help with ANALYSIS AND FINAL QUESTIONS

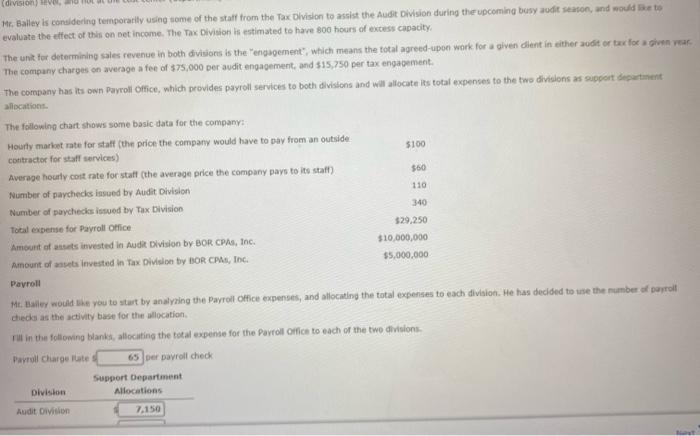

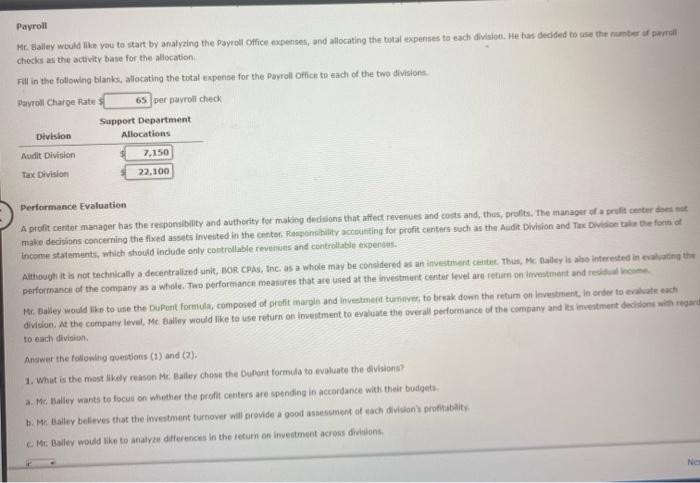

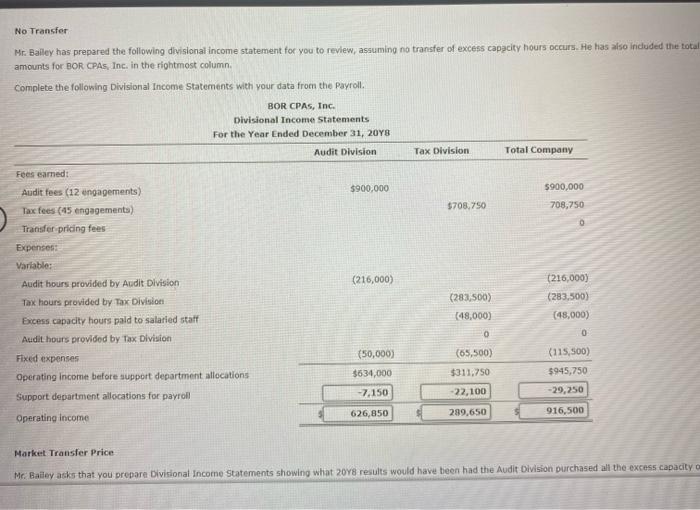

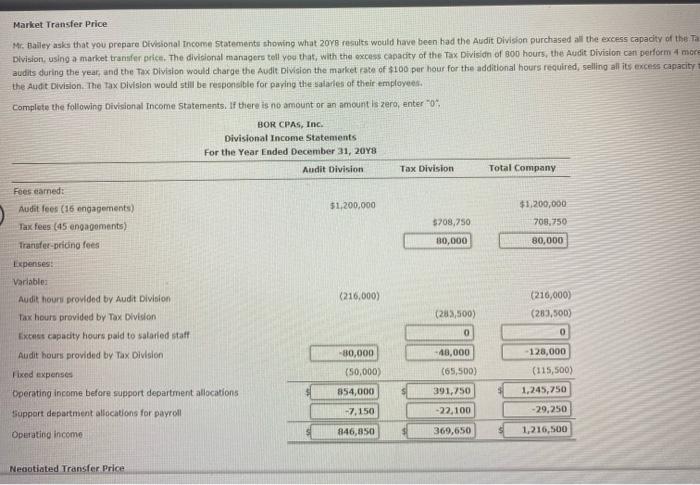

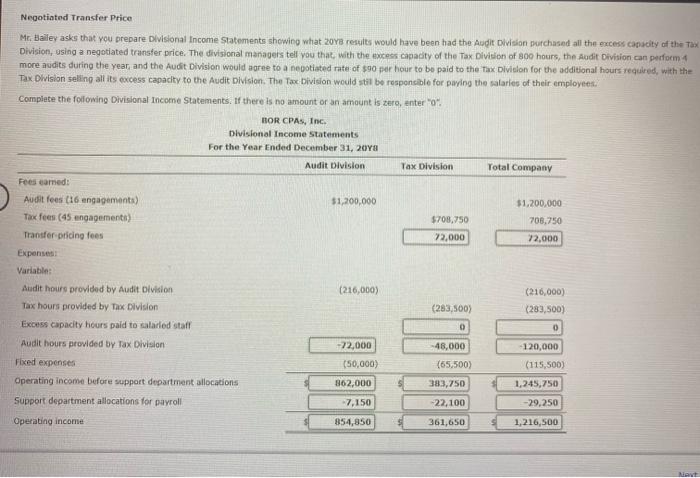

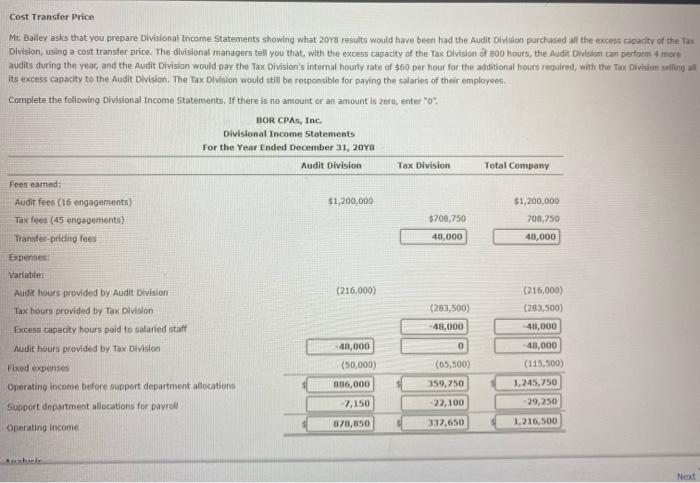

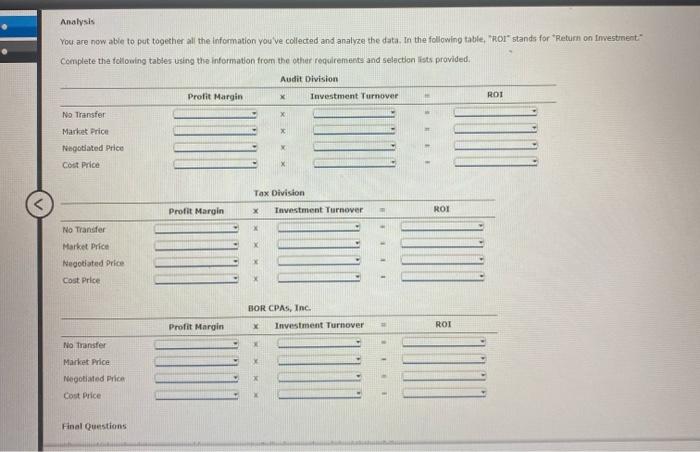

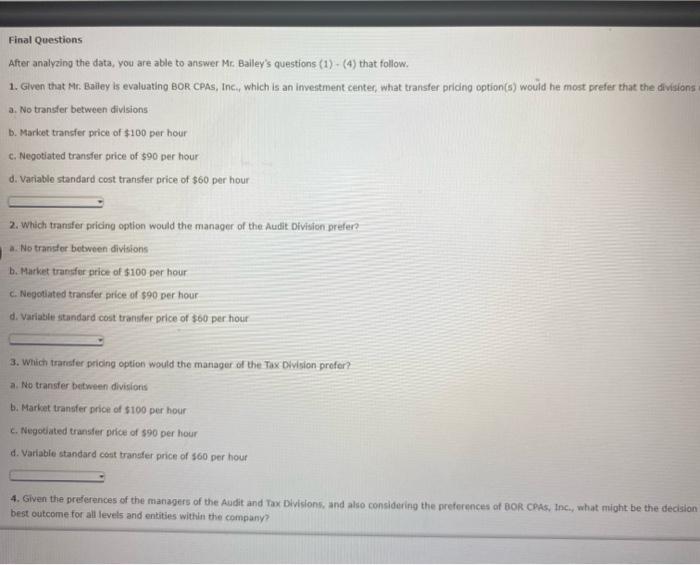

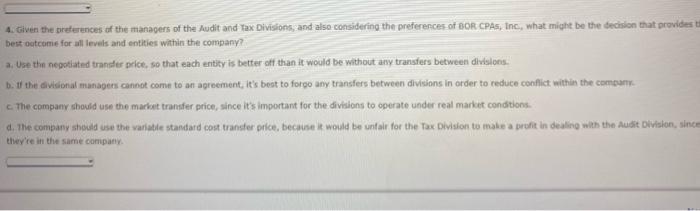

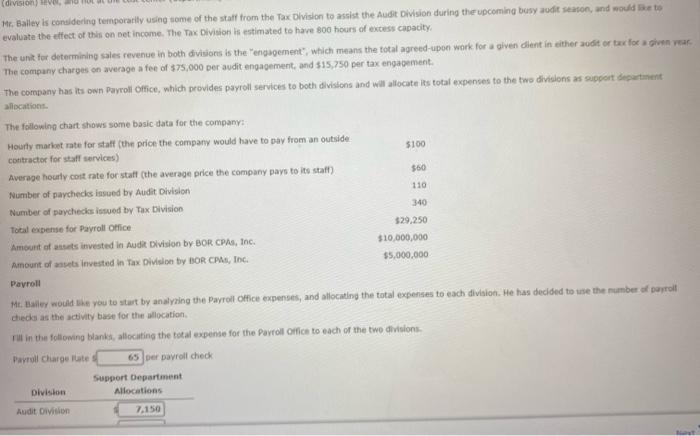

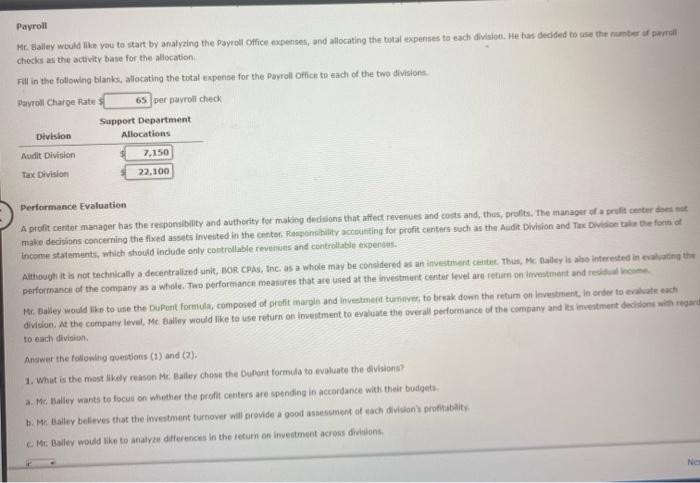

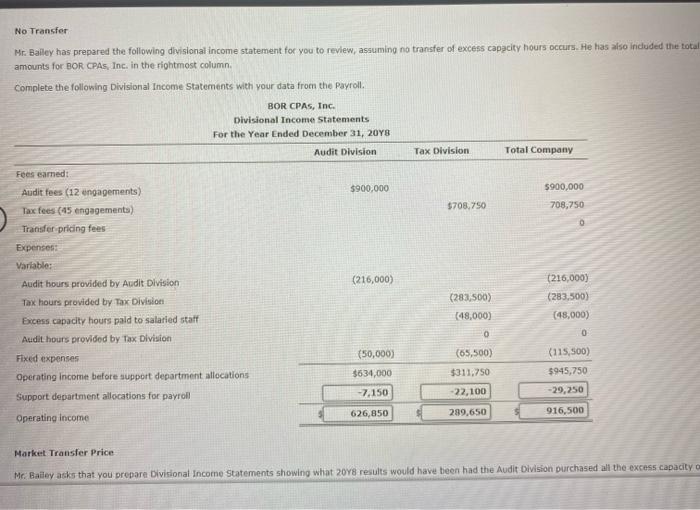

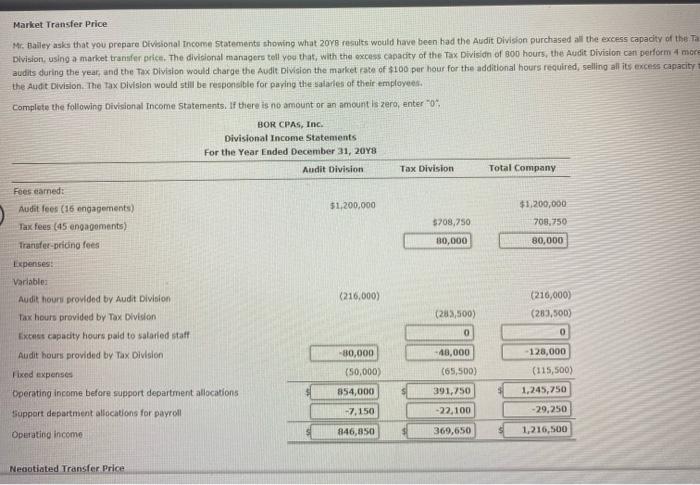

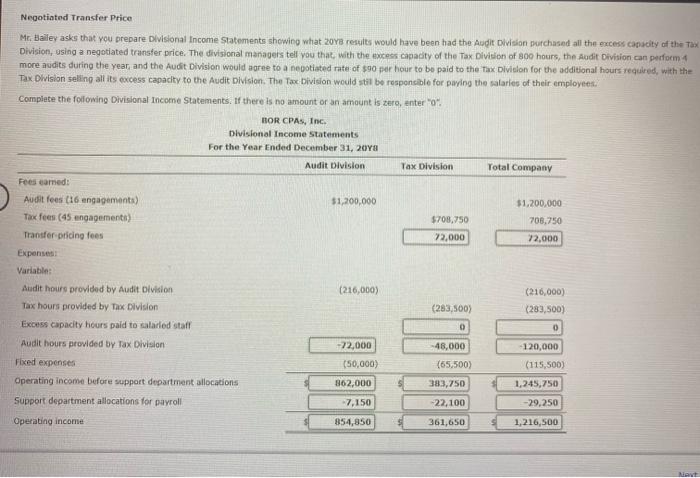

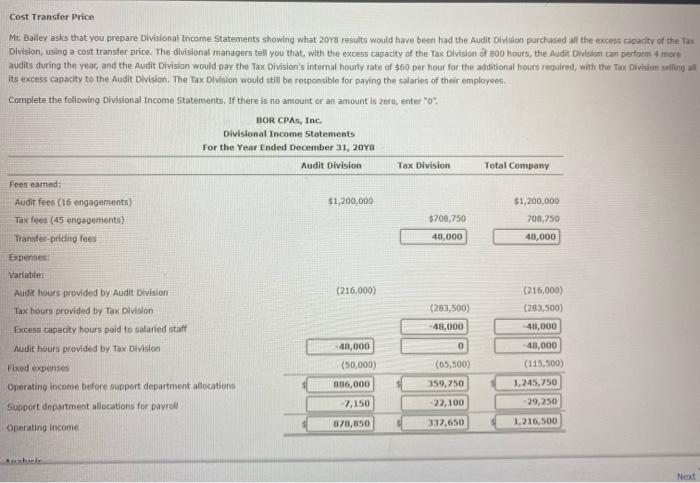

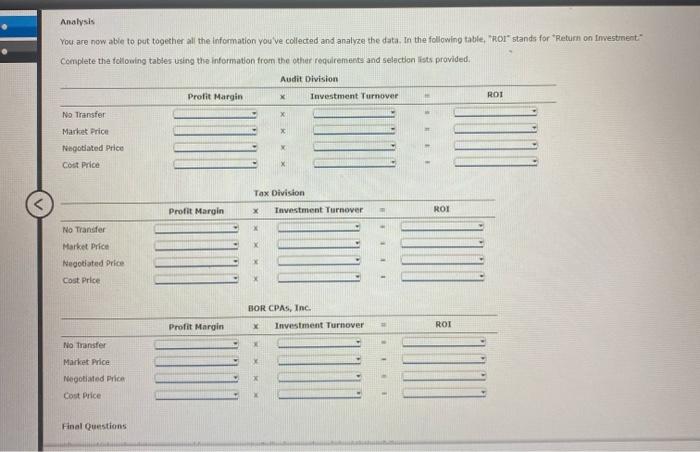

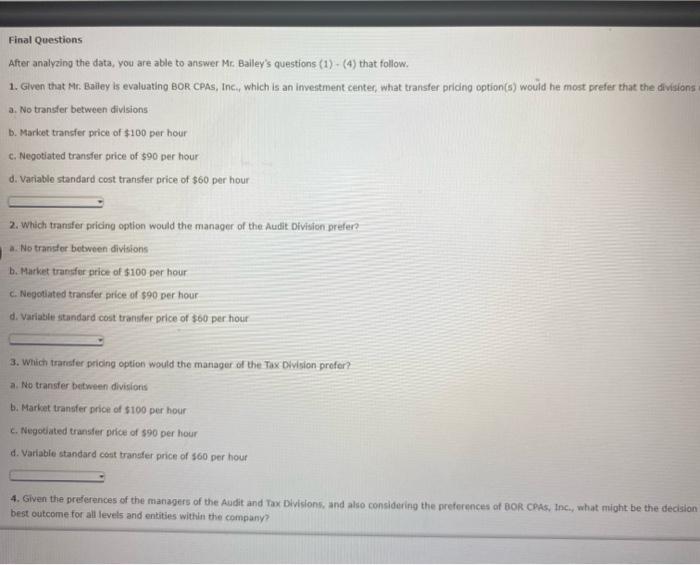

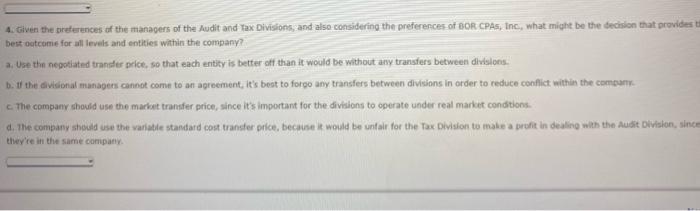

Af. Bailey is considering tenporarlly using some of the staff from the Tax Division to assist the Audit Division during the upcoming busy audit seaton, and would like te Evaluate the effect of this on bet income. The Tax Division is estimated to have 800 hours of excess capacity. The unit fer determining sales revenue in both divivons is the "engagement", which means the total agreed-upoe work for a qiven alient in either aodit or trx for a given rearThe company charges on average a fee of $75,000 per avdit engagement, and $15,750 per tax engapement: The company has its own Parroli office, which provides payroll services to both divistons and will allocate its total expenses to the two divisions as aupport depactinent allocations. Payroll Me. Baily would bike you to start by analyring the Payroll office expenses, and allocating the total expenses to each divisioc. He has decided to use the nuriber of parroll checks as the activity base for the allocation. I III in the folloming blanks, allocating the total expense for the Parroll orfice to each of the two divisions: Parrull charge liate I per parrell check Payroll Mr. Balley would like you to start by analyzing the Payroil office expenses, and allocating the total expenses to each division. He has decided to use the number of pwrrall checks as the activity