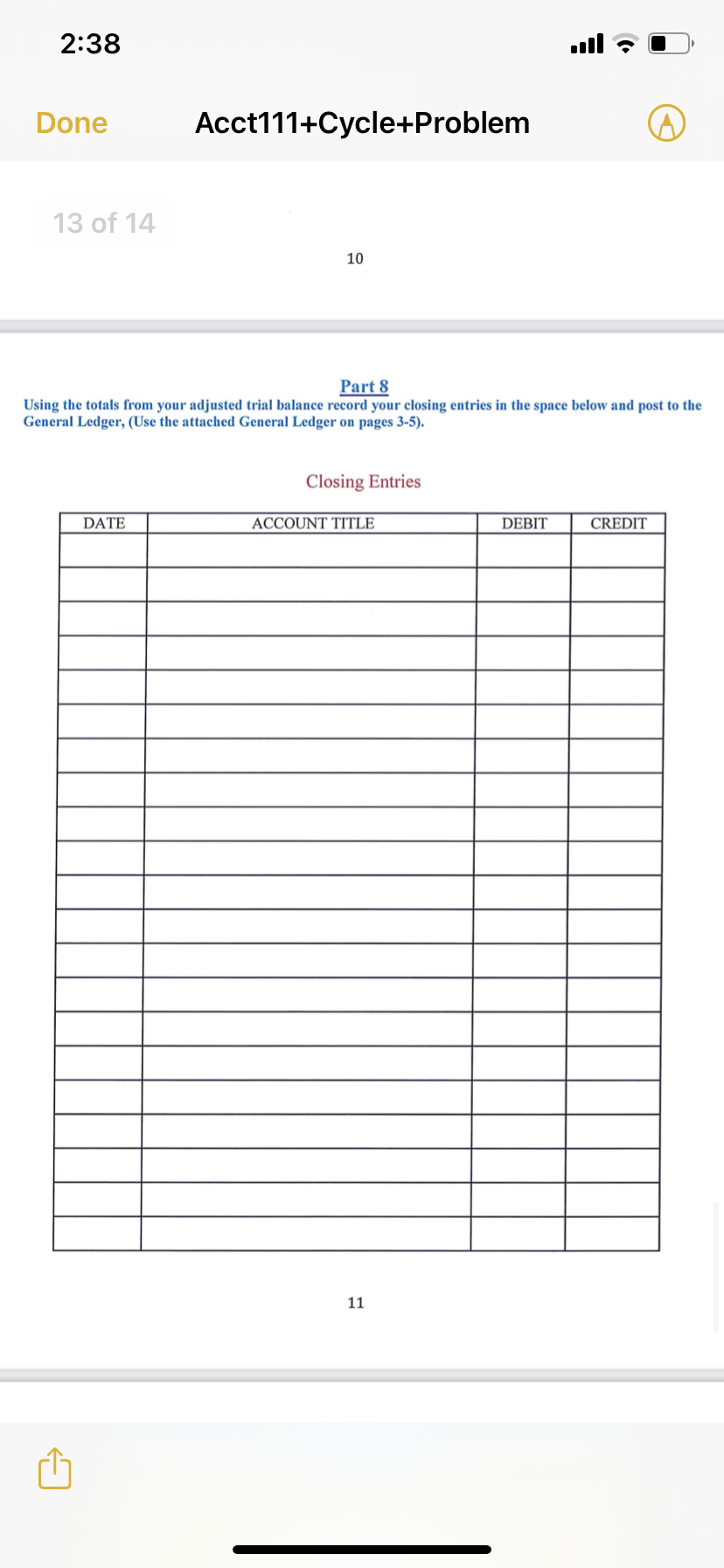

2:37 all - Done Acct111+Cycle+Problem A 5 Part 3 Complete the following Unadjusted Trial Balance from your ledger totals, (See the attached Unadjusted Trial Balance below). BAYOU TRAVEL Unadjusted Trial Balance For the Month Ended November 30, 2020 Debit Credit Cash Accounts receivable Office Supplies Prepaid Insurance Computer Equipment Accumulated Depreciation-Comp. Equip. Accounts Payable Salaries Payable T. Lambert, Capital T. Lamber, Withdrawals Commissions Earned Depreciation Expense-Comp. Equip. Supplies Expense Salaries Expense Insurance Expense Rent Expense Utilitites Expense 62:38 Delgado DELGADO 1m ago Notification 7 7 Part 5 Post your Adjusting Entries in the General Ledger and record the ledger totals, (Use the attached General Ledger on pages 3-5). Part 6 Complete the following Adjusted Trial Balance from your ledger totals: BAYOU TRAVEL Adjusted Trial Balance For the Month Ended November 30, 2020 Debit Credit Cash Accounts receivable Office Supplies Prepaid Insurance Computer Equipment Accumulated Depreciation-Comp. Equip. Accounts Payable Salaries Payable T. Lambert, Capital T. Lamber, Withdrawals Commissions Earned Depreciation Expense-Comp. Equip. Supplies Expense Salaries Expense Insurance Expense Rent Expense Utilitites Expense2:38 all - Done Acct111+Cycle+Problem A Part 4 Adjusting Entries - Record adjusting entries in the following general journal based on the information below. "wwwww* *#*SKIP A LINE BETWEEN EACH JOURNAL ENTRY * *#*# 1) Record one month's depreciation on the equipment that T. Lambert invested in the business. The equipment is estimated to have a $2,400 salvage value and a 4-year life. Compute the expense using the straight-line depreciation method. 2) Record the expiration of half of one month's pre-paid insurance during November. An inventory at the end of the month revealed that $1,400 of supplies remained on hand. 4) Bayou Travel earned $3,080 of commissions that have not yet been billed at the end of the month. 5) Bayou Travel had a part-time assistant that earned $400 in salaries during the last week in November. Bayou Travel has not recorded or paid this expense. The payroll will paid during the first week of December. Adjusting Entries DATE ACCOUNT TITLE DEBIT CREDIT V2:38 all - Done Acct111+Cycle+Problem A 6 Part 4 djusting Entries - Record adjusting entries in the following general journal based on the information below. * *#*SKIP A LINE BETWEEN EACH JOURNAL ENTRY* * Record one month's depreciation on the equipment that T. Lambert invested in the business. The equipment is estimated to have a $2,400 salvage value and a 4-year life. Compute the expense using the straight-line depreciation method. Record the expiration of half of one month's pre-paid insurance during November. An inventory at the end of the month revealed that $1,400 of supplies remained on hand. Bayou Travel earned $3,080 of commissions that have not yet been billed at the end of the month. Bayou Travel had a part-time assistant that earned $400 in salaries during the last week in November. Bayou Travel has not recorded or paid this expense. The payroll will paid during the first week of December. Adjusting Entries DATE ACCOUNT TITLE DEBIT CREDIT2:38 Done Acct111+Cycle+Problem 11 Part 9 Complete the attached Post-Closing Trial Balance from your General Ledger totals. Bayou Travel Post Closing Trial Balance For the Month Ended November 30, 2020 Debit