Answered step by step

Verified Expert Solution

Question

1 Approved Answer

24) C and D have just formed a partnership. C contributed cash of P88,000 and building that cost P400,000. The building had been used

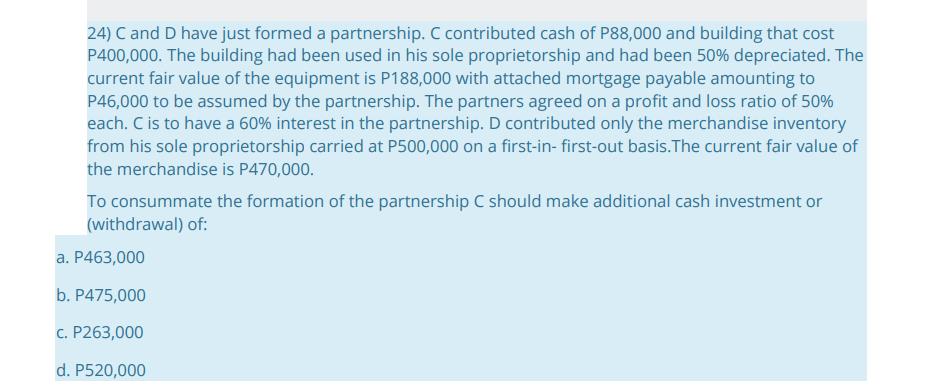

24) C and D have just formed a partnership. C contributed cash of P88,000 and building that cost P400,000. The building had been used in his sole proprietorship and had been 50% depreciated. The current fair value of the equipment is P188,000 with attached mortgage payable amounting to P46,000 to be assumed by the partnership. The partners agreed on a profit and loss ratio of 50% each. C is to have a 60% interest in the partnership. D contributed only the merchandise inventory from his sole proprietorship carried at P500,000 on a first-in-first-out basis. The current fair value of the merchandise is P470,000. To consummate the formation of the partnership C should make additional cash investment or (withdrawal) of: a. P463,000 b. P475,000 c. P263,000 d. P520,000

Step by Step Solution

★★★★★

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below C P263000 Explanation Cs contr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started