base for the allocation. Fill in the following blanks, allocating the total expense for the payroll office to each of the two divisions. Pavroli Charge fate- 4 per payroli check Performance Evaluation A profit center manager has the respansibility and authority for maling dedisions that aftect revenues and costs and, thus, profis. The manager of a pruft certer doen mot Frake decisions concerning the fixed assets invested in the center, Fresponibility accounting for profit centers such as the Audit Division and Tax bwison tair Bre form of income statements, which should indude only controllable revenues and controliable expensers. Although it is not technically a decentralized unit, Bor. CPAs, Inc, as a whole may be considered as an investanent centec, Thus, Mr, failiey is aho intereited in evaluating the performance of the company as a Whole. Two performance measures that are used at the investment center level are return on investment and reslif. of income Mr. Balley would like to use the Dupont formida, composed of prefit margin and investment turniver, to break down the return on investrient, in orites fo eraliate each to each division. Answer the followirig questions (1) and (2). 1. What is the most likely reason Mr, Bailer chose the Dufont formula to evaluate the divisions? a. Mc. Malley wants te focus on whether the profit centers are spending in accordance with their budgets. b. Me. Balley belleves that the investment turnover aill previde a good assesument of each division' profitabaity C. PC. Bailey would like to analyze differences in the return on inventment across dirisions. No Transter Mr. Balley has prepared the following divisional income statement foc you to revlew, assuming no transfer of excess capacity hours occurs. He has also included the total amounts for BOR CPAS, Inc. in the riphtmost column. Complete the following Divisional Income Statements with your data from the Payroll. Market Transter Price Mr. Baley akis that you prepare Divirional Income Statements showing what 20 r8 results would have heen had the Audit Division purchased all the excess capacity o Market