Question

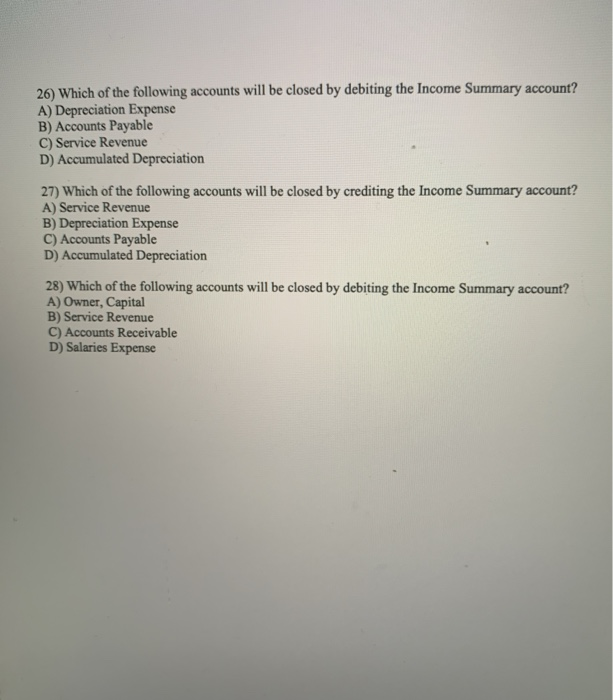

26) Which of the following accounts will be closed by debiting the Income Summary account? A) Depreciation Expense B) Accounts Payable C) Service Revenue

26) Which of the following accounts will be closed by debiting the Income Summary account? A) Depreciation Expense B) Accounts Payable C) Service Revenue D) Accumulated Depreciation 27) Which of the following accounts will be closed by crediting the Income Summary account? A) Service Revenue B) Depreciation Expense C) Accounts Payable D) Accumulated Depreciation 28) Which of the following accounts will be closed by debiting the Income Summary account? A) Owner, Capital B) Service Revenue C) Accounts Receivable D) Salaries Expense

Step by Step Solution

3.55 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Income summary account is like a temporary account or nominal account which records all ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Carl S. Warren, Jim Reeve, Jonathan Duchac

14th edition

1305088433, 978-1305088436

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App