Answered step by step

Verified Expert Solution

Question

1 Approved Answer

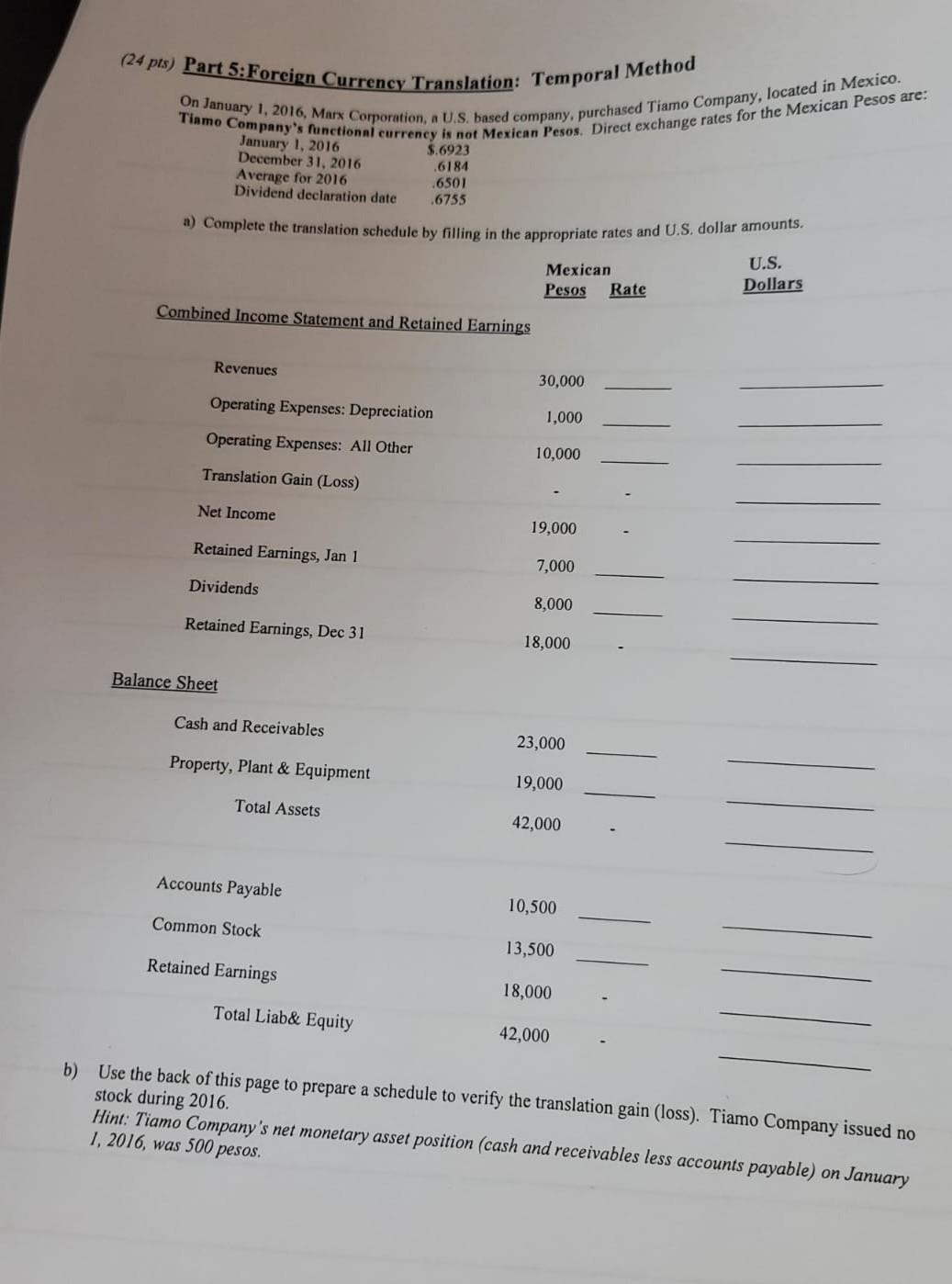

(24 pts) Part 5: Foreign Currency Translation: Temporal Method On January 1, 2016, Marx Corporation, a U.S. based company, purchased Tiamo Company, located in Mexico.

(24 pts) Part 5: Foreign Currency Translation: Temporal Method On January 1, 2016, Marx Corporation, a U.S. based company, purchased Tiamo Company, located in Mexico. Tiamo Company's functional currency is not Mexican Pesos. Direct exchange rates for the Mexican Pesos are: $.6923 .6184 Average for 2016 .6501 Dividend declaration date .6755 January 1, 2016 December 31, 2016 *) Complete the translation schedule by filling in the appropriate rates and U.S. dollar amounts. Mexican Pesos Rate U.S. Dollars Combined Income Statement and Retained Earnings Revenues 30,000 Operating Expenses: Depreciation 1,000 Operating Expenses: All Other 10,000 Translation Gain (Loss) Net Income 19,000 Retained Earnings, Jan 1 7,000 Dividends 8,000 Retained Earnings, Dec 31 18,000 Balance Sheet Cash and Receivables 23,000 Property, Plant & Equipment 19,000 Total Assets 42,000 Accounts Payable 10,500 Common Stock 13,500 Retained Earnings 18,000 Total Liab& Equity 42,000 b) Use the back of this page to prepare a schedule to verify the translation gain (loss). Tiamo Company issued no stock during 2016. Hint: Tiamo Company's net monetary asset position (cash and receivables less accounts payable) on January 1, 2016, was 500 pesos. (24 pts) Part 5: Foreign Currency Translation: Temporal Method On January 1, 2016, Marx Corporation, a U.S. based company, purchased Tiamo Company, located in Mexico. Tiamo Company's functional currency is not Mexican Pesos. Direct exchange rates for the Mexican Pesos are: $.6923 .6184 Average for 2016 .6501 Dividend declaration date .6755 January 1, 2016 December 31, 2016 *) Complete the translation schedule by filling in the appropriate rates and U.S. dollar amounts. Mexican Pesos Rate U.S. Dollars Combined Income Statement and Retained Earnings Revenues 30,000 Operating Expenses: Depreciation 1,000 Operating Expenses: All Other 10,000 Translation Gain (Loss) Net Income 19,000 Retained Earnings, Jan 1 7,000 Dividends 8,000 Retained Earnings, Dec 31 18,000 Balance Sheet Cash and Receivables 23,000 Property, Plant & Equipment 19,000 Total Assets 42,000 Accounts Payable 10,500 Common Stock 13,500 Retained Earnings 18,000 Total Liab& Equity 42,000 b) Use the back of this page to prepare a schedule to verify the translation gain (loss). Tiamo Company issued no stock during 2016. Hint: Tiamo Company's net monetary asset position (cash and receivables less accounts payable) on January 1, 2016, was 500 pesos

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started