Answered step by step

Verified Expert Solution

Question

1 Approved Answer

24) X Co. is located in Alberta. X provided a company car to its key employee in Year 1 . The car was purchased for

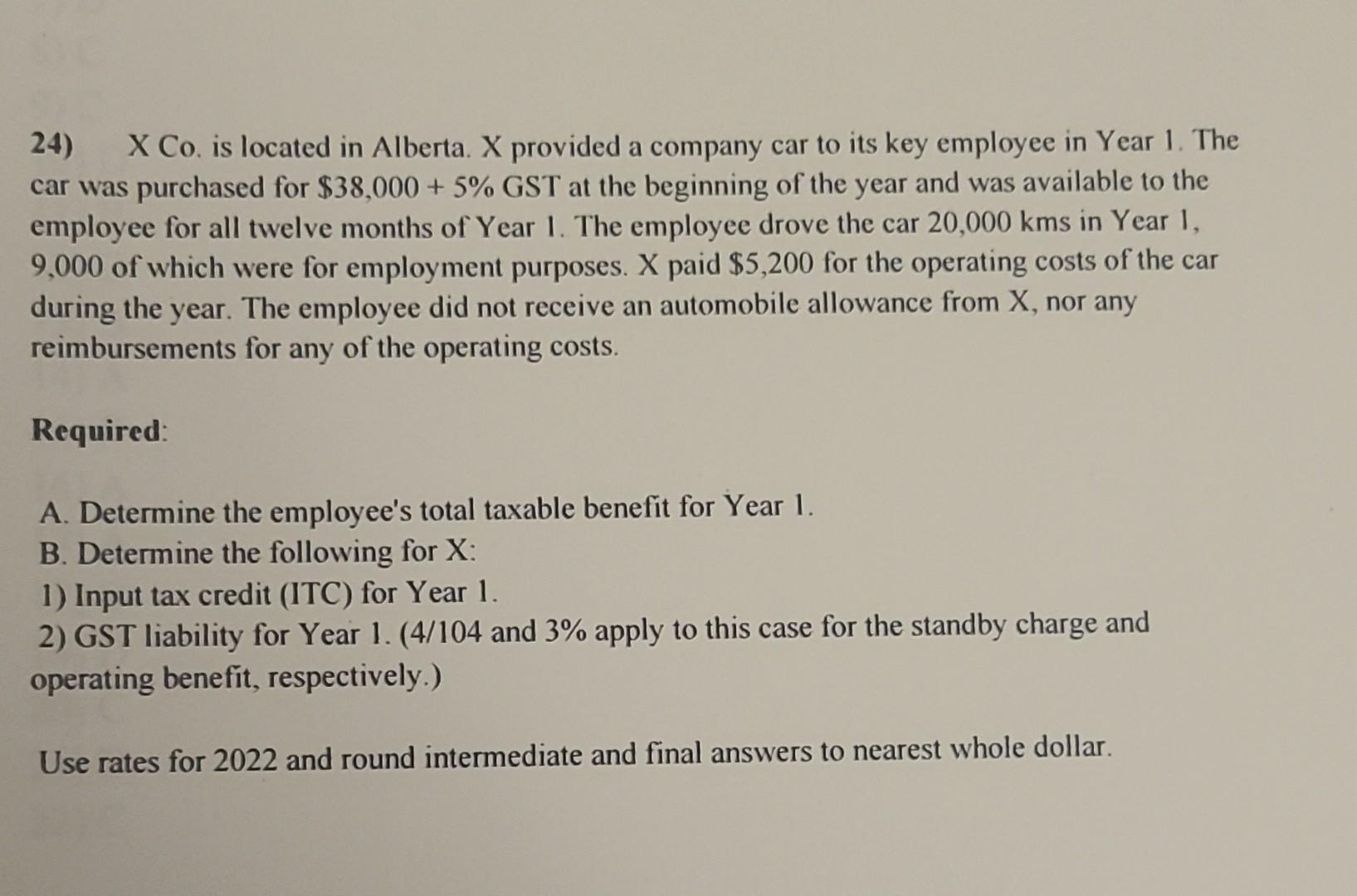

24) X Co. is located in Alberta. X provided a company car to its key employee in Year 1 . The car was purchased for $38,000+5% GST at the beginning of the year and was available to the employee for all twelve months of Year 1. The employee drove the car 20,000 kms in Year 1, 9,000 of which were for employment purposes. X paid $5,200 for the operating costs of the car during the year. The employee did not receive an automobile allowance from X, nor any reimbursements for any of the operating costs. Required: A. Determine the employee's total taxable benefit for Year 1. B. Determine the following for X : 1) Input tax credit (ITC) for Year 1. 2) GST liability for Year 1. (4/104 and 3\% apply to this case for the standby charge and operating benefit, respectively.) Use rates for 2022 and round intermediate and final answers to nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started