Credit Totals 122:38 all - Done Acct111+Cycle+Problem A 11 of 14 8 Part 7 Prepare Financial Statements on the following forms: BAYOU TRAVEL Income Statement For the Month Ended November 30, 2020 BAYOU TRAVEL Statement of Owner's Equity For the Month Ended November 30, 2020 92:37 all - Done Acct111+Cycle+Problem A BAYOU TRAVEL General Ledger (Con't) Commissions Earned Acct. No. 400 Supplies Expense Acct. No. 508 Date Balance Date Debit Credit Balance Salaries Expense Acct. No. 510 Date Debit Credit Balance Depreciation Expense-Comp. Acct. No. 502 Date Debit Credit Balance Utilities Expense Acct. No. 512 Date Debit Credit Balance Insurance Expense Acct. No. 504 Date Debit Credit Balance Rent Expense Acct. No. 506 Computer Repair Expense Acct. No. 518 Date Debit Credit Balance Date Debit Credit Balance 52:37 II" *3? [1' Done Acct111+Cycle+Problem BAYOU TRAVEL General Ledger (Can't) Account! Pa able Acct. Nu. 205 T. lebe, Ca In: Aocl. No. 300 Balance Salaries Pa able Acct. No. 208 2:37 all - Done Acct111+Cycle+Problem A BAYOU TRAVEL On November 1, 2020, Troy Lambert created a new travel agency called Bayou Travel "the Company". The Company was organized as a sole-proprietorship and has monthly accounting periods. The following transactions occurred during the Company's first month of operations. Prepare and record journal entries for each of the following transactions in the general journal provided. Nov. 1 Lambert invested $35,000 cash and computer equipment worth $16,800 in the Company. Nov. 2 The Company rented furnished office space by paying $1,800 cash for the month's (November) rent. Nov. 3 The Company purchased $2,100 of office supplies for cash. Nov. 10 The Company paid $3,000 cash for the premium on a 12-month insurance policy. Coverage begins on November 15th. Nov. 12 The Company purchased $1,000 of office supplies on account. Nov. 14 The Company paid $2,200 cash for two-weeks salaries earned by employees. Nov. 24 The Company collected $26,000 cash on commissions from airlines on tickets obtained for its' customers. Nov. 28 The Company paid another $2,300 cash for two-weeks salaries earned by employees. Nov. 29 The Company paid $500 cash for minor repairs to the Company's computer. Nov. 30 The Company paid $850 cash for this month's telephone bill. Nov. 30 Lambert withdrew $700 from the business. 12:38 Done Acct111+Cycle+Problem A 9 BAYOU TRAVEL Balance Sheet As of November 30, 2020 ASSETS LIABILITIES & OWNER EQUITY LIABILITIES OWNER EQUITY TOTAL LIABILITIES & STOCKHOLDER'S EQUITY 102:37 all - Done Acct111+Cycle+Problem 2 BAYOU TRAVEL General Ledger Cash Acct. No. 101 Prepaid Insurance Acct. No. 10 Date Debit Credit Balance Date Debit Credit Balanc Computer Equipment Acct. No. 1 Date Debit Credit Balanc Accounts Receivable Acct. No 102 Accumulated Depreciation-Comp. Equip. Acct. No. 1 Date Debit Credit Balance Date Debit Credit Balance Supplies Acct. No. 104 Income Summary Acct. No. 30 Date Debit Credit Balance Date Debit Credit Balance 32:37 all - Done Acct111+Cycle+Problem A GENERAL JOURNAL * * * * * * * SKIP A LINE BETWEEN EACH JOURNAL ENTRY * * * * * * Company Name DATE ACCOUNT TITLE DEBIT CREDIT 2 BAYOU TRAVEL General Ledger238 .III '3' [1' Done Acct111+Cycle+Problem 10 Part 8 Using the totals from your adjusted trial balance retard your closing entries in the space below and post to the General Ledger. (Use the attached General Ledger on pages 3-5). Closing Entries DATE ACCOUNT TITLE CREDIT