Transfer Price M4. Balley asks that you propare Ofvisional Income statemente showing what 208 results would have been had the Audit Division purchased all the excess capacity of the Ta Division, using a market transfer price. The divisional managers tell you that, with the excess capacity of the Tax Divisidn of 800 hours, the Audit Diviaion can perform a morf audits during the year, and the Tax Division would charge the Audit. Division the market rate of $100 par hour for the additional hours required, sellino all its excess capacity 1 the Audt Division. The Tax Division would still be responsible for paring the saiaries of their emplovees. Complete the following Divisional Income Statements, If there is no amount or an amount is zero, enter " 0, Negotiated Transfer Price Mr. Balley asks that you prepare Divisional Income Statements showing what 20YB resulte would have been had the Augit Division purchased all the excess canacity of the Tax Division, using a negotiated transfer price. The divisional manageis tell vou that, with the uxcess capacity of the Tax. Division of 800 hours, the audit oivision can perform 4 . more avdits during the year, and the Audit Division would aorne to a neostiated rate: of $90 fer hour to be paid to the tax Dividion for the additional hours required, with the Tax Division seling allits excess capacity to the Audit Division. The Tax bivision would stal be respencible for paying the salaries of their employees: Complete the folowing Divisional income Statements. If there is no amount or an amount is zero, enter " 0 :". Cost Transfer Price Mr. Bailey asks that you prepare Divisional Income Statements showing what 20 ys results would have been had the Audit Division purchased all the excess capaotr of the Tax Division, using a cost transfer price. The divisional manapers tell you that, with the excess capacity of the Tax Division of b00 hours, the Audit Division can perform 4 micre audits during the year, and the Audit Division would par the Tex Division's internal hourly rate of $60 per hour for the additional hours required, with the Tax Division sailing al its