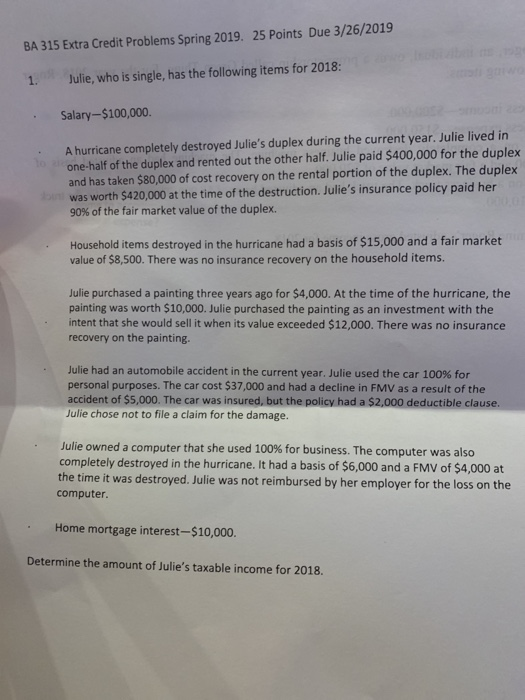

25 Points Due 3/26/2019 BA 315 Extra Credit Problems Spring 2019. 1. Julie, who is single, has the following items for 2018: Salary-$100,000 A hurricane completely destroyed Julie's duplex during the current year. Julie lived in one-half of the duplex and rented out the other half. Julie paid $400,000 for the duplex and has taken $80,000 of cost recovery on the rental portion of the duplex. The duplex was worth $420,000 at the time of the destruction. Julie's insurance policy paid her 90% of the fair market value of the duplex. Household items destroyed in the hurricane had a basis of $15,000 and a fair market value of $8,500. There was no insurance recovery on the household items. Julie purchased a painting three years ago for $4,000. At the time of the hurricane, the painting was worth $10,000. Julie purchased the painting as an investment with the intent that she would sell it when its value exceeded $12,000. There was no insurance recovery on the painting. Julie had an automobile accident in the current year. Julie used the car 100% for personal purposes. The car cost $37,000 and had a decline in FMV as a result of the accident of $5,000. The car was insured, but the policy had a $2,000 deductible clause. Julie chose not to file a claim for the damage. Julie owned a computer that she used 100% for business. The computer was also completely destroyed in the hurricane. It had a basis of $6,000 and a FMV of $4,000 at the time it was destroyed. Julie was not reimbursed by her employer for the loss on the computer. Home mortgage interest-$10,000. . Determine the amount of Julie's taxable income for 2018. 25 Points Due 3/26/2019 BA 315 Extra Credit Problems Spring 2019. 1. Julie, who is single, has the following items for 2018: Salary-$100,000 A hurricane completely destroyed Julie's duplex during the current year. Julie lived in one-half of the duplex and rented out the other half. Julie paid $400,000 for the duplex and has taken $80,000 of cost recovery on the rental portion of the duplex. The duplex was worth $420,000 at the time of the destruction. Julie's insurance policy paid her 90% of the fair market value of the duplex. Household items destroyed in the hurricane had a basis of $15,000 and a fair market value of $8,500. There was no insurance recovery on the household items. Julie purchased a painting three years ago for $4,000. At the time of the hurricane, the painting was worth $10,000. Julie purchased the painting as an investment with the intent that she would sell it when its value exceeded $12,000. There was no insurance recovery on the painting. Julie had an automobile accident in the current year. Julie used the car 100% for personal purposes. The car cost $37,000 and had a decline in FMV as a result of the accident of $5,000. The car was insured, but the policy had a $2,000 deductible clause. Julie chose not to file a claim for the damage. Julie owned a computer that she used 100% for business. The computer was also completely destroyed in the hurricane. It had a basis of $6,000 and a FMV of $4,000 at the time it was destroyed. Julie was not reimbursed by her employer for the loss on the computer. Home mortgage interest-$10,000. . Determine the amount of Julie's taxable income for 2018