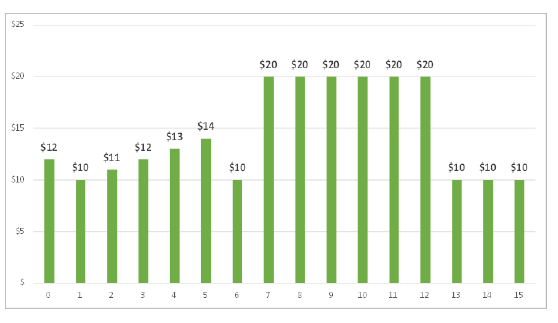

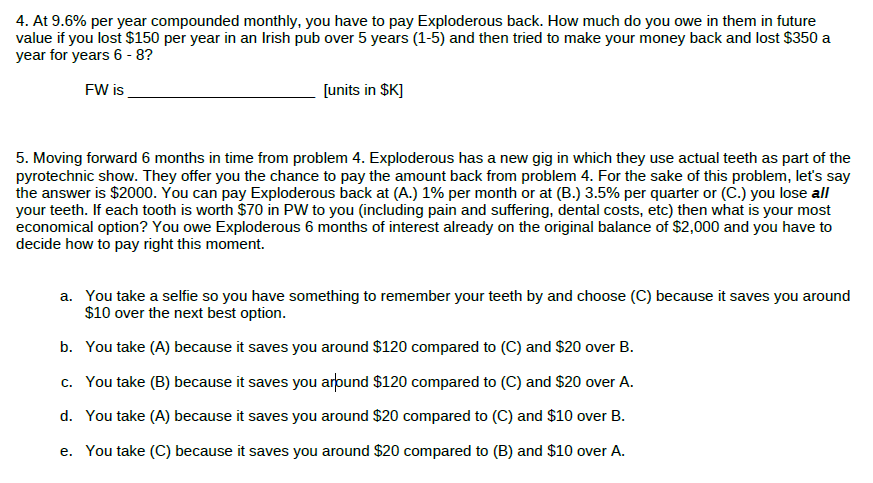

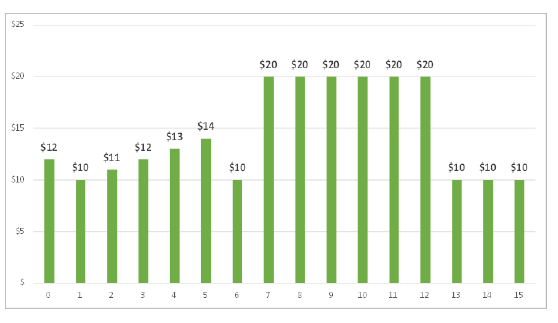

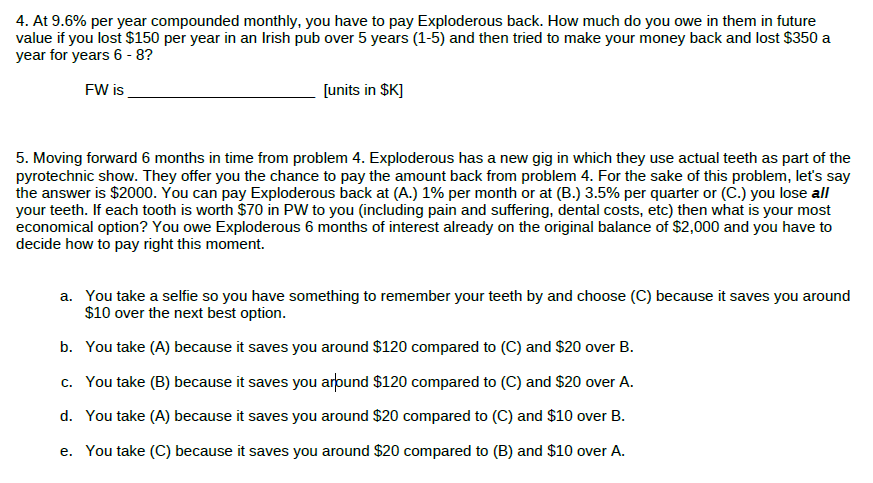

$25 $20 $20 $20 $20 $20 $20 $20 $15 $14 $13 $12 $12 $11 $10 $10 $10 $10 $10 $10 $5 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 4. At 9.6% per year compounded monthly, you have to pay Exploderous back. How much do you owe in them in future value if you lost $150 per year in an Irish pub over 5 years (1-5) and then tried to make your money back and lost $350 a year for years 6-8? FW is [units in $K] 5. Moving forward 6 months in time from problem 4. Exploderous has a new gig in which they use actual teeth as part of the pyrotechnic show. They offer you the chance to pay the amount back from problem 4. For the sake of this problem, let's say the answer is $2000. You can pay Exploderous back at (A.) 1% per month or at (B.) 3.5% per quarter or (C.) you lose all your teeth. If each tooth is worth $70 in PW to you (including pain and suffering, dental costs, etc) then what is your most economical option? You owe Exploderous 6 months of interest already on the original balance of $2,000 and you have to decide how to pay right this moment. a. You take a selfie so you have something to remember your teeth by and choose (C) because it saves you around $10 over the next best option. b. You take (A) because it saves you around $120 compared to (C) and $20 over B. C. You take (B) because it saves you arund $120 compared to (C) and $20 over A. d. You take (A) because it saves you around $20 compared to (C) and $10 over B. e. You take (C) because it saves you around $20 compared to (B) and $10 over A. $25 $20 $20 $20 $20 $20 $20 $20 $15 $14 $13 $12 $12 $11 $10 $10 $10 $10 $10 $10 $5 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 4. At 9.6% per year compounded monthly, you have to pay Exploderous back. How much do you owe in them in future value if you lost $150 per year in an Irish pub over 5 years (1-5) and then tried to make your money back and lost $350 a year for years 6-8? FW is [units in $K] 5. Moving forward 6 months in time from problem 4. Exploderous has a new gig in which they use actual teeth as part of the pyrotechnic show. They offer you the chance to pay the amount back from problem 4. For the sake of this problem, let's say the answer is $2000. You can pay Exploderous back at (A.) 1% per month or at (B.) 3.5% per quarter or (C.) you lose all your teeth. If each tooth is worth $70 in PW to you (including pain and suffering, dental costs, etc) then what is your most economical option? You owe Exploderous 6 months of interest already on the original balance of $2,000 and you have to decide how to pay right this moment. a. You take a selfie so you have something to remember your teeth by and choose (C) because it saves you around $10 over the next best option. b. You take (A) because it saves you around $120 compared to (C) and $20 over B. C. You take (B) because it saves you arund $120 compared to (C) and $20 over A. d. You take (A) because it saves you around $20 compared to (C) and $10 over B. e. You take (C) because it saves you around $20 compared to (B) and $10 over A