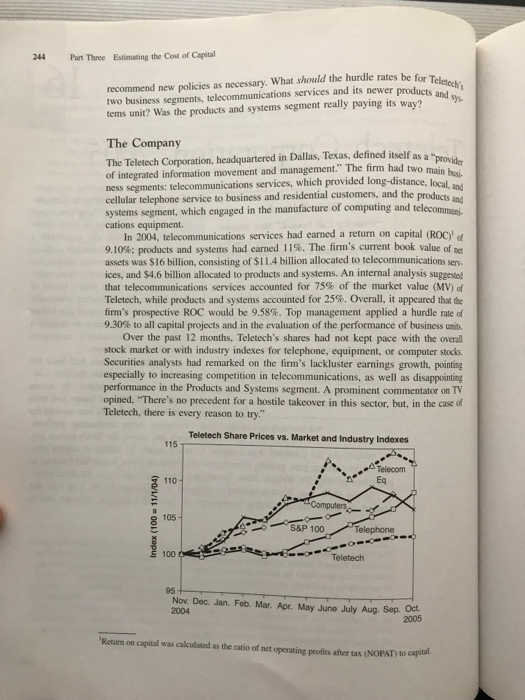

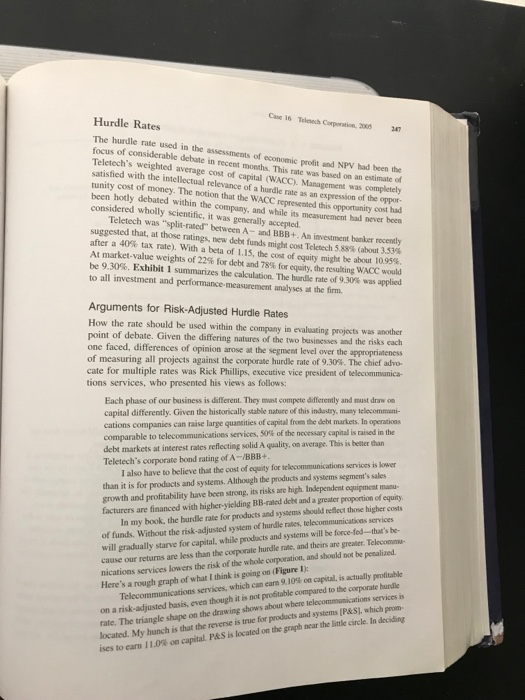

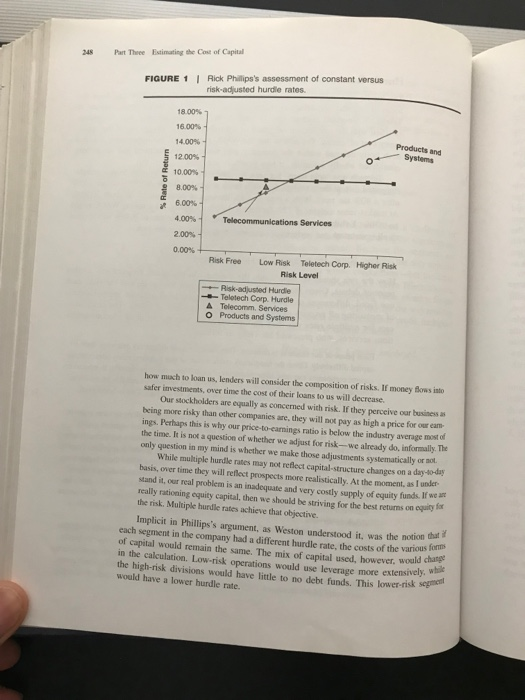

244 Part Three Estimating the Cost of Capital recommend new policies as necessary. What should the hurdle rates be for 1T two business segments, telecommunications services and its newer procth tems unit? Was the products and systems segment really paying its way? for Teletech's The Company The Teletech Corporation, headquartered in Dallas, Texas, defined itself as of integrated information movement and management." The firm had two ness segments: telecommunications services, which provided long-distance, I cellular telephone service to business and residential customers, and the systems segment, which engaged in the manufacture of computing and telecommuni cations equipment. main busi- products and In 2004, telecommunications services had eaned a return on capital (ROC f 9.10%; products and systems had earned 11%. The firm's current book value of assets was S16 billion, consisting of $11.4 billion allocated to telecommunications senv.. ices, and $4.6 billion allocated to products and systems. An internal analysis suggested that telecommunications services accounted for 75% of the market value (MV) of Teletech, while products and systems accounted for 25%. Overall, it appeared that the firm's prospective ROC would be 9.58%. Top management applied a hurdle rate of 9.30% to all capital projects and in the evaluation of the performance of business units. Over the past 12 months, Teletech's shares had not kept pace with the overall stock market or with industry indexes for telephone, equipment, or computer stocks Securities analysts had remarked on the firm's lackluster earnings growth, pointing especially to increasing competition in telecommunications, as well as disappointing performance in the Products and Systems segment. A prominent commentator on TV opined, "There's no precedent for a hostile takeover in this sector, but, in the case o Teletech, there is every reason to try." Teletech Share Prices vs. Market and Industry Indexes 115 Telecom 110 a Eq 105 S&P 100 Telephone 100 95 Nov. Dec. Jan. Fob. Mar. Apr. May June July Aug. Sep. Oct 2004 2005 Retarn on capital was calculated as the ratio of net operating profits after tax (NOPAT) to capital Case 16 Teleech Corporation, 2005 Telecommunications Services 245 Midwest. In 2004, segment revenues, net operati S11 billion, S1.18 billion, and $11.4 billion, The telecommunications services segment provided long-distance, service to more than 7 million customer lines throughout the Revenues in this segment grew at an average rate of local, and cellular Southwest and ng profit after tax (NOPAT), and net assets were 3% during 2 Since the Teletech had coped with the gradual deregulation of its industry t expansion into new services and geographical regions. Most recently, the firm had been a leading bidder for cellular telephone operations and for licenses to offer per- sonal communications services (PCS). In addition, the firm had purchased a number court-ordered breakup of the Bell System telephone monopoly in 1983, vely of telephone-operating companies through privatization auctions in Latin America. Finally, the firm had invested aggressively in new technology-primarily, digital switches and optical-fiber cables--in an effort to enhance its service quality. All of those strategic moves had been costly: the capital budget in this segment had varied between $1.5 billion and $2 billion in each of the previous 10 years. Unfortunately, profit margins in the telecommunications segment had been under pressure for several years. Government regulators had been slow to provide rate relief to Teletech for its capital investments. Other leading telecommunications providers had expanded into Teletech's geographical markets and invested in new technology and quality-enhancing assets. Teletech's management noted that large cable-TV com- panies had aggressively entered the telecommunications market and continued the pressure on profit margins. Nevertheless. Teletech was the dominant service provider in its geographical mar kets and product segments. Customer surveys leader in product quality and customer satisfaction. Its management was confident that the company could command premium prices no matter how the industry might evolve revealed that the company was the Products and Systems Before 2000, telecommunications had been the company's core business, supple- mented by an equipment-manufacturing division that produced telecommunications components. In 2000, the company acquired a leading computer-workstation manu- facturer