Question

26 CALCIRATOR PRINTER VERSION BACK NEXT Challenge Exercise 15-02 a-d Vaughn Painting Services uses a job order cost system to collect the costs of its

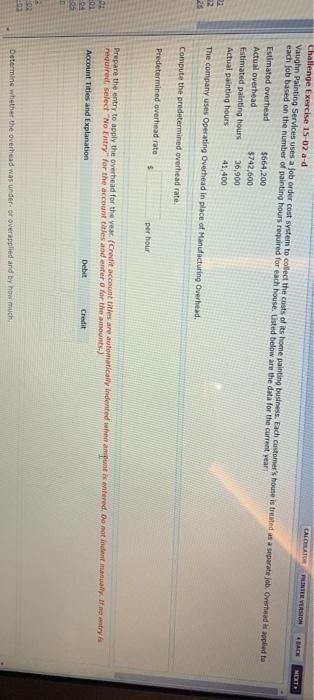

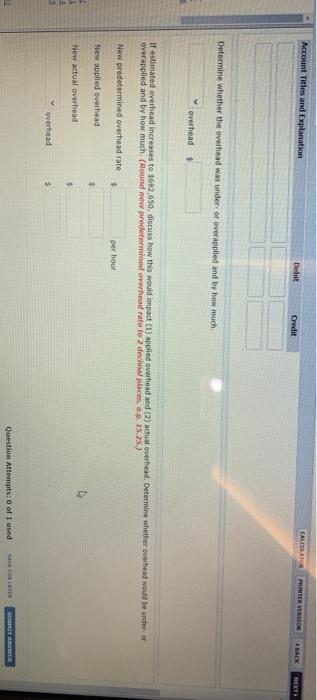

26 CALCIRATOR PRINTER VERSION BACK NEXT Challenge Exercise 15-02 a-d Vaughn Painting Services uses a job order cost system to collect the costs of its home painting business. Each customer's house is treated as a separate job. Overhead is applied to each job based on the number of painting hours required for each house. Listed below are the data for the current year: Estimated overhead Actual overhead $664,200 $742,600 Estimated painting hours 36,900 Actual painting hours 41,400 The company uses Operating Overhead in place of Manufacturing Overhead. Compute the predetermined overhead rate. Predetermined overhead rate $ per hour Prepare the entry to apply the overhead for the year. (Credit account titles are automatically indented when ampunt is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) 01 Account Titles and Explanation 05 102 03 Debit Credit Determine whether the overhead was under- or overapplied and by how much. CALCULATOR PRINTER VERSION +BACK NEXT Account Titles and Explanation Debit Credit Determine whether the overhead was under- or overapplied and by how much overhead $ If estimated overhead increases to $682,650, discuss how this would impact (1) applied overhead and (2) actual overhead. Determine whether overhead would be under or overapplied and by how much. (Round new predetermined overhead rate to 2 decimal places, e.g. 15.25.) New predetermined overhead rate $ per hour New applied overhead. 1 New actual overhead 4 overhead Question Attempts: 0 of 1 used SAVE FOR LATER SUBHIT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started