Answered step by step

Verified Expert Solution

Question

1 Approved Answer

24-23 (OBJECTIVES 24-4, 24-5, 24-6, 24-7, 24-8) Consider the following independent situations: a. Thomas Cheung is auditing the accounts of a manufacturing company that is

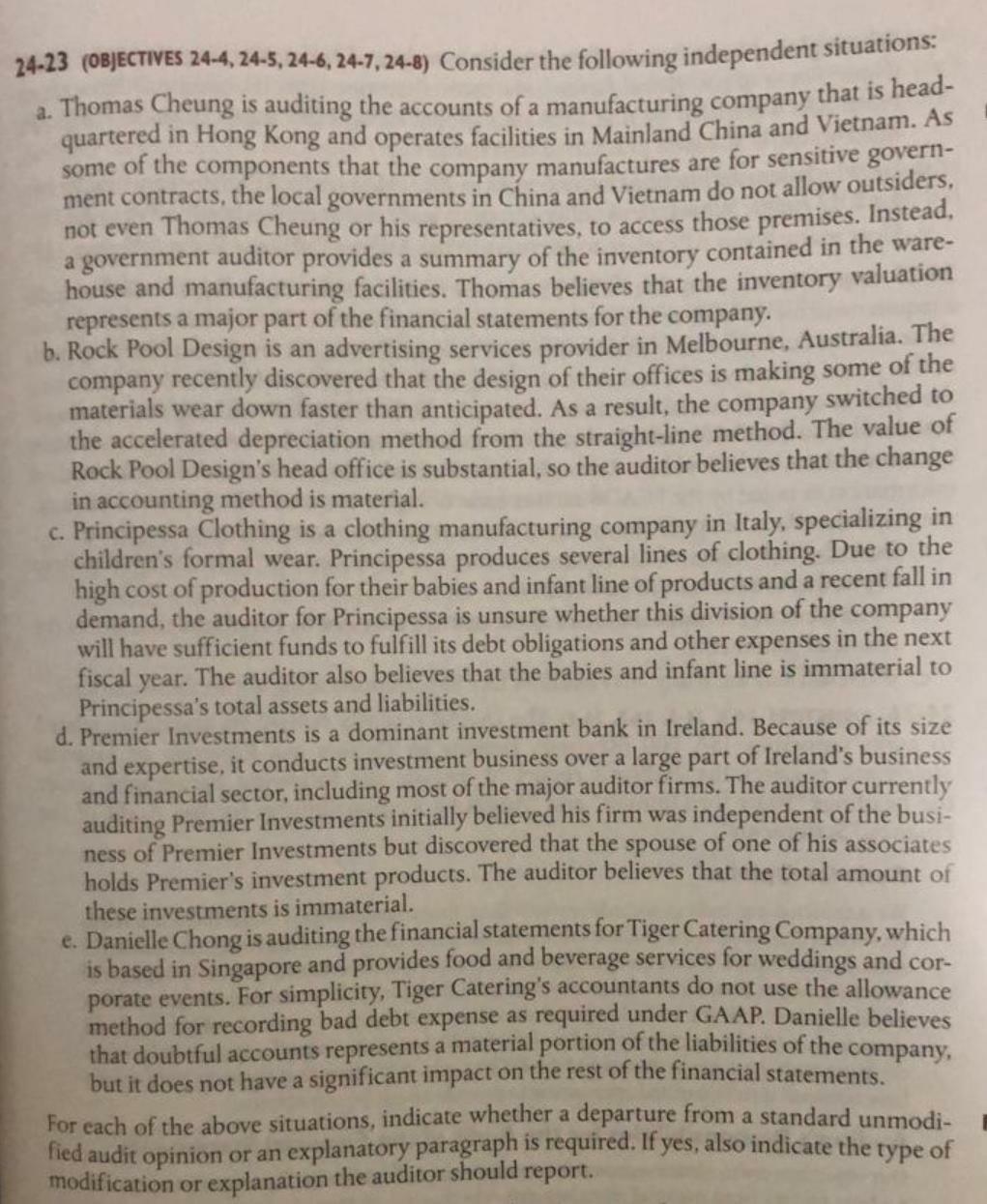

24-23 (OBJECTIVES 24-4, 24-5, 24-6, 24-7, 24-8) Consider the following independent situations: a. Thomas Cheung is auditing the accounts of a manufacturing company that is head- quartered in Hong Kong and operates facilities in Mainland China and Vietnam. As some of the components that the company manufactures are for sensitive govern- ment contracts, the local governments in China and Vietnam do not allow outsiders, not even Thomas Cheung or his representatives, to access those premises. Instead, a government auditor provides a summary of the inventory contained in the ware- house and manufacturing facilities. Thomas believes that the inventory valuation represents a major part of the financial statements for the company. b. Rock Pool Design is an advertising services provider in Melbourne, Australia. The company recently discovered that the design of their offices is making some of the materials wear down faster than anticipated. As a result, the company switched to the accelerated depreciation method from the straight-line method. The value of Rock Pool Design's head office is substantial, so the auditor believes that the change in accounting method is material. c. Principessa Clothing is a clothing manufacturing company in Italy, specializing in children's formal wear. Principessa produces several lines of clothing. Due to the high cost of production for their babies and infant line of products and a recent fall in demand, the auditor for Principessa is unsure whether this division of the company will have sufficient funds to fulfill its debt obligations and other expenses in the next fiscal year. The auditor also believes that the babies and infant line is immaterial to Principessa's total assets and liabilities. d. Premier Investments is a dominant investment bank in Ireland. Because of its size and expertise, it conducts investment business over a large part of Ireland's business and financial sector, including most of the major auditor firms. The auditor currently auditing Premier Investments initially believed his firm was independent of the busi- ness of Premier Investments but discovered that the spouse of one of his associates holds Premier's investment products. The auditor believes that the total amount of these investments is immaterial. e. Danielle Chong is auditing the financial statements for Tiger Catering Company, which is based in Singapore and provides food and beverage services for weddings and cor- porate events. For simplicity, Tiger Catering's accountants do not use the allowance method for recording bad debt expense as required under GAAP. Danielle believes that doubtful accounts represents a material portion of the liabilities of the company, but it does not have a significant impact on the rest of the financial statements. For each of the above situations, indicate whether a departure from a standard unmodi- fied audit opinion or an explanatory paragraph is required. If yes, also indicate the type of modification or explanation the auditor should report. 