with the goal of applying state-of-the-art compating technology to the design of telecommunications equipment. The explosive growth in the microcomputer mar- ket and the increased usage of telephone lines to connect home- and office-based com- puters with mainframes convinced Teletech's management of the potential value of marrying telecommunications equipment with computing technology. Using Teletech's capital base, borrowing ability, and distribution network to catapult growth, the prod- ucts and systems 2004 NOPAT and net assets were $480 million and $4.6 billion, respectively The products and systems segment was acknowledged as a technology leader in the industry. While this accounted for its rapid growth and pricing power, maintenance segment increased its sales by nearly 40% in 2004. This segment's Hurdle Rates Case 16 Teleech Corporation, 200 7 The hurdle rate used in the assessments of economic focus of considerable debate in recent moeths. This rate was based on an estimate of Teletech's weighted average cost of capital (WACC). Management was completely satisfied with the intellectual relevance of a hurdle rate as an expression of the oppor- tunity cost of money. The notion that the WACC represented this opportunity cost had been hotly debated within the company, and while its measurement had never been considered wholly scientific, it was generally accepted. profit and NPV had been the Teletech was "split-rated between A- and BBB+. An investment banker recently suggested that, at those ratings, new debt funds might cost Teletech 5,88% (about 3.53 after a 40% tax rate). With a beta of 1.15, the cost of equity might be about 1095 At market-value weights of 22% for debt and 78% for equity, the resulting w ACC would be 9.30%. Exhibit 1 summarizes the calculation. The hurdle rate of 9.30% was applied to all investment and performance-measurement analyses at the firm Arguments for Risk-Adjusted Hurdle Rates How the rate should be used within the company in evaluating projects was another point one faced, differences of opinion arose at the segment level over the appropriateness of measuring all projects against the corporate hurdle rate of 9.30%. The chief ad cate for multiple rates was Rick Phillips, executive vice president of telecommanica- tions services, who presented his views as follows: two basinesses and the risks each Each phase of our business is different. They mast compete differently and must draw on capital differently. Given the historically stable nature of this industry, many telecommeni- cations companies can raise large quantities of capital from the debt markets. In operation comparable to telecommunications services, 50% of the necessary capital is rased in the debt markets at interest rates reflecting solid A quality, on averape. This is beter than Teletech's corporate bond rating of A-/BBB+ I also have to believe that the cost of equity for telecommunications services is lower than it is for products and systems. Although the products and systems segment's sales growth and profitability have been strong, its risks are high Independent equipmest manu facturers are financed with higher-yielding BB-rated deke and a greater proportion of equity In my book, the burdle rate for products and systems should reflect those higher costs of funds. Without the risk-adjusted system of hundle rates, telecommunications services will gradually starve for capital, while perodacts and systems will be force-fed-tha's cause our returns are less than the corporate hurdle rate, and theirs are greater. Telecomma- nications services lowers the risk of the wholke corporation, and should not be penalized Here's a rough graph of what I think is going on (Figure D) Telecommunications services, which can earn 9 10% on capital, is atually profitable on a risk-adjusted basis, even though it is not profitable compared to the corporate hurdle rate. The triangle shape on the drawing shows about where telecommvunications services is located. My hunch is that the reverse is true for products and systems [P&SJ, which pom ises to earn 11.0% on capital. PAS is located on the graph near the Inle circle. In dedng 248 Part Theee Estimating the Cost of Capital FIGURE 1 I Rick Philips's assessment of constant versus risk-adjusted hurdle rates 1800% 16.00% 14.00% 12.00% 10.00% 1- 8.00% 6.00% 4.00% 2.00% 0.00% Products and Telecommunications Services Risk Free Low Risk Teletech Corp. Higher Risk Risk Level Risk-adjusted Hurdle Telotech Corp. Hurdle A Tolecomm. Services O Products and Systems how much to loan us, lenders will consider the composition of risks. If money Bows isto safer