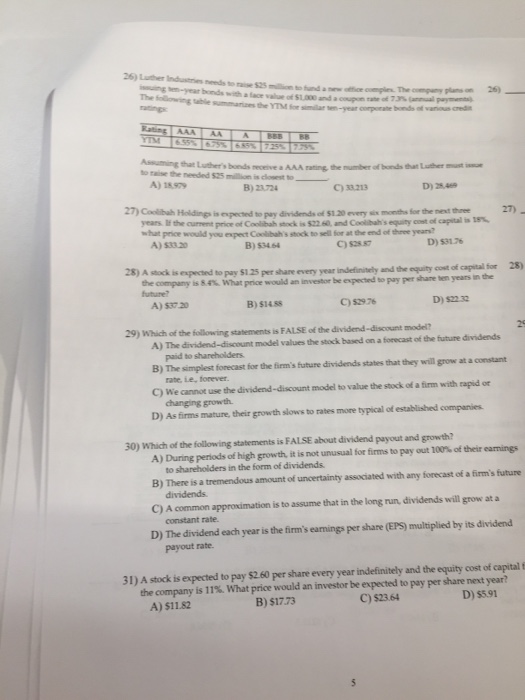

26) Luther Industries needs to raise s25 bonds with a face vallue of million to fund a w office complies. The cmuny plans on 26) summariaes the YTM for similar Assuming that Luther's bonds oeve a AAA rating the mumber of bonds thar Luther to raise the needed $25 million is closest so A) 18979 B) 23724 C) 33.213 D) 25469 27) Coolibah Holdings is expected to pay dividemds of $1.20 every six months for the mext theee 27) years. li the curment price of Coolibah stock is 522 60, and Coolibah's equity cost of capital is 1s what price would you expect Coolibah's stock to sell for at he end of three years? B) 534.64 D) $3176 28) A stock is expected to pay $1.25 per share every year indefinitely and the nquity cost of captital for 28) om- is 84%What prcewould an investor be eprted to pay per-ten years the A) $37 20 B) $1488 C) 529.76 D) $22.32 29) Which of the following statements is FALSE of the dividend-discount model? A) The dividend-discount model values the stock based on a forecast of the fututre dividends paid to sharehoiders B) The simplest forecast for the firm's future dividends states that they will grow at a constant C) We cannot use the dividend-discount model to value the stock of a firm with rapid or D) As firms mature, their growith slows to rates more typical of established companies rate, Le, forever changing growth 30) Which of the following statements is FALSE about dividend payout and growth? A)During periods of high growth, it isnt unusual ir firms topay out 100% of their earnings to shareholders in the form of dividends B) There is a tremendous amount of uncertainty associated wth any forecast firm, future C) A common approximation is to assume that in the long run, dividends will grow at a D) The dividend each year is the firm's earmings per share (EPS) multiplied by its dividend constant rate. payout rate. 31) A stock is expected to pay $2.60 per share every year indefinitely and the equity cost of capital f the company is 11%. What price would an investor be expected to pay per share next year? B) $17.73 C) $23.64 D) $591 A) $1182