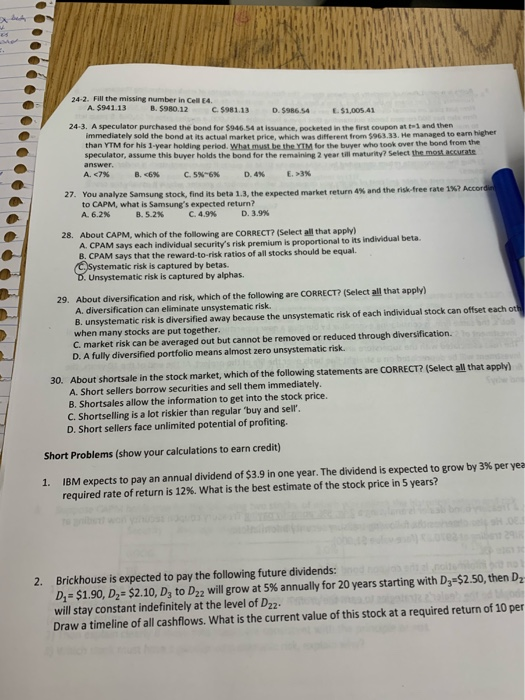

24-2. Fill the missing number in Cell E4. A. $941.13 B. $980.12 C. $981.13 D. $986.54 $1,005.41 24-3. A speculator purchased the band for $946.54 at issuance, pocketed in the first coupon at 1 and immediately sold the bond at its actual market price, which was different from 5963,33. He managed to earn here than YM for his 1-year oldin period. What the IM t he barver who took over the band from the speculator, assume this buyer holds the bond for the remaining 2 year till maturity? Select the most accurate answer. A. 3% 27. You analyze Samsung stock, find its beta 1.3, the expected market return 4% and the risk-free rate 1%? Accordi to CAPM, what is Samsung's expected return? A. 6.2% 3.5.2% C. 4.9% D. 3.9% 28. About CAPM, which of the following are CORRECT? (Select all that apply) A. CPAM says each individual security's risk premium is proportional to its individual beta. B. CPAM says that the reward-to-risk ratios of all stocks should be equal. C. Systematic risk is captured by betas. D. Unsystematic risk is captured by alphas. 29. About diversification and risk, which of the following are CORRECT? (Select all that apply) A. diversification can eliminate unsystematic risk. B. unsystematic risk is diversified away because the unsystematic risk of each individual stock can offset each oth when many stocks are put together. C. market risk can be averaged out but cannot be removed or reduced through diversification. D. A fully diversified portfolio means almost zero unsystematic risk. 30. About Shortsale in the stock market, which of the following statements are CORRECT? (Select all that apply) A. Short sellers borrow securities and sell them immediately. B. Shortsales allow the information to get into the stock price. C. Shortselling is a lot riskier than regular 'buy and sell'. D. Short sellers face unlimited potential of profiting. Short Problems (show your calculations to earn credit) 1. IBM expects to pay an annual dividend of $3.9 in one year. The dividend is expected to grow by 3% per yea required rate of return is 12%. What is the best estimate of the stock price in 5 years? 2. Brickhouse is expected to pay the following future dividends: D. - $1.90, D = $2.10, D, to Dz2 will grow at 5% annually for 20 years starting with D=$2.50, then Dz will stay constant indefinitely at the level of D22 Draw a timeline of all cashflows. What is the current value of this stock at a required return of 10 per