26

26

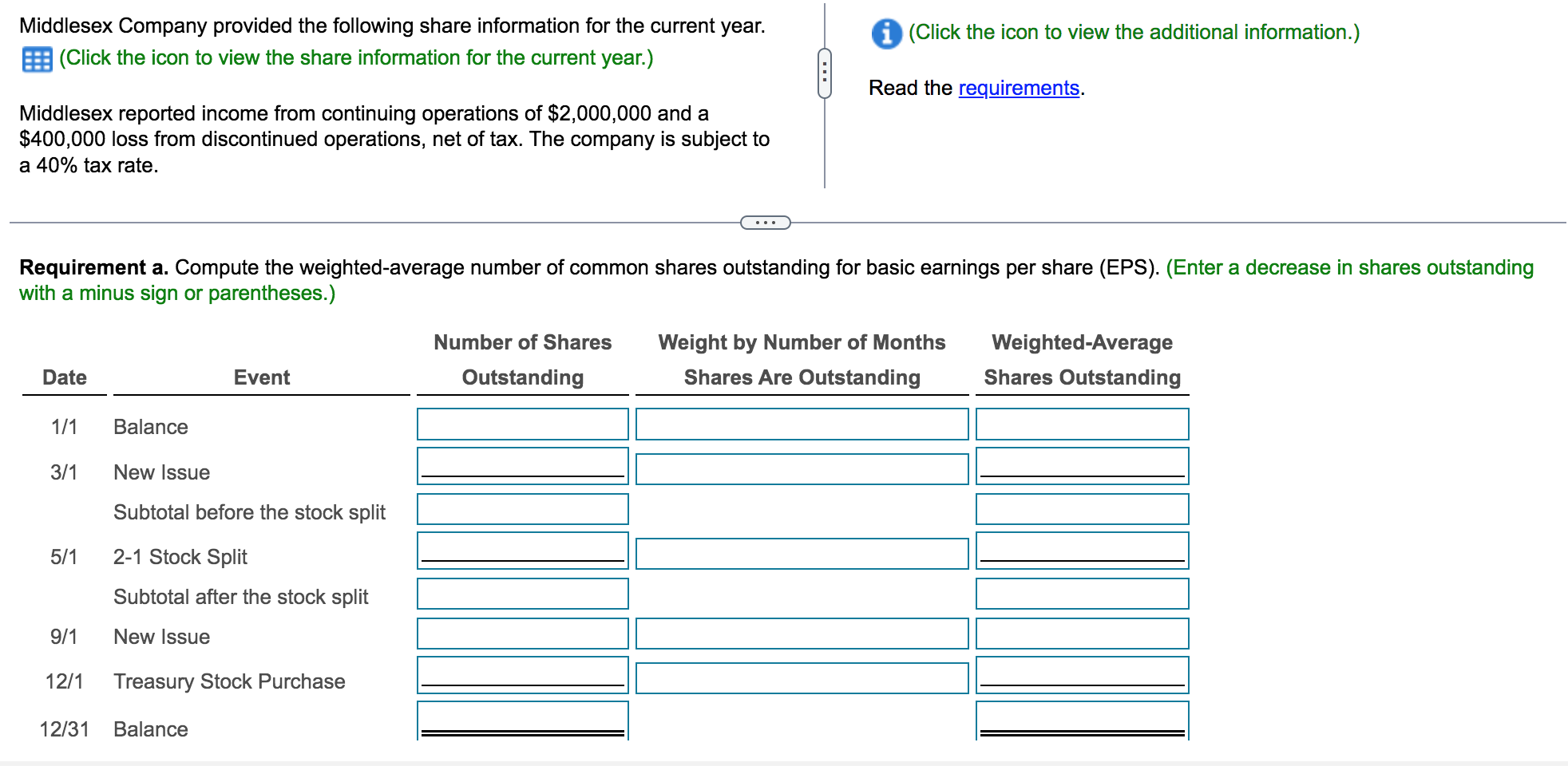

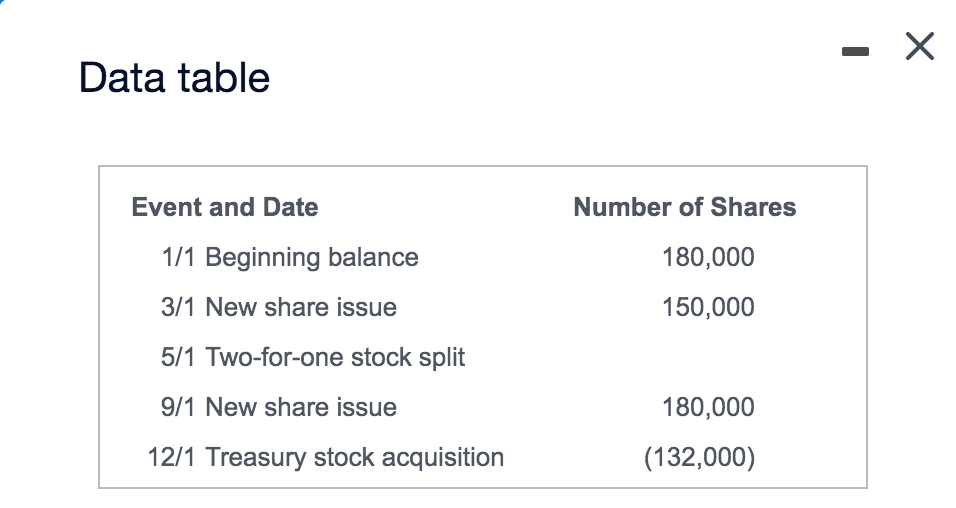

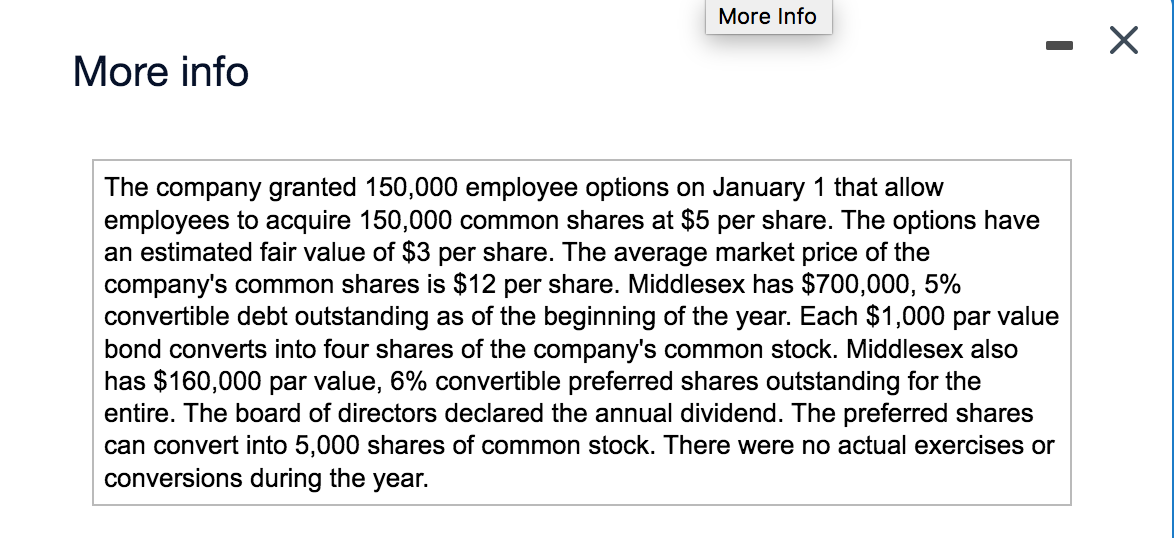

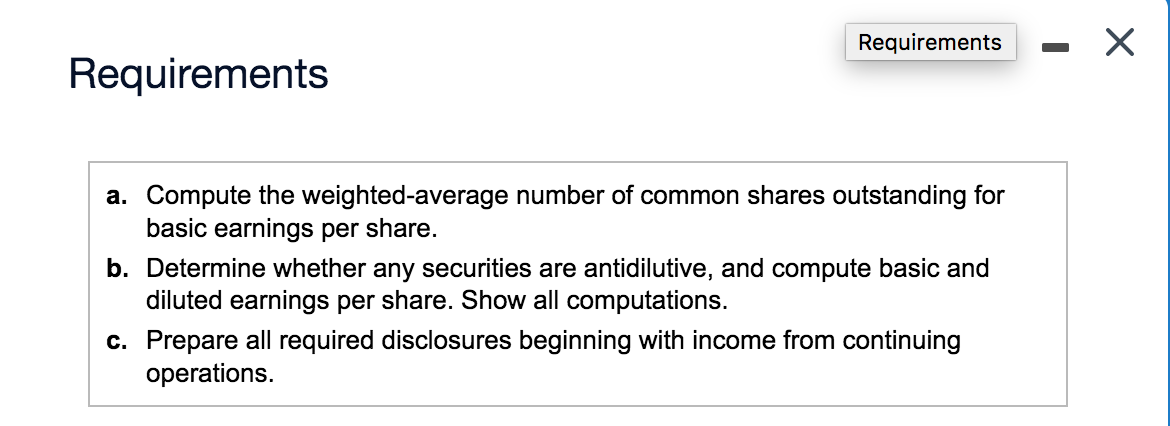

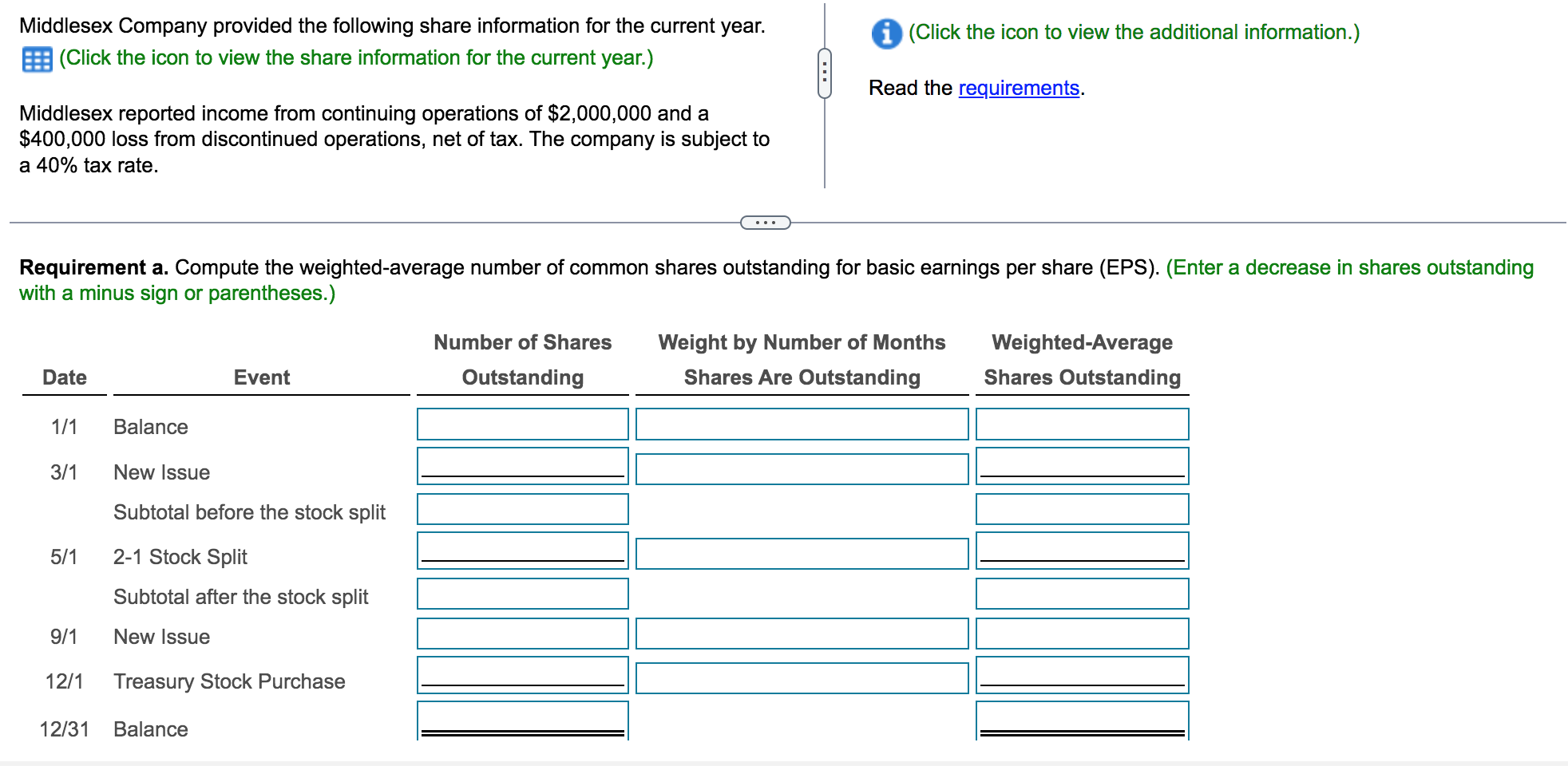

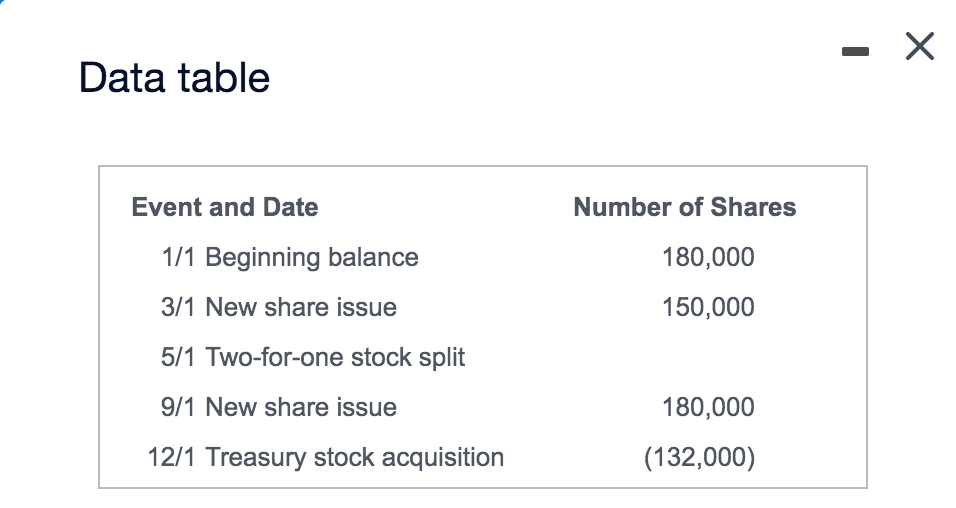

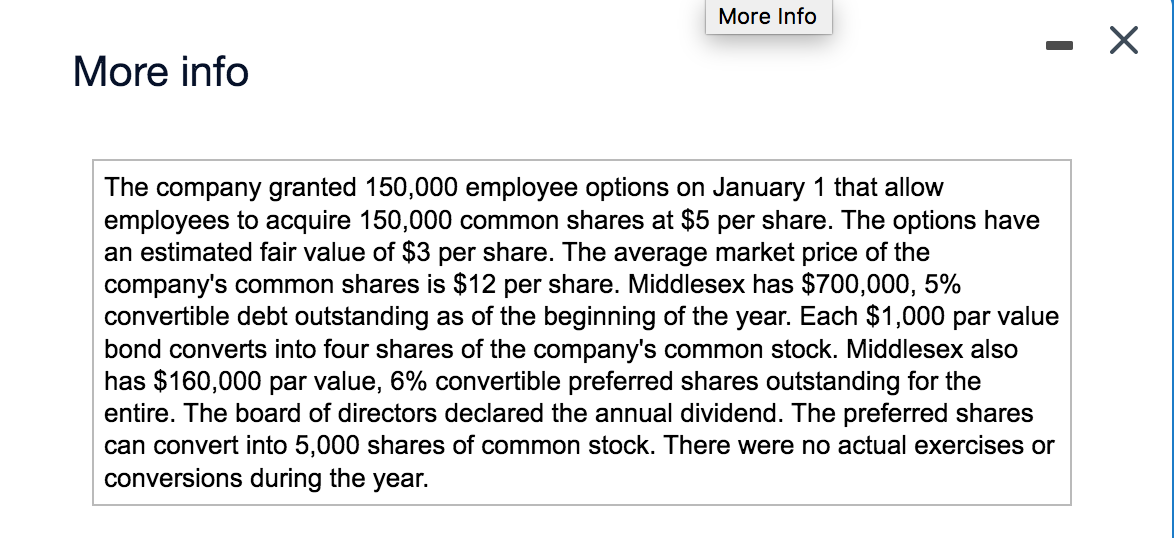

Middlesex Company provided the following share information for the current year. E: (Click the icon to view the share information for the current year.) (Click the icon to view the additional information.) Read the requirements. Middlesex reported income from continuing operations of $2,000,000 and a $400,000 loss from discontinued operations, net of tax. The company is subject to a 40% tax rate. Requirement a. Compute the weighted average number of common shares outstanding for basic earnings per share (EPS). (Enter a decrease in shares outstanding with a minus sign or parentheses.) Number of Shares Weight by Number