excess capacity to the Audit Division. The Tax Division would still be responsible for paying the salaries of their employoec. Complete the following Divisional Income 5 tatements, If there is no amount or an amount is zero, enter " 0 ". You are now able to put together all the information you ve collected and analyze the data. In the following table, "ROI" stands for "Return on investinent" Complete the following tabtes using the information fram the ofher requiremeits and selectlon lists provided. After analyzing the data, you are able to answer Mc Bailey's questions (1) - (4) that follow. 1. Given that Mr. Bailey is evaluating BOR. CPAs, Inc., which is an imvertment center, what transfer priding option(s) would he most prefer that the divisions i a. No transfer between divisions b. Market transfer price of $100 per hour c. Negotiated transfer price of 590 per hour d. Variable standard cost transter price of $60 per hour 2. Which transfer pricing option would the manager of the Audit Division prefer? a. No transfor between divtsions b. Market transfor price of $100 per hour c. Nepotiated transfer price of $90 per hour d. Variable standard cost transter price of $60 per hour 3. Which trarsifer prioing option would the manager of the Tax Division profor? a. No transfer between divisions b. Market transfer prioe of $100 per hour c. Negotated transfer price of 590 per hour d. Varlable standard cost transfer price of 560 per hour 4. Given the preferences of the managers of the Audit and Tax Divisions, and also considering the preferences of 808 CPAE, Inc., what might be the decision best outcome for all levels and entities within the company? 4. Civen the oreferences of the managers of the Audit and Fax Divisions, and also considering the preferences-of oop, CPAS, Inc, what might be the incision that provider to belt outcome for all levels and entities within the company? a. Use thin negotiated trander price. so that each entity is better off than it would be without any transfers between divislons. b. If the dividional managers cannot come to an agreement, it's best to forgo any transfers between