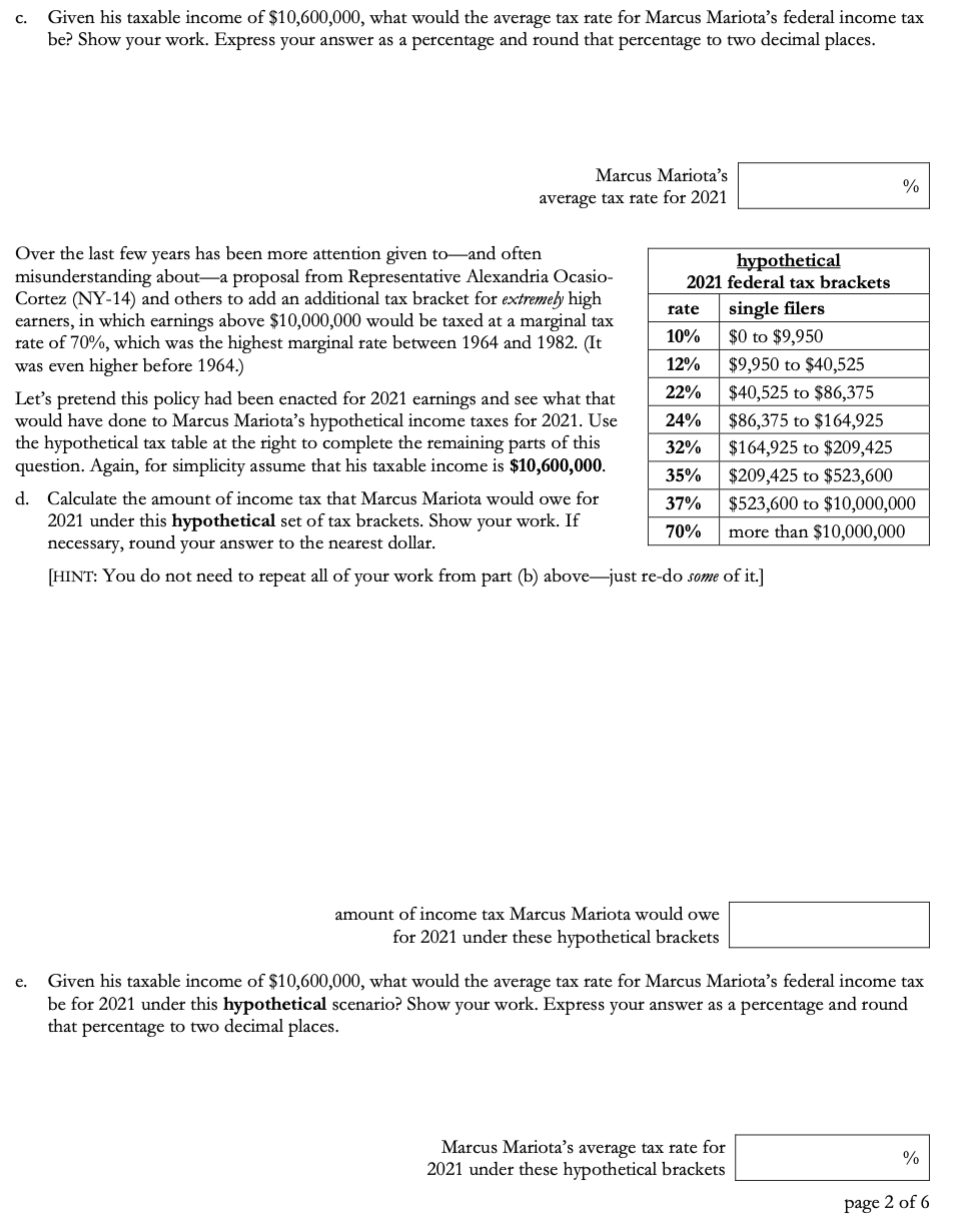

(2.5 points) In March 2021 it was reported that Marcus Mariota-NFL quarterback with the Las Vegas Raiders and Heisman-trophy-winning Oregon Duckwas slated to earn a base salary of $10,600,000 this year. For simplicity, let's assume that he earns $10,600,000 of taxable income during 2021 (that is, after the standard deduction has already been accounted for). What would Marcus Mariota's marginal tax rate be for 2021? Briefly explain. a. Marcus Mariota's marginal tax rate for 2021 % b. Calculate the amount of income tax that Marcus Mariota would owe for 2021. The income tax brackets for 2021 appear on the Session 8A slides, the Section 8 activity sheet, and part (c) of this question (except without the last hypothetical row). Show your work. If necessary, round your answer the nearest dollar. amount of income tax Marcus Mariota would owe for 2021 page 1 of 6 C. Given his taxable income of $10,600,000, what would the average tax rate for Marcus Mariota's federal income tax be? Show your work. Express your answer as a percentage and round that percentage to two decimal places. Marcus Mariota's average tax rate for 2021 % rate Over the last few years has been more attention given toand often hypothetical misunderstanding abouta proposal from Representative Alexandria Ocasio- 2021 federal tax brackets Cortez (NY-14) and others to add an additional tax bracket for extremely high earners, in which earnings above $10,000,000 would be taxed at a marginal tax single filers 10% rate of 70%, which was the highest marginal rate between 1964 and 1982. (It $0 to $9,950 was even higher before 1964.) 12% $9,950 to $40,525 Let's pretend this policy had been enacted for 2021 earnings and see what that 22% $40,525 to $86,375 would have done to Marcus Mariota's hypothetical income taxes for 2021. Use 24% $86,375 to $164,925 the hypothetical tax table at the right to complete the remaining parts of this 32% $164,925 to $209,425 question. Again, for simplicity assume that his taxable income is $10,600,000. 35% $209,425 to $523,600 d. Calculate the amount of income tax that Marcus Mariota would owe for 37% $523,600 to $10,000,000 2021 under this hypothetical set of tax brackets. Show your work. If 70% more than $10,000,000 necessary, round your answer to the nearest dollar. [HINT: You do not need to repeat all of your work from part (b) abovejust re-do some of it.] amount of income tax Marcus Mariota would owe for 2021 under these hypothetical brackets e. Given his taxable income of $10,600,000, what would the average tax rate for Marcus Mariota's federal income tax be for 2021 under this hypothetical scenario? Show your work. Express your answer as a percentage and round that percentage to two decimal places. Marcus Mariota's average tax rate for 2021 under these hypothetical