Answered step by step

Verified Expert Solution

Question

1 Approved Answer

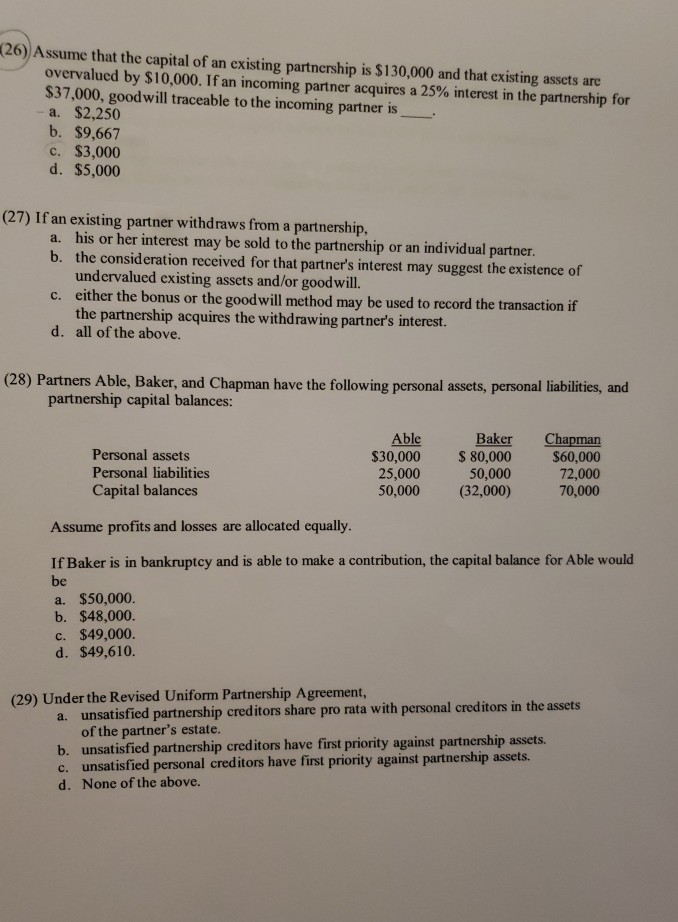

(26) Assume that the capital of an existing partnership is $130,000 and that existing assets are overvalued by $10,000. If an incoming partner acquires a

(26) Assume that the capital of an existing partnership is $130,000 and that existing assets are overvalued by $10,000. If an incoming partner acquires a 25% interest in the partnership for $37,000, good will traceable to the incoming partner is -a. $2,250 b. $9,667 c. $3,000 d. $5,000 (27) If an existing partner withdraws from a partnership, a. his or her interest may be sold to the partnership or an individual partner. b. the consideration received for that partner's interest may suggest the existence of undervalued existing assets and/or goodwill. c. either the bonus or the good will method may be used to record the transaction if the partnership acquires the withdrawing partner's interest. d. all of the above. (28) Partners Able, Baker, and Chapman have the following personal assets, personal liabilities, and partnership capital balances: Personal assets Personal liabilities Capital balances Able $30,000 25,000 50,000 Baker $ 80,000 50,000 (32,000) Chapman $60,000 72,000 70,000 Assume profits and losses are allocated equally. If Baker is in bankruptcy and is able to make a contribution, the capital balance for Able would be a. $50,000. b. $48,000. c. $49,000. d. $49,610. (29) Under the Revised Uniform Partnership Agreement, a. unsatisfied partnership creditors share pro rata with personal creditors in the assets of the partner's estate. b. unsatisfied partnership creditors have first priority against partnership assets. c. unsatisfied personal creditors have first priority against partnership assets. d. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started