of Months Shares Are Outstanding Weighted Average Shares Outstanding Date Event Outstanding 1/1 Balance 3/1 New Issue Subtotal before the stock split 5/1 2-1 Stock Split Subtotal after the stock split 9/1 New Issue 12/1 Treasury Stock Purchase 12/31 Balance - X Data table Number of Shares 180,000 Event and Date 1/1 Beginning balance 3/1 New share issue 5/1 Two-for-one stock split 150,000 9/1 New share issue 180,000 12/1 Treasury stock acquisition (132,000) More Info - More info The company granted 150,000 employee options on January 1 that allow employees to acquire 150,000 common shares at $5 per share. The options have an estimated fair value of $3 per share. The average market price of the company's common shares is $12 per share. Middlesex has $700,000, 5% convertible debt outstanding as of the beginning of the year. Each $1,000 par value bond converts into four shares of the company's common stock. Middlesex also has $160,000 par value, 6% convertible preferred shares outstanding for the entire. The board of directors declared the annual dividend. The preferred shares can convert into 5,000 shares of common stock. There were no actual exercises or conversions during the year. Requirements Requirements a. Compute the weighted average number of common shares outstanding for basic earnings per share. b. Determine whether any securities are antidilutive, and compute basic and diluted earnings per share. Show all computations. c. Prepare all required disclosures beginning with income from continuing operations. Middlesex Company provided the following share information for the current year. E: (Click the icon to view the share information for the current year.) (Click the icon to view the additional information.) Read the requirements. Middlesex reported income from continuing operations of $2,000,000 and a $400,000 loss