divisions in order to reduce conflict within the compurr. c. The company showld use the markit transfer price, since it's important for the divilions to operate under real market conditions. d. The company should use the wariatie standard cost transfer price, because it would be unfalr for the Tax Dividion to male a profit in dealing wilh the Audit Division, since they'te in the same company. Af. Bailey is considering tenporarlly using some of the staff from the Tax Division to assist the Audit Division during the upcoming busy audit seaton, and would like te Evaluate the effect of this on bet income. The Tax Division is estimated to have 800 hours of excess capacity. The unit fer determining sales revenue in both divivons is the "engagement", which means the total agreed-upoe work for a qiven alient in either aodit or trx for a given rearThe company charges on average a fee of $75,000 per avdit engagement, and $15,750 per tax engapement: The company has its own Parroli office, which provides payroll services to both divistons and will allocate its total expenses to the two divisions as aupport depactinent allocations. Payroll Me. Baily would bike you to start by analyring the Payroll office expenses, and allocating the total expenses to each divisioc. He has decided to use the nuriber of parroll checks as the activity base for the allocation. I III in the folloming blanks, allocating the total expense for the Parroll orfice to each of the two divisions: Parrull charge liate I per parrell check Payroll Mr. Balley would like you to start by analyzing the Payroil office expenses, and allocating the total expenses to each division. He has decided to use the number of pwrrall checks as the activity base for the allocation. Fill in the following blanks, allocating the total expense for the payroll office to each of the two divisions. Pavroli Charge fate- 4 per payroli check Performance Evaluation A profit center manager has the respansibility and authority for maling dedisions that aftect revenues and costs and, thus, profis. The manager of a pruft certer doen mot Frake decisions concerning