investments, over time the cost of their loans to us will decrease. Our stockholders are equally as concerned with risk. If they perceive our business as being more risky than other companies are, they will not pay as high a price for our eam ings. Perhaps this is why our price-to-earnings ratio is below the industry average most of the time. It is not a question of whether we adjust for risk-we already do, informally The only question in my mind is whether we make those adjustments systematically or not. While multiple hurdle rates may not reflect capital-structure changes on a day-90day basis, over time they will reflect prospects more realistically. At the moment, as I unler stand it, our real problem is an inadequate and very costy supply of equity funds really rationing equity capital, then we should be striving for the best returns on equirgy the risk. Multiple hurdle rates achieve that objective. for Implicit in Phillips's argument, as Weston understood it, was the notion du each segment in the company had a different hurdle rate, the costs of the various tn of capital would remain the same. The mix of capital used, however in the calculation. Low-risk operations would use leverage more extensively the high-risk divisions would have little to no debt funds. This lower-risk would have a lower hurdle rate. Cane 16 Teletech Corporation, 2005 249 Opposition to Risk-Adjusted Hurdle Rates While several others within Teletech supported Phil within the products and systems segment. Helen Buono, executive vice president of products and systems, expressed her opinion as follows: lips's views, opposition was strong All money is green. Investors can't know as much about our operations as we do. To them the firm is a black box; they hire us to take care of what is inside the box, and judge us by the dividends coming out of the box. We can't say that one part of the box has a diffiercot hurdle rate than another part of the box if our investors don't think that way. Like I say, all money is green: all investments at Teletech should be judged against one hurdle rane. Multiple hurdle rates are illogical. Suppose that the burdle rate for telecommunica- tions services was much lower than the corporate-wide hurdle rate. If we undertook imvest ments that met the segment hurdle rate, we weren't meeting the corporate hurdle rate. we would be destroying shareholder value because a put our money where the returns are best. A single hurdle rate may deprive an under profitable division of imvestments in order to channel more funds into a more profitable division, but isn't that the aim of the process? Our chal- lenge today is simple: we must earn the highest absolute rates of returm that we can get In reality, we don't finance each division separately. The corporation raises capital based on its overall prospects and record. The diversification of the company probably helps keep our capital costs down and enables us to borrow more in total than the sum of the capabilities of the divisions separatly. As a result, developing separate hurdle rates is both unrealistic and misleading. All our stockholders want is for us to invest our funds wisely in order to increase the value of their stock. This happens when we pick the most promising projects, irrespective of the source. Margaret Weston's Concerns As Weston listened to these arguments, presented over the course of several months, she became increasingly concerned about several related considerations. First, Teletech's corporate strategy had directed the company toward integrating the two segments. One effect of using multiple hurdle rates would be to make justifying high-technology research and application proposals be increased. On the one hand, she thought, perhaps multiple burdle rates were the right idea, but the notion that they should be based on capital costs rather than strategic con- siderations might be wrong. On the other hand, perhaps multiple rates based on capital costs should be used, but, in allocating funds, some qualitative adjustment should be made for unquantifiable strategic considerations. In Weston's mind, the theory was cer- tainly not clear on how to achieve strategic objectives when allocating capital. more difficult, as the required rate of retun woulkd Second, using a single measure of the cost of money (the hurdle rate or discount factor) made the NPV results consistent, at least in economic terms. If Teletech adopted multiple rates for discounting cash flows, Weston was afraid that the NPV and eco- nomic-profit calculations would lose their meaning and comparability across business segments. To her, a performance criterion had to be consistent and understandable, or it would not be useful. 