Answered step by step

Verified Expert Solution

Question

1 Approved Answer

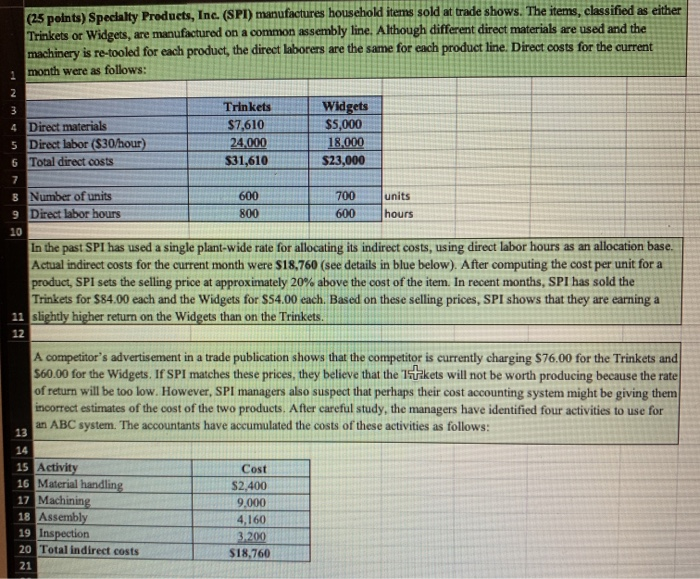

2 (25 points) Specialty Products, Inc. (SPI) manufactures household items sold at trade shows. The items, classified as either Trinkets or Widgets, are manufactured

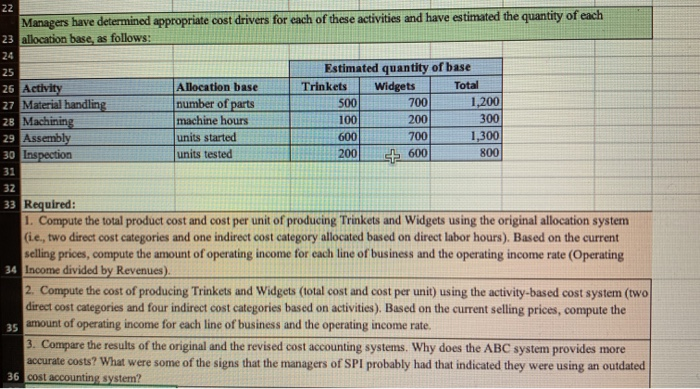

2 (25 points) Specialty Products, Inc. (SPI) manufactures household items sold at trade shows. The items, classified as either Trinkets or Widgets, are manufactured on a common assembly line. Although different direct materials are used and the machinery is re-tooled for each product, the direct laborers are the same for each product line. Direct costs for the current month were as follows: 3 4 Direct materials 5 Direct labor ($30/hour) 6 Total direct costs 7 8 Number of units 9 Direct labor hours 10 Trinkets $7,610 24,000 $31,610 13 14 15 Activity 16 Material handling 17 Machining 600 800 18 Assembly 19 Inspection 20 Total indirect costs 21 Widgets $5,000 18,000 $23,000 In the past SPI has used a single plant-wide rate for allocating its indirect costs, using direct labor hours as an allocation base. Actual indirect costs for the current month were $18,760 (see details in blue below). After computing the cost per unit for a product, SPI sets the selling price at approximately 20% above the cost of the item. In recent months, SPI has sold the Trinkets for $84.00 each and the Widgets for $54.00 each. Based on these selling prices, SPI shows that they are earning a 11 slightly higher return on the Widgets than on the Trinkets. 12 700 600 A competitor's advertisement in a trade publication shows that the competitor is currently charging $76.00 for the Trinkets and $60.00 for the Widgets. If SPI matches these prices, they believe that the 15takets will not be worth producing because the rate of return will be too low. However, SPI managers also suspect that perhaps their cost accounting system might be giving them incorrect estimates of the cost of the two products. After careful study, the managers have identified four activities to use for an ABC system. The accountants have accumulated the costs of these activities as follows: Cost $2,400 9,000 4,160 3.200 $18,760 units hours 22 Managers have determined appropriate cost drivers for each of these activities and have estimated the quantity of each 23 allocation base, as follows: 24 25 26 Activity 27 Material handling 28 Machining 29 Assembly 30 Inspection 31 Allocation base number of parts machine hours units started units tested Estimated quantity of base Widgets Total Trinkets 500 100 600 200 700 200 700 600 1,200 300 1,300 800 32 33 Required: 1. Compute the total product cost and cost per unit of producing Trinkets and Widgets using the original allocation system (i.e., two direct cost categories and one indirect cost category allocated based on direct labor hours). Based on the current selling prices, compute the amount of operating income for each line of business and the operating income rate (Operating 34 Income divided by Revenues). 2. Compute the cost of producing Trinkets and Widgets (total cost and cost per unit) using the activity-based cost system (two) direct cost categories and four indirect cost categories based on activities). Based on the current selling prices, compute the amount of operating income for each line of business and the operating income rate. 35 3. Compare the results of the original and the revised cost accounting systems. Why does the ABC system provides more accurate costs? What were some of the signs that the managers of SPI probably had that indicated they were using an outdated 36 cost accounting system?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the total product cost and cost per unit of producing Trinkets and Widgets using the original allocation system as required in part 1 we ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started