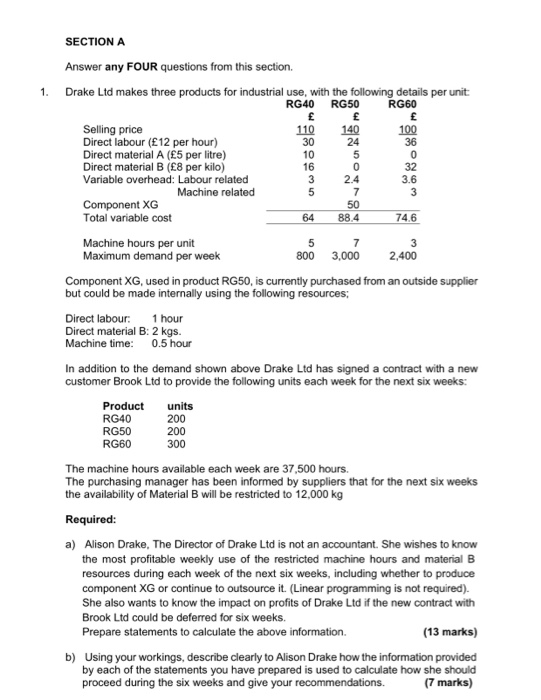

24 30 10 16 3 2.4 3 SECTION A Answer any FOUR questions from this section 1. Drake Ltd makes three products for industrial use, with the following details per unit: RG40 RG50 RG60 Selling price 110 140 100 Direct labour (12 per hour) 36 Direct material A (5 per litre) 0 Direct material B (8 per kilo) 32 Variable overhead: Labour related 3.6 Machine related 5 7 Component XG 50 Total variable cost 64 88.4 74.6 Machine hours per unit 5 7 3 Maximum demand per week 800 3,000 2,400 Component XG, used in product RG50, is currently purchased from an outside supplier but could be made internally using the following resources; Direct labour 1 hour Direct material B: 2 kgs. Machine time: 0.5 hour In addition to the demand shown above Drake Ltd has signed a contract with a new customer Brook Ltd to provide the following units each week for the next six weeks: Product units RG40 200 RG50 200 RG60 300 The machine hours available each week are 37,500 hours. The purchasing manager has been informed by suppliers that for the next six weeks the availability of Material B will be restricted to 12,000 kg Required: a) Alison Drake, The Director of Drake Ltd is not an accountant. She wishes to know the most profitable weekly use of the restricted machine hours and material B resources during each week of the next six weeks, including whether to produce component XG or continue to outsource it. (Linear programming is not required). She also wants to know the impact on profits of Drake Ltd if the new contract with Brook Ltd could be deferred for six weeks. Prepare statements to calculate the above information. (13 marks) b) Using your workings, describe clearly to Alison Drake how the information provided by each of the statements you have prepared is used to calculate how she should proceed during the six weeks and give your recommendations. (7 marks) 24 30 10 16 3 2.4 3 SECTION A Answer any FOUR questions from this section 1. Drake Ltd makes three products for industrial use, with the following details per unit: RG40 RG50 RG60 Selling price 110 140 100 Direct labour (12 per hour) 36 Direct material A (5 per litre) 0 Direct material B (8 per kilo) 32 Variable overhead: Labour related 3.6 Machine related 5 7 Component XG 50 Total variable cost 64 88.4 74.6 Machine hours per unit 5 7 3 Maximum demand per week 800 3,000 2,400 Component XG, used in product RG50, is currently purchased from an outside supplier but could be made internally using the following resources; Direct labour 1 hour Direct material B: 2 kgs. Machine time: 0.5 hour In addition to the demand shown above Drake Ltd has signed a contract with a new customer Brook Ltd to provide the following units each week for the next six weeks: Product units RG40 200 RG50 200 RG60 300 The machine hours available each week are 37,500 hours. The purchasing manager has been informed by suppliers that for the next six weeks the availability of Material B will be restricted to 12,000 kg Required: a) Alison Drake, The Director of Drake Ltd is not an accountant. She wishes to know the most profitable weekly use of the restricted machine hours and material B resources during each week of the next six weeks, including whether to produce component XG or continue to outsource it. (Linear programming is not required). She also wants to know the impact on profits of Drake Ltd if the new contract with Brook Ltd could be deferred for six weeks. Prepare statements to calculate the above information. (13 marks) b) Using your workings, describe clearly to Alison Drake how the information provided by each of the statements you have prepared is used to calculate how she should proceed during the six weeks and give your recommendations. (7 marks)