244 Part Three Estimating the Cost of Capital recommend new policies as necessary. What should the hurdle rates be for 1T two business segments, telecommunications services and its newer procth tems unit? Was the products and systems segment really paying its way? for Teletech's The Company The Teletech Corporation, headquartered in Dallas, Texas, defined itself as of integrated information movement and management." The firm had two ness segments: telecommunications services, which provided long-distance, I cellular telephone service to business and residential customers, and the systems segment, which engaged in the manufacture of computing and telecommuni cations equipment. main busi- products and In 2004, telecommunications services had eaned a return on capital (ROC f 9.10%; products and systems had earned 11%. The firm's current book value of assets was S16 billion, consisting of $11.4 billion allocated to telecommunications senv.. ices, and $4.6 billion allocated to products and systems. An internal analysis suggested that telecommunications services accounted for 75% of the market value (MV) of Teletech, while products and systems accounted for 25%. Overall, it appeared that the firm's prospective ROC would be 9.58%. Top management applied a hurdle rate of 9.30% to all capital projects and in the evaluation of the performance of business units. Over the past 12 months, Teletech's shares had not kept pace with the overall stock market or with industry indexes for telephone, equipment, or computer stocks Securities analysts had remarked on the firm's lackluster earnings growth, pointing especially to increasing competition in telecommunications, as well as disappointing performance in the Products and Systems segment. A prominent commentator on TV opined, "There's no precedent for a hostile takeover in this sector, but, in the case o Teletech, there is every reason to try." Teletech Share Prices vs. Market and Industry Indexes 115 Telecom 110 a Eq 105 S&P 100 Telephone 100 95 Nov. Dec. Jan. Fob. Mar. Apr. May June July Aug. Sep. Oct 2004 2005 Retarn on capital was calculated as the ratio of net operating profits after tax (NOPAT) to capital Case 16 Teleech Corporation, 2005 Telecommunications Services 245 Midwest. In 2004, segment revenues, net operati S11 billion, S1.18 billion, and $11.4 billion, The telecommunications services segment provided long-distance, service to more than 7 million customer lines throughout the Revenues in this segment grew at an average rate of local, and cellular Southwest and ng profit after tax (NOPAT), and net assets were 3% during 2 Since the Teletech had coped with the gradual deregulation of its industry t expansion into new services and geographical regions. Most recently, the firm had been a leading bidder for cellular telephone operations and for licenses to offer per- sonal communications services (PCS). In addition, the firm had purchased a number court-ordered breakup of the Bell System telephone monopoly in 1983, vely of telephone-operating companies through privatization auctions in Latin America. Finally, the firm had invested aggressively in new technology-primarily, digital switches and optical-fiber cables--in an effort to enhance its service quality. All of those strategic moves had been costly: the capital budget in this segment had varied between $1.5 billion and $2 billion in each of the previous 10 years. Unfortunately, profit margins in the telecommunications segment had been under pressure for several years. Government regulators had been slow to provide rate relief to Teletech for its capital investments. Other leading telecommunications providers had expanded into Teletech's geographical markets and invested in new technology and quality-enhancing assets. Teletech's management noted that large cable-TV com- panies had aggressively entered the telecommunications market and continued the pressure on profit margins. Nevertheless. Teletech was the dominant service provider in its geographical mar kets and product segments. Customer surveys leader in product quality and customer satisfaction. Its management was confident that the company could command premium prices no matter how the industry might evolve revealed that the company was the Products and Systems Before 2000, telecommunications had been the company's core business, supple- mented by an equipment-manufacturing division that produced telecommunications components. In 2000, the company acquired a leading computer-workstation manu- facturer with the goal of applying state-of-the-art compating technology