Question

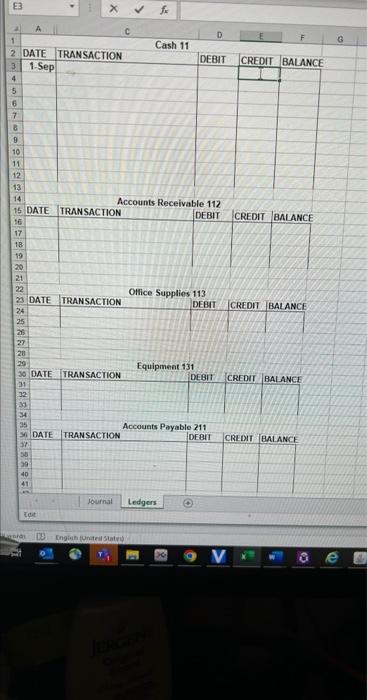

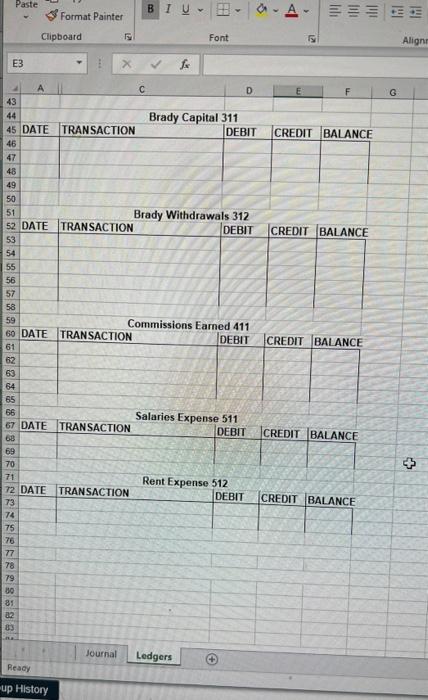

25. Matt Brady Owns and operates Brady Real Estate Partners Inc. He uses the following chart of accounts: Cash 111, Accounts Receivable 112, Office Supplies,

25. Matt Brady Owns and operates Brady Real Estate Partners Inc. He uses the following chart of accounts: Cash 111, Accounts Receivable 112, Office Supplies, 113, Equipment 131, Accounts Payable 211, Brady Capital 311, Brady Withdrawals, 312 Commissions Earned (Revenue) 411, Salaries Expense 511, Rent Expense 512.

Brady Real Estate Partners completed the following transactions during the month of September 2021.

9/1 Matt Brady invested $11,000 into the business.

9/3 Purchased $300 of office supplies on account

9/7. Purchased 2,800 worth of equipment on account.

9/9. Real estate commissions billed to clients, $5,000 on account.

9/14 Paid $2,200 cash for office salaries.

9/18 Paid $200 cash on account for office supplies purchased on 9/3.

9/23 Received a check for $3,100 from a client in payment on account for commissions billed on 9/9

9/24 Brady withdrew $400 from the business for personal use.

9/28 Paid $1100 cash for monthly rent.

Instructions:

1. Journalize the transactions using the attached journal template. Please include short explanations.

2. Post the journal transactions into the attached ledger template provided.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started