24-23 (OBJECTIVES 24-4, 24-5, 24-6, 24-7, 24-8) Consider the following independent situations: a. Thomas Cheung is auditing the accounts of a manufacturing company that is head- quartered in Hong Kong and operates facilities in Mainland China and Vietnam. As some of the components that the company manufactures are for sensitive govern- ment contracts, the local governments in China and Vietnam do not allow outsiders, not even Thomas Cheung or his representatives, to access those premises. Instead, a government auditor provides a summary of the inventory contained in the ware- house and manufacturing facilities. Thomas believes that the inventory valuation represents a major part of the financial statements for the company. b. Rock Pool Design is an advertising services provider in Melbourne, Australia. The company recently discovered that the design of their offices is making some of the materials wear down faster than anticipated. As a result, the company switched to the accelerated depreciation method from the straight-line method. The value of Rock Pool Design's head office is substantial, so the auditor believes that the change in accounting method is material. c. Principessa Clothing is a clothing manufacturing company in Italy, specializing in children's formal wear. Principessa produces several lines of clothing. Due to the high cost of production for their babies and infant line of products and a recent fall in demand, the auditor for Principessa is unsure whether this division of the company will have sufficient funds to fulfill its debt obligations and other expenses in the next fiscal year. The auditor also believes that the babies and infant line is immaterial to Principessa's total assets and liabilities. d. Premier Investments is a dominant investment bank in Ireland. Because of its size and expertise, it conducts investment business over a large part of Ireland's business and financial sector, including most of the major auditor firms. The auditor currently auditing Premier Investments initially believed his firm was independent of the busi- ness of Premier Investments but discovered that the spouse of one of his associates holds Premier's investment products. The auditor believes that the total amount of these investments is immaterial. e. Danielle Chong is auditing the financial statements for Tiger Catering Company, which is based in Singapore and provides food and beverage services for weddings and cor- porate events. For simplicity, Tiger Catering's accountants do not use the allowance method for recording bad debt expense as required under GAAP. Danielle believes that doubtful accounts represents a material portion of the liabilities of the company, but it does not have a significant impact on the rest of the financial statements. For each of the above situations, indicate whether a departure from a standard unmodi- fied audit opinion or an explanatory paragraph is required. If yes, also indicate the type of modification or explanation the auditor should report

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started