to the design of telecommunications equipment. The explosive growth in the microcomputer mar- ket and the increased usage of telephone lines to connect home- and office-based com- puters with mainframes convinced Teletech's management of the potential value of marrying telecommunications equipment with computing technology. Using Teletech's capital base, borrowing ability, and distribution network to catapult growth, the prod- ucts and systems 2004 NOPAT and net assets were $480 million and $4.6 billion, respectively The products and systems segment was acknowledged as a technology leader in the industry. While this accounted for its rapid growth and pricing power, maintenance segment increased its sales by nearly 40% in 2004. This segment's Hurdle Rates Case 16 Teleech Corporation, 200 7 The hurdle rate used in the assessments of economic focus of considerable debate in recent moeths. This rate was based on an estimate of Teletech's weighted average cost of capital (WACC). Management was completely satisfied with the intellectual relevance of a hurdle rate as an expression of the oppor- tunity cost of money. The notion that the WACC represented this opportunity cost had been hotly debated within the company, and while its measurement had never been considered wholly scientific, it was generally accepted. profit and NPV had been the Teletech was "split-rated between A- and BBB+. An investment banker recently suggested that, at those ratings, new debt funds might cost Teletech 5,88% (about 3.53 after a 40% tax rate). With a beta of 1.15, the cost of equity might be about 1095 At market-value weights of 22% for debt and 78% for equity, the resulting w ACC would be 9.30%. Exhibit 1 summarizes the calculation. The hurdle rate of 9.30% was applied to all investment and performance-measurement analyses at the firm Arguments for Risk-Adjusted Hurdle Rates How the rate should be used within the company in evaluating projects was another point one faced, differences of opinion arose at the segment level over the appropriateness of measuring all projects against the corporate hurdle rate of 9.30%. The chief ad cate for multiple rates was Rick Phillips, executive vice president of telecommanica- tions services, who presented his views as follows: two basinesses and the risks each Each phase of our business is different. They mast compete differently and must draw on capital differently. Given the historically stable nature of this industry, many telecommeni- cations companies can raise large quantities of capital from the debt markets. In operation comparable to telecommunications services, 50% of the necessary capital is rased in the debt markets at interest rates reflecting solid A quality, on averape. This is beter than Teletech's corporate bond rating of A-/BBB+ I also have to believe that the cost of equity for telecommunications services is lower than it is for products and systems. Although the products and systems segment's sales growth and profitability have been strong, its risks are high Independent equipmest manu facturers are financed with higher-yielding BB-rated deke and a greater proportion of equity In my book, the burdle rate for products and systems should reflect those higher costs of funds. Without the risk-adjusted system of hundle rates, telecommunications services will gradually starve for capital, while perodacts and systems will be force-fed-tha's cause our returns are less than the corporate hurdle rate, and theirs are greater. Telecomma- nications services lowers the risk of the wholke corporation, and should not be penalized Here's a rough graph of what I think is going on (Figure D) Telecommunications services, which can earn 9 10% on capital, is atually profitable on a risk-adjusted basis, even though it is not profitable compared to the corporate hurdle rate. The triangle shape on the drawing shows about where telecommvunications services is located. My hunch is that the reverse is true for products and systems [P&SJ, which pom ises to earn 11.0% on capital. PAS is located on the graph near the Inle circle. In dedng 248 Part Theee Estimating the Cost of Capital FIGURE 1 I Rick Philips's assessment of constant versus risk-adjusted hurdle rates 1800% 16.00% 14.00% 12.00% 10.00% 1- 8.00% 6.00% 4.00% 2.00% 0.00% Products and Telecommunications Services Risk Free Low Risk Teletech Corp. Higher Risk Risk Level Risk-adjusted Hurdle Telotech Corp. Hurdle A Tolecomm. Services O Products and Systems how much to loan us, lenders will consider the composition of risks. If money Bows isto safer investments, over time the cost of their loans to us will decrease. Our