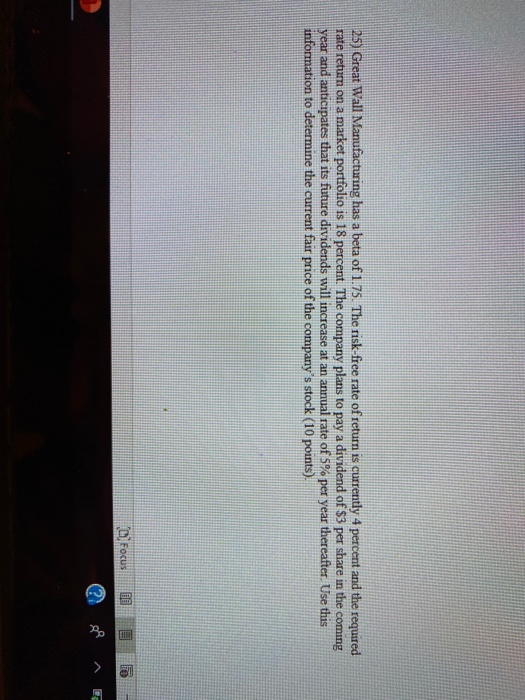

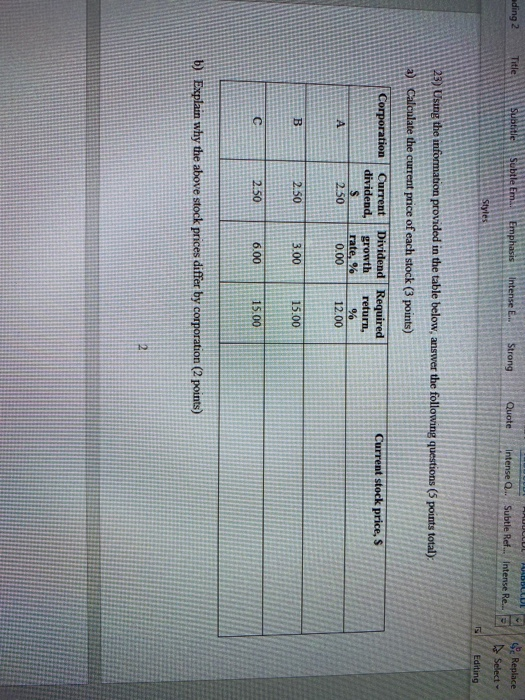

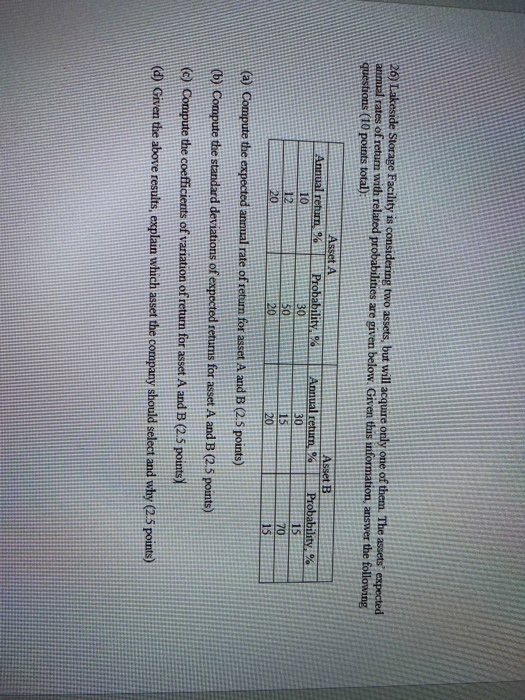

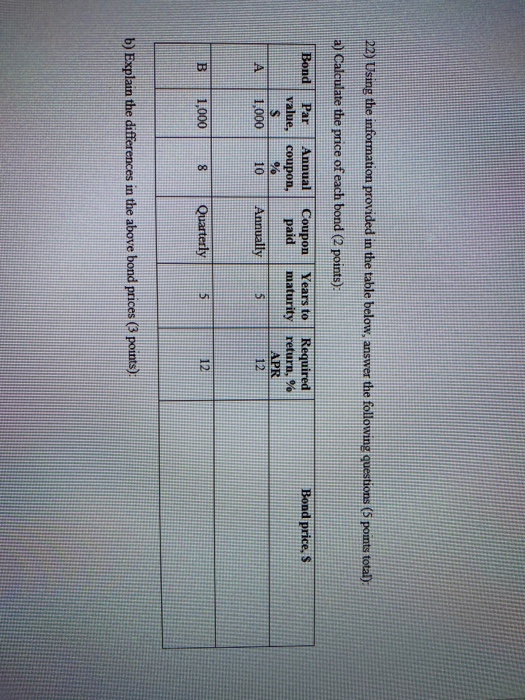

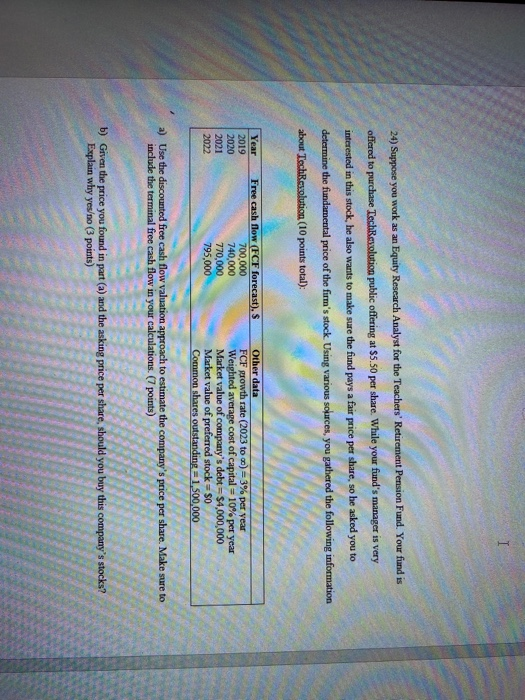

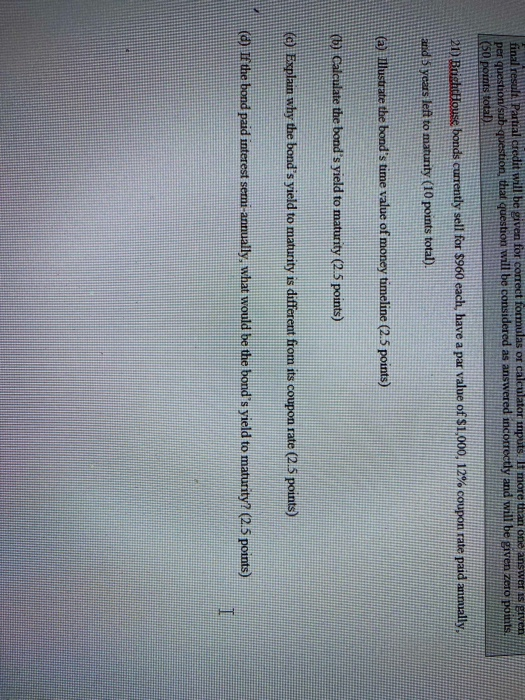

25) Great Wall Manufacturing has a beta of 1.75. The risk-free rate of return is currently 4 percent and the required rate retum on a market portfolio is 18 percent. The company plans to pay a dividend of $3 per share in the coming year and anticipates that its future dividends will increase at an annual rate of 5% per year thereafter. Use this information to determine the current fair price of the company's stock (10 points). | 3 To ading 2 Title Subtle Em Emphasis intense E. Strong Quote Intense Q... Subtle Ref... Intense Re... Replace Select Styles 5 Editing 123) Using the information provided in the table below, answer the following questions (5 points total) 2) Calculate the current price of each stock (3 points) Corporation Current stock price, Current Dividend Required dividend, growth return, rate, % 0.00 12.00 2.503.00 ||15.00 2.50 6.00 15.00 b) Explain why the above stock prices differ by corporation (2 points) 26) Lakeside Storage Facility is considering two assets, but will acquire only one of them. The assets expected me rates of return with related probabilities are given below. Given this information, answer the following questions (10 points total): Asset A Annual return % Probability % Asset B Annual return % Probability. % 30 2011 aCompute the expected annual rate of return for asset A and B (2.5 points) (6) Compute the standard deviations of expected returns for asset A and B (2.5 points) ( Compute the coefficients of variation of retum for asset A and B (2.5 points) (D) Given the above results, explain which asset the company should select and why (25 points) 22) Using the information provided in the table below, answer the following questions (5 points total): a) Calculate the price of each bond (2 points): Bond