Answered step by step

Verified Expert Solution

Question

1 Approved Answer

26 04. Ohio Steel Inc. has a 7 percent coupon bond on the market with 9 years left to 27 maturity. The bond makes aanual

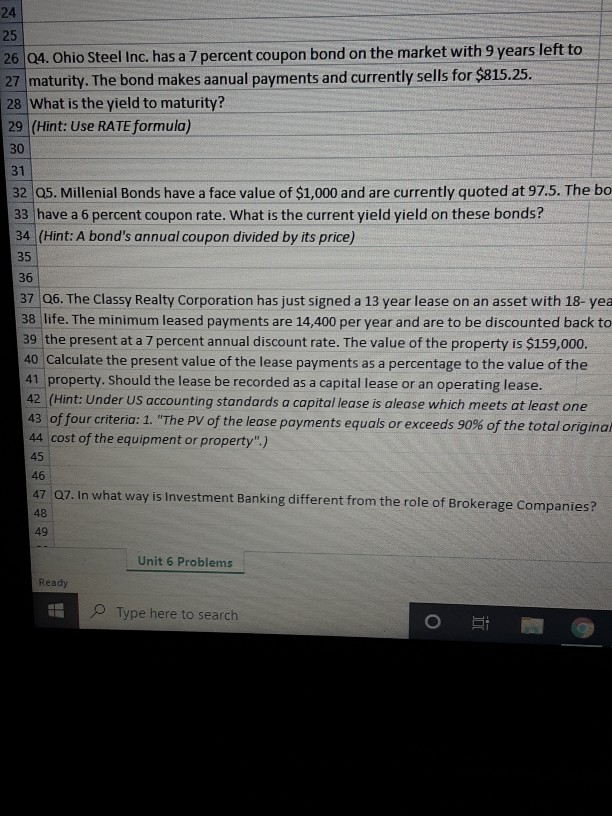

26 04. Ohio Steel Inc. has a 7 percent coupon bond on the market with 9 years left to 27 maturity. The bond makes aanual payments and currently sells for $815.25. 28 What is the yield to maturity? 29 (Hint: Use RATE formula) 30 32 05. Millenial Bonds have a face value of $1,000 and are currently quoted at 97.5. The bo 33 have a 6 percent coupon rate. What is the current yield yield on these bonds? 34 (Hint: A bond's annual coupon divided by its price) 35 36 37 Q6. The Classy Realty Corporation has just signed a 13 year lease on an asset with 18-yea 38 life. The minimum leased payments are 14,400 per year and are to be discounted back to 39 the present at a 7 percent annual discount rate. The value of the property is $159,000. 40 Calculate the present value of the lease payments as a percentage to the value of the 41 property. Should the lease be recorded as a capital lease or an operating lease. 42 (Hint: Under US accounting standards a capital lease is alease which meets at least one 43 of four criteria: 1. "The PV of the lease payments equals or exceeds 90% of the total original 44 cost of the equipment or property") 47 Q7. In what way is Investment Banking different from the role of Brokerage Companies? Unit 6 Problems Ready Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started