from discontinued operations, net of tax. The company is subject to a 40% tax rate. Requirement a. Compute the weighted average number of common shares outstanding for basic earnings per share (EPS). (Enter a decrease in shares outstanding with a minus sign or parentheses.) Number of Shares Weight by Number of Months Shares Are Outstanding Weighted Average Shares Outstanding Date Event Outstanding 1/1 Balance 3/1 New Issue Subtotal before the stock split 5/1 2-1 Stock Split Subtotal after the stock split 9/1 New Issue 12/1 Treasury Stock Purchase 12/31 Balance - X Data table Number of Shares 180,000 Event and Date 1/1 Beginning balance 3/1 New share issue 5/1 Two-for-one stock split 150,000 9/1 New share issue 180,000 12/1 Treasury stock acquisition (132,000) More Info - More info The company granted 150,000 employee options on January 1 that allow employees to acquire 150,000 common shares at $5 per share. The options have an estimated fair value of $3 per share. The average market price of the company's common shares is $12 per share. Middlesex has $700,000, 5% convertible debt outstanding as of the beginning of the year. Each $1,000 par value bond converts into four shares of the company's common stock. Middlesex also has $160,000 par value, 6% convertible preferred shares outstanding for the entire. The board of directors declared the annual dividend. The preferred shares can convert into 5,000 shares of common stock. There were no actual exercises or conversions during the year. Requirements Requirements a. Compute the weighted average number of common shares outstanding for basic earnings per share. b. Determine whether any securities are antidilutive, and compute basic and diluted earnings per share. Show all computations. c. Prepare all required disclosures beginning with income from continuing operations

26

26