the fixed assets invested in the center, Fresponibility accounting for profit centers such as the Audit Division and Tax bwison tair Bre form of income statements, which should indude only controllable revenues and controliable expensers. Although it is not technically a decentralized unit, Bor. CPAs, Inc, as a whole may be considered as an investanent centec, Thus, Mr, failiey is aho intereited in evaluating the performance of the company as a Whole. Two performance measures that are used at the investment center level are return on investment and reslif. of income Mr. Balley would like to use the Dupont formida, composed of prefit margin and investment turniver, to break down the return on investrient, in orites fo eraliate each to each division. Answer the followirig questions (1) and (2). 1. What is the most likely reason Mr, Bailer chose the Dufont formula to evaluate the divisions? a. Mc. Malley wants te focus on whether the profit centers are spending in accordance with their budgets. b. Me. Balley belleves that the investment turnover aill previde a good assesument of each division' profitabaity C. PC. Bailey would like to analyze differences in the return on inventment across dirisions. No Transter Mr. Balley has prepared the following divisional income statement foc you to revlew, assuming no transfer of excess capacity hours occurs. He has also included the total amounts for BOR CPAS, Inc. in the riphtmost column. Complete the following Divisional Income Statements with your data from the Payroll. Market Transter Price Mr. Baley akis that you prepare Divirional Income Statements showing what 20 r8 results would have heen had the Audit Division purchased all the excess capacity o Market Transfer Price M4. Balley asks that you propare Ofvisional Income statemente showing what 208 results would have been had the Audit Division purchased all the excess capacity of the Ta Division, using a market transfer price. The divisional managers tell you that, with the excess capacity of the Tax Divisidn of 800 hours, the Audit Diviaion can perform a morf audits during the year, and the Tax