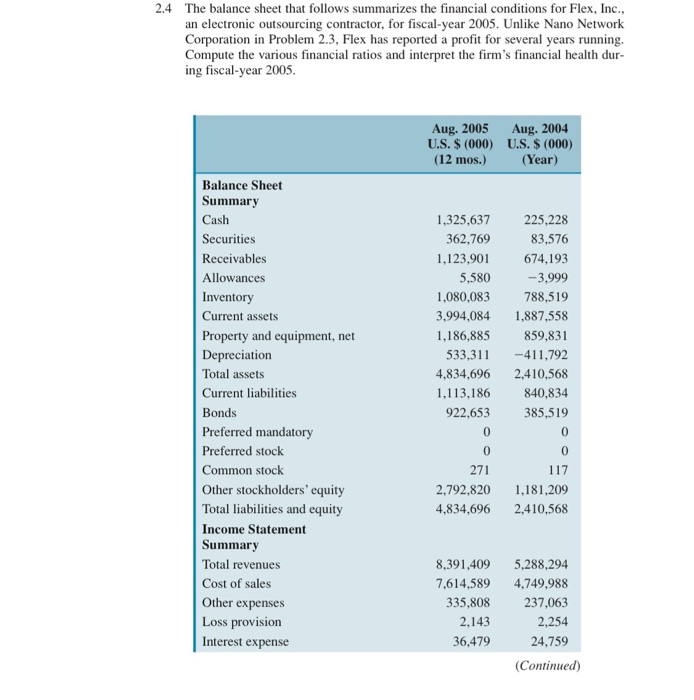

2.4 The balance sheet that follows summarizes the financial conditions for Flex, Inc., an electronic outsourcing contractor, for fiscal-year 2005. Unlike Nano Network Corporation in Problem 2.3, Flex has reported a profit for several years running, Compute the various financial ratios and interpret the firm's financial health dur- ing fiscal-year 2005. Aug. 2005 U.S. $ (000) (12 mos.) Aug. 2004 U.S. $ (000) (Year) Balance Sheet Summary Cash Securities Receivables Allowances Inventory Current assets Property and equipment, net Depreciation Total assets Current liabilities Bonds Preferred mandatory Preferred stock Common stock Other stockholders' equity Total liabilities and equity Income Statement Summary Total revenues Cost of sales Other expenses Loss provision Interest expense 1,325,637 362,769 1,123,901 5,580 1,080,083 3,994,084 1,186,885 533,311 4,834,696 1,113,186 922,653 225,228 83,576 674,193 -3,999 788,519 1,887,558 859,831 -411,792 2,410,568 840,834 385,519 0 0 271 2,792,820 4,834,696 117 1,181,209 2,410,568 8,391,409 7,614,589 335,808 2,143 36,479 5,288,294 4,749,988 237,063 2,254 24,759 (Continued) 2.4 The balance sheet that follows summarizes the financial conditions for Flex, Inc., an electronic outsourcing contractor, for fiscal-year 2005. Unlike Nano Network Corporation in Problem 2.3, Flex has reported a profit for several years running, Compute the various financial ratios and interpret the firm's financial health dur- ing fiscal-year 2005. Aug. 2005 U.S. $ (000) (12 mos.) Aug. 2004 U.S. $ (000) (Year) Balance Sheet Summary Cash Securities Receivables Allowances Inventory Current assets Property and equipment, net Depreciation Total assets Current liabilities Bonds Preferred mandatory Preferred stock Common stock Other stockholders' equity Total liabilities and equity Income Statement Summary Total revenues Cost of sales Other expenses Loss provision Interest expense 1,325,637 362,769 1,123,901 5,580 1,080,083 3,994,084 1,186,885 533,311 4,834,696 1,113,186 922,653 225,228 83,576 674,193 -3,999 788,519 1,887,558 859,831 -411,792 2,410,568 840,834 385,519 0 0 271 2,792,820 4,834,696 117 1,181,209 2,410,568 8,391,409 7,614,589 335,808 2,143 36,479 5,288,294 4,749,988 237,063 2,254 24,759 (Continued)