Answered step by step

Verified Expert Solution

Question

1 Approved Answer

24. The value of an option is equal to the: a. intrinsic value minus the time premium. b. time premium plus the intrinsic value. c.

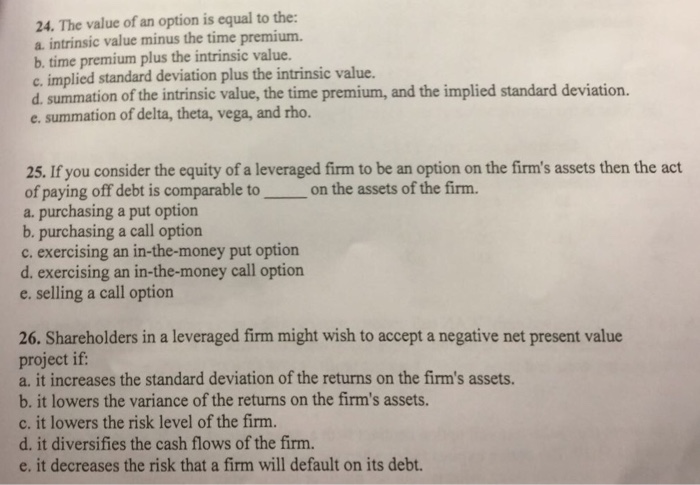

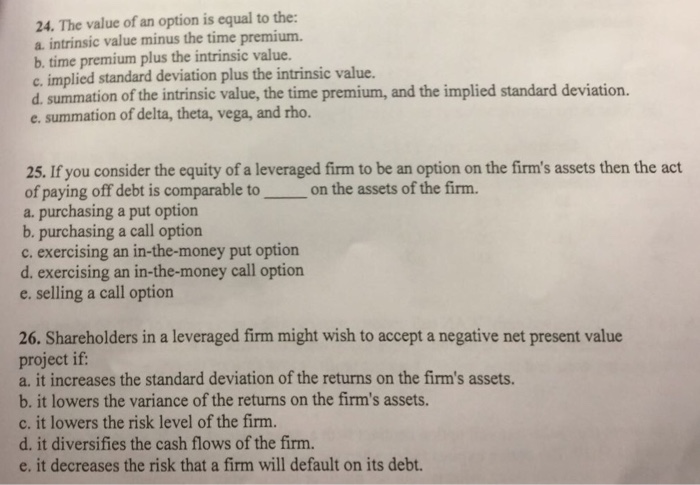

24. The value of an option is equal to the: a. intrinsic value minus the time premium. b. time premium plus the intrinsic value. c. implied standard deviation plus the intrinsic value. d. summation of the intrinsic value, the time premium, and the implied standard deviation. e. summation of delta, theta, vega, and rho. 25. If you consider the equity of a leveraged firm to be an option on the firm's assets then the act of paying off debt is comparable toon the assets of the firm. a. purchasing a put option b. purchasing a call option c. exercising an in-the-money put option d. exercising an in-the-money call option e. selling a call option 26. Shareholders in a leveraged firm might wish to accept a negative net present value project if a. it increases the standard deviation of the returns on the firm's assets. b. it lowers the variance of the returns on the firm's assets. c. it lowers the risk level of the firm. d. it diversifies the cash flows of the firm. e. it decreases the risk that a firm will default on its debt

24. The value of an option is equal to the: a. intrinsic value minus the time premium. b. time premium plus the intrinsic value. c. implied standard deviation plus the intrinsic value. d. summation of the intrinsic value, the time premium, and the implied standard deviation. e. summation of delta, theta, vega, and rho. 25. If you consider the equity of a leveraged firm to be an option on the firm's assets then the act of paying off debt is comparable toon the assets of the firm. a. purchasing a put option b. purchasing a call option c. exercising an in-the-money put option d. exercising an in-the-money call option e. selling a call option 26. Shareholders in a leveraged firm might wish to accept a negative net present value project if a. it increases the standard deviation of the returns on the firm's assets. b. it lowers the variance of the returns on the firm's assets. c. it lowers the risk level of the firm. d. it diversifies the cash flows of the firm. e. it decreases the risk that a firm will default on its debt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started