stockholders are equally as concerned with risk. If they perceive our business as being more risky than other companies are, they will not pay as high a price for our eam ings. Perhaps this is why our price-to-earnings ratio is below the industry average most of the time. It is not a question of whether we adjust for risk-we already do, informally The only question in my mind is whether we make those adjustments systematically or not. While multiple hurdle rates may not reflect capital-structure changes on a day-90day basis, over time they will reflect prospects more realistically. At the moment, as I unler stand it, our real problem is an inadequate and very costy supply of equity funds really rationing equity capital, then we should be striving for the best returns on equirgy the risk. Multiple hurdle rates achieve that objective. for Implicit in Phillips's argument, as Weston understood it, was the notion du each segment in the company had a different hurdle rate, the costs of the various tn of capital would remain the same. The mix of capital used, however in the calculation. Low-risk operations would use leverage more extensively the high-risk divisions would have little to no debt funds. This lower-risk would have a lower hurdle rate. Cane 16 Teletech Corporation, 2005 249 Opposition to Risk-Adjusted Hurdle Rates While several others within Teletech supported Phil within the products and systems segment. Helen Buono, executive vice president of products and systems, expressed her opinion as follows: lips's views, opposition was strong All money is green. Investors can't know as much about our operations as we do. To them the firm is a black box; they hire us to take care of what is inside the box, and judge us by the dividends coming out of the box. We can't say that one part of the box has a diffiercot hurdle rate than another part of the box if our investors don't think that way. Like I say, all money is green: all investments at Teletech should be judged against one hurdle rane. Multiple hurdle rates are illogical. Suppose that the burdle rate for telecommunica- tions services was much lower than the corporate-wide hurdle rate. If we undertook imvest ments that met the segment hurdle rate, we weren't meeting the corporate hurdle rate. we would be destroying shareholder value because a put our money where the returns are best. A single hurdle rate may deprive an under profitable division of imvestments in order to channel more funds into a more profitable division, but isn't that the aim of the process? Our chal- lenge today is simple: we must earn the highest absolute rates of returm that we can get In reality, we don't finance each division separately. The corporation raises capital based on its overall prospects and record. The diversification of the company probably helps keep our capital costs down and enables us to borrow more in total than the sum of the capabilities of the divisions separatly. As a result, developing separate hurdle rates is both unrealistic and misleading. All our stockholders want is for us to invest our funds wisely in order to increase the value of their stock. This happens when we pick the most promising projects, irrespective of the source. Margaret Weston's Concerns As Weston listened to these arguments, presented over the course of several months, she became increasingly concerned about several related considerations. First, Teletech's corporate strategy had directed the company toward integrating the two segments. One effect of using multiple hurdle rates would be to make justifying high-technology research and application proposals be increased. On the one hand, she thought, perhaps multiple burdle rates were the right idea, but the notion that they should be based on capital costs rather than strategic con- siderations might be wrong. On the other hand, perhaps multiple rates based on capital costs should be used, but, in allocating funds, some qualitative adjustment should be made for unquantifiable strategic considerations. In Weston's mind, the theory was cer- tainly not clear on how to achieve strategic objectives when allocating capital. more difficult, as the required rate of retun woulkd Second, using a single measure of the cost of money (the hurdle rate or discount factor) made the NPV results consistent, at least in economic terms. If Teletech adopted multiple rates for discounting cash flows, Weston was afraid that the NPV and eco- nomic-profit calculations would lose their meaning and comparability across business segments. To her, a performance criterion had to be consistent and understandable, or it would not be useful