Division would charge the Audit. Division the market rate of $100 par hour for the additional hours required, sellino all its excess capacity 1 the Audt Division. The Tax Division would still be responsible for paring the saiaries of their emplovees. Complete the following Divisional Income Statements, If there is no amount or an amount is zero, enter " 0, Negotiated Transfer Price Mr. Balley asks that you prepare Divisional Income Statements showing what 20YB resulte would have been had the Augit Division purchased all the excess canacity of the Tax Division, using a negotiated transfer price. The divisional manageis tell vou that, with the uxcess capacity of the Tax. Division of 800 hours, the audit oivision can perform 4 . more avdits during the year, and the Audit Division would aorne to a neostiated rate: of $90 fer hour to be paid to the tax Dividion for the additional hours required, with the Tax Division seling allits excess capacity to the Audit Division. The Tax bivision would stal be respencible for paying the salaries of their employees: Complete the folowing Divisional income Statements. If there is no amount or an amount is zero, enter " 0 :". Cost Transfer Price Mr. Bailey asks that you prepare Divisional Income Statements showing what 20 ys results would have been had the Audit Division purchased all the excess capaotr of the Tax Division, using a cost transfer price. The divisional manapers tell you that, with the excess capacity of the Tax Division of b00 hours, the Audit Division can perform 4 micre audits during the year, and the Audit Division would par the Tex Division's internal hourly rate of $60 per hour for the additional hours required, with the Tax Division sailing al its excess capacity to the Audit Division. The Tax Division would still be responsible for paying the salaries of their employoec. Complete the following Divisional Income 5 tatements, If there is no amount or an amount is zero, enter " 0 ". You are now able to put together all the information you ve collected and analyze the data. In the following table, "ROI" stands for "Return on investinent" Complete the following tabtes using the information fram the ofher requiremeits and selectlon lists provided. After analyzing the data, you are able to answer Mc Bailey's questions (1) - (4) that follow. 