Answered step by step

Verified Expert Solution

Question

1 Approved Answer

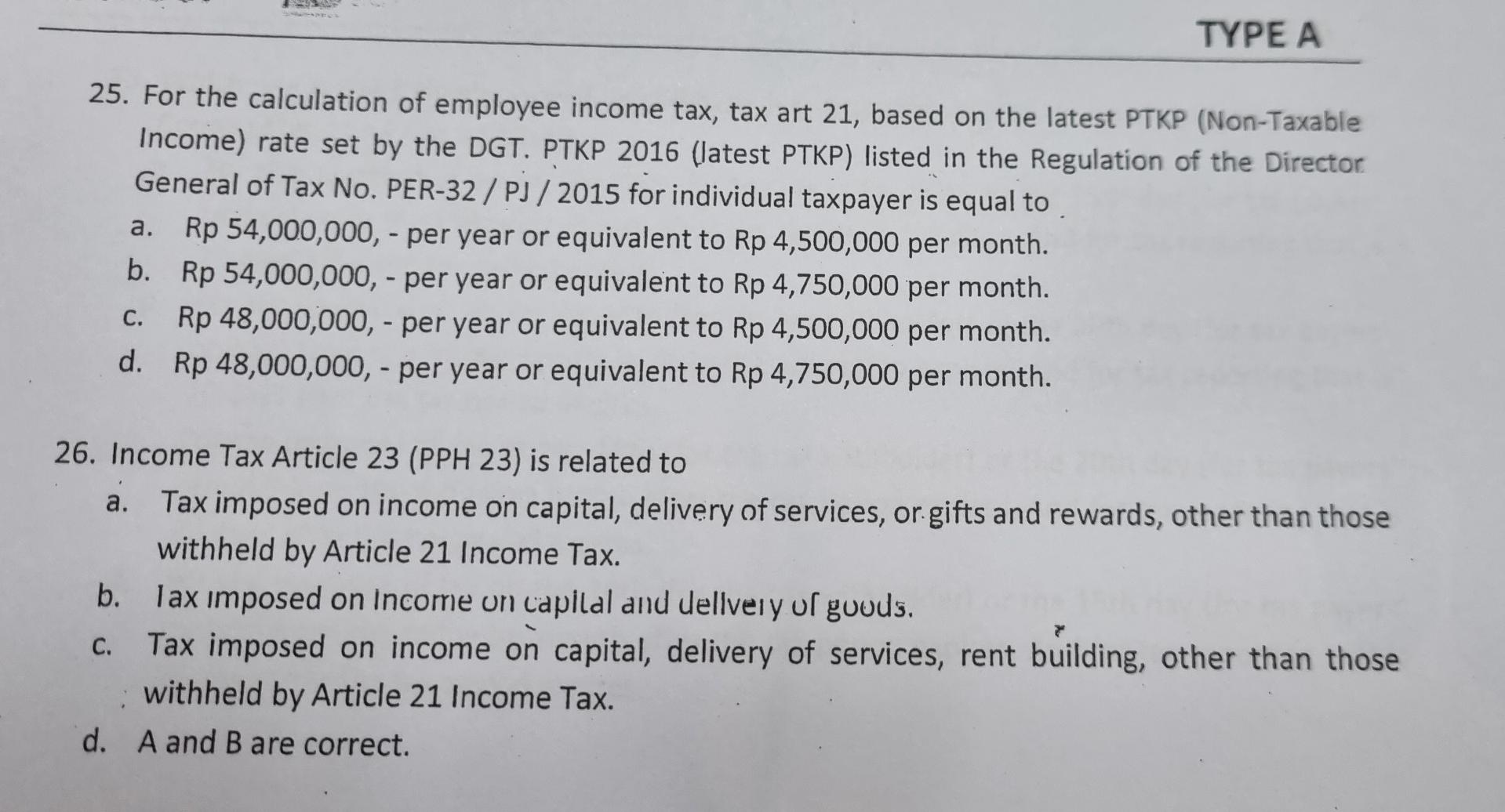

25. For the calculation of employee income tax, tax art 21 , based on the latest PTKP (Non-Taxable Income) rate set by the DGT. PTKP

25. For the calculation of employee income tax, tax art 21 , based on the latest PTKP (Non-Taxable Income) rate set by the DGT. PTKP 2016 (latest PTKP) listed in the Regulation of the Director. General of Tax No. PER-32 / PJ / 2015 for individual taxpayer is equal to a. Rp 54,000,000, - per year or equivalent to Rp4,500,000 per month. b. Rp54,000,000, - per year or equivalent to Rp4,750,000 per month. c. Rp 48,000,000, - per year or equivalent to Rp4,500,000 per month. 26. Income Tax Article 23(PPH23) is related to a. Tax imposed on income on capital, delivery of services, or gifts and rewards, other than those withheld by Article 21 Income Tax. b. Iax imposed on Incorrie un capllal and lellvery ur guuds. c. Tax imposed on income on capital, delivery of services, rent building, other than those withheld by Article 21 Income Tax. d. A and B are correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started