Question

PROBLEM 1 On January 1 of the current year A and B form a partnership to invest in property. A contributes investment land that

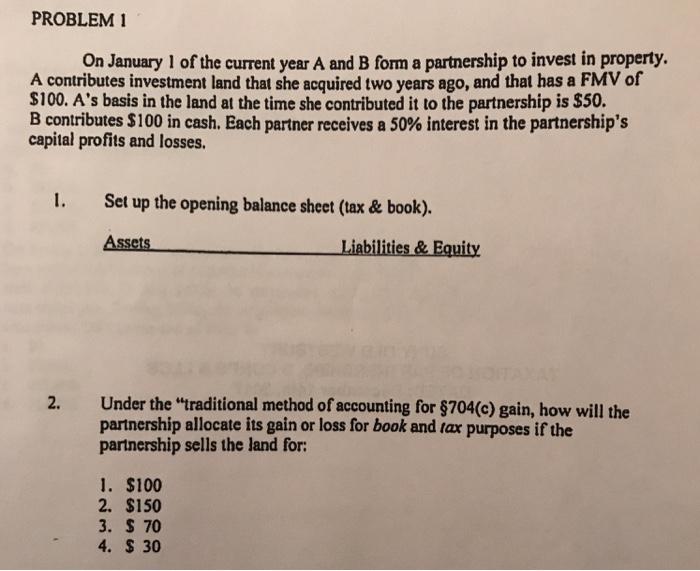

PROBLEM 1 On January 1 of the current year A and B form a partnership to invest in property. A contributes investment land that she acquired two years ago, and that has a FMV of $100. A's basis in the land at the time she contributed it to the partnership is $50. B contributes $100 in cash. Each partner receives a 50% interest in the partnership's capital profits and losses. 1. Set up the opening balance sheet (tax & book). Assets 2. Under the "traditional method of accounting for $704(c) gain, how will the partnership allocate its gain or loss for book and tax purposes if the partnership sells the land for: 1. $100 2. $150 Liabilities & Equity 3. $ 70 4. $30

Step by Step Solution

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Assets Amount Land ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Physics

Authors: Jearl Walker, Halliday Resnick

8th Extended edition

471758019, 978-0471758013

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App