Par Annual Coupon Years to Re Bond price, s value, coupon, paid maturity 1,000 10 Annually B 1.000 | 8 Quarterly b) Explain the differences in the above bond prices (3 points): 24) Suppose you work as an Equity Research Analyst for the Teachers' Retirement Pension Fund. Your fund is offered to purchase TechRevolution public offering at $5.50 per share. While your fund's manager is very interested in this stock, he also wants to make sure the fund pays a fair price per share, so he asked you to determine the fundamental price of the firm's stock. Using various sources, you gathered the following information about TechResolution (10 points total): Year 2019 2020 2021 Free cash flow (FCF forecast). S 700.000 740,000 770,000 795,000 Other data FCF growth rate (2023 to ) = 3% per year Weighted average cost of capital = 10% per year Market value of company's debt = $4,000,000 Market value of preferred stock = $0 Common shares outstanding = 1,500,000 2022 a) Use the discounted free cash flow valuation approach to estimate the company's price per share. Make sure to include the terminal free cash flow in your calculations (7 points) b) Given the price you found in part (a) and the asking price per share, should you buy this company's stocks? Explain why yeso (3 points) final result. Partial credit will be given for correct formulas or calculator inputs. If more than one answer is given per question/sub question, that question will be considered as answered incorrectly and will be given zero points! (50 points total) Bush House bonds currently sell for $960 each, have a par value of $1,000, 12% coupon rate paid annually. and 5 years left to matunity (10 points total). ) Illustrate the bond's time value of money timeline (2.5 points) (b) Calculate the bond's yield to maturity (2.5 points) KO) Explain why the band's yield to maturity is different from its coupon rate (2.5 points) (d) If the bond paid interest semi-annually, what would be the bond's yield to maturity? (2.5 points)