26. What is the future value of an annual annuity of $5,000 deposited at the beginning of each year for 15 years if the

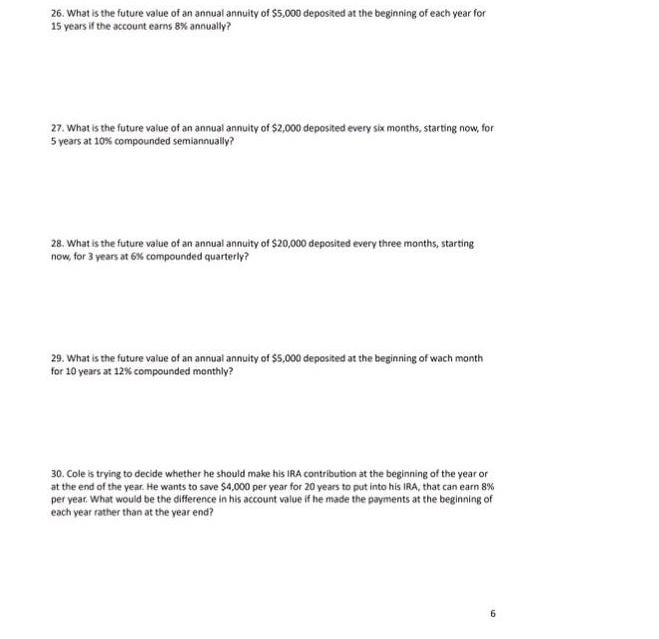

26. What is the future value of an annual annuity of $5,000 deposited at the beginning of each year for 15 years if the account earns 8% annually? 27. What is the future value of an annual annuity of $2,000 deposited every six months, starting now, for 5 years at 10% compounded semiannually? 28. What is the future value of an annual annuity of $20,000 deposited every three months, starting now, for 3 years at 6% compounded quarterly? 29. What is the future value of an annual annuity of $5,000 deposited at the beginning of wach month for 10 years at 12% compounded monthly? 30. Cole is trying to decide whether he should make his IRA contribution at the beginning of the year or at the end of the year. He wants to save $4,000 per year for 20 years to put into his IRA, that can earn 8% per year. What would be the difference in his account value if he made the payments at the beginning of each year rather than at the year end? 6

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the future values of the annuities and the difference in account value for Coles IRA we can use the future value of an ordinary annuity f...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started