brackets % page 2 of 6 (2.5 points) In March 2021 it was reported that Marcus Mariota-NFL quarterback with the Las Vegas Raiders and Heisman-trophy-winning Oregon Duckwas slated to earn a base salary of $10,600,000 this year. For simplicity, let's assume that he earns $10,600,000 of taxable income during 2021 (that is, after the standard deduction has already been accounted for). What would Marcus Mariota's marginal tax rate be for 2021? Briefly explain. a. Marcus Mariota's marginal tax rate for 2021 % b. Calculate the amount of income tax that Marcus Mariota would owe for 2021. The income tax brackets for 2021 appear on the Session 8A slides, the Section 8 activity sheet, and part (c) of this question (except without the last hypothetical row). Show your work. If necessary, round your answer the nearest dollar. amount of income tax Marcus Mariota would owe for 2021 page 1 of 6 C. Given his taxable income of $10,600,000, what would the average tax rate for Marcus Mariota's federal income tax be? Show your work. Express your answer as a percentage and round that percentage to two decimal places. Marcus Mariota's average tax rate for 2021 % rate Over the last few years has been more attention given toand often hypothetical misunderstanding abouta proposal from Representative Alexandria Ocasio- 2021 federal tax brackets Cortez (NY-14) and others to add an additional tax bracket for extremely high earners, in which earnings above $10,000,000 would be taxed at a marginal tax single filers 10% rate of 70%, which was the highest marginal rate between 1964 and 1982. (It $0 to $9,950 was even higher before 1964.) 12% $9,950 to $40,525 Let's pretend this policy had been enacted for 2021 earnings and see what that 22% $40,525 to $86,375 would have done to Marcus Mariota's hypothetical income taxes for 2021. Use 24% $86,375 to $164,925 the hypothetical tax table at the right to complete the remaining parts of this 32% $164,925 to $209,425 question. Again, for simplicity assume that his taxable income is $10,600,000. 35% $209,425 to $523,600 d. Calculate the amount of income tax that Marcus Mariota would owe for 37% $523,600 to $10,000,000 2021 under this hypothetical set of tax brackets. Show your work. If 70% more than $10,000,000 necessary, round your answer to the nearest dollar. [HINT: You do not need to repeat all of your work from part (b) abovejust re-do some of it.] amount of income tax Marcus Mariota would owe for 2021 under these hypothetical brackets e. Given his taxable income of $10,600,000, what would the average tax rate for Marcus Mariota's federal income tax be for 2021 under this hypothetical scenario? Show your work. Express your answer as a percentage and round that percentage to two decimal places. Marcus Mariota's average tax rate for 2021 under these hypothetical brackets % page 2 of 6