1. Given that Mr. Bailey is evaluating BOR. CPAs, Inc., which is an imvertment center, what transfer priding option(s) would he most prefer that the divisions i a. No transfer between divisions b. Market transfer price of $100 per hour c. Negotiated transfer price of 590 per hour d. Variable standard cost transter price of $60 per hour 2. Which transfer pricing option would the manager of the Audit Division prefer? a. No transfor between divtsions b. Market transfor price of $100 per hour c. Nepotiated transfer price of $90 per hour d. Variable standard cost transter price of $60 per hour 3. Which trarsifer prioing option would the manager of the Tax Division profor? a. No transfer between divisions b. Market transfer prioe of $100 per hour c. Negotated transfer price of 590 per hour d. Varlable standard cost transfer price of 560 per hour 4. Given the preferences of the managers of the Audit and Tax Divisions, and also considering the preferences of 808 CPAE, Inc., what might be the decision best outcome for all levels and entities within the company? 4. Civen the oreferences of the managers of the Audit and Fax Divisions, and also considering the preferences-of oop, CPAS, Inc, what might be the incision that provider to belt outcome for all levels and entities within the company? a. Use thin negotiated trander price. so that each entity is better off than it would be without any transfers between divislons. b. If the dividional managers cannot come to an agreement, it's best to forgo any transfers between divisions in order to reduce conflict within the compurr. c. The company showld use the markit transfer price, since it's important for the divilions to operate under real market conditions. d. The company should use the wariatie standard cost transfer price, because it would be unfalr for the Tax Dividion to male a profit in dealing wilh the Audit Division, since they'te in the same company