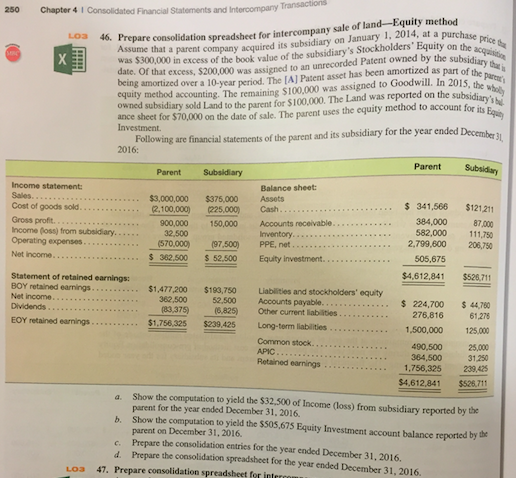

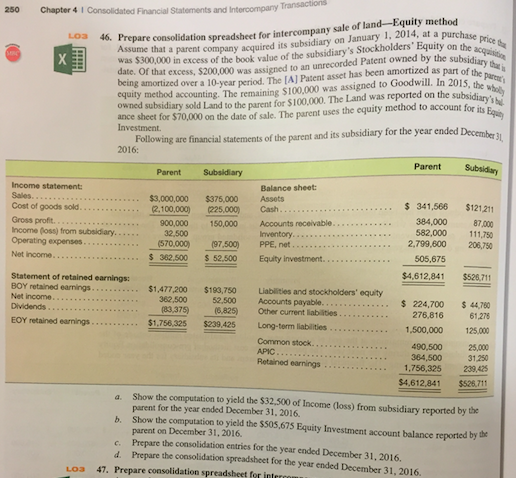

250 Chapter 4 1 Consolidated Financial Statements and Intercompary T Loa 46. Prepare consolidation spreadsheet for intercompany sale of land-Equity method price was $300,000 in excess of the book value of the subsidiary's Stockholders Equity on the date. Of that excess, $200, bein being amortized over a 10-year period. The [A] Patent asset has been amortized as part of the equity method accounting. The remaining S 100,000 was assigned to Goodwill. In 2015, the owned subsidiary sold Land to the parent for $100,000. The Land was reported on the subsi subsidiary on January 1, 2014, at a Assume that a parent company acquired its y thu 000 was assigned to an unrecorded Patent owned by the sub ance sheet for $70,000 on the date of sale. The parent uses the equity method to account for its In Following are financial statements of the parent and its subsidiary for the year ended Decembe 2016: Parent Subsidiary Parent Subsidiary Income statement: Sales. Cost of goods sold Gross proft Balance sheet: 5000000 $375,000 Aasets (2,100,000) 25,000) s 341,566 $121211 Cash 384,000 87000 582,000 111,70 2,799,600 206,750 900,000 150,000 Accounts receivable Operating expenses Net income 32,500 (570,000) 382,500 $ 52.500 Equity investment. (97,500) PPE, net 505,675 $4,612,841 $526,711 Statement of retained earnings: BOY retained earnings Net income. $1.477 200 $183,750 Liabilities and stockholders' equity 52,500 Accounts payable. (6.825) Other current liablities 224,700 $44,780 61,278 375) 276,816 $1.756.325 $239.425 Long-term liabilities.... Common stock. APIC Retained earnings 1,500,000 125,000 490,500 25,000 . 364,500 31250 1,756,325 239,42 $4,612,841 $526.711 a. Show the computation to yield the $32.,500 of Income (loss) from subsidiary reported by the parent for the year ended December 31, 2016. Show the computation to yield the $505,675 Equity Investment account balance reported by the parent on December 31, 2016 b. the consolidation entries for the year ended December 31, 2016. the consolidation spreadsheet for the year ended December 31, 2016. L03 47. Prepare consolidation spreadsheet for interro 250 Chapter 4 1 Consolidated Financial Statements and Intercompary T Loa 46. Prepare consolidation spreadsheet for intercompany sale of land-Equity method price was $300,000 in excess of the book value of the subsidiary's Stockholders Equity on the date. Of that excess, $200, bein being amortized over a 10-year period. The [A] Patent asset has been amortized as part of the equity method accounting. The remaining S 100,000 was assigned to Goodwill. In 2015, the owned subsidiary sold Land to the parent for $100,000. The Land was reported on the subsi subsidiary on January 1, 2014, at a Assume that a parent company acquired its y thu 000 was assigned to an unrecorded Patent owned by the sub ance sheet for $70,000 on the date of sale. The parent uses the equity method to account for its In Following are financial statements of the parent and its subsidiary for the year ended Decembe 2016: Parent Subsidiary Parent Subsidiary Income statement: Sales. Cost of goods sold Gross proft Balance sheet: 5000000 $375,000 Aasets (2,100,000) 25,000) s 341,566 $121211 Cash 384,000 87000 582,000 111,70 2,799,600 206,750 900,000 150,000 Accounts receivable Operating expenses Net income 32,500 (570,000) 382,500 $ 52.500 Equity investment. (97,500) PPE, net 505,675 $4,612,841 $526,711 Statement of retained earnings: BOY retained earnings Net income. $1.477 200 $183,750 Liabilities and stockholders' equity 52,500 Accounts payable. (6.825) Other current liablities 224,700 $44,780 61,278 375) 276,816 $1.756.325 $239.425 Long-term liabilities.... Common stock. APIC Retained earnings 1,500,000 125,000 490,500 25,000 . 364,500 31250 1,756,325 239,42 $4,612,841 $526.711 a. Show the computation to yield the $32.,500 of Income (loss) from subsidiary reported by the parent for the year ended December 31, 2016. Show the computation to yield the $505,675 Equity Investment account balance reported by the parent on December 31, 2016 b. the consolidation entries for the year ended December 31, 2016. the consolidation spreadsheet for the year ended December 31, 2016. L03 47. Prepare consolidation spreadsheet for interro